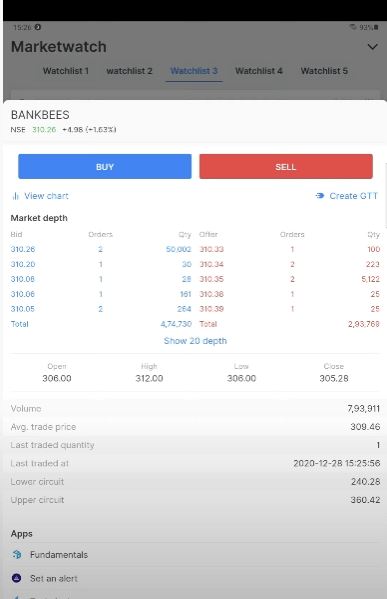

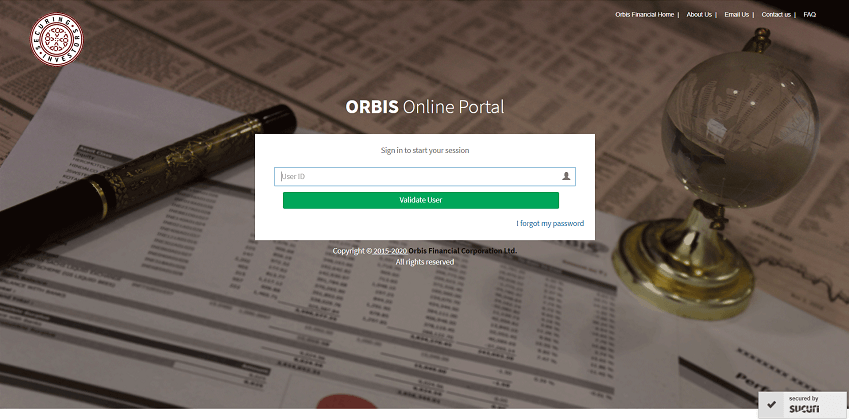

How to Buy Bank Nifty options on ZerodhaYou cannot trade in all the Nifty and Bank Nifty options on Zerodha because of the Open interest limitation of this broker. The position limit of Zerodha is set by the exchange of a trading member or broker. In the bank nifty and nifty index, options contracts are limited to 500 crores or 15% of the total open interest market. However, since Zerodha has many clients actively trading in index options, the position limit is usually met. Due to the above limitation, the allowed trading range is restricted to keep the OI utilization within sanctioned limits. However, Zerodha has tied up with - Orbis Financial to curb the limitation and to enable trades in all Nifty and Bank Nifty options contracts for their clients. To start trading in all the Bank Nifty and Nifty options, you will have to open a custodian account with Orbis, but you need not worry about the change in the platform, as you will continue to trade with Zerodha using Kite.

In this format, the custodian will settle all the funds and trades instead of directly settling with Zerodha. As a result, as more Zerodha clients move to Orbis, the overall OI utilization will also reduce. Invest and trade with Kite by Zerodha, India's largest retail stockbroker. Open an account now. https://zerodha.com/open-account?c=DC2031 After all this, you will still be able to use Kite, with some restrictions in trading:

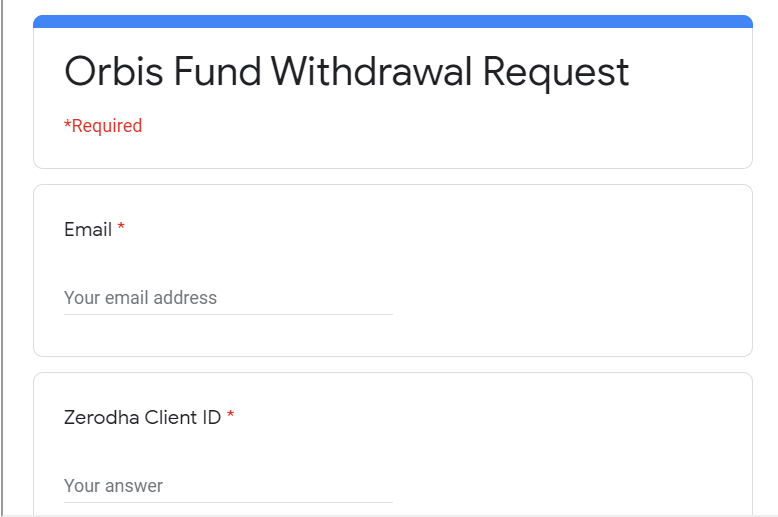

If the trader's Orbis account is mapped with Zerodha, they will not be able to place the withdrawal request in Console.

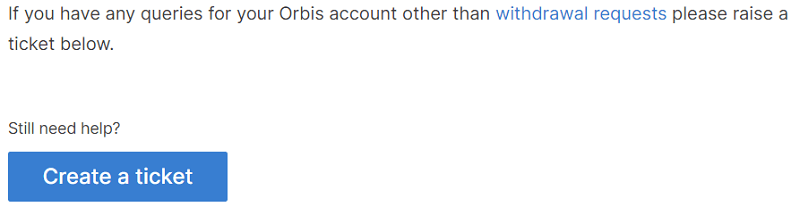

As Orbis settles Funds/trades, Zerodha will show none of the obligations in the contract note, and the trader has to refer to the margin statement that is sent by Orbis. Please raise a ticket below to request the migration of your account to Orbis, and Zerodha's team will reach out to help.

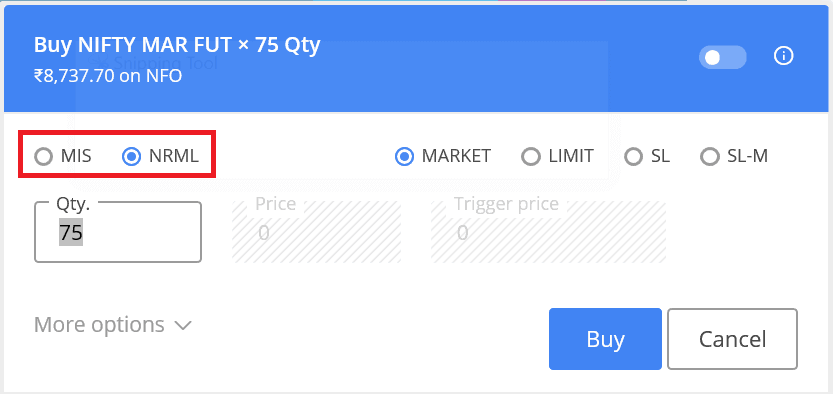

Important: Zerodha can take up to 4-6 weeks to complete migration to Orbis once you confirm your interest.MIS and NRMLMIS stands for Margin Intraday Square Off and is useful for traders doing intraday trading in Options. Intraday trading means to buy and sell the order on the same day. The trade is completed on that day. Nothing is carried off to the next day. Zerodha offers margin leverage for intraday traders. There is no margin provided for traders buying options as there is no margin requirement for such a trade. However, the seller of options is required to maintain a margin. When you use an MIS code, you only need to maintain 50% of the margin. So, entering this code gives 50% margin leverage to Option sellers and allows them to make more trade with the same amount of money.

Order Types You have four options in orders to choose from:

Quantity Each option contract has a lot size. Each lot size consists of a fixed number of shares as decided by the exchange. Nifty contracts have a lot size of 75 shares. Enter the qty as per the lot size, whatever you want. Price You need to enter the premium price for each individual share.

Next Topic#

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share