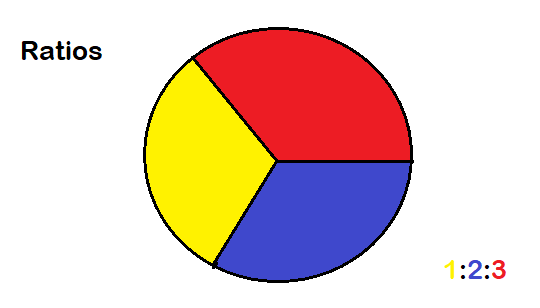

Ratio DefinitionThe notion of ratios is essential in mathematics and is utilized in several applications ranging from finance and economics to physics and engineering. A ratio compares two quantities, given as the quotient of one item divided by the other. The definition of a ratio is a mathematical notion that is utilized in many domains, including finance, economics, and statistics. In this article, we will look at the definition of ratios and their features and uses. For example, if we have 5 apples and 3 oranges, we may represent the apple-to-orange ratio as 5:3, indicating that there are 5 apples for every 3 oranges. In a ratio, the colon (:) sign is used to separate the two values. Instead, we may represent the ratio as a fraction, with the first item as the numerator and the second quantity as the denominator. In this situation, the proportion of apples to oranges is 5/3. Ratios can also be expressed in decimal or percentage form. To convert a ratio to a decimal, we divide the first quantity by the second quantity. In the case of the ratio of apples to oranges, this would be 5 divided by 3, which equals 1.67. To convert a ratio to a percentage, multiply the decimal form by 100. Therefore, the ratio of apples to oranges would be expressed as 167%.

Properties of RatioOne of the most important properties of ratios is that they can be simplified. A ratio is said to be in its simplest form if the two quantities have no common factors other than 1. For example, the ratio of 6:3 can be simplified to 2:1 because both 6 and 3 are divisible by 3. However, the ratio of 7:9 cannot be simplified any further because 7 and 9 have no common factors other than 1. Another important property of ratios is that they can compare quantities measured in different units. For example, if we want to compare the heights of two people, one of whom is 6 feet tall and the other is 72 inches tall, we can express the ratio of their heights as 6:72 or 1:12. This tells us that the taller person is 12 times taller than, the shorter person, regardless of the units in which their heights are measured.

Types of RatiosDifferent types of ratios are used in different fields of study and industries. Financial RatiosFinancial ratios are used to assess a company's financial performance. They are computed by multiplying one financial statistic by another. Liquidity Ratios, Profitability Ratios, Solvency Ratios, and Efficiency Ratios are the four types of financial ratios.

Liquidity ratios measure a company's ability to meet its short-term obligations. These ratios determine whether a company has enough cash or liquid assets to pay its current debts. Examples of liquidity ratios include the current, quick, and cash ratios. -Divide current assets by current liabilities to get the current ratio. It assesses a company's capacity to pay current bills with current assets. A ratio of 2:1 is typically seen as healthy. -Quick assets are divided by current liabilities to get the quick ratio (the acid test ratio). Cash, marketable securities, and accounts receivable are examples of quick assets. This ratio assesses a company's capacity to meet its current liabilities using its most liquid assets. -Cash and cash equivalents are divided by current liabilities to obtain the cash ratio. It assesses a company's capacity to pay current liabilities from cash reserves.

Profitability ratios assess a firm's capacity to create profits from its revenue, assets, and equity. Profitability ratios such as the gross profit margin, operating profit margin, net profit margin, return on assets (ROA), and return on equity are examples of profitability ratios (ROE). -Divide gross profit by revenue to get the gross profit margin. It calculates the remaining revenue portion after subtracting the cost of items sold. A larger gross profit margin shows that the company model is more efficient. -Operating profit is divided by sales to obtain the operating profit margin. It assesses a company's capacity to profit from its primary business. -Divide net income by revenue to get the net profit margin. It is the proportion of revenue that remains after all expenditures, including taxes and interest, have been deducted. - Return on assets (ROA) is computed by dividing net income by total assets. It assesses a company's capacity to profit from its assets. Divide net income by total equity to determine ROE. It assesses a company's capacity to make profits from the investment of its shareholders.

Solvency ratios assess a firm's capacity to satisfy long-term obligations. These ratios assess whether or not a corporation can pay its obligations on time. The debt-to-equity ratio, interest coverage ratio, and debt service coverage ratio are all examples of solvency ratios. -Total liabilities are divided by total equity to establish the debt-to-equity ratio. It compares the amount of debt a firm has to its equity. A high debt-to-equity ratio suggests a greater likelihood of bankruptcy. -Divide earnings before interest and taxes (EBIT) by interest expenditure to get the interest coverage ratio. It assesses a company's capacity to cover interest expenditures with earnings. -Divide earnings before interest, taxes, depreciation, and amortization (EBITDA) by total debt service to obtain the debt service coverage ratio. It assesses a company's capacity to make debt principal and interest payments.

