Advantages and Disadvantages of Credit card

Introduction

Technology holds our life in all ways, including methods of spending money daily. Now we spend money using technology such as online transfer of money (payments), using debit or credit cards where cash is not required instantly. But online or e-payment is different from payment via credit card as if in both the payment user must have money in their bank account instantly while credit card payment can be kept on hold for a certain period.

Credit can be built using the credit card, providing expanded buying power. It needs to be clarified. Let's get familiar with a credit cards.

A credit card is a small-sized rectangular plastic, or magnetic card considered a financial tool offered by a bank or financial institute. With a credit card, users can borrow funds. The credit card has the name of its owner and a unique credit card number with which it can be accessed. Cardholders can borrow funds to pay for goods and services with the merchant that accepts the credit card payment. Credit cards are used with the condition that cardholders have to pay back the borrowed amount of money with additional applicable interest or charges by the billing date or over time.

"Credit card is a plastic card with a magnetic strip and a chip issued to a person who applied for credit card. It holds all the information of the user and can be swiped for paying buying items."

Banks or other financial institutions can issue credit cards and stores, and to expand their use, they offer discounts and perks such as cashback or reward mile. This all depends on the credit score attained by the user after using it for buying items. A bank issue a credit card with a certain credit limit, the maximum amount user can borrow. It's just a limit of the amount offered by bank to the user as a loan in an instant instead of providing a full loan in cash. Users can borrow as long as it reaches the credit limit and pay the minimum monthly payment required by the user.

A credit card can be categorized as a reward credit card; cash back credit card, travel credit card, business credit card, student credit card, secured credit card, store credit card, fuel credit card, contactless credit card, premium/ signature credit card, entertainment credit card, lifestyle credit card, and co-branded credit card.

Credit card shows and maintains your financial health. Still, when it comes to buying credit cards, the user must know about their advantages and disadvantages and how to overcome the disadvantages and use them effectively.

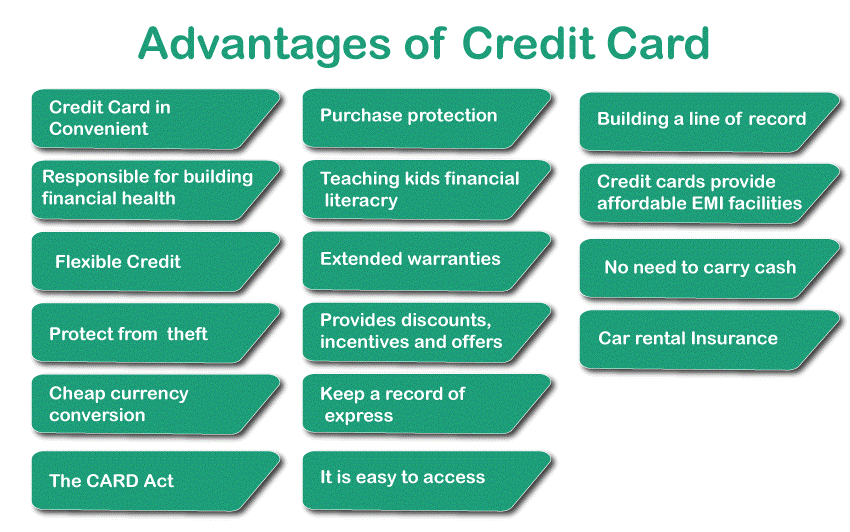

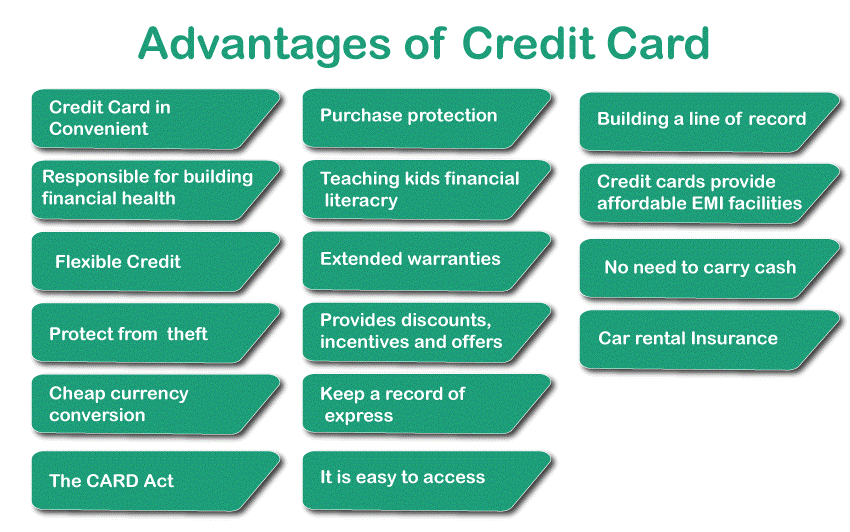

Advantages of credit card

- Credit card is convenient.

