What is the full form of SSISSI: Small Scale IndustriesSSI stands for Small Scale Industries. For driving the Economic Growth of Developing Nations, Small-scale industries, also known as SSIs, are a crucial part of the economic landscape of developing nations. These industries are defined as those which employ a relatively small number of workers and have a limited turnover. Despite their size, they play a significant role in the growth and development of economies, especially in the developing world. In developing countries, small-scale industries often form the backbone of the economy, providing employment opportunities and contributing to GDP growth. They also play a vital role in promoting entrepreneurship and innovation. SSIs are known for their ability to adapt quickly to changing market conditions, making them ideal for promoting economic growth and development in the face of rapidly changing global markets.

Small-scale industries are an essential part of the economic landscape in many countries, particularly in the developing world. They promote economic growth and development, create employment opportunities, and drive innovation and entrepreneurship. However, they also face significant challenges, including financing access and competition from larger businesses. To overcome these challenges and support the growth of small-scale industries, governments, and other organizations need to provide a supportive environment and access to finance, technical assistance, and training and development opportunities. A small firm or enterprise can register as a Small-Scale Industry (SSI) and take advantage of the many incentives offered to SSIs under various programs by going through the registration process. While some similar variables are considered when determining whether an enterprise is eligible for SSI registration, the eligibility requirements for SSI registration differ from nation to country. What Can Govt Do About It?Governments and other organizations must provide a supportive environment to support small-scale industries and promote economic growth and development. This can include providing access to finance, technical assistance, and training and development opportunities. Governments can also provide tax incentives and other forms of support to encourage the growth and development of small-scale industries. Small-scale industries are essential to many country's economies, particularly in the developing world. They are often characterized by their small size, relatively small number of employees, and limited turnover. Despite their size, they are critical in promoting economic growth and development. They provide an income source for individuals who may otherwise be unemployed and help to reduce poverty in these areas. By doing so, they also help to improve the standard of living of people in rural areas, which can help to reduce migration from rural to urban areas.

In addition, small-scale industries are a significant source of innovation and entrepreneurship. They provide a platform for individuals to start their businesses, bringing new products and services to market. This can spur economic growth and development by promoting competition and driving innovation. Small-scale industries can also provide training and development opportunities for young people, helping to develop the next generation of entrepreneurs and business leaders. Governments and other organizations can play a crucial role in supporting the growth of small-scale industries and promoting economic growth and development. This can include providing access to finance, technical assistance, and training and development opportunities. Governments can also provide tax incentives and other forms of support to encourage the growth and development of small-scale industries. Organizations can also support marketing, supply chain management, and product development to help small-scale industries overcome challenges and grow their businesses. Prerequisites For SSI RegistrationThe prerequisites for SSI registration in India are covered in this article. Investment in Plant and Equipment Investing in plant and machinery is the primary need for SSI registration. If an enterprise's investment in equipment and machinery falls within a particular range, it is regarded as suitable for SSI registration in India. The investment threshold for SSI registration is set at Rs. 1 crore for manufacturing businesses and Rs. 10 lakhs for service businesses as of 2021. The Ministry of Micro, Small, and Medium Enterprises (MSME) established this cap, which is frequently updated. Industry Type The industry in which the firm operates significantly impacts whether it qualifies for SSI registration. According to the MSME Act, micro, small, and medium-sized businesses have invested in machinery and plant. If their equipment and machinery investment is within the set limits, manufacturing and service-oriented businesses are eligible for SSI registration. Ownership Structure When determining whether an organization is eligible for SSI registration, its ownership structure is also considered. An enterprise may be owned in India by an individual, a partnership firm, a company, or a cooperative. The business should be independent, not a division of a sizable industrial organization. Number of Workers Employed When determining whether an enterprise qualifies for SSI registration, its employees are also considered. If a business employs fewer than ten employees in the service sector and fewer than 50 employees in the manufacturing sector, it is qualified for SSI registration in India. Business Type The type of the enterprise's operations plays a significant role in evaluating whether or not it qualifies for SSI registration. Businesses that produce hazardous items, engage in illegal activities or harm the environment are not eligible for SSI registration. Location of the Enterprise When determining whether an enterprise is eligible for SSI registration, its location is also considered. Businesses in rural areas, the North Eastern region, and Himachal Pradesh are eligible for extra incentives in India. Compliance with Rules and Regulations Before requesting SSI registration, the business must abide by all laws and regulations that apply to it, including labour, environmental, and tax laws. SSI registration is a procedure that enables a small business to take advantage of the various incentives offered to SSIs under various schemes. The requirements for SSI registration vary from nation to nation. Still, some universal factors are considered when determining an enterprise's eligibility for SSI registration, including investment in plant and machinery, type of industry, ownership structure, number of employees, nature of the business, location of the enterprise, and compliance with laws and regulations.

