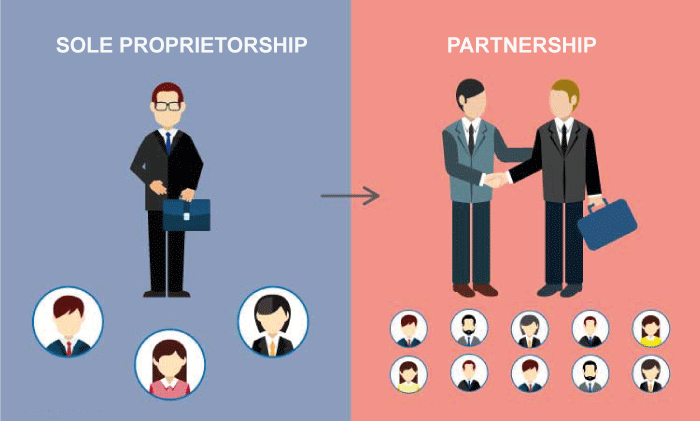

Difference between Sole Proprietorship and PartnershipWhile starting a business, it seems like an important step to decide if the company would function under one leader who gave the foundational idea for its further development or if it would be a partnership between many people who provided efforts for the making of an institution by managing finances, marketing and selling shares and spreading the business by hiring and supervising employees.

The four typical forms of business organizations are Limited Liability Company, corporation, sole proprietorship, and partnership. The Limited Liability Company is a trading process that prevents the original proprietor from taking personal responsibility for the loans or incrimination. A corporation is an organization that is possessed and controlled by the shareholders. They appoint the board of directors to supervise the activities of the company. The enterprise of a sole proprietorship is when the idea of an individual generates the business scheme and they decide to lead the business without any other associates. On the other hand, a business partnership can be formed if several individuals come together to form an idea for a successful establishment. Let us now differentiate between sole proprietorship and partnership by discussing each in detail: Sole Proprietorship: What is it?The program, which is owned particularly by one individual so that there would be no legitimate discrepancy between the possessor and the organization, is known as a sole proprietorship or trader sole. An individual handles all affairs associated with the trade without having any appointed legal person. The individual can choose to register his/her business name to the authority to start a business. In other words, he is the sole benefactor of all financial gain and would take responsibility for all losses the company undergoes. Therefore, the owner must pay taxes for profits from the business. Some examples of a sole proprietorship are a photographer, bakery owner, plumber, housekeeper, etc.

The involvement of government authorities is limited to sole businesses. Therefore, these are easy to structure and dismantle. Small start-ups are either run by individuals throughout their lifespan or develop into LLCs (Limited Liability Companies) or Corporations. Features of the Sole Proprietorship

Benefits of Sole Proprietorship

Disadvantages of Sole Proprietorship

Partnership: What is it?A company with a formal agreement between two or more participants who decide to be in charge of a business and split its profits is known as a Partnership. In a traditional partnership, the stockholders share profits equally and take responsibility for losses that the company experiences together. The partnership can be any project or plan that multiple people decide to engage themselves in. Partnerships can be formed between governments, individual citizens, non-profit organizations, and so on.

