Advantages and Disadvantages of E-Banking

Definition of E-Banking:

E-banking is a system that provides users with a range of online banking services through the use of the internet and telecommunications networks. Customers can use this method to access their bank accounts online and carry out different financial operations online. Online banking, virtual banking, and internet banking are other names for it.

- E-banking is a fast, easy, and secure electronic service that enables clients to do financial transactions anywhere without going to a bank branch. Customers get access to the e-banking service around-the-clock, seven days a week.

- The expansion of the financial industry enables traditional banks to explore a variety of online services. By offering online banking services, the banking industry aims to improve client service. Customers can conduct online banking through the use of the internet, which is also known as virtual banking.

- Customers can use the main medium of the internet to undertake both financial and non-financial services. The financial sector is continually innovating, with examples like virtual banks without branches and cutting-edge online services that let you manage all accounts effectively (Ismail, 2017). Virtual banking has completely altered the financial industry, creating a convenient banking system.

- Instead of exchanging different conventional documents like cash, checks, etc., monies are exchanged here by the transmission of electronic signals. Various E-banking services, including ATMs, mobile banking, debit cards, telebanking, the EFT (Electronic Fund Transfer) system, and ECS, are available (Electronic Clearing Services).

The Different E-Banking Services:

- Automated Teller Machines: ATMs, let you conduct banking transactions whenever you want. Typically, to make a cash withdrawal, a deposit, or to transfer money between accounts, you must insert your ATM card and enter your PIN. Some banks and ATM operators impose fees, especially if you don't have an account with them or your transactions occur in a remote location. A price and the amount charged must typically be displayed on the terminal screen of ATMs before you finalize a transaction. Consult your financial institution and the ATMs you use for more details on these fees.

- Internet Banking: Customers have access to a banking service that enables them to utilize the bank's website or application to conduct various financial and non-financial transactions online. To process customer service requests automatically without requiring human involvement, a network service provider links a personal computer directly to a bank's host computer system utilizing the Internet banking system and method. The system can distinguish between customer service requests that can be processed automatically and those that require a customer support representative. Customers who use remote banking can access the bank's other automated services because the system is connected to the host computer system.

- Mobile banking: For mobile banking, almost all banks have developed smartphone applications that enable you to finish transactions at the touch of a button. All of the following are required: a smartphone, an active bank account, an internet connection, a mobile application, and mobile banking. It is the most recent electronic banking service that enables bank customers to do different financial transactions utilizing a mobile device. Since a mobile device needs to have a WAP browser loaded to provide access to information, mobile banking relies on WAP (Wireless Application Protocol) technology. Banks may be able to expand their traditional customer base through e-banking, offer new products and services, and improve their ability to compete in the payment services sector.

- Debit card: In our daily lives, we only use debit cards for a few transactions. To purchase a POS, conduct an online transaction, or withdraw money from an ATM, a client simply needs to swipe a debit card because it is linked to their bank account. The funds are instantly removed from in this way, the customer's account.

- Credit Card: Similar to a debit card, a credit card is a form of payment that banks provide to customers depending on their credit history and score. The cardholder is permitted to borrow money and make payments up to a set limit. The cap is decided by the card's issuers. When using a credit card, the cardholder consents to pay certain fees and repay the purchased amount within a specific time frame.

- Electronic cheques: A paper cheque is converted into an electronic payment when it is presented to a firm in person or when it is received by mail. An electronic system processes your cheque when you present it to a cashier at a store, saving both the cheque's amount and your financial information. Your cheque should be branded or invalidated when the merchant gives it back to you so that it cannot be used again. When your bank or another financial institution receives the information from the cheque electronically, the funds are transferred to the merchant's account.

The system could electronically receive the data from your cheque when you mail it to a company or other organization to pay them, which results in a money transfer from your account to theirs.

