Difference between Forward and Future ContractProfessional buyers with extensive experience in the market vouch for the importance of becoming familiar with the key trading techniques and strategies. If someone desires to build a strong financial account, trading futures is one of the many financial tools and strategies that can help buyers guarantee a successful portfolio. Investors can, however, use a variety of derivative products to meet their investing objectives.

You must first have a thorough understanding of the various options because there is always a substantial financial risk involved in buying futures. The distinction between forward and futures contracts is one topic that almost all beginning derivatives investors find confusing. By educating yourself on the differences between the two derivative contracts an individual can able to make best choice. In forward contracts and futures contracts, two parties commit to purchase or sell a particular commodity at a predetermined price by a specified date in the future. By securing the purchase or sale price in advance, buyers and sellers can reduce the risks brought on by future price changes. A forward contract is one whose conditions are individually tailored, or bargained for, between the buyer and seller. It is a contract wherein two parties exchange the fundamental commodity at a predetermined price at a later date. Although a futures contract is a regulated version of a forward contract, they are not exactly identical. An arrangement to purchase or sell the fundamental financial instrument at a given price and period in the future is known as a futures contract. However, futures contracts are regulated contracts that are traded on stock markets. As a result, they are satisfied every day. These agreements have consistent conditions and set expiration dates. Futures carry minimal risk because they ensure pay-outs for the specified period. While a forward contract is exchanged OTC, or over the counter, between two financial organizations or between a financial institution and a customer, a futures contract is sold on a market. A forward contract is an over-the-counter (OTC) agreement that closes only once, at the conclusion of the deal. The specific conditions of the deal are negotiated by both sides. It is secretly arranged and carries some failure risk because the partner is in charge of making the payment. People frequently misinterpret these contracts because, in both of them, the asset is delivered at a specified future time. But if you look a little closer, you'll see that these two contracts vary on a number of different fronts. To help you comprehend the distinctions among forward and futures contracts, we have provided all the information you need in this article. Derivative TradingFundamentally, the price change of the fundamental commodity for a derivative product determines how contingent trading is done. These assets could be securities like equities, money, notes, or goods. There are two kinds of derivative trading: private contracts between parties without an official middleman and normal financial contracts with the stock market as counter-party.

In derivatives dealing, parties enter into an arrangement to purchase and sell commodities at a fixed price and timeframe. Derivative contracts are primarily used by businesses and individuals as risk management tools. Examples of derivative transactions whose worth is drawn from the base resources include futures and swaps between them. These contracts are identical and adhere to the same principles. However, there are some distinctions between forward contracts and future contract. Forward ContractsAn object will be traded at a future date at a predetermined price under a secretly arranged forward contract between an interested party and a seller.

They don't sell on the market as a result. Forward contracts' terms and conditions, which include the quantity of the base commodity that will be given and the specifics of what will be provided, among other things, are more malleable due to the structure of the contract. Forward contracts are frequently used by hedgers to reduce an asset's price fluctuation. A forward contract does not experience fluctuations in price because the conditions are predetermined at the time of execution. This means that even if the cost of corn drops to 50 cents per ear, the conditions of the agreement between the two parties to sell 1,000 ears of corn for $1,000 cannot be altered. Additionally, it guarantees the dispatch of the commodity or the monetary payment (if stated). The structure of these contracts prevents them from being easily accessible to individual buyers. It can be challenging to forecast the marketplace for them. This is due to the fact that the arrangements and their specifics are typically kept private between the customer and the seller. Due to the fact that they are private deals, there is a high level of collateral risk, which increases the possibility that one partner, will be at default. Contract must include:

