Advantages and Disadvantages of Plastic MoneyThe role of money in everyday lives is essential. But from where came the need for cash? You may remember studying about a time when products were exchanged for commodities under a barter system, then coins made of gold and silver were introduced. As time passed, humans started doing business using paper money and coins. Over time, humans also began using technology to purchase goods. Technology is to blame for the usage of plastic money. Your credit or debit card is termed plastic money, yet it also applies to money transfers made by wire through one bank to the other. We should try to understand plastic money more broadly. What do you mean by Plastic Money?The term "plastic money" may refer to the usage of plastic cards, such as debit/credit cards, in the context of electronic transactions, taking into account the consumer's needs while processing big purchases so customers don't need to carry physical paper money on them.

Debit cards, Key Cards, credit cards, Money Access Cards, Client Cards, and Cash Cards are just a few examples of plastic money. The sole reasons why users use these cards are for their personal safety and convenience so they may make significant purchases. The Origins of Plastic MoneyCharge cards cannot be overlooked considering the history of "plastic money." The development of debit and credit cards was laid by charge cards. As early as the early 1900s, companies started issuing charge cards. Customers' loyalty to the business was mostly maintained via these cards. Frank Mcnamara was the one who came up with the idea for the credit card. Frank forgot his wallet and was out of money after supper with a fellow business partner. Then he had an insight that made him conceive the idea of a charge card. The "Diners Club Card" was a universal card that could be used wherever. The first really adaptable charge card was produced due to this ground-breaking idea.

Unwanted credit cards were a significant issue for the Chicago market in the 1960s. By the middle of the 1960s, credit card firms had not yet entered the Chicago market. Therefore, several businesses started distributing "pre-approved cards."Because they were unintentionally sent to children, pets, convicted criminals, and even toddlers, this mailing strategy proved to be almost disastrous for those credit card businesses. Even worse, organized criminal groups exploited the situation by enlisting dishonest employees to intercept cards. Due to the pre-approval status of the seized cards, the occupants of the postal address were charged hundreds of dollars without them even being aware that the cards had been taken. Barclays in London launched the first card in 1967, while Chemical Banks in Nyc did the same in 1969. The adoption of a magnetic stripe and identifying information numbers was the most important development. To perform safe payments utilizing microprocessor technology, a hardware security module was introduced in 1973, another important development in the history of plastic money. Following this, smart cards were first launched in the late 1970s and became popular in the middle of the 1980s. Different Forms of Plastic MoneyPlastic money is available in a variety of forms. The most frequently utilised payment methods are debit and credit cards. 1. Credit Cards

Credit cards are provided by the bank and let customers borrow money up to a specific amount to make purchases or cash withdrawals. Additionally referred to as charge cards, these credit cards. Both in-store and ATM cash withdrawals using credit cards are options. Credit card interest rates are often high, and even minimum monthly payments may be costly. 1. Debit Cards

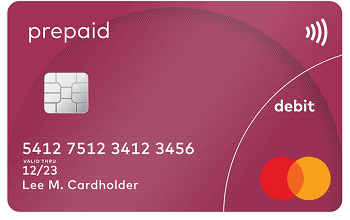

Customers may use their debit cards to make purchases using money already in their savings accounts. A debit card allows instantaneous money transfer from the user's savings account to the merchant's account. Purchases at a shop or cash withdrawals from an ATM may both be made using debit cards. Debit card use typically carries no fees, although cash withdrawals from ATMs could be subject to charges. Additionally, several banks provide incentive programs for clients who often use debit cards. 2. Prepaid Cards

