Difference Between Perfect Competition and Monopolistic

Perfect Competition Market

Perfect competition is an ideal scenario in which the market has so many well-informed buyers and sellers that monopolies cannot occur. As a result, commodity prices are determined by demand and are not influenced by buyers and sellers. Perfect competition models are an ideal benchmark for comparing real markets. They are also the theoretical opposition to monopolies. Under monopolies, the price is set solely by the sellers; in perfect competition, it is set by supply and demand, allowing businesses to profit without inflating rates above what's reasonable.

Key Features of Perfect Competition Market

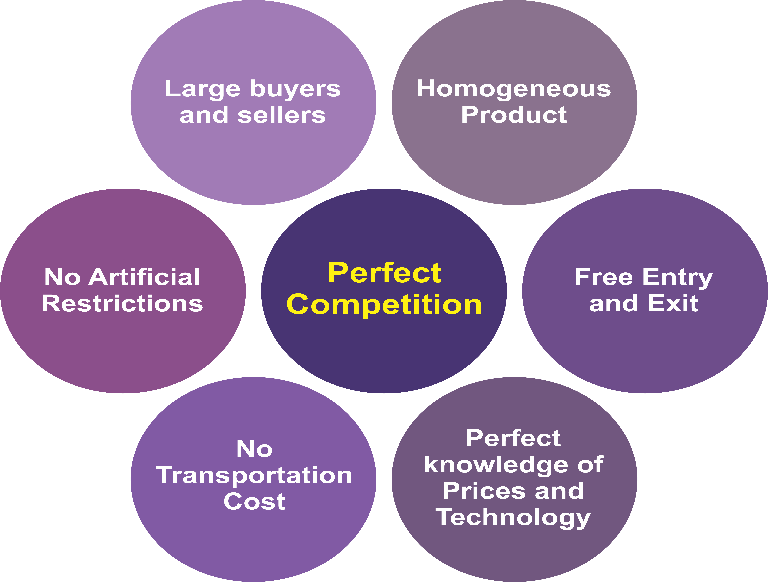

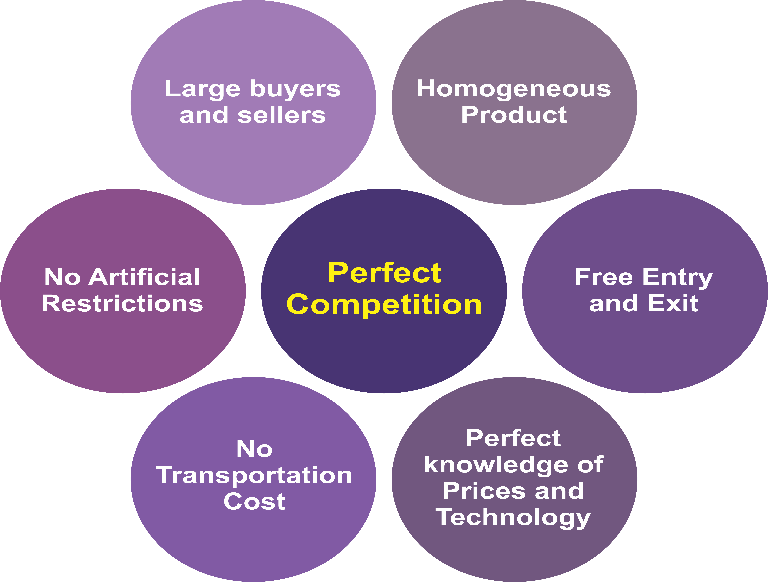

Perfect competition has the following five key features:

- Many Competing Firms: A market with perfect competition has many potential buyers and sellers. As a result, businesses are referred to as "price takers." Put another way; the company must sell at the "equilibrium" price, the price at which supply and demand are balanced. If not, they must stop business because several other companies will provide the same product for less money. Customers, therefore, bear little costs when moving to a substitute item. Since so many businesses are in the market, no one can raise prices. If they do, buyers can move to less expensive alternatives, forcing them out of the market.

- Similar Products Sold: When there is perfect competition, businesses sell similar products. It is sometimes referred to as being "homogenous" in economics. It just indicates that the items are comparable as well. The average customer might not be able to distinguish one firm from another. Therefore, switching is easy and cheap if you're willing to do so. One important example is dairy. For instance, multiple dairy farms provide retailers with milk, yet the item is relatively the same. Supermarkets often alter their contracts with dairy producers without the general public even realizing it.

