What is IPO in Share Market?The process of offering shares by a private corporation to the public for the first time is known as Initial Public Offering (IPO). IPO helps the company in raising funds from public investors. These shares are issued in the primary market and after issuing IPO a company becomes a public company. When a company transits from the private to the public, the time in between is crucial for the private investors to know their return on investment as it typically includes a share premium for the current private investors. Meanwhile, it also allows the public investor to buy the company's shares.

How does an IPO work?Before an IPO, a company is termed private. The company has fewer investors than a pre-IPO private company, including the founders, family, and friends, as well as some professional investors such as venture capitalists or angel investors. An initial public offering (IPO) is a significant milestone for a company because it allows it to raise a huge amount of capital that it may utilize for growth and expansion. This also increases transparency and share listing credibility which is a plus point for the company when it wants to raise funds by borrowing. When a firm has grown to the point where it believes it can comply with SEC requirements, as well as the rewards and responsibilities of public shareholders, it will begin to advertise its desire to go public. Typically, a company reaches this stage of growth when its private valuation turns to approximately $1 billion, also called unicorn status. However, depending on market competition and the firm's capacity to meet listing standards, a company with good fundamentals and proven profitability potential can offer its IPO. Underwriting due diligence determines the prices of the IPO shares. Advantages of IPOVarious advantages of the IPO are as follows:

Disadvantages of IPOVarious disadvantages of the IPO are as follows:

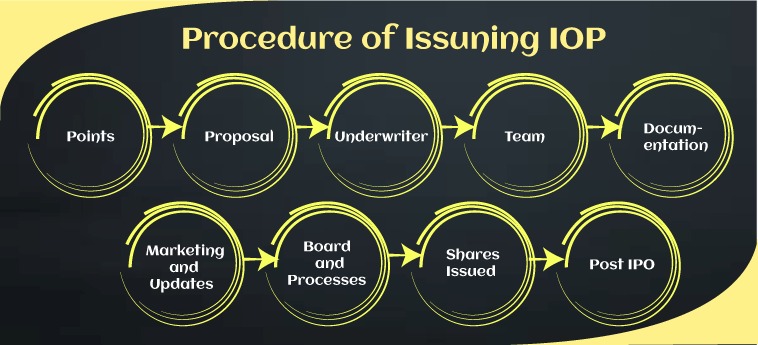

Procedure for Issuing IPOAn IPO is consisting of two parts: the pre-marketing phase of the offering and the initial public offering. When a company wants to issue IPO, it will advertise to underwriters by soliciting private bids or can also make a public statement. The further process of IPO is led by the underwriters who are chosen by the company. A company can choose one or more than one underwriter to complete the different steps of the IPO process collaboratively and effectively. These underwriters perform all tasks including due diligence, filing, marketing, document preparation, and issuance.

