What is a CVV number?CVV stands for Card Verification Value. It is three digits of code present at the back of your debit card (ATM card) or credit card. This is a very secret code which plays an important role when you do online transaction. So, never share this CVV number with anyone. Each debit card has this CVV number. This number is a unique number on each card. The CVV number is issued by the banks or financial institutions based on the following details:

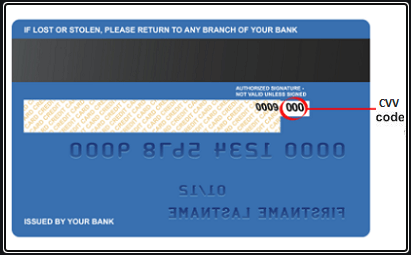

A card contains such details on a debit/credit card: card number, full name of cardholder, date of issue, expiry date of card, and CVV number. These details are confidential, which should not be shared with anyone, especially CVV number, card number, and expiry date. Any un-authorize person can use your debit/credit card details to hack your account and debit a big amount from your bank account. Where can you find this CVV number?You can locate the CVV number very easily on debit/credit. CVV number present at the backside of your debit or credit card. It is a three digits number. On Visa and Mastercard, it will be three digits code. Visa or Mastercard

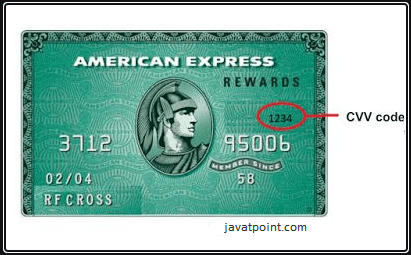

Most of the time, the CVV number presents at the front of the card. But in certain types of debit/credit cards, CVV number could be a four-digits number printed at the front of the debit card. E.g., on American Express cards, it will four digits number present at the front of the card. American Express Card

SecuritySecurity of your card is the first concern. That is why this CVV number mostly printed at the back of the card. Nowadays, there are various tools and technologies available in the market to steal the CVV number. For Example, CCTV cameras. Any un-authorize person can use your debit/credit card details to hack your account and debit a big amount from your bank account. For example - Understand with the help of a real-life example When shopping online using e-commerce apps like amazon, Myntra, Flipkart, these apps ask you to save your card details to make fast transactions. You have saved your card details on these e-commerce apps, but they never save the CVV number of your card. Whenever you will transact through your saved card, they will ask for the CVV number for safety purposes. Points need to be noticedBelow are some essential points about the CVV number:

Note: "The CVV number of your card never stores when you make transaction either online or on a shop using your card. Every time it asks for CVV number to do a successful transaction. "Different names of CVVThe CVV (Card Verification Values) is not only known by the name of CVV. It has several names as given below:

So, do not be confused between them if an online merchant asks for its number. Components of CVVThere are two parts of Card Verification Values (CVV): 1. Black Magnetic StripBlack magnetic strip is an essential component of CVV on your card. You have seen this black magnetic strip at back of the debit card. It contains very crucial unique data inside this black strip of debit card. This information is fetched when a card is swiped through a magnetic card reader machine. 2. Three digits numberThe second component of CVV contains three digits number. These digits (CVV number) are required while making any online transaction using your debit card. Is CVV number and PIN number are same? No, the CVV number and PIN number are not the same. Do not get confused between the CVV number and PIN. They both are different. CVV is a Card Verification number, which is three digits of code issued by Bank (debit card issuer), while PIN is a Personal Identification Number set by the card user itself. CVV number is required when doing online transactions or over the phone, whereas a PIN is required when making in-person transactions with the card in ATMs. Is it safe to provide CVV number on e-commerce site? Generally, it is safe to provide the CVV number while shopping with a trusted e-commerce website. But do not shop with untrusted websites either select the Cash on Delivery (COD) payment method to pay on it. This will save you from fraudulent transactions and hacking your card details. So, never share the confidential information of your card on an unknown and untrusted website. Always use a trusted site while saving your confidential information on it for safety measures. Does the CVV number store to the machine while swiping the card? A question comes to mind that what if I swipe my card when we make card payment in shops or malls. So, you do not need to be worry because CVV cannot be stored, unlike the other details of a card. When you swipe your card with a magnetic card reader machine while making payment using your card, your CVV number does not store. CVV number is confidential information that cannot be shared with others for security reasons. How does the CVV number work?Whenever you use your card to make some payment on e-commerce websites, each time they ask for a CVV number, even for your saved card. These e-commerce sites never save CVV number and save you from online fraud. Besides that, when you swipe the card with magnetic card reader machines, they also do not copy or store the CVV number. Although Payment Card Industry Data Security Standard works well to save the debit card users from fraudulent transactions. Remember that your CVV (Card Verification Value) cannot be guessed by just knowing the debit/credit card number. In case if there is any change in data held inside the black magnetic strip of your card, the transaction will be declined due to "damaged card". So, we have a bit less worry about fraudulent transactions as they offer multiple ways to protect us.

Next TopicHow to make money by Guest Posting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share