Advantages and Disadvantages of Double Entry SystemThe double entry system is a universally accepted method of accounting in which each business transaction is recorded in a minimum of two accounts, i.e., one account is debited, and the other is credited for the same transaction. This follows the principle that every transaction's effect occurs on a minimum of two accounts, one from where the money goes out and the other from where the money comes in. In this system, the debit amount is always equal to the credit amount at every transaction.

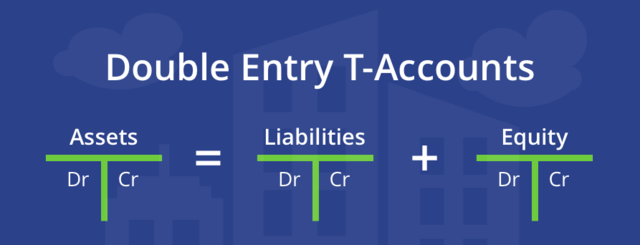

The double-entry accounting system is believed to exist since the 12th Century. In 1494 Luca Pacioli from Italy published the first thesis on the Double Entry System. Now, he is regarded as the father of accounting. It is a widely accepted bookkeeping system, and all business forms follow this accounting system. The double-entry accounting system implements the accounting equation in which all the assets are equal to the liabilities and capital. It can be expressed as: - Assets = Liabilities + Owner's Equity

Understanding Double Entry System with an exampleIn an organization, the cash balance is $5,000; this is its asset. If it purchases a new Plant & Machinery worth $3,000, it will also increase the company's assets. The accounting treatment of the purchase of plant & machinery will have two effects: the increase in the amount of plant & machinery and a decrease in the cash amount. The plant & machinery account will increase with debit, the cash account will decrease with credit, and the amount on both sides will be $3,000.

Here we can see the dual effect of the transaction in which the plant & machinery account increased while the cash account decreased. Therefore, this accounting system will be regarded as a double-entry system. So, the whole summary of the double entry system is that in every transaction, one account is debited; consequently, another account is credited. Advantages of Double Entry System

Disadvantages of Double Entry System

Bottom LineA double-entry system is a comprehensive method of recording all monetary transactions of the business. Each transaction is debited corresponding to its credited account. It shows both sides of the transaction, where the money went from which account. It helps companies prepare financial statements like profit loss accounts and balance sheets. Due to its technicalities, small businesses find it difficult to implement this bookkeeping system. Still, after incurring some extra cost for the specialist, they can get the advantage of a widely accepted formal accounting system. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share