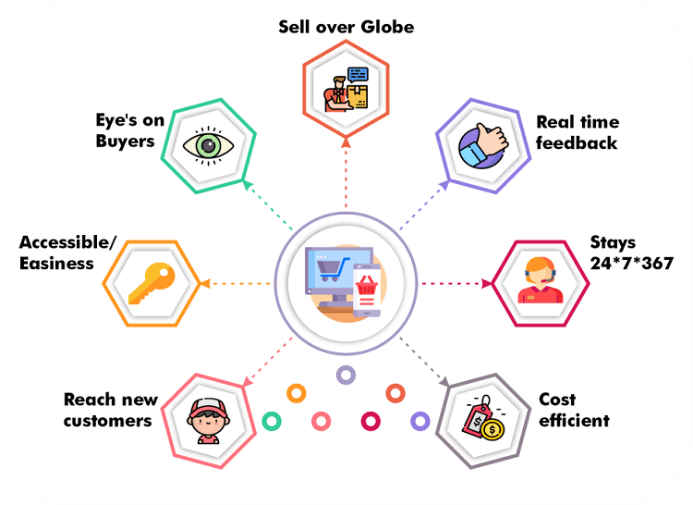

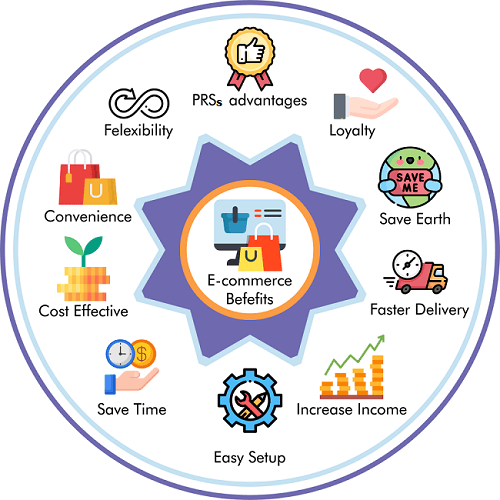

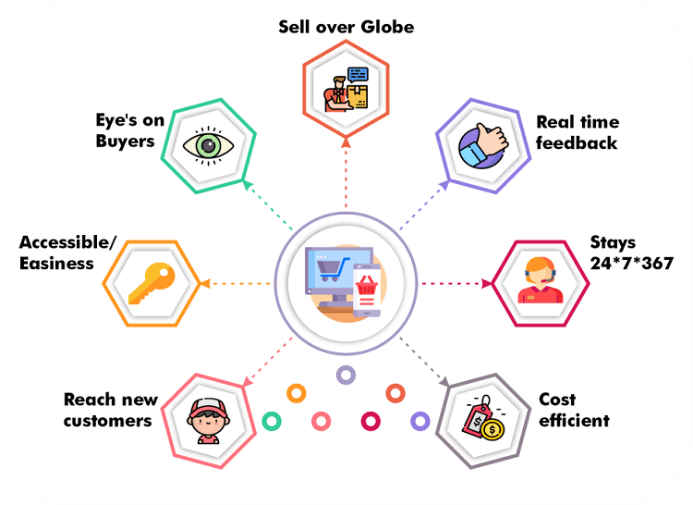

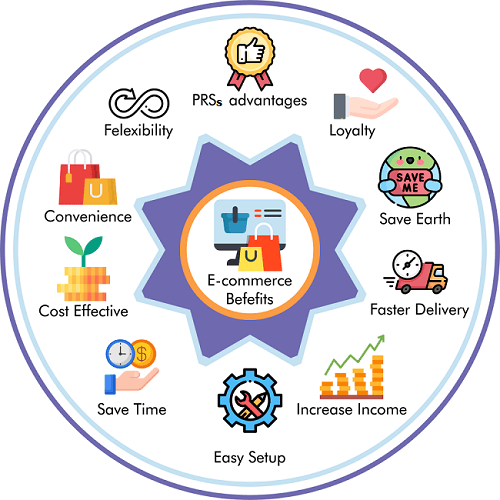

Advantages

- Convenience: E-banking makes it very easy for users to do different financial activities. People don't need to go to the bank to access their bank accounts; they can do it at any time while sitting in their homes. Finding time in a busy schedule to go to the bank to check on account balances, interest rates, successful money transfers, and other updates might take a lot of work. For the convenience of its customers, banking systems have created virtual banking systems that may be accessed from any location and at any time. There are several reasons why a banking holiday prevents the transfer of your money. By offering services around-the-clock, 365 days a year, online banking systems have made things easier. It resolves issues that customers faced with the previous banking system. There is no need to stand in line for money transactions or deportations.

- Faster Service: People don't have to wait in line to pay their bills or transfer money thanks to this system, which offers quick service. Instant money transfers between accounts are possible with internet payment options.

- Higher Interest Rate: Online banking services offer their users higher interest rates. It has decreased the operational costs of banks, enabling them to provide better interest rates on consumer deposits.

- Service Quality: Internet banking has raised the level of client service. Using online banking to make payments is quick, secure, and effortless. Using e-banking apps, customers may keep track of all account-related transactions.

- 24-7 Facility: Customers have access to e-banking services around-the-clock, seven days a week, 24 hours a day. Customers can access banking services and products at any time, from any location.

- Liquidity: It gives customers access to more readily available finances. They can conveniently withdraw cash from ATMs at any time and from any location.

- Discounts: The ability to take advantage of numerous discounts is another significant benefit of using online banking services. People benefit from several discount programs in stores that accept credit or debit cards.

- Transfer assistance: The virtual banking system makes it simple to transfer money 365 days a year. You don't have to limit yourself to carrying out transactions during business hours; you have 24 hours to do as you choose.

- Surveillance service: Customers have access to an updated passbook at any time to manage their financial plans and keep track of their transactions.

- Paying bills online: Because it offers a feature to pay any sort of bill, including energy, water supply, telephone, and other services, you don't need to stand in line to pay your bills.

Disadvantages:

- Security problems: Online hackers' hacking of e-banking systems has led to several security problems. Customers could suffer significant financial loss if they lose their login information when making payments.

- High Start-Up Cost: It costs a lot to set up different computers, software, hardware, a modem, and an internet network. Banking businesses must make significant investments to launch online banking services.

- Lack of Direct Interaction Between Clients and Banks: Direct communication between customers and banks is one barrier to internet banking. Customers communicate with banks online through their websites. Customers can occasionally not address their problems by contacting the bank virtually.

- Transaction issues: Banking servers frequently go down, which causes transactions to fail. Online payment issues that customers encounter are inconvenient.

- Training and development: Banks must teach their employees so that they can better serve clients online. For keeping skilled and trained workers, significant investment is needed.

- Long process to use e-banking: In certain nations, government banks offer online banking through the completion of an application, which is then approved before allowing access to a security password to log in. To properly log in, one must download the relevant banking app and fill out all required fields (Sharma, 2016).

- Challenging for beginners: It will be difficult for novices to understand e-banking; they may find it difficult. Because they are worried about losing money, customers are typically reluctant to explore all of the features and alternatives offered on the website or app. If prompt assistance is not provided, new clients typically give up and switch back to traditional banking.

- No Cash Deposit Platform: There is no platform for cash deposits in e-banking services. This suggests that e-banking customers must visit their local bank branches or automated teller machine locations to deposit cash instead of using the platform (whether they need instant services or not).

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now