What is the full form of AU BankAU Bank is not an acronym, so it doesn't have any full form. AU Bank:

AU gets its name from Aurum, the Latin word for gold and its chemical symbol, 'AU', which is considered auspicious in many parts of India. Hence, AU Bank does not have a full form It's a commercial bank that is listed in India. AU Financiers India Ltd., a firm that provides auto financing, was founded in 1996. It was changed into a small finance bank in the year 2017. The founder of AU Bank is Sanjay Agarwal. AU Bank employs more than 23,000 people. AU Bank is among the Fortune India 500 listed firms. In November 2017, AU Bank was added to the Schedule of Commercial Banks by the Central Bank of India. AU Bank favors secured loans over unsecured loans, unlike other banks that favor secured loans.

Sanjay Agarwal, the founder of AU Bank, leads the AU small finance bank as CEO and Managing Director. He is a first-generation business owner and Chartered Accountant with rank. It is a corporation that has previously provided auto financing. L.N.Finco Gems Private Ltd. was the inaugural name of the AU Bank. In Rajasthan, AU Bank was established as a private limited company with an authorized share capital of Rs 0.1 million. AU Bank aims to offer secured loans constantly. According to CRISIL ratings, AU Bank has a credit rating of AA-/stable. The AU Bank operates in 15 states and two union territories. A market capitalization of Rs. 37,942 crores is held by AU Small Finance Bank, listed on the NSE and BSE. Based on price-to-book, the stock increased 51% during its initial trade day to become India's most expensive bank.

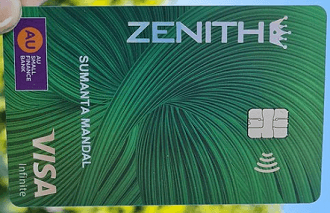

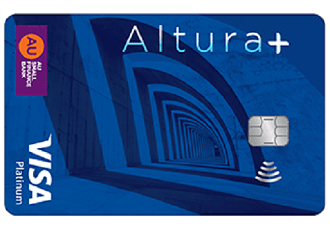

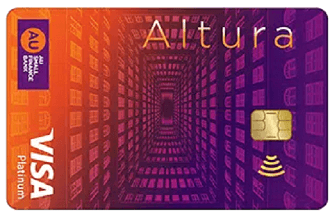

The bank's development possibilities were further enhanced by the Reserve Bank of India's addition of the bank to its list of commercial banks in November 2017. This decreased the cost of short-term funding and enhanced the bank's capacity to offer services. VisionIndian culture, in particular, has long viewed gold as a symbol of economic wealth and power. This is a practice that spans all of human history. The gold standard is a monetary system that applies to contemporary money in which a nation's currency or paper money is closely correlated to its gold holdings. It only made it natural to name the business after this priceless metal everyone strives for because of its significant relevance in India. Almost every household views gold as an optimistic and constantly appreciating treasure. The Latin word Aurum, which also happens to be the chemical symbol for gold and is seen as being auspicious in many regions of India, is where the name AU comes from. As a result, AU Small Finance Bank needs a comprehensive form. To become the most desirable employer in the world and the most trusted retail bank, regarded as the model for economic success and financial inclusion, where regular people do amazing things to change society as a whole, thereby ensuring Trust, Confidence, and Customer Satisfaction is the primary vision of AU Bank. Services Provided by AU BankIn contrast to other small finance banks, which have unsecured loans because of their origins in microfinance, practically all of AU Small Finance Bank's loans as of March 2018 were secured due to the business's history as a car finance company. Due to the lower returns (interest rates), this offers compared to unsecured loans, and the bank has worked extra hard to increase its deposit base. Moreover, bank deposits are less expensive than alternative sources of funding. To establish itself as a comprehensive provider of financial goods and services, it has also pushed to .diversify into loan and savings products, including deposits, payment, transaction banking, and distribution of third-party products. I. Savings Bank AccountWith various perks to aid wealth growth, Au Bank's specially created Savings Account offers a hassle-free banking experience. To meet customer demands and provide value throughout a person's financial activities, they have carefully selected a number of Savings Account types. By providing monthly interest distributions to all of its clients, AU Bank continues to defy the status quo in banking and move away from the conventional banking scenario. Also, a person can benefit from more than 100+ benefits using a debit or credit card. II. Credit CardA credit card makes it easy for someone to purchase beyond their permitted spending amount. Credit card payments are already very typical whenever it comes to online transactions. With minimal paperwork, anyone may apply for the card. A credit card is a financial tool that enables users to conduct cashless transactions following an established credit limit. The credit limit is established by a person's credit history, income, and credit score. It gives you more purchasing power and is a fantastic method to establish your credit history. AU Credit Cards provide many benefits, from international travel to supermarket buying. Let's explore a few AU Credit Cards benefits.

Credit Cards Available at AU Small Finance Bank

III. Fixed DepositWith term lengths ranging from 7 days to 120 months, AU Small Finance Bank provides FD interest rates to the general public of 3.75-8.00% p.a. and senior citizens of 4.25-8.50% p.a. For tenors of five years, the interest rate on tax-saving FDs from AU Small Finance Bank is 7.20% for the general public and 7.70% for senior citizens' depositors. Also, the bank provides NRIs with various fixed deposit options, including NRO and NRE fixed deposits. Due to the RBI's recognition of AU Small Finance Bank as a scheduled bank, its depositors are now qualified for deposit protection under the Depositor Insurance and Credit Guarantee Corporation (DICGC). If a scheduled bank fails or merges with another institution, the deposit insurance cover provided by DICGC, a subsidiary of the RBI, guarantees cumulative deposits made by each depositor in each scheduled bank up to Rs 5 lakh, including his fixed deposits, savings, current, and recurring deposits. Market Cap.A financial organization called Au Little Finance Bank Ltd. was established in 1996. (Having a market cap of Rs 39,367.54 Crore). For the fiscal year ending March 31, 2022, Au Small Finance Bank Ltd.'s primary products/revenue segments are Interest & Discount on Loans & Bills, Income from Investment, Interest, and Interest on Balances with RBI, as well as Other Inter-Bank Funds. The bank reports standalone Gross Non-Performing Assets (Gross NPAs) and Standalone Net Non-Performing Assets (Net NPAs) as being.00% and.00% of total assets, respectively, for the quarter ending December 31, 2022.

The firm recorded a Standalone Total Income of Rs 2,412.96 Crore for December 31, 2022, up 7.74% from a Standalone Total Income of Rs 2,239.65 Crore for the prior quarter and up 36.16% from a Standalone Total Income of Rs 1,772.09 Crore for the prior year's same period. The bank declared a net profit after tax for the most recent quarter of Rs 392.83 crore. Bottom LineIn 1996, AU Financiers (India) Ltd. was established and on April 19, 2017, the company changed its name to Au, Small Finance Bank. To boost the economy, Au Financiers was established as a non-deposit taking Non-Banking Finance Company (NBFC). Interest rates on fixed deposits are determined daily and vary from bank to bank in India. The fixed deposit interest rates offered by AU Bank to its clients are well-known for being competitive. With the help of the FD Calculator, customers can find out how much a deposit will be worth when it matures and what interest rates are being given for a specific deposit period or tenure.

Next TopicFull Forms List

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share