- Equal Market Share: Because businesses can't compete on pricing, competitors have almost the same market share. Prices cannot be lowered as long as businesses produce at a margin where marginal revenue equals marginal cost. When a company lowers prices, it begins to lose money because the product is more expensive to produce than it is to sell, which causes the company to go out of business. In addition, if any company raises prices, there is enough competition to draw customers away from that shop and drive it out of business. Consequently, this limits a company's capacity to expand its market share.

- Buyers have full information: This is known as "Perfect Information" in economics. The consumer knows the store down the street offers the identical thing for less money. Businesses are, therefore, hesitant to boost prices before a competitor. Customers are further aware of a product's quality. For instance, a company could cut expenditures to offer a product of lower quality and generate more profit. Customers will know the product's shortcomings since they have perfect information. They will then move to different companies, forcing the first company out of business.

- Ease of Entry and Exit: Companies can enter and leave the market cheaply. Money, time, or information may be used for this. For example, a significant amount of capital must be invested upfront in the oil and gas sector. It makes it difficult for competitors to enter the market. These expenses are nonexistent or very little in a perfectly competitive environment. Under perfect competition, businesses might easily quit the market as well. A business can, for instance, have a lengthy contract. However, they cannot quit the market without incurring high fees.

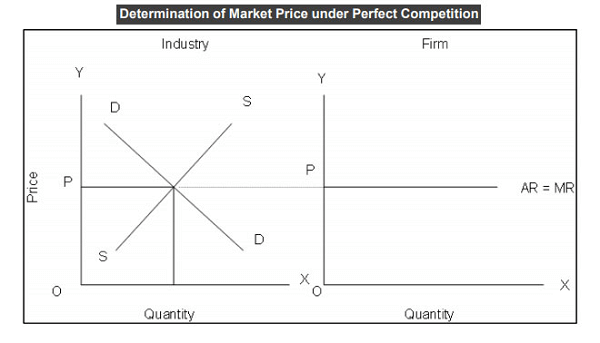

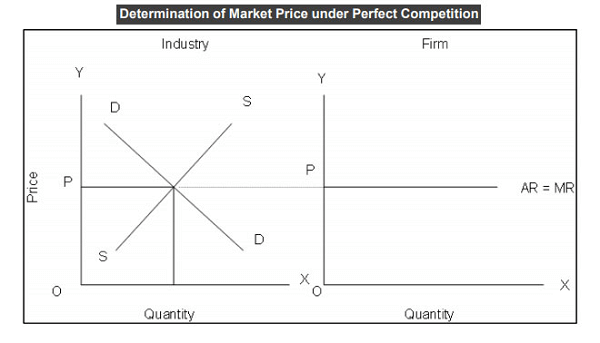

Market Equilibrium in Perfect Competition Market

Competitive equilibrium is when profit-maximizing producers and utility-maximizing consumers reach an equilibrium price in competitive markets with freely determined prices. The quantity supplied and the quantity required are equal at this equilibrium price. In other words, buyers and sellers feel they are receiving a fair offer. In general, the desires of consumers and producers differ. The former intends to spend as little money as possible, whereas the latter wants the best product price.

It indicates that as prices have been raised, the quantity wanted by sellers tends to decrease, and the quantity supplied by sellers tends to increase, whereas when prices are decreased, the quantity wanted by sellers rises, and the quantity supplied by sellers declines. When these quantities are out of balance, the market experiences a shortage or surplus. Up to the time when buyers and sellers can agree on one combination of price and quantity in the market, entrepreneurs have an incentive (in the form of profit opportunities) to participate in trading or to reallocate real resources. The market is said to be in equilibrium when the supply and demand curves intersect, and the amount supplied equals the amount demanded. Both buyers and sellers maximize their financial profits at equilibrium pricing about the capabilities of technology and the available resources. Not everyone gets what they want, but all participants in the market do their best to find a balance between their wants and a certain scarcity of economic goods. Therefore, Competitive equilibrium is regarded as optimal for economic efficiency.

Benefits of Perfect Competition Market

- They are capable of achieving the greatest economic welfare and consumer surplus.

