Scope Of Management AccountingAccounting, or measuring, processing, and transmitting financial information, continues to be an essential part of successful business activities in industries ranging from education to healthcare, technology, and hospitality. Most financial accounting is performed outside a company, such as the general public, investors, creditors, government agencies, regulatory authorities, and other stakeholders. What is Management Accounting?Accounting as a management tool is a modern notion of management accounting. According to the ICMA London, management accounting is "the presenting of accounting information in such a way as to aid management in the establishment of policy and the day-to-day operations of an organization." Thus, management accounting refers to any accounting that assists management in conducting business more efficiently. Furthermore, management accounting is concerned with all accounting information beneficial for the management in carrying out its responsibilities. Controlling uses marginal costing, standard costing, budgeting, profit and loss breakpoint analysis, cost-quantity return, ratio analysis, company comparison, unified costing, and internal audit, are some of them. A cost accountant will use most of these strategies as well. Management accounting delivers financial information to internal management, employees, managers, and executives of a business to inform decision-making and improve performance. Management accounting is also a strategic partner. They work to secure future success by exploring methods that add value to their company's products or services. They accomplish this by utilizing numbers, data, and research to assist leadership in making informed decisions to avoid risk and maximize profit on behalf of the firm. Management accountants investigate and explain the "why" behind the numbers. Management accounting differs from financial accounting because it focuses on how to notify internal decision-makers. Financial accounts collect data and generate reports for external government agencies and other stakeholders, with less emphasis on forecasting the future. Scope of Management Accounting

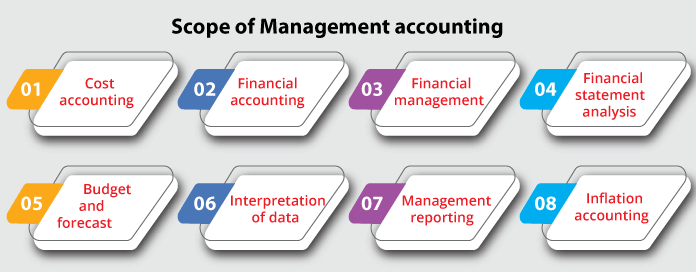

Management accounting covers a wide range of areas, such as financial accounting, cost accounting, budgeting, and taxes. The primary goal is to assist management in performing its planning, directing, and managing tasks. The following are some of the areas of management accounting specialty. The scope of management accounting is vast and can be divided into several categories:

A detailed description of the various scopes of management accounting is as follows: 1. Cost AccountingCost accounting is a crucial accounting technique because it provides cost analysis tools for a business, such as marginal cost, operational cost, inventory costing, budget control, etc. These are required by business management to draft and outline the business needs. Cost accounting assists in determining the total budget for any firm and gives several methods for estimating and calculating the entire cost of providing a service to the consumer. Cost accounting is also essential for business analysts and executives since each company's activity depends on the cost involved. 2. Financial AccountingFinancial accounting and cost-accounting are not the same things. As mentioned earlier, cost accounting involves calculating and analyzing the overall cost of a business process. Conversely, financial accounting calculates and analyses business transactions, including expenses, inventories, assets, and reporting. Financial statements are critical in financial accounting and are prepared regularly at the end of each fiscal year. Financial statements comprise the company's balance sheet and the overall profit or loss produced by the business or company in the current fiscal year. Financial accounting is critical for the organization's financial forecasts because it provides the general financial information incurred throughout the current fiscal year. Financial accounting is also significant in that it assists management in operating successfully and implementing coordination across corporate processes to carry out business planning. 3. Budgeting and ForecastingBudgeting and forecasting are also part of the management accounting scope, including budget control and business forecasting trends. Budget management systems are based on financial data and business performance. Budget control aids in identifying and analyzing the causes and weak points that slow down coordination and decrease business performance. On the other hand, forecasting is an essential function of management accounting because it provides a business view from the stakeholders' perspective. Business budgeting and forecasting outline the company's goals and plans and the expected outcomes of the activities carried out to help prepare the company in case of an emergency. 4. Data InterpretationData interpretation is described as converting business data into facts and statistics that business management can easily understand. Interpreting your work is just as crucial to your business as financial reporting because it helps you avoid drawing erroneous conclusions from your business data. If the data is not appropriately comprehended and evaluated, it might spell doom for a market business. The data for the current year is analyzed and compared to past data to better understand the business's growth. 5. Financial AdministrationFinancial management is the administration and planning of a company's financial resources. Raising cash and using them wisely is critical for sound financial management. The purpose of considering financial management as managerial accounting in terms of scale is to optimize a company's profits through the efficient use of cash. Finance was and continues to be the most crucial part of every organization, and a business cannot function without effective financial management. 6. Management Reporting/ReportingReporting is essential for each business manager. Obtaining reports on time is critical for managing corporate growth and resources. The timely report assists management in making successful decisions and keeps management informed of ongoing operations. Data and reports are presented to management in simple graphs, charts, and presentations. According to the company requirements, reports are retrieved weekly, monthly, quarterly, and yearly, and these reports are beneficial when examining corporate data. 7. Accounting for InflationInflation analysis is critical in business and is described as a drastic change in financial results when market prices change. Inflation accounting refers to inflation analysis tools that aid in identifying the causes of inflation and eradicating them for improved performance. 8. Analysis of Financial StatementsAs mentioned earlier in financial accounting, financial statements are prepared after each fiscal year to study and analyze the financial growth of a business. The financial accounts provide insights into the business and aid in its growth through their interpretations and conclusions. Thus, it can state that extent of management accounting analyses business data and successfully interprets it for effective business planning and decision-making to maximize profit and fully utilize resources.

Next TopicGAAP Accounting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share