IMPS - Immediate Payment Service

Money is one of the important components of life. Sometimes when our loved ones are in urgent need of money, a money transfer is one of the best, easiest and quickest ways to help them. But in a country like India, bank transfer services like NEFT or RTGS often take too much time, which can be an issue. This was such a big challenge faced by the Indian banking services or the corporate world's payments. So, to improve this situation, NPCI (National Payment Corporation of India) launched a service of IMPS, an electronic fund mobile banking service by the banks for immediate payments. What is an IMPS?IMPS or the Immediate Payment Service is an interbank electronic fund's services which are especially working in India, and these services are reliable and fast. The best thing about IMPS is it works on mobile and is available at all times (24*7). To use this service, the sender must know the receiver's bank account number and IFSC code (Indian Financial System Code). In India, all the well-known banks like State Bank of India, Bank of India, Union Bank of India, ICIC Bank, Yes Bank, Axis Bank, and HDFC Bank and moreover nearby 53 commercial banks, 101 rural banks/ district/ Urban banks, 24 prepaid payment instruments in India ( PPI) are using this service. In this country (India) per month, nearly 200 million transactions happen; if we talk about credits, 20 billion (rough amount) of money transactions happens in India every month. Some History about IMPSNPCI started the service of IMPS in August 2010. In the beginning, the IMPS service provided to four members (State bank of India, Bank of India, later yes Bank, Axis Bank, and HDFC bank) who joined them in September 2010. The DG RBI Smt. Shyamla Gopinath publicly launched the IMPS service on 22nd of the November in 2010 in Mumbai. What are the main objectives of the IMPS service?The IMPS service is working successfully across India, with few main objectives given below.

What are the main units or participants of the IMPS?There are four main units or participants of the IMPS, which are compulsory of the transactions by the IMPS Service. 1. Remitter Remitters are the senders who are using the services to send the money or make the payments to someone. These are the primary units for the transactions. 2. Beneficiary Beneficiaries are the receivers who get benefits due to the services. These are the end-users of the service. 3. Banks The banks must have the IMPS services and also may have enough security for safe transactions. 4. NPCI (National Financial Switch) All this work of transactions is done under the NPCI. They keep all the information about all the transactions that happen across the country. Who are the live members of the IMPS services?The banks or payment Applications that are supporting the IMPS services and are registered by the National Payment Corporation of India (NPCI) are known as the live members of the IMPS service. These are the current live members of the IMPS in India; 1. The private, public and payment banks Private and public banks like (Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank, City Bank, HDFC Bank, ICIC Bank, Kotak Mahindra Bank, Punjab National Bank, and State Bank of India, Union Bank, IDFC bank, etc.) are live members of the IMPS service. 2. The RRB's Bank The banks of the Rural Area like (Dakshin Bihar Gramin Bank, Baroda Uttar Pradesh Gramin Bank, Utkal Gramin Bank, Baroda Gramin Bank, Uttrakhand Gramin Bank, Sarva UP Gramin Bank, Paschim Banga Gramin Bank, Assam Gramin bank, and Tripura Gramin Bank etc.) are the live members of the IMPS service. 3. Co-operative Banks There are many Co-operative Banks (Cosmos Bank, the Nainital Bank LTD, Janata sahakari Bank, Apna Sahakari Bank, Rajapur Urban Co-operative Bank, etc.) that support the service of IMPS. 4. Small financial banks Ujjwal Small Finance Bank, ESAF Small Finance Bank, Utkarsh Small Finance Bank, Jana Small finance bank etc., are some finance banks with IMPS service. 5. PPI's (prepaid payment instruments in India) Some payment apps or methods like Muthoot Finance Bank, PAYTM, One MobiKwik system Pvt. Ltd, Phone pe Pvt. Ltd, etc., support IMPS. What are the main steps for using the IMPS services?Registration process of the sender:

Registration process of the receiver:

Steps for sender while sending money:

Steps to receive money

IMPS through Account Number and IFS codeThe transactions of the IMPS is done through the MMID + Mobile Number, but in few cases, sometimes the sender faces an issue with the MMID or the sender or receiver's mobile isn't registered with the Bank. At that time, another way the sender can use is the Account Number and the IFSC code. The IMPS transfers can also be done with the help of account numbers and IFSC but it's better to use it only in the case of an emergency. Precautions while using IMPS services?There are many case histories about the fraud, and the theft that happened, due to the unawareness or carelessness of the consumers while making online bank transactions. So while using these services, you need to be careful about some important facts, which are as follows;

Advantages and disadvantages of the IMPS services?

Everything that works must have cons and pros. The same goes for IMPS services. They are created to support users and make things easier for them, but little carelessness may lead to big harm to the users. These are the main advantage or disadvantages of the IMPS services; Advantages of IMPS

Disadvantages of the IMPS

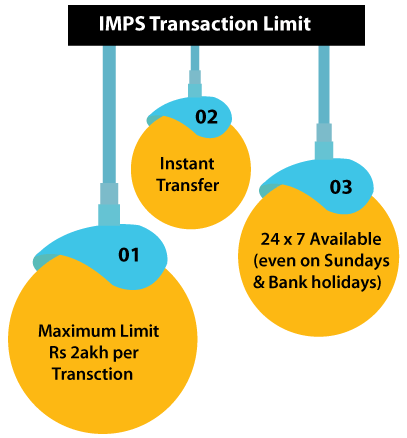

What is the difference between NEFT and IMPS services?NEFT and IMPS services work for 24 hours and seven days a week, but the major difference between both is that IMPS services are really quick and individual, whereas the NEFT services work along with branches. One other difference is that IMPS Service is only an online service, but the NEFT services can be used online and offline (from Banks). If you don't know what is NEFT here is the definition: NEFT (National Electronic fund transfer) is a payment service offered by the Reserve Bank of India, allowing electronic transactions from one account to another. What is the difference between RTGS and IMPS?The biggest difference between RTGS and IMPS is IMPS don't have any limit of transactions, whereas the RTGS works for more than or equal to 2 lakh. Another difference between RTGS and IMPS is management. RTGS is managed by the Reserve bank of India, whereas the IMPS is managed by the National Payment Corporation of India. If you don't know what the RTGS is: RTGS (Real Time Gross Settlement) is used for high amount transactions. It is also used for the immediate transfer of funds from one account to another account. The transaction done is accepted for the real-time and gross investments. The most important thing to note for the RTGS service is that it only works for equal to or more than 2 lakh. Some Important points to remember about the IMPS

Next TopicSDM - Sub Divisional Magistrate

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share