Difference Between Shares and DebentureBefore knowing the difference between shares and debentures, it is most important to know the answer to the question, what are shares and debentures? So, let's start with the answer to this question first. The nature of the business was relatively limited at first. However, as civilization evolved on Earth, so did the nature of trade. First, the barter system was established; initially, it was a sole proprietorship, and later, a partnership was formed. However, both have limitations, as running a large-scale business is impossible. A joint-stock company was formed to correct this error. A large-scale company can now be conducted using this medium. The joint-stock corporation emerged as a result of the industrial revolution. This firm can easily collect, manage, and plan large amounts of capital. In contrast to a sole proprietorship or partnership business, the responsibility of the shareholders is typically restricted rather than unrestricted. In short, a joint-stock company should be the firm's legal form if it is to be run on a vast scale in the modern day. A company makes its arrangement with the fund to achieve its long-term needs in two ways:

SharesA company's capital is split up into smaller units, and these smaller units are called shares. The term "share" denotes a portion of money with ownership rights. In accordance with Section 1(48) of the Indian Companies Act of 2013, "share" refers to a share in a company's share capital. A business can divide its capital into shares of 1 rupee, 100 rupees, 1000 rupees, or any other appropriate amount. A share is a division of a company's total capital.

For example, if a company has a total capital of Rs 50,000,000 and we divide it into 50,000 units, and the cost of each unit is Rs 100, then each unit of Rs 100 shall be referred to as a share of the company. Characteristics or features of shares

Based on the Companies Act 2013, under Section 43, a company is allowed to issue two types of shares, those being:

1. Preference shares [Section 43(b)]Shares with the preference right have the following features:

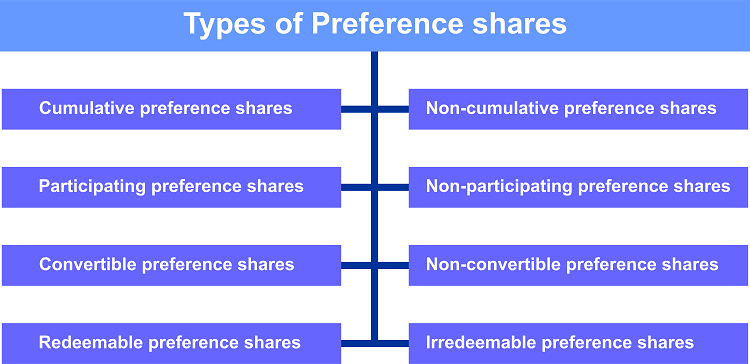

A predetermined dividend rate is paid out of the annual profit before being distributed to equity owners. Preference shares may also have rights not mentioned above, depending on the duration of the issue, which is specified in the company's prospectus or "Articles of Association." Classification of preference shares There are eight types of preferences shared, such as: I) Based on dividend rights.

II) Based on conversion

III) Based on redemption

IV) Based on participation in surplus profit

1. Cumulative preference shares Cumulative shares are those shares on which the arrears of dividends accumulate. It is possible that if the company could not generate profit in any year, then the preference shares' dividend would not be payable that year. In such cases, unpaid dividends on cumulative preference shares should be treated as arrears. Arrears of dividends will accumulate, and such dividends will be payable out of the profit of the subsequent year. Equity share dividends will be owed after clearing such arrears. 2. Non-cumulative preference shares Non-cumulative preference shares are those on which arrears of dividends do not accumulate as per the articles of association. If the company does not generate a profit in any given year, this type of shareholder cannot claim dividend arrears. Also, the right to claim lapses on non-cumulative preference shares. If the company does not pay the dividend on such shares during a particular year, the right to claim the dividend lapses. 3. Convertible preference share The shares that can be converted into equity shares within a prescribed period are known as convertible preference shares. 4. Non-convertible preference share These are the shares that cannot be converted into equity shares. These shares are known as non-convertible preference shares. 5. Redeemable preference share These shares are redeemable or represent the company's choice after a fixed or set period. So that's why these shares are recognized as redeemable preference shares. 6. Irredeemable preference share These shares cannot be redeemed for all reps purchased by the company's choosing, so they are recognized as irredeemable preference shares. After the amendment of the Companies Act 2013 under section 55(1), the company that is limited by shares has no right to issue irredeemable preference. 7. Participating in preference sharing These are the shares that entitle the holder to a portion of a company's surplus profit or the remainder of the company's excess profit after equity shareholders. In other words, the shareholders of participating preference shares are granted shares in surplus profit aside from a fixed dividend rate. 8. Non-participating preference share These are those shares that grant repayment of only a fixed rate of dividend to their shareholders. Shareholders of non-participating preference shares do not get any claims from the surplus profit of the company or the remaining company's excess profit. Note: Not all preference shares will be assumed to be cumulative and non-participating if the articles of association are silent.2. Equity shares [section 43(a)]These shares are paid to equity shareholders after the payments are made to preference shareholders. The shares do not have preference shares. In other words, in the payment of the dividends or the capital repayment, none of the preferential rights are enjoyed by the shareholders of this share, so this term is referred to as an equity share.