1. Proposals The first step is to submit the proposals and valuations to the underwriters, which include their services, the best type of security to issue, the offering price, the number of shares to be issued, and the projected timeframe for the market offering. 2. Underwriter The next step is to choose the underwriters and formally agree to their terms by signing an underwriting agreement. 3. Team After it, the company should form a team of IPO that include underwriters, lawyers, Certified Public Accountants (CPAs), and experts from the Securities and Exchange Commission (SEC). 4. Documentation In the process of documentation of IPO, the company's information is required. The primary IPO filing document is the S-1 Registration Statement. This document is divided into two parts; the prospectus and the privately held filling information. The S-1 contains the preliminary information related to the expected date of filing. This information will be revised often throughout the pre-IPO process along with the prospectus included in it. 5. Marketing and Updates At this step, the company creates the marketing materials for the pre-marketing of the stock issuance. This is the work of the underwriters and executives to market the share issuance so that the estimated and the final offering price of IPO can be determined. Underwriters are free to revise their work throughout the process of marketing. And they can also change the IPO price or the date of the issuance as per the market suitability. The public companies must adhere to both the requirements of exchange listing and SEC. 6. Board and Processes Now, the company has to form a Board of Directors, BoD and ensure the process for reporting auditable financial and accounting information every quarter. 7. Shares Issued Now, the company is ready to issue its shares in the primary market on the IPO date. The company receives the capital from the primary issuance of shares in the form of cash and this capital is recorded as stockholders' equity on the liability side of the balance sheet. Subsequently, the share value of the balance sheet gets dependent on the shareholder's equity per share valuation comprehensively. 8. Post-IPO Issuing the shares is not the last work that the company has to do in the process of issuing an IPO. To complete this procedure, the company has to institute some post-IPO provisions. This may include a specified time frame for the underwriters to buy the additional amount of shares after the IPO date. Meanwhile, certain shareholders may have quiet periods. Alternatives of IPO1. Direct Listing When a company issues IPO without any underwriter then it is known as a direct listing. This option skips the process of underwriters which may increase the risk if the offerings do not do as per expectation. But there is also the possibility of having more benefits from the higher share pricing. But this method is favorable only for a company with a well-known brand value and attractive business. 2. Dutch Auction In this auction, the price of IPO is not pre-determined. Potential buyers can place bids on the shares they wish to buy and the amount they can afford. The shares are then distributed to the bidders who are willing to pay the highest price. Performance of IPOThere are some IPOs that may be overly-hyped by investment banks. This can lead to initial loss to the business. However, most IPOs are famous for gaining in short-term trading as they are issued to the public. Few considerations that decide the performance of the IPO are as follows: 1. Lock-up Period It is a caveat outlining a period after becoming a public company when major shareholders are not allowed to sell their shares. During this period, company insiders and early investors are prohibited to sell their shares so that the market will not flood with additional shares for sale. Usually, the lock-up periods last for 90 to 190 days. After the end of this period, most of the trading restrictions are removed. When a company goes public, the officials and employees of the company sign a lock-up agreement. It is a legal contract that binds underwriters and insiders of the company to sell any share for a particular period. As seen many shares take a steep downturn after the expiration of the lock-up period. This is because, when all the insiders got permission of selling their stock this creates a rush in the market. After all, everyone wants to a make profit as soon as possible. This excess supply of stocks leads to severe downward pressure on the prices of the stock. 2. Waiting Period The waiting period is included in the offering terms of some investment banks. This sets aside some shares for purchase after a particular period. If this allocation is purchased by the underwriters then the price may increase and if not then the price may decrease. 3. Flipping It refers to the process of reselling the shares in the first few days of purchase so that a quick profit can be earned. This practice is common when the stock is discounted and soars on the first day of trading. 4. Tracking Stocks Tracking stocks are created in the case of a standard IPO when an existing firm spins out a portion of its business as a separate organization. These are a sort of equity given by a parent business that is in charge of monitoring the financial performance of a certain segment or division. These equities are traded on the open market separately from the parent company's stock. The major reason for spin-offs and the development of tracking stocks is that separate sections of a company can create more profit than the firm as a whole in some situations. For example, if a division is facing the problems of higher current losses but it has a high growth potential then it may be beneficial for the company to carve out the problem and keep the parent the company as a large shareholder then let the division raise capital through IPO. From the perspective of an investor, these IPO opportunities can be interesting. In general, a parent firm's spin-off provides its investors with a wealth of information about the parent company and its position in the company. Because investors are more aware of spin-offs, they may experience less initial volatility. 5. IPOs over the Long-term IPOs are known for their volatile opening day returns because of which many investors buy them to become benevolent from the discounts involved. Over the long-term, the prices of IPO get settled into a steady value which is followed by traditional stock price metrics such as moving averages. So those investors who want to buy IPOs but do not want to take the individual stock risk may go with the managed funds focused on IPO universes. FAQsQ. What is the purpose of IPO? Ans. IPO helps the companies is raising funds in the share market for the first time. Some motivations for issuing IPO are raising capital, providing liquidity to the founders and early investors, and getting a higher valuation. Q. Who can invest in IPO? Ans. Mostly, it is seen that the demand for the IPOs is higher than the supply. Because of it, there is not any guarantee that all the investors who want to buy the share will get them. Those who want to invest in IPO can contact their brokerage firm although sometimes, the access to IPO is limited to only larger investors. Another option by which you can invest in IPO is mutual funds or other investment instruments. Q. Is it a good decision to invest in IPO? Ans. IPOs are highly popular among investors because of their volatile price movements on the day of IPO and shortly thereafter. However, there is an equal possibility of having profit and loss. Ultimately, investors should become rational before investing and should judge IPO according to the prospectus, financial circumstances, and risk tolerance of the company.

Next TopicWhat is Volume in Share Market

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share