Drawings in AccountingAn account collection is a record of the amount withdrawn from an employer held by the employer or accountant. These withdrawals are made for personal use rather than business purposes, albeit they are treated significantly differently than employee wages. A drawing account is not a bank account in and of itself. It is important to keep a detailed record of these withdrawals as they need to be offset against the owner's capital. Using a separate drawing account makes it easier to keep track of these activities and balance your books after each fiscal year when you need to know how to close your drawing account.

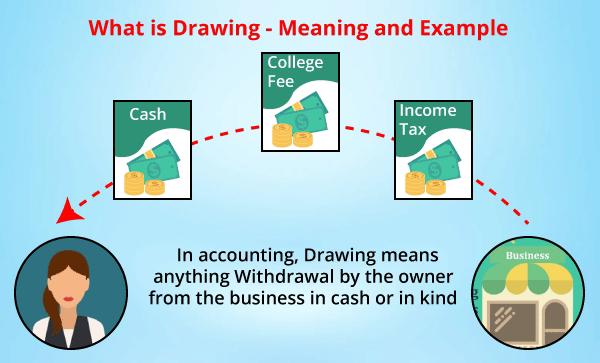

Definition of DrawingsDrawings are sums a business owner takes for personal use in anticipation of profit. Drawings are typically done in cash, but the owner may withdraw other assets or items for his personal use. Profits made by the firm, on the other hand, increase the owner's capital; drawings, on the other hand, decrease the quantity of capital.

What impact do drawings have on your financial statements?Drawings are withdrawals made by the owner in accounting terms. As a result, the company's financial statement will reflect a decline in assets equal to the amount withdrawn. It will also reflect a diminution in the owner's equity because the owner is cashing in on a little portion of their claim to the company. Drawings will also appear on a cash flow statement because they reflect a financial activity that its accounting departments must appropriately report. In accounting, how do you record drawings?An owner withdrawal is normally recorded as a debit on your balance sheet. If the withdrawal is for goods or services, the amount recorded is usually a cost value. The exact quantity withdrawn can be easily quantified if the withdrawal is performed in cash. Drawings accounts are transient documents that must balance after a fiscal year or term. It can be resolved in various ways, including reimbursement by the owner or a cut in the owner's compensation to compensate for the withdrawn amount. In a balance sheet, where do drawings go?The balance sheet, also known as a statement of financial status, is an important document for measuring and demonstrating your company's financial position. The standard balance sheet lists the company's assets, liabilities, and capital. As a result, the arrangement of drawings inside the balance sheet is determined by how they are classified. Are drawings considered assets or expenses?Drawings from business accounts may include the owner withdrawing cash or products from the company but this is not a typical business expense. The standard balance sheet lists the company's assets, liabilities, and capital. It is also a withdrawal from the company's account, as it is offset against the owner's liability but is not considered a liability. Maintaining a drawing account that needs to be closed at the end of the fiscal year is important to ensure that the books are not disturbed by this financial change while maintaining a comprehensive record of all moving parts of the business. What constitutes a drawing?A drawing is any money taken from a corporate account for personal use in accounting terminology. It can be in the form of a wage or something as basic as lunch paid for with your corporate credit card. A drawing is similar to a wage, except it is only applicable to sole proprietors or partners. Drawings, on the other hand, do not simply include cash withdrawals. It might also involve items and services taken from the company for personal use by the owner. For example, it could imply obtaining business property or using worksite resources. If ABC takes money from the firm for personal use, the money is referred to as drawing. And ABC is obligated to repay the money taken from the firm. What's the distinction between capital and drawings?Capital refers to money invested in a firm by any individual or group. When a person puts money into a firm, he hopes to make more money. Instead of investing cash, he prefers to maximize profit. Drawing, on the other hand, is the polar opposite. Drawing is a person's liability that he must pay. The item, money, or assets that the business owner removes from the business for his use are referred to as drawings. It is a popular form of transaction in business. Any person or organization utilizing money who puts his capital in the business to start his business might be included. However, if the person takes out the same capital afterwards, it is referred to as a drawing. Keeping Track of Transactions in the Drawing AccountA drawing account journal entry consists of a drawing account debit and a cash account credit. Closing a sole proprietor's subscription account Journal entries include a debit to the owner's equity account and a credit to the subscription account. For example, Eve Smith's drawing account has a debit balance of $24,000 after an accounting year. Eve drew $2,000 per month for personal use, debiting her drawing account and crediting her cash account with each transaction. Closing the Drawing Account, the journal entry contains a $ 24,000 credit to Eve's drawing account and a $ 24,000 debit to Eve's equity account. What is a drawing account? How does it work?A drawing account is the dissolution of the owner's capital. The debit balance of the subscription account is different from the expected balance of the owner's equity account because the owner's withdrawal reduces the company's equity. Every journal entry must include debit and credit by double-entry bookkeeping. All transactions withdrawn from a withdrawal account have the same opposite credit as a cash account, as cash withdrawals require credit to the cash account. The subscription account must be closed with credit (representing the total withdrawal amount) at the end of the year to track the distribution to the owner for a particular year, and the balance will be debited to the principal owner's equity account. Example:A practical example of trading with a sole proprietor to better understand the concept of drawing accounts and their benefits. Assume the owner (Mr ABC) began the sole proprietorship business (XYZ Enterprises) with a $1000 investment/equity capital. XYZ Enterprises' balance sheet as of April 1st, 2017: Assume Mr ABC withdraws $100 from the company for personal use during the fiscal year FY18. The preceding transaction will result in a $100 decrease in the cash balance and the Owner's equity capital on the balance sheet. As a result, the post-transaction balance sheet looks like this: The previous instance is a transaction; however, in a proprietorship/partnership, the owners may make several transactions for their benefit during a fiscal year. If the owner uses the company's resources (cash or goods) for personal use, there is a mechanism to record such transactions and adjust the company's balance sheet. Journal Entry for the Drawing AccountExpanding the topic from the first half of the article, I used an example where Mr. ABC (owner) withdrew $ 100 from his real estate business (XYZ Enterprises) for personal use. This transaction will result in a decrease in the XYZ Enterprises' owners' equity capital and a decrease in the enterprise's Cash Balance. The following transactions will be recorded in the drawing account because this account is set up as a contra owner's equity account to record these and other similar transactions. The owner's cash above transaction will be recorded as a debit in the owner's account and a credit in the cash account in its journal entry. The following will be the entries for the transactions above: It is closed after the fiscal year because it is a temporary account. The balance of the subscription account will be transferred to the owner's equity account after the fiscal year, reducing the owner's equity account by $ 100. As a result, the owner's capital at the end of the year is: Owner Capital = (1000) + (100) = $ 900 In addition, from the fiscal year 2018, the cash account on the asset side of the balance sheet will decrease by $ 100, and the closing balance will be as follows. (200 cash withdrawals) = (200100) = $ 100 As a result, the XYZ Enterprises balance sheet position will be after 2018, including the impact of the above transactions. The Drawing Account in SummaryA drawing account is an enterprise account used to report transactions concerning the withdrawal of whatever via the company proprietor who has his cash invested with inside the enterprise, which is generally a sole proprietorship or partnership.

Next TopicFunctions of Management Accounting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share