What is the Full Form of ROIROI: Return On InvestmentROI stands for Return on Investment. It is generally defined as the net profit ratio over the total investment cost. Investment refers to the return on the cost made on an investment, and high ROI is termed as a profit compared to the price on which the investment was made. ROI is used to evaluate whether the assets made give you profits or losses. Sometimes, it develops the business, but in some cases, it can be a loss as the overall ROI for an enterprise is used as a way to grade how well a company is managed and how efficient the company is

Now businesses use different kinds of matrices to evaluate the profitability and general financial health of the enterprise. The most popular is whether investing capital or implementing a market strategy such as PPC is the return on investment. ROI also helps you to decide which business schools will be beneficial to attend, as it refers to something that can identify financial return and investment profit. It is the easiest way to calculate ROI using time as an investment. Now the ROI figure is also applied to different types of investment and industries, such as social return on investment, return on asset, Ad spend, and equity. ExamplesNow the investment can be of a specific type. It can be in the assets, and the stock's equity or the jewellery depends, but the return on the investment isn't always the same as the business venture depends on the finance in the finance should be calculated in such a way that the risk can be avoided. Now the different types of investment you can look at could be new equipment or higher quality materials at development or might make an investment in more digital goods like cloud-based services and new content management software, or it would be desirable to identify the return on investment Calculation of ROIROI = (Net Profit /Investment) × 100 Importance of ROICalculating ROI helps you to know whether the investment you are making is helpful to your business or not. This is a handy tool for evaluating your past business decision and telling you about your business prospects. You can also use this information from ROI calculation to compare some of the new business opportunities and decides whether to pursue them or not. Now if a same kind of investment continuously gives you higher profits then you can focus on similar types of investments. Still, if those investments do not generate enough profit to cover the cost, then this indicates that you should try a new strategy to improvise your business investment. Is ROI is always high on investment?Not always, as the result of investments is not always high as it depends on the type of investment an individual make. Benefits of ROI

the rik can be mesured fit aansprofit aans thusvidual make Limitation of ROI:- Everything has to have advantages and disadvantages, and the ROI, too, has the limitation:-

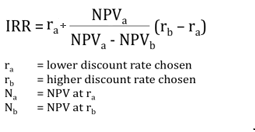

Good ROI PercentageApproximately 7% or greater is considered a good ROI for stock investment. This is also an average annual return of the sip accounting for inflation. Because of higher profit or loss, some years, it can be a higher return, and some years it can be a lower, but overall, the performance is still smooth around this percentage. TimeTime is a critical consideration while evaluating the ROI of a particular investment. Now time factor is always considered when evaluating and comparing the performance across the buy currently, even if the investment on a higher profit based on it the longitude time to realise the less efficient than the investment; therefore, we should always think of the efficient timing into consideration. Calculation of ROI with TimeThe calculation of ROI for the period by dividing the net profit period by the investment amount and then multiplying the result by a hundred to obtain a percentage. Difference between ROI and IRRThese two are the most popular way of calculating investment. IRR is the internal rate of return, and it is a little confusing and difficult to estimate. It decides whether to take on the new project or not. They always calculate the ROI, which gives an approximate return on the investment, so choosing the asset becomes easier. The difference between IRR and ROI is that ROI over-represents the total growth from start to finish of the investment. Still, IRR considers the annual growth rate now, both numerical should typically be of the same course of 1 year, but they will not be the same for a more extended period. Now the goal of IRR is to consider the rate of discount by making the present value of the sum of annual nominal cash inflows equal to the initial net cash outlay for the investment. Before calculating IRR, the investor should understand the discount rate and net present value presenting value which will be equivalent to a guaranteed deal in one year. The IRR discount rate that makes the NPV of future cash flow equal to zero indicates the annualised rate and also assumes that the dividends and cash flow are continuously invested at a discount rate. The reinvestment rate is now the IRR, which will make a project more attractive than it is. It can also be said as an advantage and use the modified internal rate of return. Formula of IRR

Difference between ROI AND ROEROI means the return on equity and is a financial matrix that considers the profitability of a business with prospects of equity, generally representing the owner associated with the asset. It is in favour of both owners and creditors. Equity refers to shareholders' equity only, and it measures the return on shareholders' investment in a company rather than the acquisition of an asset. The amount of profit of a company is generated when compared to its shareholder's equity. It is the net income divided by the shareholder's equity. The companies with higher ROI are generating more profit for their shareholders. Now, both help evaluate how healthy or efficient a company is in terms of profit generation and investment; despite the significance of the storm, they can be used interchangeably for a different purpose now; the purpose of calculating is to measure the profit, evaluation of the effectiveness of the investment or generating a return for your business, on the other hand, the return on shareholders' investment rather than on companies investment the purpose of calculating how much the company is generating its profit when compared to shareholders equity. ROE= Net Profit after taxes/Shareholder equity Now, these are the best performance matrixes that evaluate the profitability of a business or an investment. The ROI tells you if you have made a suitable investment or a poor one, or a great one.

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share