- There is no lack of information because all the perfect knowledge is available.

- Normal cost profits only fully cover opportunity costs.

- They distribute resources in the most effective way possible.

Drawbacks of Perfect Competition Market

- Due to the vast number of competing businesses providing the same things, there is no chance of making the greatest profit.

- There is no courage to develop new technology because of the perfect knowledge and the ability to share all the information.

- Because all the products are identical and unbranded, there is a lack of distinctiveness.

- Reducing the research and development process.

Monopolistic Market

When numerous businesses provide goods or services with essentially the same functionality but differ in specific ways, this is referred to in economics as monopolistic competition. A monopolistic market implies a pure monopoly, which shows a single entity's dominance in supplying goods and services to the market.

A few characteristics of monopoly and perfect competition are reflected in monopolistic competition. As an example, the producers act as price takers, much like monopoly players, and have a variety of suppliers, access to substitute goods, and unrestricted entry and exit, just like in perfect competition. On the other hand, a monopolistic market is an excellent example of a pure monopoly because it allows one company to control the whole market and enjoy full market share. Using the opportunity to impose excessive prices in this manner.

These companies can adjust different factors to get the greatest profits because they are the only players in the market with a monopolistic structure. A monopolist also has the power to pressure suppliers to cut their pricing for input goods. As a result, quality and input suppliers suffer while profits rise.