Having a credit card means no worry of paying an instant or requirement of cash for big or small purchases. It is quite easy to carry a credit card with you instead of cash as you can keep a tab on the credit card. Users aren't liable for unauthorized charges when a credit card is lost or stolen, but this condition is not the same for cash.

-

Responsible for building financial health

Proper credit card usage and paying credit card bills on time will help build a healthy financial status by maintaining a line of credit. Banks use this credit line for viewing credit card usage and credit repayment.

-

Flexible credit

The credit card can pay back the credit amount within an interest-free period. It is the period (range between 45-60 days) during which the credit amount is not charged any interest. The user must pay off the balance due by the credit card bill payment date, and the interest is applied to the credited amount after the due date. This is a great advantage of a credit card, where users can pay credit amounts in the credit due period without interest applied.

-

Protect from theft

If a user loses a credit card or somebody steals it, then the user won't lose any money because it has $0 liability guarantees, but we can't predict the same for cash.

-

Cheap currency conversion

Credit cards are the most convenient for international purchases to convert money automatically and provide the best exchange rates possible. Rather, exchanging a currency may charge some extra amount, but with a Master card or Visa card, users can save up to 8% as they have no foreign transaction fees in traveling abroad.

-

Purchase protection

Credit cards provide additional protection in terms of insurance for credit card purchases, even in case it is lost, stolen, or damaged. A credit card statement can be used if the user wishes to file a claim.

-

Teaching kids financial literacy

A credit card can be a good example of teaching kids financial literacy. If parents use a credit card correctly, they can teach their kids only to spend what is necessary, even if they can temporarily do so. They spend only when it's necessary and within a limit.

-

Extended warranties

Unknowingly people waste money or pay extra charges to extend warranties from retailers. In spite, they can get this offer for free with a credit card. Some credit cards offer extended warranties as a benefit on the purchased items without extra charges.

- Provide discounts, incentives, and offers

Usually, people avoid having a credit card as they refer to it as an expense for which credit card companies face problems, so to deal with this, they start offering a discount on purchases made through credit cards. Swiping the credit card gives you cash back and reward point accumulation at every time that can be later redeemed as air miles or used for paying the outstanding card dues. Some lenders offer discounts on holidays or large purchases, flight tickets, etc., by purchasing through a credit card. This scenario help users to save money.

-

Keep a record of expenses.

Using a credit card for all your expenses is recorded by the credit card company, and a detailed list of expenses is sent with your monthly credit card statement. It helps determine and track your purchases and spending, acknowledged for tax purposes and chalking out a budget. Lenders will provide instant alerts at each card swipe time in detail containing the amount of credit still available and the current outstanding on the card.

-

Building a line of record

Being a constant user of credit cards will make a good user credit history, and banks or credit cards offer you the chance to build a line of credit. Banks and financial institutions often look for the credit card usage history and prevail various discounts and offer to the customers. This makes the credit card important for future loans or rental applications.

-

Credit cards provide affordable EMI facilities.

This is one of the important advantages of having a credit card, as it can instantly credit a large amount of money to the user. If a user doesn't want to shrink their savings then they can choose to pay off their purchase in equated monthly installments, generally known as EMIs. In this condition, users don't have to pay a lump sum for purchases, and being cheaper to take out a personal loan to repay the credit amount (or purchase). Now, most people opt for the EMI option to pay off their purchase as it doesn't affect their savings and bank balance instantly, and they can pay the amount on the decided date of every month.

-

No need to carry cash

The best alternative for not carrying cash with you is because today, credit cards are accepted almost everywhere, and the transaction process is simple too.

-

Car rental insurance

This is one advantage given by many credit card companies that provide supplemental rental car insurance. With this user doesn't need to buy the insurance offered by the rental company, as credit car rental insurance automatically covers the user in the event of damage or theft.

-

The CARD Act

The Credit CARD Act of 2009 was made, which applied only to credit card customers in which using credit cards becomes safe and secure. Due to this act, the user doesn't worry about excessive fees and saves the account balance by not making it expensive without cause.

-

It is easy to access

The credit card's biggest advantage is that it is easy to access anywhere without having cash in your pockets. It allows you to use your card and pay for your purchase later in a given period. When you use the card, the money will be deducted from your account slowly, thus denting your bank balance every time of swipe.

