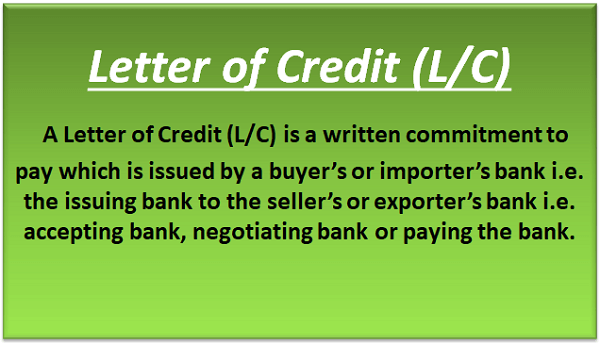

What is the Full Form of LCLC: Letter of CreditLC Stands for a Letter of Credit. In international transactions, a letter of credit is typically used when the issuing bank, or the buyer's bank, ensures that the buyer will pay the seller the exact amount. The bank must settle any unpaid debts on the buyer's behalf if the buyer neglects to make the required payment to the seller.

Features of LCThe following are the characteristics of the letter of credit:

Types of LCThe following list includes the various letter of credit types:

What is the Process?

To obtain the letter of credit, the buyer must visit the bank in his home country and submit various pieces of information, including the payment amount, the date and mode of shipping the goods, their arrival time and location, the seller's information, etc. The bank will issue the LC a promise to deliver the money to the seller, after receiving the details and if satisfied. The bank will then send the money to the seller's bank, which is often situated in the seller's home country. The seller's bank will validate the LC and send it to the seller after receiving it. The seller must then confirm that the buyer and seller have accepted all of the terms and conditions specified in the LC. The vendor must now fulfill all LC standards to order to be paid via LC. The seller will get the payment within the time-frame indicated in the LC, provided that all requirements are satisfied and the supplied items are by the contract. An LC Example:

Mr. Charles, owner of the clothing firm Textile Incorporation in the United States, got a $20,000 order for clothing from Clothing Incorporation in London. Mr. Charles wanted a letter of credit because he had no experience with the clothes company. As a result, the buyer requested that the local bank issue the LC to the seller's bank. The LC is a document that serves as a guarantee from the buyer's bank, stating that if the buyer fails to make any payments due, the issuing bank will do so on the buyer's behalf. Elements:The following list describes the components of a letter of credit:

Importance of LC

LC Advantages and Disadvantages:Advantages of LC:

Disadvantages of LC:

The Conclusion:Therefore, a Letter of Credit (LC) is necessary for successful international operations. Before entering any agreements, one should completely comprehend the rules and procedures. A Letter of Credit lowers the chance of dues not being paid, enhancing commercial transactions worldwide. Therefore, the seller typically requests a Letter of Credit while exporting their goods.

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share