Features of Partnerships

Benefits of Partnership

Disadvantages of Partnership

Difference between Sole Proprietorship and Partnership

Let us now understand the major types of both sole proprietorship and partnership: Types of ProprietorshipIn the modern world, individuals yearn to be independent, and starting a sole proprietorship from a specific idea is the process of earning capital and status speedily. There are various kinds of sectors to start a sole proprietorship business. Here are some common sectors in which one can choose to start a business: 1. The Trading SectorThe first thought that comes to our mind after the mention of business practices is trade and services. The demand for trade is increasing worldwide, and successful business tycoons are providing support to other small-scale businesses. Individuals can earn a lot of capital, even through small businesses, if they get successful. Individual businesses can prosper online as well as offline in many sectors. If the business goal and production values are managed beforehand, the business can grow successfully. The following are some examples of a sole proprietorship: a. Wholesale and Dispatching Services In the wholesale business, the retailers buy goods from the resellers at higher prices. The resellers, as expressed by the term, resell the purchased products and reap profits. Wholesale is one of the most prominent sole proprietorships at the present day. In addition, if the business is maintained online, the work would be easier, and experience would be doubled as the public would have access to and awareness regarding the business. The WFH scheme could be effective in the process. Some of the well-known online reselling companies are Amazon, Walmart marketplace, eBay, Godaddy, Bonanza, and so on. Drop shipping is a type of retail service in which it is the seller's (drop shipper) responsibility to take orders from the customer. The drop shipping supplier's job is to dispatch the product and then deliver it to the customer. The drop shipping company or store that takes orders doesn't own the stock of products. Instead, they take packaged products from the supplier and deliver them to the target customer. The supplier's tasks are maintaining a warehouse and paying rent, packing and transporting goods, maintaining accounts, and operating returns. This is why resellers and drop shippers are different. It is easier work for the drop shippers as they don't have to keep items at hand. However, both are categorized as sole proprietorships. This is because an individual can handle these businesses without the assistance of partners. b. Retailers These individuals purchase goods from manufacturers or wholesalers and sell them in small quantities to customers. Categories of retailers are departmental stores, supermarkets, and specialty stores such as florists, footwear, bookstores, online retailers, and so on. The retailers and wholesalers are different from one another as both use different e-commerce platforms. Retailers utilize B2C transactions as they sell products directly to the customers without the involvement of a third-party supplier. They buy goods wholesale to sell out to the customer. On the other hand, wholesalers use B2B transactions to sell goods in bulk to the retailers, who at last sell them to the public. Retailers contribute to the feasible utilization and manufacturing of items of daily use. Retailers act as a chain that connects the producers and consumers in the marketing plan. The retail stores and businesses could be commenced and managed by an individual conveniently, and these shops can be developed into big businesses as well. Retailing could be a better option for individuals acquiring small capital. c. Sales Representatives A sales representative acts as a spokesperson for a company trying to sell its products to customers. These professional agents often work independently to receive apportionment based on the products they have sold out. Most companies hire sales representatives from sales agencies. The sales representative assists in presenting and maintaining the brand's identity in front of the public. In other words, sales representatives work as middlemen between the customers and the company that supplies products and services. Hiring a sales representative is more cost-effective than employing one permanently, especially in small businesses. Appointing a sales representative can be profitable since they have many connections in the business community. Traders can gain greater expedience through online exposure. 2. Service-providing BusinessesThe individuals in this business possess expertise in a specific sector. It may be teaching, dancing, cooking, etc., where a person can use their skills/ knowledge as a method of earning. These types of businesses do not need any capital to function. However, there would be some goods required in their service provision process. The necessary requirements may be a space and accessories related to the provided service. For example: If an individual decides to open a beauty salon, he/ she would require a place and beauty products to start a business. In the era of technology, these individual businesses prosper very quickly. Online courses are the best example of service businesses. The following are some examples of a sole proprietorship in a service-providing sector: a. Private Sessions The time setting and place for the sessions are decided as preferred by the service provider. Many students require private tutoring even after receiving education from the best schools. Other than educational institutions, private sessions can include various activities such as music lessons, fashion studies, dance classes, etc. b. Cleaning Services Housekeeping and vehicle cleaning services are much needed in today's busy corporate life. Working individuals need more time to clean their homes and vehicles or cook their own food. Therefore, house cleaning services are essential to keep homes spotless and organized. c. Independent Bloggers Individuals can use their writing talent to spread awareness and share their views regarding subjects such as science, sports, entertainment, politics, etc. With a steady internet connection, a person can write blogs and articles and earn money. 3. AgricultureIn rural areas, this business is known to be a prominent source to earn a living. However, various branches of agriculture can be used to start a business in urban areas as well. Urban beekeeping, horticulture, and maintenance of greenhouses are some examples of individual agricultural businesses in towns. In this business, a person does not need to learn any specific skills. It only requires some basic knowledge regarding agriculture. Here are some businesses associated with agriculture in urban areas: a. Growing Ornamental Plants for Business Plants such as roses, lilies, tulips, and other flowering plants are used as a part of home décor. These plants can also be used for making bouquets. Therefore, this may be a really good option for people who want to start a small business based on foliage. Ornamental plants are quite expensive these days, and it can be easy to profit for traders who like gardening. The unique shape and beauty of a flower help to decide its price. b. Production of Fertilizers In this business, the proprietor owns cattle or knows someone who owns a dairy farm, so they can collect the cow dung and produce natural fertilizers from it. It would be advantageous for the trader and also for the environment. That is because natural fertilizers and manure are good for soil fertility. Types of PartnershipsThe partnerships are categorized into different types on the basis of state and the location of the company. Some of these types are given below: 1. General Partnerships or GPsA general partnership is a type of contractual relationship formed between two or more individuals who agree to divide the responsibilities, finances, experience, and legal liabilities of the collectively owned business. In this kind of partnership, the individuals accept to take responsibility for possible unlimited liability. Unlike a Limited Liability Company, there is no restriction on liabilities in a general partnership. The partners are responsible for dealing with debts, and their assets can be seized if there are overdue payments. Because the general partnership is a flow-through entity, the revenues directly go to the owners. While paying taxes, each partner has to report their share of profits and losses collected from the partnership individually. It is the individual that is taxed, not the partnership. 2. Limited Liability PartnershipIn LLPs, the shareholders can take advantage of the profits acquired by the company while minimizing their liability for the decisions made by other partners. Before forming an LLP, the individuals should check the regulations of their country and consult with an experienced lawyer. All the members of the company have limited liability. Each member needs to remain careful of other members' legal mistakes as they can affect the company significantly. The personal assets of a partner remain untouched by the lawsuit. However, the partnership assets will get confiscated if the company or a partner is sued, as the liability for an individual is limited. In a lawsuit, it is mainly the partnership that is targeted to make the company crumble down. However, if the company suffers losses due to one partner's wrongdoings, he/she is held accountable for it. 3. Limited PartnershipA limited partnership consists of two or more individuals. The general partner is the one who looks after and controls the business. On the other hand, the limited partners do not participate in leading the company. The downside of a limited partnership is that the general partner has unlimited liability for financial obligation, while other limited partners carry limited liability for only the amount they have brought shares of. Limited partners have restricted control over the affairs of business as they do not take part in everyday matters of the company. Generally, the limited partners have no interest in matters of decision-making and administration. They remain a part of the company to invest and take their share of the company's profit. ConclusionUltimately, a thorough knowledge of the business is required for a company to function properly. Be it a sole proprietorship or a partnership, traders have to choose what type of business they are comfortable with.

Next TopicDifference Between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share