Equity shares are also referred to as the "risk capital" of the company. As a rule, shareholders of equity shares manage the company's business. After the payment of the preference dividend, the equity shareholders are entitled to or have the right to receive all the profits. As a result, shareholders of the equity share do not get dividend payments at a fixed rate. So their share of dividends can be different from year to year. Hence, if the company cannot generate profit, these equity shareholders may not receive dividends. StockA collection or bunch of sets of fully paid shares is referred to as "stock." Therefore, the stock is a fund's capital that can be divided into any desired number or amount, and capital stock ownership is represented in terms of money instead of numbers. The characteristics of stocks.

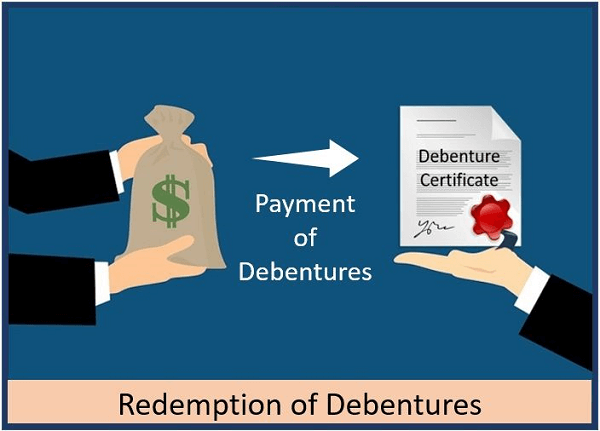

DebenturesOne of the key components of raising long-term loan capital for the company is called a "debenture." As a general rule, the document termed a debenture is used to generate loans. Debentures have a fixed percentage of interest. After a certain period, the debentures can be redeemed by the company. According to the Law of Companies Act 2013, under Section 2 (30), "stock bonds and other company instruments that serve as evidence of a debt, whether constituting a charge on the company's assets or not." To sum up, everything that has been mentioned above, debentures are the issuance of a certificate or document by the company acknowledging debt for the money taken as a loan. It is an undertaking to repay a specific amount of borrowed money plus interest at a particular rate.

Nature or characteristics of debentures

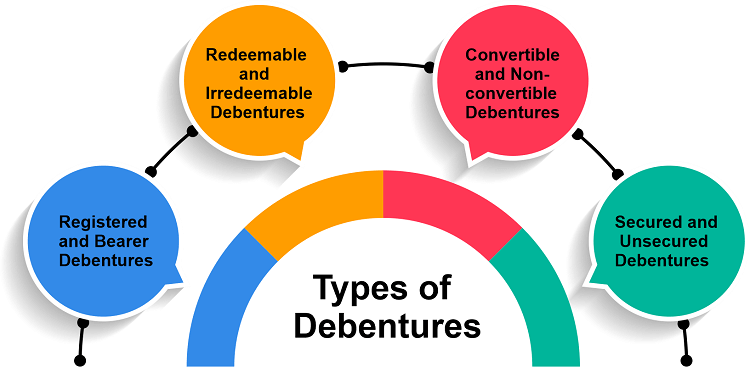

Types of DebenturesI) Based on transferability 1. Registered debentures These are the debentures that are recorded or documented in the debenture holder's register, and they are referred to as "registered debentures." Only the registered holder will receive interest or principal repayment. A deed of transfer is the only way to transfer those debentures, and we can also say that it cannot be delivered to someone else to transfer it. 2. Bearer debenture These debentures are payable to their debenture holder, referred to as the "bearer debenture." These kinds of debentures can be transferred by delivery. The interest is paid by the company that is linked to the debentures. The company of bearer debentures maintains no records. II) Based on security 3. Mortgage debentures When the debentures are secured by placing a fixed or floating charge on the company's assets, that is referred to as "mortgage debentures." That means if the company commits any default in paying interest or repaying the principal amount, the debenture holders have the right to recover the dues from the mortgaged property. Mortgage debentures are also known as secured debentures, which are secured against some particular company assets. Mortgage debentures may be classified as:

4. Unsecured, Simple, or Naked Debentures The debentures for which the company does not offer anything by way of security are called "simple" or "naked" debentures. These debentures are also referred to as "unsecured debentures." These debentures are repayable at a fixed interest rate after a certain time or period. III) Based on redemption 5. Redeemable debentures These debentures may be repayable within a particular period on a specific date. The repayment can be issued in installments or as a lump sum per the company's terms. 6. Irredeemable debentures Irredeemable debentures are not payable during the company's life, and such debentures become payable only on the company's liquidation. IV) Based on convertibility 7. Convertible debentures This term is used when debentures can be converted into shares within a certain time frame or on a specific date. And as per the issue's terms, the debentures' conversion occurs. 8. Non-convertible debentures These debentures cannot be converted into equity shares, and the holders have no right to do so. V) Based on the coupon (interest) rate According to coupon (interest) rates, there are two types of debentures: 9. Debentures issued with a coupon rate Coupon rates are interest rates on specified debentures, such as 12% or 14%. 10. Debentures issued with a coupon rate A debenture without a coupon rate does not carry a specific interest rate. And these debentures are also known by two other names: "zero coupon bond" and "deep discount bond." What is the difference between shares and debentures?The Conclusion of all that has been mentioned above:

Next TopicDifference between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share