Types of Forward ContractA particular kind of derivative asset is a forward contract. This is an arrangement between two investors wherein the parties agree to purchase or dispose of an underlying commodity or security at a later time, in the specified amount, and at the specified price. These contracts are not regulated and are traded OTC (over the counter), which means they are not subject to many laws. We will cover the various kinds of forward contracts afterwards in this article. Forward contracts are mainly used by traders as a form of insurance against market instability in commodities and foreign exchange. However, forward contracts can also incorporate other types of assets, such as stock, government obligations, real estate, and a lot more. Forward contracts are helpful as a tool for safeguarding. Investors, despite this, additionally apply it for speculative reasons to benefit from changes in the values of securities. Now that we are aware of what forward contracts are, let's examine the different kinds. Following are the types of forward contracts: 1. Window ForwardsInvestors can purchase currencies through these forward contracts at a variety of payment times. In simple terms, these contracts enable buyers to obtain a more advantageous and practical exchange rate than they would through the use of a regular forward contract. For instance, after a period of three months, Mr. Kapoor is required to reach a resolution with his US-based provider. However, no firm date has been set. Consequently, Mr. Kapoor chooses a window forward contract that allows him to make transactions any day between April 1 and April 30 of the forthcoming fourth month but not after the 30th. 2. Long-Dated ForwardsAs the name implies, these agreements have much longer payment periods than standard forward contracts. A typical forward contract normally has a maximum 12-month expiration date. Long-dated forwards, however, have an expiration date that can be up to 10 years in the future. Long-dated forwards have the same characteristics as conventional forward contracts, with the exception of paying at a later date. 3. Non Deliverable Funds (NDFs)Forward contracts that are non-deliverable have very distinct characteristics from conventional forward contracts. Physical transfer of the security or financial instrument does not take place, as is the case with similar arrangements. Instead, when the settlement is completed, the parties simply trade the disparity sum. Based on the contract rate and the market rate at the moment of payment, the differential sum is calculated. Such forward contracts are typically chosen by buyers who lack sufficient funds, are unwilling to pledge large sums of money, or want to prevent large amounts of money. 4. Flexible ForwardA forward contract of this nature offers buyers freedom when swapping money. Buyers who use such a contract have the choice to swap the money prior to the payment date. Participants to this contract may exchange the amount of money in full or may divide the exchange into multiple instalments prior to the settling date. 5. Closed Outright ForwardThis is the most basic kind of forward contract. These forward contracts may also be referred to as European contracts or "conventional forward contracts." Investors can swap the primary asset under these kinds of contracts at a predetermined future date. For example, consider the scenario where you engaged in business with a foreign supplier. The payment deadline is also the 28th of the following month. By engaging into a closed full forward contract for the 28th of the following month, you can fix the exchange rate. 6. Fixed Date Forward ContractThis kind of forward contract permits for the trade of the primary commodity at the specified expiration date. Alternately, we could state that these contracts have a set expiration date. The majority of forward arrangements are only for established dates. 7. Forward Option ContractThese forward agreements resemble flexible forward agreements in many ways. An option forward contract enables participants to trade the underlying asset at any given moment throughout the specified time frame. Future ContractsA forward contract is an exclusive, modifiable contract that closes at its conclusion and is exchanged over the counter (OTC). The conditions of a futures contract are regulated, and it is exchanged on a market where values are resolved every day until the contract's expiration. Speculators who make bets on the way that the cost of an asset will change often resort to these contracts. They are typically blocked out before they are fully developed, and birth rarely occurs. In this situation, a monetary compromise is typical.

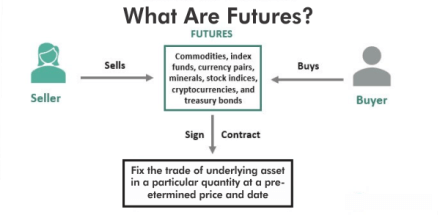

They have clearinghouses that ensure the deals because they are exchanged on a market. This significantly reduces the likelihood of failure to almost zero. There are contracts offered for commodities, currencies, and stock market benchmarks. Oil and petroleum are two of the most widely used commodities for futures transactions, along with cereals like wheat and maize. In a standardized financial deal known as a futures contract, the volume and cost are set and due at a later time. They are also known as futures, and they can be exchanged on an exchange for shares in any market sector, including equities, products, foreign currencies, etc. Additionally, the deal must be executed by both parties by law. The elements that follow are included in the futures contract's normal terms and conditions, such as

