Difference Between Stock Market and Share MarketIntroductionThe stock and share markets are terms often used interchangeably but differ significantly. They represent different aspects of the financial market and have unique characteristics. Understanding the differences between these two markets is important before investing your hard-earned money.

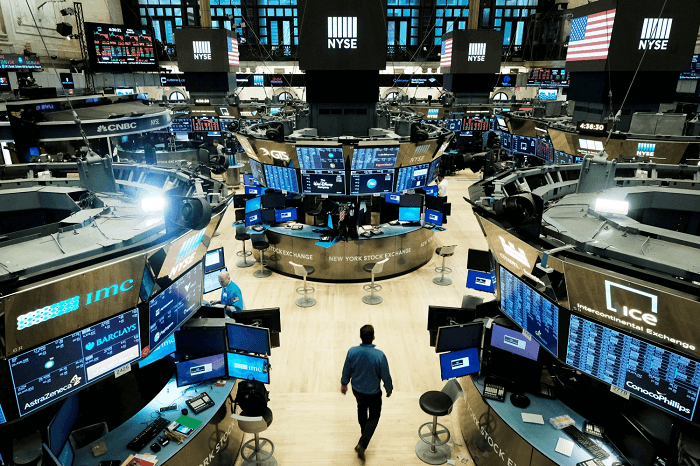

The stock market is a platform where companies issue stocks to raise capital, and investors buy and sell those stocks. Stocks represent a portion of Ownership in a company, and owning stocks means owning a portion of that company's assets and profits. A stock market is an important tool for companies to raise capital for their operations and expansion. At the same time, investors use the stock market to earn returns on their investments. On the other hand, the share market is a broader term encompassing all types of securities, such as stocks, bonds, debentures, and mutual funds. It is a marketplace where securities are bought and sold. It includes the primary market (where securities are first issued) and the secondary market (where already issued securities are traded). Investing in the stock and share markets can be lucrative but comes with risks. Understanding the differences between these markets is crucial in making informed investment decisions. Factors such as market capitalization, market participants, and regulatory authorities play a significant role in how these markets operate and can affect investment outcomes. This article will delve deeper into the differences between the stock and share markets, examining Ownership, trading, market capitalization, market participants, risk and returns, regulatory authorities, and the global perspective. By the end of this article, readers should clearly understand the differences between these two markets and be better equipped to make informed investment decisions. More About Stock Market and Share MarketAs discussed, the terms, stock and share markets are two distinct marketplaces where investors buy and sell securities. While these terms are often used interchangeably, they have different meanings and functions. One of the main differences between the stock and share markets is the types of traded securities. While the stock market primarily deals with stocks, the share market deals with a broader range of securities. The share market allows investors to diversify their portfolios by investing in different types of securities, which can help to reduce risk. Another difference between the two markets is the level of risk involved. The stock market is generally considered more volatile than the share market, as the value of stocks can fluctuate rapidly in response to changes in the economy or company-specific news. On the other hand, the share market can also be volatile but tends to be less so than the stock market. This is because it includes a broader range of securities, which can help to spread risk across different investments. In summary, while the stock and share markets are often used interchangeably, they are two distinct marketplaces with different characteristics. The stock market deals primarily with stocks, while the share market deals with a broader range of securities. Both markets provide a means for companies to raise capital and for investors to build wealth over the long term. Ownership of Stocks and Shares

