ATM AbbreviationAn ATM (Automated Teller Machine) is an outlet of electronic banking that permits users to complete common transactions without taking the help of a branch teller or representative. With a debit card or credit card, anyone can access the cash in most of the ATMs. ATMs are very convenient and they permit users to perform self-service transactions quickly such as transfer money between accounts, bill payments, cash withdrawals, and deposits. Commonly, fees are charged for money withdrawals by the ATM operator, and by the bank in which our account is registered. All or some of these fees could be ignored by directly withdrawing the money from the bank. Note: ATMs are called as cash machines or automated back machines (ABM) in different locations of the world.Benefits of ATMThe first ATM was shown in 1967 in London at the Barclay's Bank branch. Although, in Japan, there are cash dispenser reports that were in use in the middle of the 1960s. Various interbank communications networks that permitted a user to use a single card of a bank in another ATM of a bank came later in the 1970s. ATMs had developed across the globe and they are securing an existence in all the major countries. Now, they are detected even in small island nations like the United States of Micronesia and Kiribati. Now, there are 3.5 million+ ATMs available in use around the globe. Key BenefitsLet's discuss some benefits.

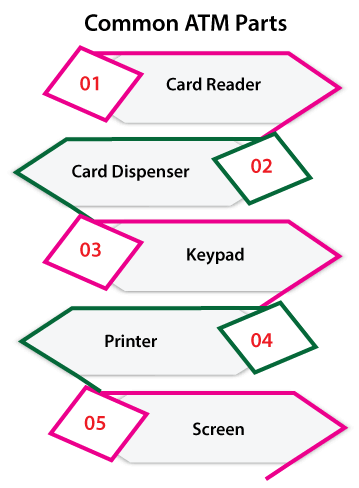

Types of Automated Teller MachinesThere are two kinds of ATMs available, called basic and complex units. The basic units permit users to get updates on account equities and withdraw cash. The complex machines allow deposits, offer line-to-credit transfers and payments, and authenticate account information. A customer should be the holder of an account at the bank which operates a particular machine for accessing the advanced benefits of these complex units. Analysts anticipate automated teller machines will become more famous and estimate an expansion in the ATM withdrawal numbers. The future ATMs are expected to be complete service terminals in addition to or rather than traditional bank tellers. However, the design of all ATMs is distinct. Each unit includes similar parts:

1. Card reader Card readers are used to reading the chip. This chip is placed on the front side of the card or some magnetic stripes on the opposite side of the card. 2. Cash dispenser Many bills are dispensed by a slot inside the machine. This slot is linked to the safe at the machine's bottom area. 3. Keypad This part is used by the users of the machines to input data or information, including the transaction amount, transaction type, and personal identification number (also known as a PIN). 4. Printer Customers can claim receipts that are printed here if required. The receipt can record the account balance, the amount, and the transaction type. 5. Screen The issues of an ATM prompt that guide the user from the process of running the transaction. Also, information is transmitted over the screen like account balances and information. Note: Now, full-service machines often have some slots to deposit paper checks.Modern ATM featuresATMs have been varying over time. The technology of the machine is becoming sophisticated to facilitate a great experience for the consumers. It makes transactions secure and safe. A few of the wide changes are as follows:

ATM card use BenefitsThe benefits of using ATM card are listed below:

Special Considerations of ATMVarious ATMs are placed in areas such as restaurants, casinos, gas stations, railway and bus stations, airports, convenience stores, grocery stores, shopping centers, and other places. These ATMs are multi-functional, but other ATMs outside tend to be entirely or primarily created for cash withdrawals. Mainly, ATMs require users for using plastic cards to complete their transactions. These plastic cards can either a bank credit card or a debit card. Users need to specify the PIN before completing a transaction. Several cards come along with a chip. This chip transmits information from the card to that machine. It works similarly as the code reader scans the bar code. Fees of ATMThe holders of an account can use the ATM of the bank with no charges. On the other hand, accessing cash from a unit purchased by any competing bank incurs a fee usually. Ownership of ATMIn several cases, credit and bank unions own the ATMs. However, businesses and individuals may also lease or buy ATMs over their own or from the ATM franchise. The benefit model is dependent on some charging fees to the users of the machine if small businesses or individuals like gas stations and restaurants own ATMs. Also, banks own ATMs along with intent. They apply an ATM convenience for attracting clients. ATMs overcome a few of the burdens of user service through bank tellers and saving money from banks in payroll costs. ATM DisadvantagesThere are disadvantages too. Let's discuss some of the disadvantages.

Next TopicJira Alternatives

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share