Efficiency ratios are financial measures that assess how effectively a business uses its assets to create income. These ratios assess a company's operational efficiency and how successfully its resources are utilized to create profits. Efficiency ratios are particularly important for companies with high fixed asset levels, such as manufacturing or production companies. These ratios can help managers identify areas to improve efficiency and increase profits. Here are some of the most commonly used efficiency ratios:

The inventory turnover ratio indicates how rapidly a company's inventory is sold. It is computed by taking the cost of products sold and dividing it by the average inventory balance. The inventory turnover ratio formula is as follows: Inventory turnover ratio = average inventory/cost of goods sold A high inventory turnover ratio implies that a firm sells its goods fast and effectively. In contrast, a low ratio suggests that a company holds onto its product for an inordinately long period. A high inventory turnover ratio can also suggest that a company keeps minimal inventory levels, which can lead to stockouts and lost sales.

The asset turnover ratio assesses how well a corporation generates income from its assets. It is determined by dividing total assets by total revenue. The asset turnover ratio formula is as follows: Revenue divided by total assets equals asset turnover ratio. A high asset turnover ratio implies that a corporation generates more income per dollar of assets, whereas a low ratio suggests that a company is not properly utilizing its assets. A high asset turnover ratio can suggest that a company is managing its assets well and is generating strong revenue growth.

The accounts receivable turnover ratio measures how a firm collects its receivables. It is determined by dividing net credit sales by the average amount owed. The accounts receivable turnover ratio is calculated as follows: Accounts receivable turnover ratio = Net credit sales / Average accounts receivable A high accounts receivable turnover ratio suggests that a firm collects its receivables promptly and effectively, whereas a low percentage indicates that a company struggles to collect its receivables. A high accounts receivable turnover ratio can also suggest that a company has effective credit policies and manages its accounts receivable well.

The accounts payable turnover ratio assesses how quickly a corporation pays its vendors. It is computed by dividing the average accounts payable balance by the cost of items sold. The accounts payable turnover ratio is calculated as follows: Accounts payable turnover ratio = cost of goods sold / average accounts payable A high accounts payable turnover ratio shows that a firm pays its suppliers swiftly and effectively, whereas a low ratio suggests that it pays its suppliers too slowly. A high accounts payable turnover percentage may indicate that a firm has positive ties with its suppliers and can negotiate advantageous payment arrangements.

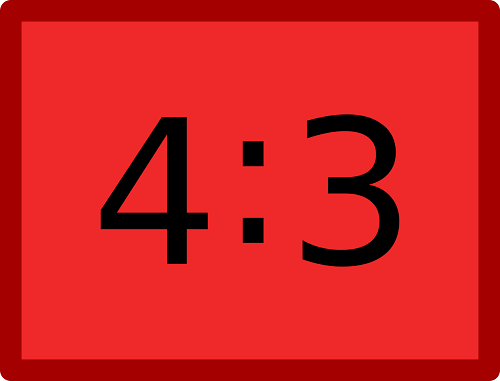

The fixed asset turnover ratio assesses how effectively a corporation generates income from its fixed assets. Revenue is divided by net fixed assets to arrive at this figure. The fixed asset turnover ratio is calculated as follows: Revenue / Net fixed assets = Fixed asset turnover ratio A high fixed asset turnover ratio indicates that a company is generating strong revenue growth relative to its investment in fixed assets. In contrast, a low ratio indicates that a company is not using its fixed assets effectively. A high fixed asset turnover ratio can also suggest a company investing in new technology and equipment to improve efficiency and productivity. Application of RatioRatios are a fundamental concept with various applications in various fields. Ratios can be used to compare two or more quantities and expressed in different forms, such as decimals, percentages, or fractions. 1. MathematicsThe ratio is a fundamental mathematical notion that is employed in a wide variety of mathematical applications. A ratio is a comparison of two or more quantities in mathematics. It is expressed as the quotient of one quantity divided by another and is often written as a fraction or a decimal. Ratios are used in various mathematical contexts, including geometry, algebra, and statistics, and are an essential tool for solving many mathematical problems. One of the most important applications of ratios in mathematics is geometry. In geometry, ratios are used to compare the sizes of different geometric figures. For example, the ratio of the length of the sides of a rectangle is used to determine the shape's aspect ratio. The aspect ratio describes how "wide" or "narrow" a shape is and can be used to determine its size or compare it to other shapes. In algebra, ratios solve many problems, including those involving proportions and rates. For example, ratios can be used to solve problems involving percentages, such as finding the percentage increase or decrease in the price of an item. Ratios can also be used to solve problems involving rates of change, such as determining the average speed of a moving object.

