How to Invest in Share MarketWhat is Share Market?A share market is a place where the shares of various publicly-held companies are bought and sold. These financial actions are performed through Institutional Formal Exchange or Over-the-Counter (OTC) market. The OTC works under several rules and regulations which are formed by the governing authorities like SEBI (Securities Exchange Board of India) in our country.

Types of MarketThere are two types of markets to invest in shares. They include:

Initial Public Offering (IPO)IPO (Initial Public Offering) is the sale of shares by a privately owned company to the public for the first time. IPOs are a good option for inviting investors. When a company sells its shares in the primary stock market for the first time it is called Initial Public Offerings. After completion of the process and allotment of shares the company gets listed on a stock exchange and gets permission to sell its shares in the secondary market. Types of Investment in Share MarketVarious types of investment in the share market are as follows:

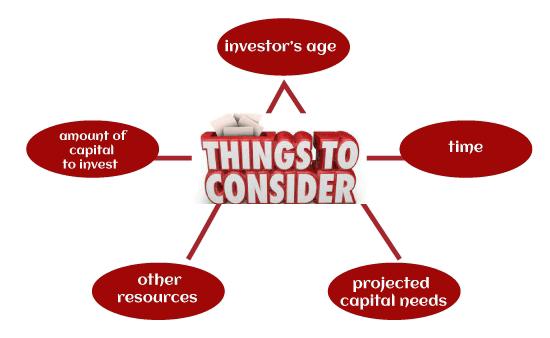

Factors to be considered before Investing

Building a PortfolioInvesting in the share market is an excellent way to earn profits. All you need to do for this is to make a proper portfolio or can say investment plans. A portfolio is a draft of financial assets that are owned by an investor. For having an attractive portfolio, you should keep the given points in your mind:

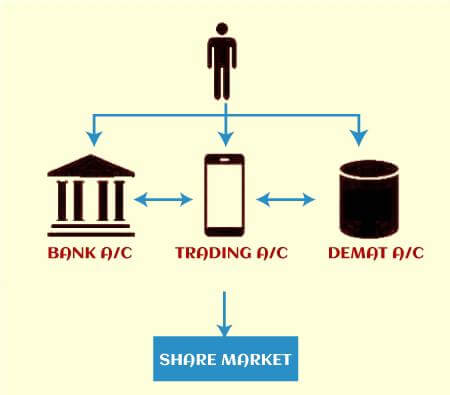

Requirements to Open a Demat AccountThere are certain prerequisites that you should remember while investing in the shares of any company. These requirements are:

How to Open a Demat Account?The procedure for opening a Demat account is given below:

Steps for Investing in Share MarketShares or stocks are the most important instrument of the share market. Here, we are discussing the steps that you are required to follow while investing in the share market. They include the followings:

Step 1: The first and most important step to invest in the share market is to open a Demat account. It is also required to make sure that the Demat account is linked with a pre-existing bank account so that all the transactions can take place without any hurdle. Step 2: The next step is to sign in to the Demat account. You can take the help of a mobile-based application or web platform to perform this action. Step 3: The next step is to choose shares of the company in which you want to invest. For this purpose, you should closely analyze the growth and profit of the company and many other factors so that you can get maximum return from your investment. Step 4: To invest in a company or to buy shares, you must have sufficient funds. So, you should check that there are enough savings available in your bank account to buy the shares of your choice. Step 5: Now, you can buy the shares at the listed price and also specify the number of shares that you want to buy. Step 6: This is the last step in the process of investing in the share market. At this step, the seller reciprocates the request of the investor of purchasing the shares and after it, the order gets executed. Post completion of the transaction, the bank account of the investor gets debited with the amount for which he/she has bought the shares, and simultaneously, the shares are received in the Demat account of the investor in the electronic form.

Next TopicBranches of Accounting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share