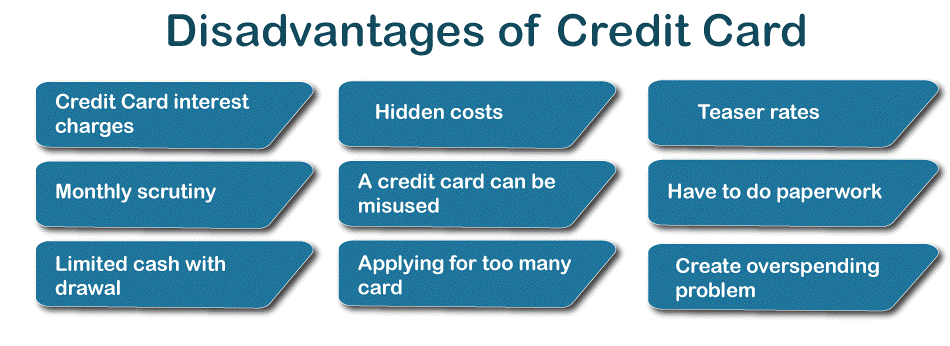

Disadvantages of credit card

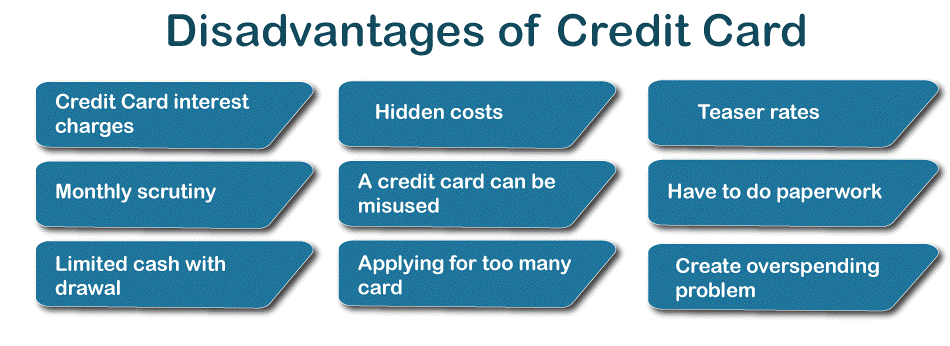

Access to everything is harmful to everybody, same with credit cards as being advantageous in financial terms, and credit cards have a few disadvantages too. Here are some of the disadvantages of having a credit card such as:

- Credit card interest charges

Compared with other interest rates, credit card APRs are high (around 20.16%). Interest rate is applicable on the billed amount in case of late payments that can lead you to high debts. This can be avoided by paying credit card bills on time.

-

Monthly scrutiny

Users must review every month's credit card bill to ensure that it reflects accurate purchases and there is no sign of fraud in using the credit card because credit cards are the prime and easiest target of scammers.

-

Limited cash withdrawal

Cash withdrawal criteria for a credit card differs from the debit card as withdrawal from a debit card hardly charges fees, but cash withdrawal with a credit card charges fees. Most cardholders have to pay interest of around 3.35% per month on withdrawing cash via credit card. So to deal with this, before purchasing a credit card, the user must go through all the terms and conditions applied to all the expenses done by using a credit card. Users must smartly choose and buy the type of credit card.

-

Hidden costs

The major disadvantage of having a credit card is that credit card banks or companies apply hidden charges that can create a dent in the pocket. At the time of issue, they declare it free, but afterward, they make additional charges associated with getting a credit card. These hidden charges include joining fees, processing fees, annual fees, charges and interest on cash advances, and many other extra charges levied on credit card users.

-

A credit card can be misused.

These (credit cards) are tools for credit building, but sometimes people build a credit score for large purchases. After crediting a large amount, they flew away and won't return the amount. In this techno-savvy time thief does not need your physical card to do fraud or theft as the thief only needs the number on your card or your details to make money disappear from your bank account.

-

Applying and keeping too many cards can burden your pocket and damage your credit card.

A good credit score in financial terms is beneficial in many ways. It is calculated & piled on the user's credit card payment history, length of history, current amount owned, new credit, and types of credit card used. The credit score is maintained & improved by regularly using the credit card and paying back on time. User has to use a limited number of cards that can be maintained properly, but every time application for a new card can negatively impact their credit score. Lenders get suspicious and check your credit report to assess your creditworthiness. Each credit card attached with expenses and several back-to-backs affects your pocket badly.

- Teaser rates

Some credit cards are offered at low introductory rates to grab people's attention but these last for a limited time. Once the teaser rate expires, the balance jumps dramatically because of the interest rate charged to them.

-

Have to do paperwork

It is mandatory for the users of credit cards to save receipts and check them against the generated statement of the card every month. This helps them with cheating and fraud with their card but also gives them another work of maintaining the bills. It also ensures users that they haven't been overcharged.

- Create overspending problem

The instant offering of money credit cards lets you make unnecessary purchases of the available limit. Being a supplement form of income for some people, they shop to fulfill their desires rather than necessities. This temptation can lead them to a debt trap later because they cannot make monthly payments on credit cards. This can be cured by not spending more than 50-60% of the credit limit. Users must keep a hold on the habit of overspend

Conclusion: Financially, at a certain stage, everyone needs to borrow money to fulfill financial goals, and credit cards are the best option to arrange money on your own without outside help. But with numerous advantages, credit cards can easily erode your credit and financial help if used irresponsibly.

So, before applying for a credit card or incorporating it into your financial plan, consider its advantages and disadvantages based on your circumstances. For details, the user must take help from a trained credit counselor.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now