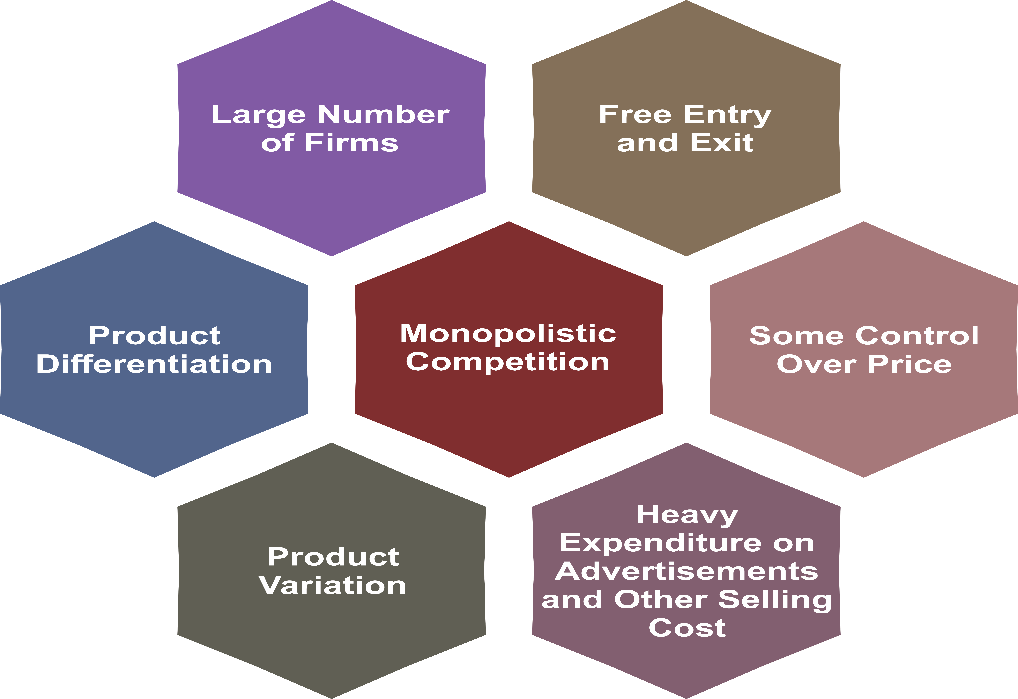

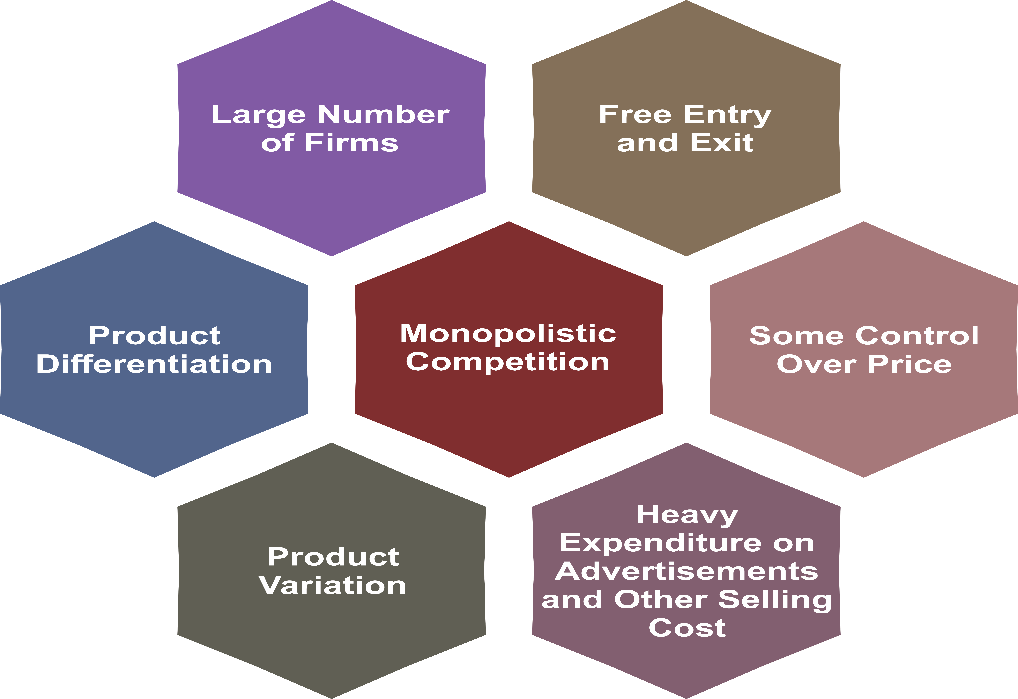

Key Features of a Monopolistic Market

In a monopolistic market structure, the monopolist has several unique features that set it apart from other market structures. Here are some of the key features of a monopolistic market:

- A Large Number of Sellers: Many businesses sell similar but distinct products. Each business runs independently and holds a small portion of the market. Therefore, the market price is only somewhat within the control of a single business. Market competition is a result of a large number of businesses.

- Product Differentiation: Despite the enormous number of suppliers, each company can exercise some monopoly by broadening its product range. Product differentiation is differentiating items based on brand, size, color, and shape attributes. A company's product is an immediate but imperfect replacement for another company's."product differentiation" implies that consumers can distinguish between identical items made by various companies. As a result, customers are also willing to pay various costs for the same product made by various businesses. It gives a particular company some monopoly ability to control the market price of its goods.

- Selling costs: Products are differentiated under monopolistic competition, and the purchasers are made aware of these differences by selling prices. Selling costs are the costs involved with the product's marketing, sales promotion, and advertising. These expenses are made to convince customers to choose one product brand over a competitor's. For this reason, selling costs comprise an important part of the entire cost under monopolistic competition.

- Freedom of Entry and Exit: Businesses can enter or exit an industry under monopolistic competition. It guarantees that a company will not experience abnormal earnings or losses over the long term. It must be noted, as well, that admission is not as simple and cost-free under monopolistic competition as it is under perfect competition.

- Lack of Perfect Knowledge: Buyers and sellers do not completely understand the market conditions. Consumers' perceptions of items are falsely raised by selling costs, making it more challenging to make informed decisions about the many goods on the market. As a result, even though a certain product is expensive, people choose it even though other similarly-quality products are available at lower prices.

- Pricing Decision: A company subject to monopolistic competition neither sets nor takes prices. Each company, however, has some control over the pricing by creating a unique product or building an impressive reputation. Depending on how loyal consumers are to his brand, he may have more or less control over price.

Benefits of a Monopolistic Market

- Since there are no close substitutes for the goods, the monopolists' business does not need to spend much money on advertising and promotion to set their items apart.

- A monopolist will boost production efficiency more than the existence of an extra seller, preventing manufacturing from achieving economies of scale.

- With the government's monopoly, natural resources are maintained and very important for the community's welfare.

- The encouragement of innovation is due to the protection of individual property rights.