A different kind of plastic currency is prepaid cards. These cards may be used everywhere that accepts credit or debit cards since a specific amount of money is placed onto them. The company that issues prepaid cards often charges a fee for every transaction in addition to an annual cost for card ownership. These cards are well-liked by customers that do not have a bank account or who wish to stay away from the costs connected with conventional banking accounts. Advantages of Plastic Money:1. Living cashless The problems associated with carrying cash have been reduced by the invention of plastic money, which has also made life simpler. We may travel the globe with some of the greatest credit cards without worrying about bringing cash. 2. Increased safety The reduction in thefts and crimes is one benefit of utilising credit or debit cards. It is challenging and requires special skills to hack a card's PIN. As a consequence, owners of credit and debit cards may feel somewhat secure about the protection of their money. 3. Financial flexibility Credit cards enable users to conduct transactions and make payments even when they lack the necessary finances. It is quite helpful, particularly if you don't have much money. Credit cards help lessen the need of obtaining financial support from others in times of need. You may finance your need using a credit card and then pay it back over time in installments. A credit card is also simple to get. You may get a credit card as long as you satisfy the requirements set out by your bank. 4. Simplicity of transactions Internet banking, cash payments, as well as other transaction may all be completed easily through the use of debit and credit cards. Plastic money may be used to make purchases everywhere and is exceedingly easy to use. In addition, many online merchants offer discounts for debit and credit card purchases. 5. Amazing savings and deals Every issuer of credit and debit cards provides promotions and savings on retail purchases. You may use them to increase your savings and get rewards on purchases. 6. Travel cost savings Traveling without plastic money might be costly. Access to lounges and amazing discounts on trip reservations are provided by credit and debit cards. Plastic money is essential if you're travelling since you can't get the same advantages from utilising cash. The Disadvantages of Plastic Money1. Plastic money alone won't always be helpful: Plastic money isn't a total cash substitute. Cash itself is necessary in certain areas. We need cash since neither the newspaper guy nor the fish vendor has a POS system to process plastic money whenever we purchase fish from the market. In a similar vein, while we make monetary contributions to houses of worship, they do not accept plastic money there too. We cannot entirely replace cash until we can use plastic money everywhere. However, some small retail establishments refuse to accept plastic money. There are very few businesses that take plastic money in villages. For our protection, it forces us to constantly carry some cash. 2. Plastic money is also not 100% safe: There is some danger associated with transactions using plastic money, so it is not completely secure either. particularly while purchasing online. We are communicating card information through the internet, which is not necessarily a secure medium. Some websites are just created to steal our bank data and make off with the money. We must resist falling victim to such frauds and hackers. In this environment, one should be an informed internet buyer. 3. Minimum purchase restrictions: It is one of the main drawbacks of utilising plastic money since one must complete a minimum amount be able to swipe the cards. You cannot use the cards for such a transaction until you spend at least Rs. 50.00, for example, even if we have only paid Rs. 40.00 for the products. In this instance, you will need to make an unneeded purchase in order to raise the amount to Rs. 50.00. We could have prevented spending an additional Rs. ten dollars if we had enough cash on hand. 4. Service fee: In certain circumstances, the bank levies a service fee when we use plastic money to make purchases rather than actual cash. For instance, in certain nations, you must pay a service fee when using a credit card to buy gold from a jewelry store. This extra fee won't be charged if you pay with cash. 5. The card itself may sustain damage: Consider a scenario in which you make a purchase and discover at the checkout counter that your card has been scratched or dented or that you are attempting to swipe, but a chip fault or damage is blocking the transaction. You'll undoubtedly wish you had some money on hand. These situations only arise while using plastic money. Although it may be an unusual instance, the likelihood cannot be totally disregarded. 6. Charges for late payments: Using a credit card enables you to make purchases now and make payments over time. It allows you a grace period, but if we don't pay by the deadline, interest will be applied. Cash transactions do not result in non-payment since there is no bank credit taken. ConclusionIn today's society, practically everyone carries both cash and plastic money. To effectively utilize plastic money, however, we must be aware of its benefits and drawbacks. Plastic money may be quite helpful at times, it is indeed true, but that does not mean it always is. When spending cash or digital money, one should use caution. Money has worth no matter what; thus, whether the theft takes place online or offline, we shouldn't be the victims.

Next TopicAdvantages and Disadvantages of MS Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share