Accounting Books

Formats of Books of Accounts

There are three types of formats that can be used by companies to record financial transactions. The companies can get register with these formats at the BIR Regional District Office except for the computerized format (as it is based on the company's Certificate of Registration). Once the BIR stamps the format, it gets approved.

- Manual Books of Accounts

This book of accounts is the traditional journal, ledger, and book columns. It can be easily available at an office supply store and offices. Under this book of accounts, the entries are done in a handwritten manner. Manual books of accounts are the most suitable way of recording financial information for small-scale businesses as it is cheaper and easier to register with BIR.

- Loose Leaf Books of Accounts

Under this format, the transactions are recorded by encoding the details on the computer and generating template copies by printing this out. It is done with the help of loose-leaf approved formats that are to be bound as the bookkeeping record of taxpayers.

- Computerized Books of Accounts

Under this format, the accounting books are prepared with the help of a computerized accounting program that facilitates efficient and fast record keeping of financial transactions. This format demands more time to get approved in comparison to the others because the agency has to fully assess the system in line with rules and regulations. The companies can register this format at the National Office of BIR.

Basic Books of Accounts

In accounting the are two main books which include a journal and a ledger. In a journal, financial transactions are recorded chronologically while in a ledger, financial activities are classified according to their nature. Both these books can be understood as follows:

1. Journal

An accounting journal is an official record that contains all the financial transactions of a company arranged by date. The process of recording financial transactions in a Journal is called Journalizing. The accounting journals help the accountants, bookkeepers, and auditors in tracking and analyzing the financial status of an entity. The transactions in the journal are presented in terms of credits and debits as well as explained the transactions. Usually, a journal is maintained in the form of a book.

A Journal is also known as a book of prime entry or original entry because, in this accounting book, all business transactions are recorded for the first time. A point should be noticed here is that the transactions are recorded as per the order of their occurrence, i.e., chronological order.

There are different accounting journals that are maintained by accountants and bookkeepers to record the accounting transactions. They include the followings:

- Purchase Day Book or Purchase Journal

Under this book of accounting, the merchandise or assets purchased on credit are recorded. This journal does not include the assets or merchandise purchased in cash or through a bank account.

- Sales Day Book or Sales Journal

This journal is used to record the credit sales of merchandise and assets only. This accounting book does not include the cash sales of assets and merchandise because the income received from the cash sales is transferred to the cash receipt journal.

- Return Inward Book or Sales Return Journal

This journal includes all the credit sales returns get from the clients and customers that were sold to them by the company.

- Return Outward Book or Purchase Return Journal

This journal includes all inventory returned by a company that was previously purchased on credit. It is the credit purchases that are returned by a customer to the supplier due to defects in products or any other appropriate reason. However, in this case, the customer is the company itself and the supplier will be the provider of inventory.

- Cash Receipts Journal

Under this book of accounts, all the transactions which are related to cash or cheque receipts are recorded. They can be included payment received from the sale of goods and services via cash, accounts receivable, interest receipts, bank loans, and cash sale of assets.

- Cash Payment or Disbursement Journal

In the CPJ all the transactions which are related to the payment in cash or bank are recorded. They can be included cheques paid for expenses and payments for accounts payable. In short, Cash Payment Journal contains all the payments done via cash or cheque.

- General Journal or Journal Proper

In this journal, all the transactions other than the transactions of cash payment, cash receipts, purchase journals, and sales journals are recorded. These transactions include the purchased asset on credit, adjustment of accounts, the stock of goods at the end of the year, and rectification of errors.

Functions of Journal

Some of the most important functions of a journal are given below:

- Analytical Function

It is necessary to analyze each transaction into the debit and the credit aspect while recording these transactions in a journal. This analysis is helpful in understanding the effect of each transaction on the financial position of the business.

- Recording Function

This is a business language. This function helps in maintaining the record of financial transactions based on the principles. The entries of these records are supported by a brief narration which helps understand the transaction for a layman in simpler terms.

- Historical Function

The journal book of a company contains a chronological record of financial transactions for future reference. This is further useful for the organization in analyzing its past performance and figuring out the future possibilities for growth and development.

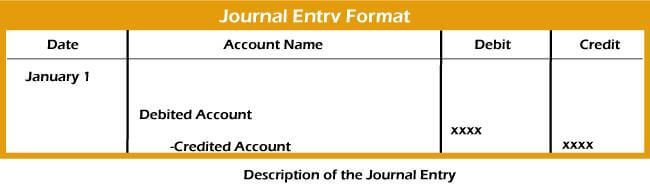

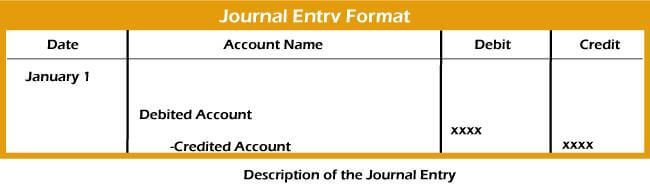

Elements in an Accounting Journal

The following elements are included in an accounting journal:

- The account number and name.