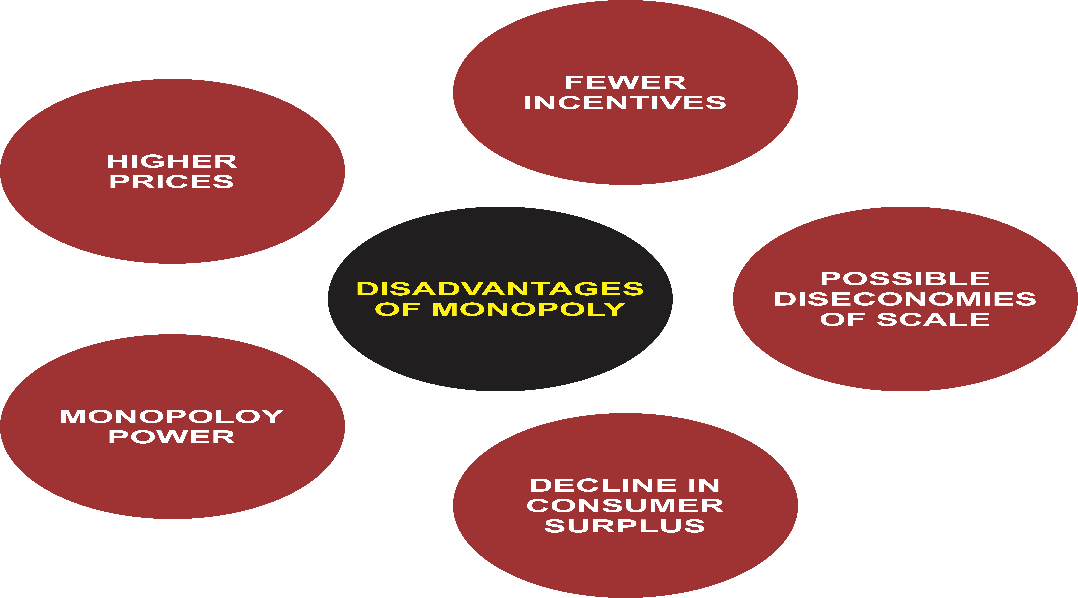

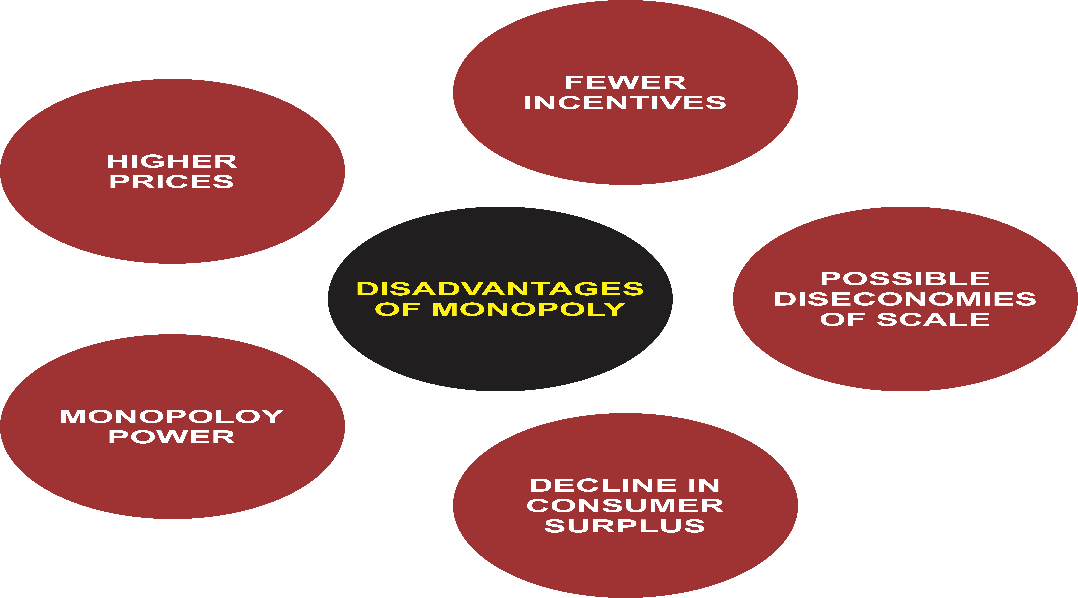

Drawbacks of a Monopolistic Market

A monopolistic market is a structure in which a single firm controls the entire market for a particular good or service. Monopoly refers to a market structure in which a single firm is the only seller of a particular good or service and has complete control over its production and distribution. While monopolies have some advantages, they also have drawbacks that can harm consumers and the economy.

