What is PE in Share MarketWhat is the Price-to-Earnings (P/E) Ratio?The price-to-earnings ratio (P/E ratio) is a valuation statistic that compares a company's current share price to its earnings per share (EPS). The price-to-earnings ratio is also known as the earnings multiple or the price multiple. P/E ratios can be calculated on a trailing (backward-looking) or forward-looking (projected) basis. In an apples-to-apples comparison, investors and analysts use P/E ratios to estimate the relative value of a company's shares. It can also be used to compare a company to its track record and compare aggregate markets to one another or over time.

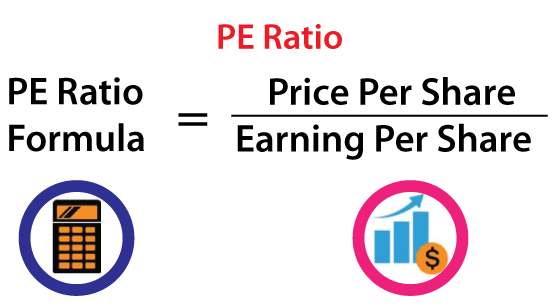

The Fundamentals of the PE RatioThe price of a company's share is divided by its earnings per share in the P/E ratio. The earnings reported by the corporation are gross earnings. Gross profits are the amount left over after all expenses, including taxes and debt interest, have been deducted. So-called net profits are more than gross profits. Furthermore, net gains exceed reported earnings. But what exactly is a "net?" It is far from disgusting. It can be much lower in some nations, such as Japan. The disparity is not as pronounced in most countries, yet it still exists. As a result, P/E ratios are typically greater than they would be if we used net earnings rather than reported earnings. The price-to-earnings ratio is abbreviated as the P/E ratio. P/E ratios are popular in the stock market because they reflect how much you are paying for a dollar of profit. Formula and Calculation of the P/E RatioThis process's formula and calculation are as follows. To calculate the P/E ratio, divide the current stock price by the earnings per share (EPS). The current stock price (P) can be obtained by simply entering a stock's ticker symbol into any finance website; however, although this tangible value shows what investors must currently pay for a stock, the EPS is a slightly more enigmatic statistic. There are two types of EPS. TTM is a Wall Street abbreviation for "trailing 12 months." This figure represents the company's performance over the previous 12 months. The second type of EPS can be seen in a company's results report, which frequently includes EPS guidance. It is the company's best-educated forecast for how much money it will make. These various types of EPS serve as the foundation for trailing and forward P/E ratios, respectively.

What is the formula for calculating the PE Ratio?The PE ratio is derived by dividing a stock's market price by earnings per share. The resulting number is then multiplied by 100. A PE ratio of 8, for example, suggests that the shares are sold for 8 rupees for every rupee of profit made by the company. A PE ratio of 15 indicates that it is being sold at 15 rupees for each rupee of profit. For example, if TCS's PE Ratio is 10, it signifies that TCS's current market price is ten times its EPS. A company's PE ratio tells us at what price investors are buying or selling the company's stock. The greater a company's PE ratio, the more expensive it is for investors to buy shares, so if a company's PE ratio rises, the value of its shares will rise as well. On the other side, if a company's PE ratio falls, its share value falls since investors find it cheaper to buy more shares because they are paying less money per share. The Drawbacks of Using the P/E RatioThe price-to-earnings ratio, like any other fundamental designed to inform investors about whether or not a stock is worth buying, has a few important limitations that investors should be aware of because investors are frequently led to believe that there is a single metric that will provide complete insight into an investment decision, which is rarely the case. Companies that aren't profitable and, as a result, have no earnings or negative earnings per share make calculating their P/E difficult. Different people have different ideas about how to deal with this. Some claim a negative P/E, some a zero P/E, and the majority state that the P/E does not exist (N/A or not available) or is not interpretable until a company becomes profitable for comparison purposes. When comparing the P/E ratios of different companies, one major disadvantage of using P/E ratios emerges. Their valuations and growth rates can often vary significantly between industries due to the various ways in which companies earn money and the varying timelines in which they earn that money. As a result, one should only use P/E as a comparative tool when comparing companies in the same industry because this is the only type of comparison that will offer useful insight. When comparing the P/E ratios of a telecoms firm and an energy company, for example, one may conclude that the former is the superior investment, but this is not a reliable assumption. How Should You Use PE Ratios When Investing in the Stock Market?The price-to-earnings ratio, or pe ratio, is the most frequent method for determining a stock's value. It's also one of the most difficult topics in finance to grasp. Individual enterprises and the market as a whole have pe ratios. A company's pe ratio is typically represented as price/earnings or p/e. It's expressed as price/earnings-to-growth, or p/e.g., for the market as a whole (but it's also written pe/e.g.). It works by taking the company's stock price and dividing it by its profits per share (EPS), then multiplying it by a growth rate. The outcome tells you how much your earnings must increase each year to justify the present stock price. If you don't believe the company will grow at that rate, you should hold off on purchasing stock until it does. When the stock is nearing its 52-week high, it is the perfect time to decide whether to buy or sell. The price/earnings ratio is an economic measure of the relationship between a stock's price and earnings per share. It is determined by dividing a stock's current market price by earnings per share. Identifying the PE RatioThe most popular method for determining the fair market value of a share of common stock is to calculate its intrinsic value by discounting future cash inflows at a risk-free rate. The resulting value is divided by the number of outstanding shares to calculate the fair market value per share (often called the intrinsic value). The price/earnings ratio (or "P/E") is calculated by dividing the company's fair market value per share by either: 1) the company's actual earnings per share or 2) the company's diluted profits per share (if there are outstanding options and warrants). Comparing Businesses Using the P/E ratio: The P/E ratio can compare firms' stock prices in the same sector industry and subject them to the same socio-economic conditions. Even if Company X and Company Y sell their commodity at Rs.100, their P/E ratios may differ because they determine the profits earned and how the stocks have developed for each firm. Both companies' earnings may differ. For example, X may have reported revenues of Rs. Twenty per share, implying a PE ratio of 5, but Y may have earned Rs. 30 per share, implying a PE ratio of 3.33. Y is less expensive, and the investor chooses to invest in Y's stocks because the ROI is better. PE ratios by industry:PE ratios may differ by industry ? what is considered the benchmark for the automobile sector may be too low for a business in the technology sector. A reasonable indicator that a sector or industry is overpriced is when the average PE ratio of all companies in that sector or industry is considerably higher than the historical P/E average. While investing, stock marketers assess the whole market value of the industry to understand how a sector is performing and then compare it to the stock price of the specific firm to make a considered decision. Why Are PE Ratios Important to Investors? When making an investment selection, investors consider the PE Ratio. They invest in firms whose earnings are outpacing the stock price. In such a circumstance, they assume that the company's earnings will eventually justify the high price tag. The PE Ratio can compare one firm to another or even across industries. It also aids in identifying whether a firm is under or overvalued compared to its peers or underlying fundamentals. It is simple to calculate how much money a company generates on each rupee invested by shareholders by dividing its Profit per Share (PPS) by the current share price to develop a PE ratio. P/E Ratios of Various Types

ConclusionThe PE ratio is an important tool for analysing a company's and market's performance at any given time. Investors and organizations utilize this ratio to make financial decisions and properly evaluate their stocks based on share market value and present or prospective profits. Despite being a thorough metric for determining a company's worth, the PE ratio can be inconsistent due to fluctuating stock prices or yields.

Next TopicHow to Trade in the Stock Market

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share