What is the full form of PPSPPS: Positive Pay SystemPPS stands for Positive Pay System. It is a system which is developed by the National payment corporation of India for the banking sector, and it is used for reconfirming the key or important details of large value cheques. A cheque issued under the positive pay system contains all the essential information such as bank name, amount to be withdrawn, etc. And you can submit these details to drawee bank through electronic means such as internet banking, SMS, ATM etc. The details in high-value cheques are cross-checked by drawee bank while issuing it, and if any difference is there, it is highlighted.

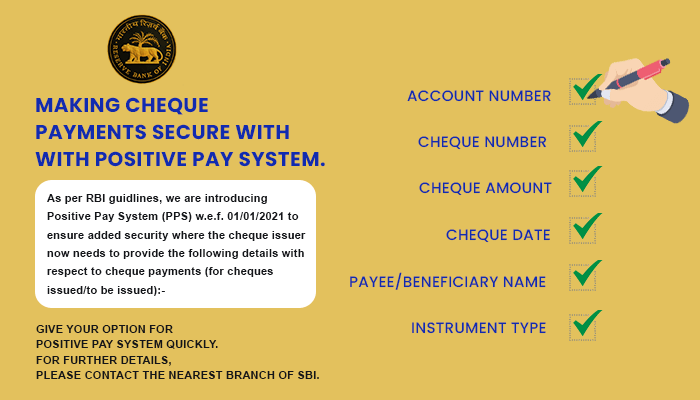

Amount Contained in Positive pay system?Reserve Bank of India issues direction to the private or public banks to use this system or enable the facility for all account holders who have issued cheques for Rs 50,000 and above. But this provision is at the account holder's discretion to avail of this facility, and it is mandatory for banks in case the cheque's value is Rs 5 lakh and above. What is the importance of a positive pay system for customers?Sometimes the cheque will be returned. Some banks have provisions because if details of large value cheques, such as date, the amount payable etc., are not pre-registered with the bank, the bank returns the cheque. For the hassle-free clearance of high-value cheques, the customer must ensure that the important details are provided in the time-bound manner prescribed or mentioned by the banks. The dispute resolution mechanism will accept only those issues pre-registered with the positive pay system and will be one of the guidelines of the Reserve Bank of India. As soon as the cheque is cancelled or returned to the customer, the customer will get an SMS with the reason for return or cancellation.

Details that are contained in the cheque and provided to the bank

Way to submit the details:You can submit details under the positive pay system through the use of the respective bank's website, mobile banking, internet banking, or offline mode by visiting bank branches if the customer has not used the electronic banking services. How to register with certain banks?If the Customer is an SBI account holder, here's how to register for the Positive Pay system. Under this, one needs to do a one-time registration of their cheque with the bank and operate an account for Positive Pay System through any of the branches of SBI by applying the prescribed format. Registration for the positive pay system can also be done through alternate channels like Corporate Internet Banking (CINB), Retail internet banking corporation, Mobile Banking (YonoLite) and YONO (Mobile App), or by visiting bank branches. Advantages of a Positive Pay System1. Prevent Cheque Fraud- The most important advantage of a positive pay system is that it helps prevent fraud by a faulty user. When you use or run a cheque from your business partner through the positive pay system, system alarm differences such as incorrect amount, duplicate cheque, proxy user, a cheque that doesn't exist in the issue file, a cheque that is supposed to be void or cancelled or issue with payee information, this process is important for reducing fraud and protect you and your customer from losses. 2. Offers High Value to Business- When you provide a payee positive pay system to your business partners, you bestow them with a high-value-added service that provides certain benefits such as Automatic check Matching, and clarifying the accounts payable method, reconciling payroll records. As you know, business customers, partners or individuals are typically more valuable to financial institutions. The payee's positive pay can assist financial institutions in attracting these valuable commercial customers and businesses. 3. Automatic Fraud Removal Method- A positive pay system helps the financial institution save time and resources. If the positive pay system is not present, the bank must check all the cheques manually, which is very time-consuming, and access the consumer via phone or email.

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share