Types of Future ContractFutures are frequently used by traders seeking to benefit from price fluctuations as well as by companies in a variety of industries to hedge against price instability. The right to purchase or sell a specific commodity at a fixed price in the future is granted by a futures contract to a customer or seller. The finance and trade marketplaces both offer several types of futures. Examples of financial futures include stock, benchmark, currency, and interest futures. Agricultural goods, metals, oil, cotton, oilseeds, and other goods are also accessible as futures. 1. Commodities FuturesInvestors can buy and sell tangible goods known as commodities. Some of the most common commodities for which buyers buy futures contracts are oil, metals, natural gas, food cereals, and others. Such agreements are secured by the properties themselves. For producers in particular, commodity contracts are absolutely essential for controlling the risk associated with prices. In order to market his product at an appropriate cost on a certain date in the future, a farmer or primary crop provider may execute a futures contract. He will know up front exactly how much he will be compensated for his job in this manner. If the cost decreases in the future, he won't have to worry about sacrificing money. 2. Currency FuturesContracts based on foreign exchange prices are known as currency futures. The participants in the deal decide on an exchange rate for the conversion of two currencies at a later time. The exchange rate risk that can arise in long-term foreign dealings can be reduced or eliminated with the aid of such contracts. Usually, the parties will end these contracts prior to the expiration date in order to satisfy their requirements. 3. Futures on Interest RatesInterest rate futures are a sort of insurance against the possibility that the interest rate on a financial asset will fluctuate at a certain point in the future. Interest rate ambiguity may place extra financial strain on companies, leading to substantial losses. Interest rate futures frequently appear alongside money market or bond market assets like government bonds, bills, etc. These commodities serve as the foundation for futures transactions. 4. Equities FuturesInvestors can hedge risks, wager, or just trade using single company and stock market benchmark futures. They also serve as an indicator of trader sentiment and market trust. Futures on a single stock serve as a safeguard against potential stock price fluctuations. On the other side, stock market index futures follow the change of an indicator. Company futures are financial instruments that impose a duty on the buyer or seller to purchase or sell a particular stock at a specific price and on a particular date in the future. Investors who have a sizable interest in one or more companies benefit from them. In the case of a possible equity price drop, they want to safeguard their risk situation. Key Differences between Forward and Future contracts

What Characteristics of Forward Contracts and Futures Contracts are Similar?Unlike forward contracts, which are negotiated secretly between two parties, futures contracts are traded on platforms, making their specifics accessible to the public. Therefore, before considering dealing in them, any investor can view and investigate them. More significantly, because futures contracts are common, they have fixed conditions and an end date. Forward contracts, on the other hand, are customized to the needs of both parties involved.

Now that the meanings are out of the way, the comparison of the two contract kinds can solely be made. Both the buyer and the seller will carry out their business on a specified date via forward and future contracts.

If you intend to deal in forward contracts and futures contracts as an investor or broker, you must first comprehend their parallels and distinctions. Let's examine their parallels before examining the differences between forward and future contracts. 1. Purchase CommitmentBoth contracts require the buyer and the seller to make a promise to close a deal at a certain price by a particular deadline. In both cases, a duty is established for both parties. 2. Predicting MethodsBoth forms of contracts are employed as anticipatory strategies to guarantee that the cost is fixed. Clients engage in these agreements to safeguard themselves against anticipated price increases, whereas suppliers do so to safeguard themselves against anticipated price decreases. 3. Risk is PresentBoth contracts carry a certain risk when used, despite the fact that the degree of collateral risk varies among the two contracts. 4. The RegulationRules that apply to the implementation of both contract forms exist. While forwards draw their guidelines from clauses in contract law, futures policies are provided by a central regulating body. Why are Futures Contracts Preferable to Forward Contracts?Since futures contracts are exchanged on platforms as opposed to forwards, which are discussed in secret between participants, the information they contain is made publicly available. Futures have lower counterparty risk than forward transactions because they are controlled. The standardization of futures contracts implies that they have predetermined conditions and an expiration date. Conversely, forwards are tailored to the requirements of the people concerned.

Next TopicDifference between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share