Difference Between Cash Flow and Fund FlowThe basis of the accounting discipline is the idea of cash flow and fund flow. These are advantageous to evaluate a company's liquidity condition. Both the statements of cash flow and fund flow have a unique scope and function in a firm.

A company's changes in its cash position (inflows and outflows) are displayed on the cash flow statement. It is a declaration of analytical reconciliation that explains the causes of variations between opening and closing cash balances over a period of time. The Fund Flow Statement, on the other hand, is a statement that illustrates the fluctuations in the entity's financial situation or changes in working capital between the two fiscal years. Cash Flow Statement

Cash flow is the amount of cash that comes in and goes out of a company. Businesses receive income from sales and spend that amount on overhead. Additionally, they could make money via investments, royalties, licensing deals, and interest payments. One of the most crucial goals of financial reporting is to assess the volume, timeliness, and unexpected character of cash flows as well as their sources and destinations. It is crucial for determining a firm's liquidity, adaptability, and overall financial performance. Positive cash flow is a sign that a company's liquid assets are growing, allowing it to meet commitments, reinvest in its operations, distribute profits to shareholders, cover costs, and act as a safety net against upcoming financial difficulties. Strong financial flexibility enables businesses to benefit from lucrative investments. They also perform better during recessions since they don't incur the price of financial hardship.

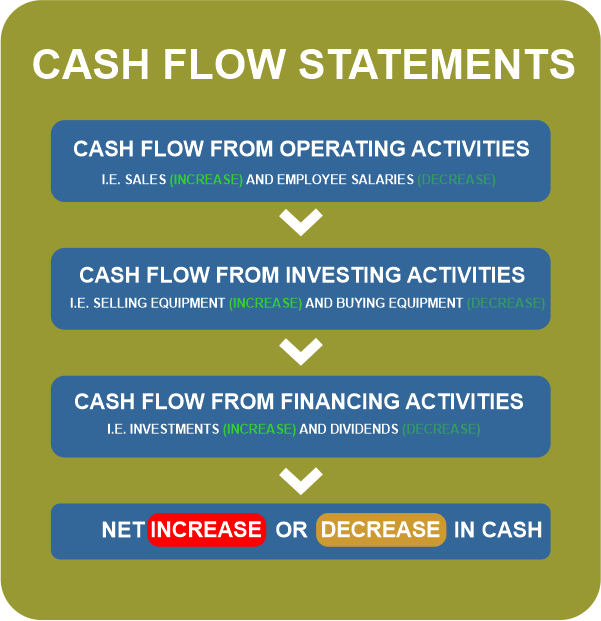

The cash flow statement is a typical financial report that shows the sources and uses of cash for a business over a specific time period and may be used to analyze cash flows. Business management, analysts, and investors may use it to judge a company's ability to earn enough cash to pay off its obligations and keep control of its operating costs. A company's most important financial statements are the cash flow statement, balance sheet, and income statement. Types of Cash Flow1) Cash Flows from Operations (CFO) The term "cash flow from operations" (CFO), often referred to as "operating cash flow," describes financial activities that are directly associated with the production and sale of goods. The CFO of an organization can determine whether or not there is enough money coming in to pay bills or cover operating expenses. In other words, a company has to generate more operational cash inflows than operating cash outflows in order to stay financially viable over the long run. To calculate operating cash flow, cash from sales is deducted from cash spent for operational expenses over time. The cash flow statement of an organization, which is presented quarterly and annually, includes operating cash flow information. Operating cash flow reveals if a company can generate enough money to fund and expand operations, but it may also indicate when a company could require outside financing for capital expansion. It should be noted that the CFO is important in separating sales from funds received. For instance, revenue and profits would increase if a business made a sizable transaction with a customer. However, if it is difficult to collect the money from the consumer, the increased revenue may not necessarily boost cash flow. 2) Cash Flows from Investing (CFI) The terms "cash flow from investing" (CFI) and "investing cash flow" refers to a report that details the amount of money made or spent on various investment-related activities during a certain time period. Speculative asset acquisition, stock investment, and asset sale are a few examples of investing activity. Negative cash flow from investment activities is not always a warning sign. It could be the consequence of significant investments being made in the future prosperity of the company, such as in R & D. 3) Cash Flows from Financing (CFF) "Financing cash flow" (CFF) is the word used to describe the net cash flows used to sustain both the capital and the operations of the organization. Finance activities include, for example, investments in debt, shares, and dividend payments. The cash flow from financing activities provides information to investors about a company's capital structure management and financial health. Cash that enters and leaves different financial assets over a certain period of time is referred to as fund flow. A monthly or quarterly measurement is typical. Fund Flow Statement

Fund flow is not a performance indicator for any asset. For mutual funds, for instance, fund flow monitors the cash spent on buying shares, also known as inflows, and the cash used to redeem shares, also known as outflows. It needs to mention how well or poorly a fund performed. A net inflow happens when there are more cash flows than outflows, such as into the mutual fund. When there is a net inflow, managers have extra money to invest. This should increase demand for financial instruments like stocks and bonds. A net outflow would mean that the mutual fund received more money than was put in it. Importance of a Funds Flow

Limitations of Funds FlowDespite being crucial for examining a company's financial situation, the statement has the following drawbacks:

Key Differences Between Cash Flow Statement and Fund Flow Statement

Tabular Comparison Between Cash flow and Fund Flow

ConclusionCash is one of the parts that make up working capital. As a result, when the position of cash improves, so does the position of funds, but the opposite is not true. When there is an inflow of funds, there is also an inflow of cash; nevertheless, the fund inflow does not cause the inflow of cash. We may conclude that the "Cash Flow Statement" is more important for the shorter the planning period, whereas the "Fund Flow Statement" is more crucial for the longer the planning period.

Next TopicDifference between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share