Difference Between Cheques and Bills of ExchangeA cheque and a bill of exchange (BOE) are both payment instruments, but their legal meanings and attributes differ. The parties concerned must consider the financial and legal implications of both cheques and bills of exchange. Several laws and regulation govern their usage and legality. Cheque:

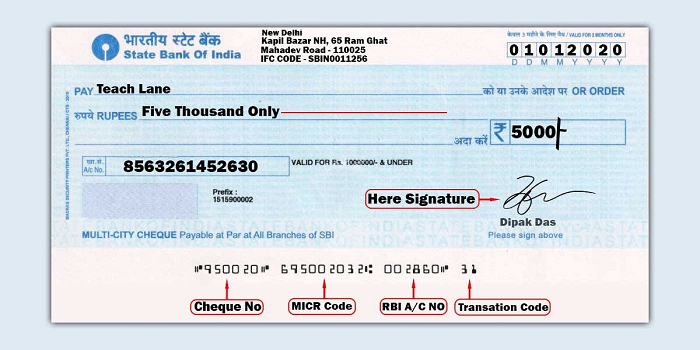

A cheque is a written order from a bank account holder to pay a certain sum of money on demand to a named recipient or bearer. The account holder signs the cheque to approve the payment, which can be drawn on either a current or savings account. The bank honors the cheque by either providing cash to the bearer or debiting the account of the account holder & transferring the money to the payee's account. A cheque can be postdated to be written when the money is in the account. In both corporate and personal transactions, cheques are frequently used as a form of payment since they provide a secure and practical alternative to carrying cash. Bills of Exchange:

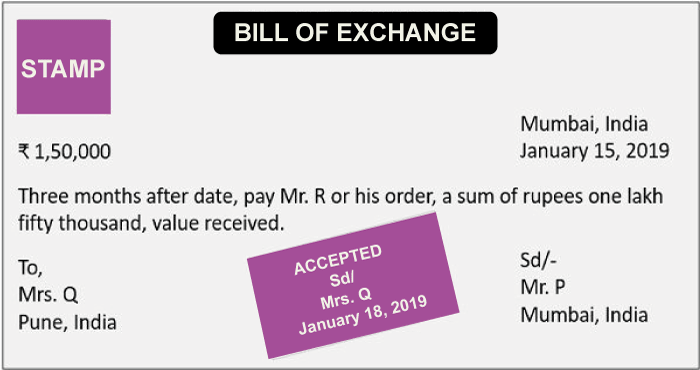

A bill of exchange is a written request for payment of a certain amount of money to a particular recipient (the payee) on a specific future date from one person (the drawer) to another (the drawee). International commercial transactions frequently employ bills of exchange to facilitate the transfer of goods & services between countries. The buyer or importer is often the drawee of the bill, whereas the drawer is typically the provider of the products or services. The payee, who agrees to pay the payment on the designated date, is usually a bank or financial institution. A bank can discount bills of exchange to provide the holder instant cash at a reduced value, or the recipient can endorse them to transfer the ownership to another party. ComparisonBills of exchange are frequently backed by collateral or guarantees to assure payment, unlike cheques, which are subject to clearing and can bounce if there is not enough amount in the account. In conclusion, whereas bills of exchange are frequently used in international commerce, checks are typically used for domestic transactions. Both instruments offer a way to send and receive payments in several professional and personal situations. According to the information above, the following are some essential differences between cheques & bills of exchange:

ConclusionIn conclusion, even though they are both negotiable documents used to make payments, cheques and bills of exchange differ significantly from one another. Cheques are often used for ordinary transactions, involve two parties, or are payable upon demand. Three parties are involved, a bill of exchange is payable at a specific future date, and it is typically used in business transactions. It is crucial for both organizations and individuals to comprehend these distinctions since they influence how these products are utilized and the rights and obligations of the parties involved.

Next TopicDifference Between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share