- A header to write the date of entry.

- A reference or journal entry number for retrieving the journal when needed.

- The journal's description in the footer.

- The amount of debit and credit.

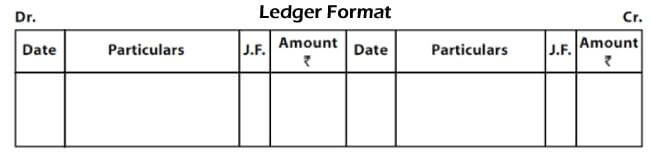

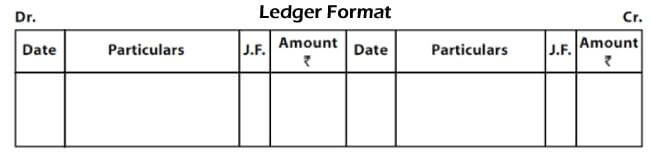

2. Ledger

All the accounts recognized as per the transactions recorded in various journals are opened and maintained in a separate book of accounting called Ledger. So, a ledger contains all types of accounts related to assets, liabilities, capital, expenses, and revenues. The process of recording all the items of a journal into the ledger is called the posting entries from Journal to Ledger Accounts.

Ledger has following the types:

- General Ledger

The master collection of all the accounts that summarize all the financial transactions of a company is called a general ledger. This ledger contains a small set of ledgers that are used to record all the business transactions in the financial statements of the company. This includes debit and credit entries for every transaction that is recorded. The total balance of both the debit and credit sides should be equal to prepare the financial statements from it.

General ledger has two types:

- Nominal Ledger

As can be understood from the name, this ledger contains all nominal accounts, i.e., expenses, losses, incomes, and gains. Example: Salaries, wages, purchases, sales, return outward/inward, stationery, depreciation, rent, etc.

- Private Ledger

This ledger includes confidential accounts such as capital, drawings, salaries, etc. These accounts can be accessed by selected individuals only.

- Purchase Ledger

This ledger contains all the financial transactions that the company has done with the suppliers. It includes purchases that have been paid and that are outstanding. If the volume of purchases is like then it is not required to maintain a purchase ledger instead of it, the company can directly enter these transactions into the general ledger. Each purchase ledger account has a credit balance which represents the amount owed to a supplier by the company. The sum of this due amount is known as Accounts Payable.

- Sales Ledger

Just like the purchase ledger account, it is not mandatory to maintain a sales Ledger account if the business has just one customer but one account in the nominal ledger will be enough. Most of the companies deal with a large number of customers and many of them buy goods on credit. This increases the value of maintaining the sales ledger. This ledger contains all the transactions which are related to the credit sales of goods and services. The sum of the amount of credit sales is known as Accounts Receivable.

Difference between Accounting Journal and Accounting Ledger

The prime difference between both the books of accounts, i.e., journal and ledger can be understood with the help of information given below:

| Basis of Difference |

Journal |

Ledger |

| 1. Definition1. |

A subsidiary book of account that records all the financial transactions is called a journal. |

A principal book of accounts that classifies various financial transactions recorded in a journal, is called a ledger. |

| 2. Order |

It is necessary to record the entries or transactions in chronological order on the day of their occurrences in a journal. |

The ledger classifies the transactions or entries from the journal under the respective accounts to which these transactions are related. |

| 3. Explanation |

Each journal entry contains a detailed narration of the financial transaction which helps in understanding the transaction easily. |

The ledger accounts do not have a detailed narration of each financial transaction. |

| 4. Result |

The journal can not reveal the total result of a financial transaction. |

The ledger accounts are helpful in getting the result of financial transactions for a particular account. |

| 5. Trial Balance |

The journal is not useful in the preparation of trial balance directly. |

The ledger helps in the preparation of the trial balance. |

| 6. Financial Statements |

The journal does not play any direct role in the preparation of the financial statements of the organization. |

The balance from different ledger accounts helps in the preparation of the financial statements of the organization. |

| 7. Opening Balance |

There is not any opening balance in a Journal which is a point of concern with the current transactions that take place on a daily basis. |

Some ledger accounts include the opening balance which is the closing balance of the previous year. |

Bookkeeping

Bookkeeping refers to the process of systematically recording the financial transactions and information related to the day-to-day activities of a company. It ensures that this record is up-to-date, accurate, and comprehensive.

These books are maintained by an individual or entity who is called a bookkeeper. The bookkeepers are responsible to manage all the financial data of a business. Accurate bookkeeping helps in tracking all the financial transactions on the books which are further useful in making effective and efficient decisions concerning investment, operation, and finance.

But this method of recording the transactions is highly time and cost-consuming. Also, there is a higher possibility of mistakes and inaccuracy in bookkeeping.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now