CPF Calculator in ExcelWhat is the CPF?Let's start by clarifying the definition of CPF. What precisely is it? "CPF is an abbreviation referring to the Central Provident Fund, a comprehensive social security savings program set up by the Singaporean government for the financial security of Singaporeans and permanent residents." Now, you might be wondering what the main objective of CPF is. It was introduced with the deliberate goal of providing all citizens & permanent residents of the nation with a stable financial basis for their retirement, medical needs, and housing requirements throughout their lives. It's similar to having a lifelong companion by your side at all the important times. CPF operates as follows: Employers and employees contribute to the fund, which is managed and supervised by the CPF Board, a reputable organization that guarantees the employees' hard-earned cash is used wisely. All businesses and employers will contribution to the CPF of their employees. However, how the contributions to the CPF are determined? It is calculated as a percentage of an employee's pay, so higher the income, the more they can save for the future. Note that the current cap on the Ordinary Wage is $6,000. Now let's explore the three key accounts that form the foundation of CPF and make everything possible:

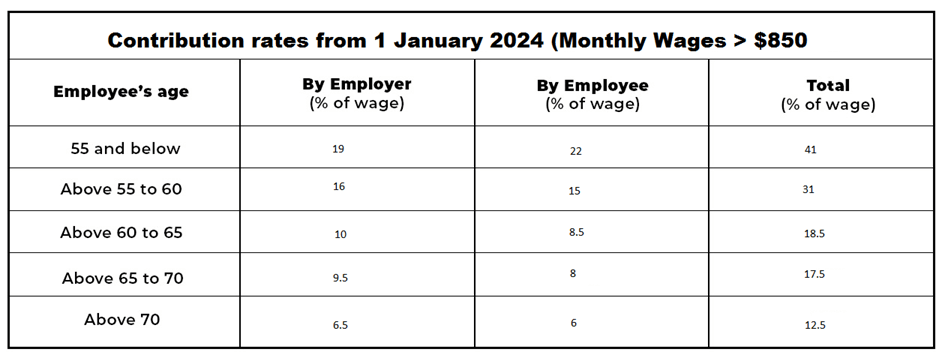

Rates and Regulations for Singapore PR CPF as of January 1, 2024The following CPF contribution rates will take effect on January 1, 2024:

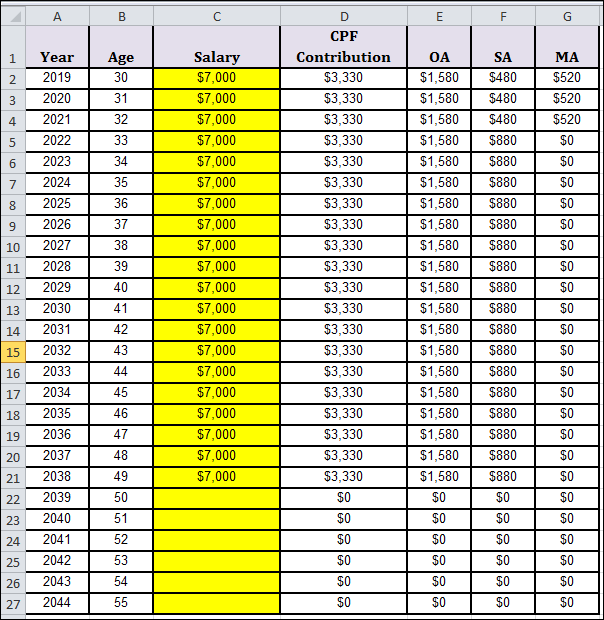

To support retirement adequacy, it is important to remember that CPF contribution rates are rising over time. To address demographic shifts and guarantee enough money for retirement, the Singaporean government reviews and modifies CPF rates regularly. Steps to calculate CPFAll right, now let's calculate your contribution to the CPF. However, using an Excel CPF calculator, you can simplify the process and get optimal results. To calculate CPF contributions using Excel, follow the below given steps: Step 1: Download and open the Excel spreadsheet for the CPF calculator. Step 2: Calculate your savings for CPF. Enter your expected monthly salary and the number of years you plan to work for in the Monthly CPF Contribution worksheet.

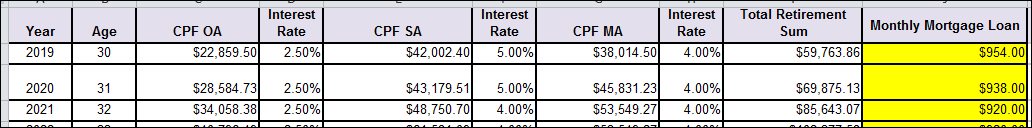

Step 3: Set up your CPF tracking device. Select the tab labeled CPF Calculations. In the CPF Tracker, update the CPF account numbers from the previous year. These will be the starting points of the CPF OA, CPF SA, & CPF MA worksheets. Enter the monthly mortgage repayment amount into the "Monthly Mortgage Loan" column if you have a mortgage loan.

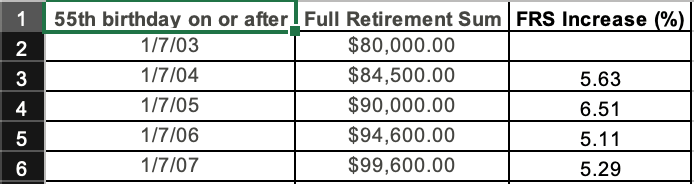

Step 4: Calculate your FRS To project the FRS amount after you turn 55, use the CPF Full Retirement Sum (FRS) Projection worksheet.

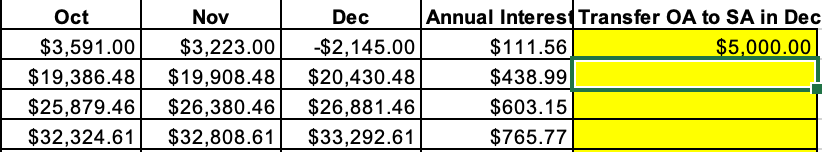

Step 5 (Optional): Look into transferring from OA to SA. The CPF OA worksheet has a column labelled "Transfer OA to SA." Using this column, you can estimate the possible effects of transferring money from your OA for your SA during December.

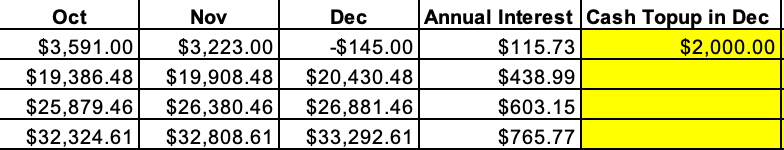

Step 6 (Optional): Think about adding more cash. There is a section titled "Cash Top Up in Dec." among the CPF OA, CPF MA, and CPF SA worksheets. In this division, you can enter any one-time cash top-ups made to each of your CPF accounts. The appropriate sum will later be added to each CPF account in the month of December.

Step 7: (Optional) Revise the annual interest calculation. Because the annual CPF interest rates may vary, it may not be easy to calculate them. Add current numbers to the Annual Interest computation for increased accuracy as the year progresses. ConclusionI hope this tutorial helped you gain the utmost knowledge about CPF and made you realize how important it is to secure your retirement. You can easily calculate your CPF savings based on your age and monthly salary via the CPF calculator Excel template (stated in the above section). This will allow you to plan a comfortable retirement and make well-informed monetary decisions. Understanding how to compute CPF contributions is essential for every working person in Singapore, where financial planning is highly valued. By effectively managing our CPF contributions, we can build a safe financial future and enjoy a comfortable retirement.

Next TopicCustomer service tracker in Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share