2. FinanceRatios are often used in finance to assess a company's success. The price-to-earnings (P/E) ratio, gauges the price investors are ready to pay for each dollar of earnings, is one of the most often used financial statistics. The P/E ratio is derived by dividing a stock's current market price by its earnings per share (EPS). A high P/E ratio indicates that investors are willing to pay more for a company's earnings, which suggests that the company is expected to grow. Another commonly used financial ratio is the debt-to-equity (D/E) ratio, which measures a company's leverage or the amount of debt it has relative to its equity. The D/E ratio is computed by dividing a company's total debt by equity. A high D/E ratio shows that a corporation has more debt than equity, which may imply financial danger. 3. EconomicsRatios are also widely used in economics to measure the relative size of different economic variables. One of the most commonly used financial ratios is the Gross Domestic Product (GDP) per capita, which measures the average income of a country's citizens. The GDP per capita is computed by dividing a country's total GDP by population. Another important economic ratio is the debt-to-GDP ratio, which compares a country's debt to its GDP. The debt-to-GDP ratio is calculated by dividing a country's total debt by its GDP. A high debt-to-GDP ratio indicates that a country's debt is larger than its economic output, which may indicate financial instability. 4. EngineeringIn engineering, ratios represent the connection between two or more physical quantities. One of the most commonly used ratios in engineering is the aspect ratio, which is the ratio of the length of an object to its width. The aspect ratio is used to describe the shape of an object, and it is important in aerodynamics, where the shape of an object affects its ability to move through the air. Another important ratio in engineering is the power-to-weight ratio, which measures the amount of power an object can generate relative to its weight. The power-to-weight ratio is important in designing vehicles and machines. A high power-to-weight ratio is desirable because it indicates that an object can generate much power without being too heavy. 5. ScienceIn physics, ratios represent the connection between two or more physical quantities. The mole ratio, which indicates the ratio of the moles of one material to the number of moles of another component in a chemical reaction, is one of the most widely used ratios in science. The mole ratio is useful in chemistry because it enables researchers to forecast the results of a chemical process. The signal-to-noise ratio, which assesses the intensity of a signal about the background noise, is another essential ratio in research. The signal-to-noise ratio is important in fields such as astronomy and telecommunications, where weak signals must be distinguished from background noise. 6. SportsRatios are also used in sports to compare the performance of athletes. One of the most commonly used ratios in sports is the batting average in baseball. The batting average measures the percentage of times a player successfully hits the ball during their at-bats. This ratio is calculated by dividing the number of hits by the number of at-bats. A high batting average indicates that a player is successful at making contact with the ball and getting on base, while a low batting average suggests that a player is struggling to hit the ball. In basketball, ratios such as the shooting percentage and the three-point percentage are used to measure the accuracy of a player's shots. The shooting percentage measures the number of successful shots made divided by the number of shots attempted, while the three-point percentage measures the number of successful three-point shots made divided by the number of attempted three-point shots. These ratios help to compare the accuracy of different players' shooting abilities and can be used to identify areas for improvement. In soccer, the goal-scoring ratio is used to measure the success of individual players or teams. This ratio is calculated by dividing the number of goals scored by the number of shots attempted. A high goal-scoring ratio indicates that a player or team is skilled at converting their shots into goals, while a low goal-scoring ratio suggests that they are struggling to find the back of the Net. In track and field, ratios such as the speed and jump ratios are used to measure the performance of athletes. The speed ratio measures the distance an athlete travels in a given time, while the jump ratio measures the height or distance an athlete jumps relative to their body size. These ratios help to compare the performances of different athletes across different events and can be used to identify areas for improvement. In team sports such as football, the pass completion and possession ratios are used to analyze teams' performance. The pass completion ratio measures the percentage of successful passes a team makes. In contrast, the possession ratio measures the time a team possesses the ball relative to their opponents. These ratios help to identify the strengths and weaknesses of different teams and can be used to develop strategies to improve their performance ConclusionIn summary, ratios are a powerful tool for analyzing the financial performance of a company, but they should be used in conjunction with other tools and metrics. Different ratios serve different purposes, and it is important to understand the specific context in which each type of ratio is used. Investors and analysts may acquire significant insights into a company's financial health and make educated decisions regarding investments and other financial transactions by employing ratios in a careful and informed manner. It is critical to remember that ratios should be assessed in conjunction with other financial measures and industry benchmarks. For example, a company's current ratio of 2:1 may be considered healthy, but if the industry average is 3:1, the company may still be struggling to meet its short-term obligations. Moreover, ratios should be part of a comprehensive financial analysis that considers a company's financial history, market trends, and other external factors that may impact its performance. Additionally, ratios are only one tool among many used in financial analysis. They should be used with other tools such as financial statements, trend analysis, and SWOT analysis.

Next TopicRecord Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share