- Monopolies can raise prices above the level of competition, which results in greater customer costs. It is one of their key disadvantages. In a competitive market, businesses must keep their prices low to draw customers. Still, in a monopolistic market, the monopolist is free to charge higher rates because there are no alternative options for consumers. As a result, consumers may experience a decline in their level of welfare due to having to pay more for products and services.

- Monopolies can also limit the number of products and services produced, resulting in shortages and rationing. In a competitive market, businesses are driven to produce as much as possible to meet demand and increase profits. To maintain high prices and maximize profits, a monopolist in a market could restrict production, which might result in shortages and rationing. It can be very harmful in sectors like healthcare, where a lack of supply can negatively affect people's health.

- Monopolies can hinder creativity and technological advancement as well. Businesses continually innovate and enhance their goods and services in a competitive market to stay one step ahead of their rivals. Because there is no rivalry in a monopolistic market, the monopolist may not be motivated to innovate or improve their products. It may result in a slowdown in technical advancement and a shortage of new goods and services.

- Monopolies can concentrate wealth and power in the hands of a select group of people or businesses. The monopolist may be able to exercise their dominance to shape public policies, restrict competition, and set pricing. Because a small number of people or businesses have disproportionate power and influence over the economy, this can result in a lack of democracy and economic inequality.

- Monopolies can be harmful to the economy as a whole, as they can lead to a misallocation of resources. When a single firm controls an entire market, it may allocate resources inefficiently, producing too much of certain goods or services and too little of others. It can lead to a lack of diversity and resilience in the economy, making it more vulnerable to economic shocks and crises.

Difference Between Perfect Competition and Monopolistic: Table

| Aspect |

Perfect Competition |

Monopolistic |

| Number of firms |

Perfect competition is characterized by many buyers and sellers, meaning no single entity controls the market. |

The monopolistic competition also has many firms, but each one has some degree of market power. |

| Market power |

In perfect competition, no firm has market power, and each is a price taker. |

In monopolistic competition, each firm has some market power and can influence the price of its product to some extent. |

| Barriers to entry |

Low |

Low |

| Product differentiation |

Perfect competition does not allow for product differentiation, as all products are identical. |

Monopolistic competition, on the other hand, allows for some degree of product differentiation, where firms can differentiate their products through branding, packaging, and other marketing techniques. |

| Price control |

In perfect competition, no firm control the product's price, and the market forces of supply and demand set the price. |

In monopolistic competition, firms have some control over the price of their products, but the extent of this control is limited by the degree of competition in the market. |

| Advertising |

In perfect competition, there is little to no advertising, as all products are identical, and there is no need for firms to differentiate themselves. |

In monopolistic competition, advertising is significant as firms attempt to differentiate their products and create brand loyalty among consumers. |

| Information |

In perfect competition, all market participants have perfect information about the market and the products sold. |

In monopolistic competition, information is imperfect, and firms may attempt to influence consumers' perceptions of their products through advertising and other marketing techniques. |

| Demand curve |

In perfect competition, the demand curve is perfectly elastic, meaning that any price change will result in a proportional change in the quantity demanded. |

In monopolistic competition, the demand curve is relatively elastic, meaning that a price change will result in a less-than-proportional change in the quantity demanded. |

| Profit |

In perfect competition, firms can only earn a normal profit in the long run, as there are no barriers to entry, and new firms will enter the market until profits are driven to zero. |

In monopolistic competition, firms can earn a profit in the long run, but this profit is limited by the degree of competition in the market. |

Conclusion

In conclusion, monopolistic and perfect competition are significant market structures that present special benefits and drawbacks to companies and consumers. Perfect competition is extremely effective and competitive because it has a huge number of businesses that manufacture the same kind of commodities, no entrance barriers, and no price regulation. Contrarily, monopolistic competition is characterized by many companies that provide distinctive products, low entry barriers, some price control, and extensive marketing, which could result in greater costs and decreased efficiency.

Businesses must carefully consider their market structure and adapt their strategies accordingly to remain competitive and profitable. Understanding the differences between perfect and monopolistic competition can help businesses make informed decisions about pricing, production, and marketing strategies that align with their objectives and maximize their chances of success in the market.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now