What is the Full Form of PLI

PLI: Postal Life Insurance

Postal life insurance is referred to as PLI. To meet the needs of various people, PLI at the post office offers a variety of life insurance products at affordable premium prices. One of India's oldest and most reputable life insurance plans is the Post Office PLI scheme. It began in February 1884, intending to offer its employees welfare benefits.

Post Office Life Insurance had more than 50 lakh PLI policies as of March 31, 2021. In the case of the policyholder's death, the insurance offers your family financial security. When purchasing an insurance plan, the sooner you do it, the less premium you will be expected to pay the insurance provider.

You should also decide if you want your insurance policy to last until retirement. Either go to the post office in person or get postal life insurance online. Additionally, the user can terminate the postal insurance plan after three years; however, the plan's nature and duration affect the surrender value.

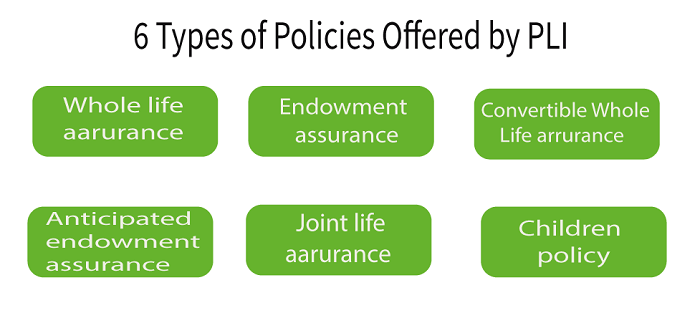

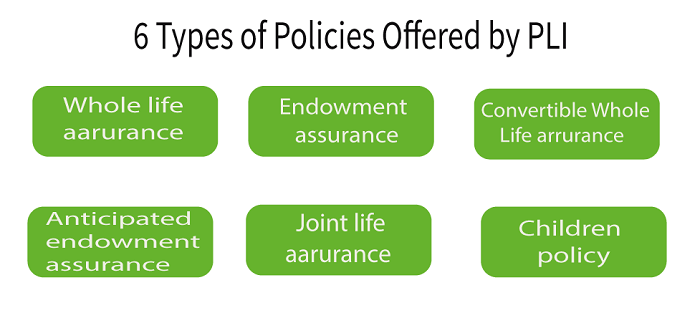

Postal life insurance policy types

1. Whole Life Assurance (Suraksha)

The policyholder can earn a bonus as a final payoff in this plan and receive the sum guaranteed. If the policyholder passes away, the whole sum is payable to the nominee; otherwise, it is handed to the policyholder after they become 80.

Salient features:

- Age Criteria: Entry age must be between 19 and 55 years old.

- Sum Assured: The sum assured is between 20,000 and 50 lakh rupees.

- Scheme payout: Sum Guaranteed + bonus.

- Loan Facility: After four years, you can apply for a loan.

- Withdrawal: After three years, policies may be withdrawn.

- Eligibility to Receive Bonus: Policyholders who surrender their policies before five years are not entitled to receive the bonus. If the insurance is abandoned, compensation on the lower sum insured must be paid.

- Premiums Payable: The age at which premiums are payable is either 55, 58, or 60 years.

- Bonus: For every INR 1000 amount insured annually, there is a stated bonus of INR 76.

2. Convertible Whole Life Assurance (Suvidha)

Suvidha, a full life insurance plan, is another name for this product. The policyholder can change the current policy into an investment assurance plan, and it can be converted only when the current policy has been in effect for five years.

Salient features:

- Age Criteria: Entry age must be between 19 and 55 years old.

- Sum Assured: The sum assured is between 20,000 and 50 lakh rupees.

- Scheme Payout: Sum Guaranteed + Bonus (on achievingthe maturity age)

- Policy Conversion: An endowment assurance policy's bonus is paid out when the policy is converted.

- Loan Facility: After four years, you can apply for a loan.

- Withdrawal: After three years, policies may be withdrawn.

- Eligibility for Bonus: If policyholders surrender their current policy before five years, they are not eligible for the bonus.

- Bonus: For every INR 1000 amount insured annually, there is a stated bonus of INR 76.

3. Endowment Assurance (Santosh)

The insurer guarantees the policyholder that they will get the payoff up to the amount of the bonus and the sum assured up until the predetermined maturity age of 35, 40, 45, 50, 55, 58, & 60 years old.

Salient features:

- Age Criteria: Entry age must be between 19 and 55 years old.

- Sum Assured: The sum assured is between 20,000 and 50 lakh rupees.

- Scheme Payout: Sum Guaranteed + bonus

- Loan Facility: After three years, you can apply for a loan.

- Withdrawal: After three years, policies may be withdrawn.

- Eligibility to Receive Bonus: Policyholders who relinquish their policies before five years are not entitled to receive the bonus. If the insurance is surrendered, a bonus on the decreased sum guaranteed must be paid.

- Bonus: For every INR 1000 amount insured annually, there is a stated bonus of INR 52.

4. Mutual Life Assurance (Yugal Suraksha)

In this type of insurance, the primary policyholder can insure their spouse under the same terms as themselves.

Salient features:

- Age requirements: Entry age ranges from 21 to 45 years old. The couple seeking insurance must be between the ages of 21 and 45.

- Sum Assured: The sum assured is between 20,000 and 50 lakh rupees.