Benefits of Applying for SSITax Benefits SSI units are qualified for several tax advantages, including reduced excise taxes, exemptions from income taxes, and reduced electricity rates. Financial Help SSI units are eligible for financial assistance under several government programs, including the Credit Linked Capital Subsidy Program, the Technology Upgrading Fund Scheme, and the Prime Minister's Employment Generation Programme. Priority Lending Banks and other financial institutions may lend on SSI units first. They can receive financing with simpler conditions and lower interest rates. Protection from Delayed Payments SSI units are protected from delayed payments by big businesses and government agencies under the Micro, Small, and Medium Enterprises Development (MSMED) Act of 2006. Preference in Procurement Public sector organizations and government bodies offer SSI entities preference when buying goods and services.

SSI Registration ProcessObtaining a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department is the first step in the SSI registration process. The following step is to apply for the Udyog Aadhaar Memorandum (UAM) via the MSME Ministry's official website. The UAM, a 12-digit number exclusively owned, acts as the SSI unit's official certificate of recognition. Here are a few more details about SSI registration in India: De-registration An SSI unit may choose to do so if it exceeds the investment cap imposed on SSIs or stops conducting business operations. The Udyog Aadhaar Memorandum (UAM), obtained during the registration, must be turned in along with an application to the MSME Ministry to complete the de-registration process. Upgrade If an SSI unit exceeds the investment threshold set for SSIs, it may choose to upgrade to a medium size organization. An application must be submitted to the MSME Ministry to upgrade, and a new certificate of recognition must be obtained. Some of the Essential Traits of SSISize The amount invested in the manufacturing equipment and plant used to identify small-scale industries. In most nations, this is often restricted to a particular sum, ordinarily less than a predetermined limit. Ownership Small-scale businesses are typically owned and run by a single person or a small group rather than by established companies. Production SSIs often generate a broad range of products, including services, capital goods, and consumer goods. They serve regional markets as well. However, some might have a wider audience. Labour-Intensive SSIs frequently require a sizable staff to create goods and services. Numerous work opportunities are created, especially in rural and undeveloped areas. Technology Compared to larger sectors, SSIs frequently employ easier and more conventional manufacturing techniques. Their inadequate cash and resource investments are the cause of this. Flexibility Due to their ability to swiftly adjust to shifting market conditions and consumer tastes, small-scale enterprises are frequently more flexible than bigger industries. Innovation Small-scale industries are renowned for their innovative approach to production, despite using simpler technologies. They can frequently offer distinctive products and services tailored to the local market. Dependence on Local Resources For their inputs and raw materials, small-scale industries frequently rely on local resources. As a result, local economies are encouraged to grow, and their reliance on imports decreases. Contribution to GDP Many countries Gross Domestic Products (GDPs) are significantly boosted by small-scale companies. They are a significant employer as well, especially in rural areas. Government Support The government frequently assists small-scale industries through subsidies, tax breaks, and simple credit approval. This encourages their development and expansion. Important Roles that SSI Play in the Indian EconomyEmployment Creation India's small-scale industries, particularly those in rural and disadvantaged areas, are a significant source of employment. They give jobs to many people, especially those with little education or experience. Economic Development Small-scale industries are a key driver of India's economic development and contribute substantially to the nation's GDP. Development of Entrepreneurship Small businesses support entrepreneurship and inspire people to launch their firms. This encourages innovation and raises market rivalry. Industry Decentralization Small-scale businesses contribute to the industrial sector's decentralization by lowering the concentration of industries in metropolitan regions. This lessens regional economic development asymmetries and supports the development of rural areas. Balance of Trade Small-scale companies generate a variety of goods and services that are needed by the local market, reducing India's reliance on imports. This contributes to a better trade balance and a smaller trade deficit. Export Promotion Small businesses are essential to India's export of goods and services. They provide products and services sought after in international marketplaces and contribute to a rise in the nation's foreign exchange revenues. Small-scale industries, frequently found in rural and disadvantaged areas, contribute to regional development. This raises the standard of living in these places and lessens economic inequalities between the regions.