Ownership of stocks and shares is one of the key differences between the stock market and the share market. In the stock market, investors own stocks, representing a portion of a company's Ownership. When an investor buys stocks in a company, they become a shareholder and have a claim to a portion of that company's assets and profits. Shareholders can vote on certain company matters, such as electing board members or approving major decisions. In contrast, the share market is a broader marketplace where investors can own various securities such as stocks, bonds, debentures, and mutual funds. Each of these securities represents a different type of Ownership. For example, owning a bond means that an investor owns a portion of the debt issued by a company or government entity and is entitled to receive interest payments. Ownership in the share market can be direct or indirect. Direct Ownership occurs when an investor buys a security outright, such as a stock or bond. Indirect Ownership occurs when an investor buys security through a mutual fund or exchange-traded fund (ETF), which owns a basket of different securities. In this case, the investor owns a portion of the fund, which in turn owns a portion of the underlying securities. Ownership in the stock market can also come in different classes. For example, some companies issue multiple classes of stocks, each with different voting rights or dividend payments. This allows the company's founders or insiders to retain control of the company while still raising capital from public investors. Overall, Ownership in the stock and share markets can be complex, with different types of securities and classes of Ownership. Investors need to understand the ownership structure of the securities they invest in and the voting rights and dividend policies associated with them. This information can help investors make informed decisions about their investments and achieve their financial goals. Trading of Stocks and SharesTrading stocks and shares is a key aspect of the stock and share markets. In both markets, investors buy and sell securities to earn a profit. In the stock market, stocks are traded through a stock exchange. The stock exchange serves as a marketplace where buyers and sellers of stocks can come together to trade. When an investor wants to buy a stock, they bid for a certain price, and when a seller is willing to sell at that price, the trade is executed. Similarly, when an investor wants to sell a stock, they ask for a certain price, and when a buyer is willing to buy at that price, the trade is executed. In the share market, securities are traded through various channels, such as stock exchanges, over-the-counter markets, and electronic trading platforms. The trading process is similar to the stock market, with buyers and sellers collating to trade securities. The stock and share markets have different trading strategies that investors can use to buy and sell securities. For example, investors can use a buy-and-hold strategy to buy stocks or other securities and hold them for a long period, expecting to earn a profit over time. Alternatively, investors can use a more active trading strategy, such as day trading or swing trading, where they buy and sell securities quickly to earn profits in the short term. Trading of stocks and shares can be influenced by factors such as market trends, economic indicators, company-specific news, and geopolitical events. It is important for investors to stay informed about these factors and to understand how they can impact the value of their investments. Overall, trading stocks and shares is a dynamic and ever-changing process, with different strategies and factors that can impact investment performance. By understanding the trading process and staying informed about market trends, investors can make informed decisions about their investments and work towards achieving their financial goals. Market Capitalization

Market capitalization, or market cap, measures a company's value and is often used as a key metric by investors and analysts. It is calculated by multiplying the total number of a company's outstanding shares by its market price per share. Market capitalization is used to classify companies into large-cap, mid-cap, and small-cap categories. Large-cap companies have a market capitalization of over $10 billion, mid-cap companies have a market capitalization between $2 billion and $10 billion, and small-cap companies have a market capitalization of under $2 billion. Market capitalization is an important metric because it can provide investors with an indication of a company's growth potential and risk level. Large-cap companies are generally considered less risky and more stable than small-cap companies but may have lower growth potential. Conversely, small-cap companies may have higher growth potential but are considered more risky and volatile. In addition to classifying companies, market capitalization can be used to compare companies within the same industry or sector. For example, two companies in the technology sector may have similar revenues, but one may have a higher market capitalization due to its perceived growth potential or other factors. Company performance, economic trends, and market sentiment influence market capitalization. For example, if a company reports strong earnings or announces a new product, its market capitalization may increase. Conversely, if a company reports poor earnings or is involved in a scandal, its market capitalization may decrease. Market capitalization is an important metric for investors and analysts to consider when evaluating a company's value and growth potential. By understanding market capitalization and how different factors can influence it, investors can make informed decisions about their investments and work towards achieving their financial goals. Market ParticipantsThe stock market and share market are dynamic and complex systems that involve a wide range of participants. Understanding the different market participants can provide insight into how the markets operate and investment decisions are made.

Overall, the stock market and share market involve a diverse group of participants with different goals, strategies, and levels of influence. By understanding the role of different market participants, investors can make informed decisions about their investments and navigate the complex landscape of the markets. Risk and Returns