- Scheme Payout: With a single premium, the scheme guarantees life insurance coverage for both couples up to the bonus sum promised. In the event of the demise of the spouse or the primary policyholder, benefits are given to any of the survivors.

- Loan Facility: After four years, you can apply for a loan.

- Withdrawal: After three years, policies may be withdrawn.

- Eligibility to Receive Bonus: Policyholders who surrender their policies before five years are not entitled to receive the bonus. A bonus on the lower sum insured must be paid if the insurance is surrendered.

- Bonus: For every INR 1000 amount insured annually, there is a stated bonus of INR 52.

5. Anticipated Endowment Assurance (Sumangal)

This strategy is called "sumangal," an insurance plan offering a money-back guarantee. The highest sum insured under this plan is INR 50 lakh, which is ideal for individuals who want consistent returns throughout the policy.

It should be noted that when the policyholder, unfortunately, passes away, these monthly payments are not considered. In this case, in addition to the bonus, the nominee would also get the balance of the sum insured.

Salient features:

- Age criteria: 19 to 40 (for a 20-year policy term) & 45 years of age(for a15-year policy term).

- Policy Term: 15 or 20 years, depending on the policy.

- Sum Assured: The sum assured is between 20,000 and 50 lakh rupees.

- Survival Benefits: These benefits, coupled with a bonus upon maturity, are paid regularly.

- Bonus: For every INR 1000 amount insured annually, there is a stated bonus of INR 48.

6. Family Policy (Bal Jeevan Bima)

This policy aims to offer insurance protection to the key policyholder's children. However, this insurance can only provide coverage for a maximum of two of the policyholder's children.

Salient features:

- Child Age Criteria: 5 to 20 years old are considered.

- Main Policyholder Age Criteria: Maximum age for policyholders is 45.

- Sum Assured: Up to INR 3 lakh, or the amount that is less than the sum guaranteed by the parent.

- Scheme payout: Sum Guaranteed + bonus.

- Policy Surrender: Inaccessible. Five years of premium payments must be made consecutively.

- Loan Facility: No loan facility is available.

- Prerequisites: A child's medical examination is not necessary.

- Bonus: For every INR 1000 amount insured annually, there is a stated bonus of INR 52.

Postal life insurance policy features

An insurance holder may benefit from the following:

- Nomination facility: The policyholder can name their beneficiary and modify the nomination.

- Outstanding returns: The post office's PLI plan offers the greatest level of protection and a bonus larger than other insurers.

- Loan availability: You may use your insurance policy as collateral for loans. However, if you have an Endowment Assurance or a whole life insurance plan, you must wait three to four policy years before applying for a loan.

- Loan facility: A loan facility is offered following this policy. Once the policy has reached three years of maturity, in the case of an endowment assurance policy, or four years of the policy period, in the case of a whole life insurance policy, the policyholder may pledge their policy as collateral to the Heads of the Region/Circle on behalf of the President of India. Under this system, there are also assignment facilities accessible.

- Policy Revival: Reviving an expired policy is an option open to policyholders. When insurance has expired, it may be renewed under the following circumstances:

- After six consecutive missed premium payments and fewer than three years of coverage, the policy has expired.

- When a policy has been in place for more than three years, and there have been 12 consecutive non-payment of premiums, the policy has expired.

- Duplicate Policy Document: If the policyholder loses the original document, a duplicate will be sent. This also holds if the insured needs a copy of the policy document because it was shredded, burnt, or otherwise damaged.

- Selection of a nominee: Policyholders of post office insurance may designate their beneficiaries. You may also choose to replace the PLI nominee during the plan's term.

- Insurance Conversion: This policy can be changed from a Whole Life Assurance policy to an Endowment Assurance Policy. According to the rules and specifications established by the insurer, an endowment assurance policy may be changed to another endowment assurance plan.

- Income tax advantages: The policyholder is eligible for up to INR 1.5 lakh in income tax benefits under Section 80C of the Income Tax Act on the premiums paid. 20% of the full insurance coverage is free from tax.

- Multiple PLI policies: There is no restriction on the number of PLI insurance you can purchase. The promised sum must be at least 20,000 and no more than ten lakhs.

Postal Life Insurance Plan Eligibility Requirements

People working in the following industries are qualified to purchase PLI policies:

- Central government

- Reserve Bank of India (RBI)

- Defence assistance

- Public sector organizations, financial institutions, and nationalized banks

- Postal Department

- Federal government

- Paramilitary groups

- Local organizations

Few other points to remember

- Institutions of higher learning, outside agencies, and independent bodies

- Postal insurance policies are not available to anybody working in the private sector.

- For all post office PLI plans, the applicant must be between 19 and 55.

- The maximum age to purchase a postal children's insurance, except for the kid plan, is 45 years old, and the child must be between the ages of five and twenty.

How Do You Purchase Online Postal Life Insurance Plans?

- Visit the India Post website and log in.

- Go to the "Purchase a Policy" section.

- Next, choose the quote and the product and coverage that are best for you.

- Please provide the information relevant to your personal, employment, medical, and other needs.

- Pay the initial premium amount to generate a proposal.

- After doing this, you must print out a copy of the proposal application and the other necessary documents to the post office closest to you.

- The list of necessary papers is available in the "tools and utilities" section.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now