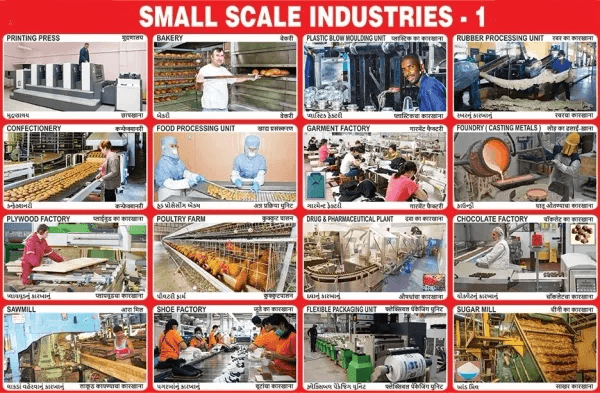

Technologies Transfer Small businesses assist in transferring technology from more established businesses to the community market. This supports the growth of new industries and raises the productivity and competitiveness of the regional market. Government Assistance The Indian government offers a variety of financial incentives to small businesses, including subsidies, tax breaks, and simple credit approval procedures. This encourages their development and expansion. Forms of SSIManufacturing Industries These sectors create a variety of consumer goods, including textiles, leather goods, paper products, plastics, and food items. Businesses that offer services to people and organizations, such as repair and maintenance, travel and hospitality, and financial services, are categorized as part of the service industries. Agro-Based Industries These sectors of the economy are based on agriculture and produce goods for human consumption, such as dairy, produce, and meat. Industries in handicraft production include those that create ceramics, jewellery, textiles, wood items, and other handicrafts and traditional goods. Industry Sectors Offering Repair and Maintenance Services These sectors offer repair and maintenance services for various items, including machines, automobiles, and electronics. IT-Enabled Services These sectors offer information technology-enabled services like data processing, web design, and software development. Micro and Village Industries Micro and village industries are small-scale businesses often based in rural areas and employ conventional production techniques and local resources. Small-scale artisan industries focus on creating handmade products, including textiles, pottery, and jewellery. AdvantagesOne of the critical advantages of small-scale industries is their ability to generate employment opportunities in rural and semi-urban areas. They help to reduce poverty by providing income and employment to people who would otherwise be unemployed. In addition, small-scale industries also help to improve the standard of living of people in rural areas by providing essential goods and services. This helps reduce migration from rural to urban areas, which helps ease the pressure on urban infrastructure and services. Small-scale industries are also an essential source of innovation and entrepreneurship. They provide a platform for individuals to start businesses and bring new products and services to market. This can spur economic growth and development by promoting competition and driving innovation. Additionally, small-scale industries often provide training and development opportunities for young people, helping to develop the next generation of entrepreneurs and business leaders. ChallengesDespite their many benefits, small-scale industries face several challenges. One of the biggest challenges they face is access to finance. Many small-scale industries need help to secure the financing they need to grow and develop their businesses. This can be due to a lack of collateral, poor credit history, or an understanding of the financial system. As a result, many small-scale industries are forced to rely on informal sources of financing, such as loans from friends and family, which can be expensive and unpredictable. Another challenge facing small-scale industries is competition from larger, more established businesses. This can make it difficult for small-scale industries to compete on price, quality, and delivery times. To overcome this challenge, small-scale industries must focus on developing niche products and services that can differentiate them from their larger competitors. Small-scale industries face several challenges, including access to finance. Many small-scale industries need help to secure the financing they need to grow and develop their businesses. This can be due to a lack of collateral, poor credit history, or an understanding of the financial system. As a result, many small-scale industries are forced to rely on informal sources of financing, such as loans from friends and family, which can be expensive and unpredictable. ConclusionIn conclusion, small-scale industries play a critical role in developing nations' economic growth and development. They provide employment opportunities, promote entrepreneurship and innovation, and help to reduce poverty. However, they also face significant challenges, including financing access and competition from larger businesses. To overcome these challenges and support the growth of small-scale industries, governments, and other organizations need to provide a supportive environment and access to finance, technical assistance, and training and development opportunities. By doing so, they can help to drive economic growth and development and improve the lives of people in developing nations.

Next TopicFull Forms List

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share