Risk and return are two fundamental concepts in finance that are closely intertwined. Generally speaking, the higher the risk, the higher the potential return, and vice versa. Understanding the relationship between risk and return is essential for investors who want to make informed investment decisions and maximize their returns. Risk refers to the uncertainty and potential for loss of any investment. All investments carry some degree of risk, but the level of risk can vary widely depending on several factors, such as the type of investment, the industry or sector it belongs to, and the overall economic and political environment. For example, stocks are generally considered to be riskier than bonds because they are more volatile and their returns are less predictable. Conversely, returns refer to the gains or losses that an investor realizes on an investment. Returns can come in the form of capital gains, which occur when the value of an investment increases, or dividends, which are regular payments made by companies to their shareholders. Investors must consider the relationship between risk and return when making investment decisions. Higher-risk investments have the potential for higher returns and a greater chance of loss. Conversely, lower-risk investments typically offer lower returns but a lower risk of loss. Investors can manage risk and maximize returns by diversifying their portfolios across different asset classes, industries, and sectors. By spreading their investments across a range of assets, investors can reduce the overall risk of their portfolio while still maintaining the potential for strong returns. Another key factor in managing risk and returns is carefully researching and analyzing investments before making decisions. This may involve analyzing financial statements, examining industry trends and market conditions, and seeking advice from financial professionals. In conclusion, risk and return are essential for investors to understand when making investment decisions. By carefully considering the relationship between risk and return, diversifying their portfolio, and conducting thorough research, investors can manage risk and maximize returns over the long term. Regulatory AuthoritiesRegulatory authorities play a crucial role in overseeing the stock and share markets' activities, ensuring that the markets operate fairly, transparently, and efficiently. In most countries, regulatory authorities are established by the government. They are given the power to set rules and regulations, investigate violations of those rules, and enforce penalties for non-compliance. One of the primary functions of regulatory authorities is to protect investors from fraud and unethical behaviour. They may set rules to govern the behaviour of market participants, such as brokers, traders, and investment advisors. They may investigate and prosecute those who engage in illegal or unethical activities. Regulatory authorities also play a role in ensuring that the markets operate efficiently and transparently. They may require companies to disclose important financial information to the public, such as quarterly earnings reports and other financial statements. They may also set standards for listing securities on stock exchanges and regulate the trading of those securities to ensure that the markets operate fairly and orderly. Another important function of regulatory authorities is to promote market stability and prevent systemic risks. They may monitor the activities of financial institutions and other market participants to identify potential risks to the overall stability of the financial system. They may also take action to prevent or mitigate the effects of financial crises, such as the 2008 financial crisis. Examples of regulatory authorities include the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Securities and Exchange Board of India (SEBI). These agencies have broad powers to oversee the stock and share markets' activities. They enforce various rules and regulations to protect investors and promote market stability. In conclusion, regulatory authorities are critical in ensuring the fair and efficient operation of the stock and share markets. By setting rules and regulations, investigating violations of those rules, and enforcing penalties for non-compliance, they help to protect investors, promote market stability, and maintain public trust in the financial system. Global Perspective

The stock market and share market are global, with investors from all over the world participating in these markets. As a result, understanding the global perspective is essential for investors who want to make informed investment decisions and maximize their returns. One key aspect of the global perspective is the interconnectedness of financial markets. Economic events in one part of the world can significantly impact markets in other parts of the world. For example, a recession in the United States can lead to a downturn in stock markets worldwide as investors become more risk-averse. Another important aspect of the global perspective is the role of international trade and globalization. Companies listed on stock exchanges and share markets are often multinational corporations that do business in multiple countries. As a result, changes in international trade policies or political events in one part of the world can significantly impact the performance of these companies and the markets in which they operate. The global perspective also highlights the importance of diversification. Investors who limit their investments to a single country or region are more vulnerable to economic and political risks that are specific to that area. By diversifying across different countries and regions, investors can reduce the overall risk of their portfolio and take advantage of opportunities in different markets. Finally, the global perspective highlights the importance of staying informed about global economic and political events. Investors who keep up with global news and trends are better equipped to make informed investment decisions and adjust their portfolios in response to changing market conditions. In conclusion, understanding the global perspective is essential for investors who want to succeed in the stock and share markets. By recognizing the interconnectedness of financial markets, the role of international trade and globalization, and the importance of diversification and staying informed, investors can make more informed decisions and maximize their returns over the long term. ConclusionIn conclusion, the stock market and share market are two important financial markets that offer opportunities for investors to buy and sell securities and earn returns on their investments. While the terms stock market and share market are often used interchangeably, the two have some key differences. Ownership in the stock market typically represents Ownership in a publicly traded company, while Ownership in the share market represents Ownership in a mutual fund or exchange-traded fund. Additionally, the stock market tends to be focused on individual stocks, while the share market is focused on a broader range of securities. Trading in both markets involves buying and selling securities to earn a return on investment. Investors in both markets need to consider the risks and potential returns of different investments carefully and may use various strategies to maximize their returns while minimizing their risks. Market capitalization is an important metric used to measure the size and value of a market. The stock market typically has a higher market capitalization than the share market, reflecting the market's larger size and greater liquidity. A wide range of market participants, including individual investors, institutional investors, and market makers, play a role in the stock and share markets. Regulatory authorities are also essential in ensuring that the markets operate fairly, transparently, and efficiently. Finally, the global perspective is essential for investors who want to make informed investment decisions and maximize their returns. The interconnectedness of financial markets, the role of international trade and globalization, and the importance of diversification and staying informed are all key factors to consider when investing in the stock and share markets. In summary, the stock and share markets are complex financial markets that offer opportunities and risks for investors. Understanding the key differences between the two markets and the risks and potential returns of different investments is essential for success. Investors can maximize their returns and achieve their financial goals by staying informed, diversifying their portfolios, and taking a long-term perspective. Stock Market and Share Market Difference Table

Next TopicDifference between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share