Invoice Format in Microsoft ExcelIt is well known that a well-crafted invoice must be professional and informative, which is responsible for giving all the necessary information to ensure adequate payment. And for considering out so many elements a question will now be arising that: Which could be the best alternatives to go about setting up an excellent invoice template in Microsoft Excel? So in this tutorial, we might be looking at some key elements which are required to be getting included in an effective invoice template. Right from invoicing basics to the additional information and many more, read on for everything that we need to know about while creating an invoice in order to gets results. What do we understand by the term Invoice Template in Microsoft Excel?In Microsoft Excel, an invoice template is primarily a kind of form that various businesses make use of it to request payment from their customers. And the template includes all the necessary information which a particular customer needs for the purpose of making a payment effectively with less delay, which includes the followings things as well:

Besides all this, it was well known that most of the businesses have invoice templates, which they use it for their customers. And instead of this, there are so many online tools that a particular business can make use of it for the purpose of creating a custom invoice template as well. And the main benefit of making use of an online tool is that it usually allows many businesses to easily change look as well as the format of their created invoice templates without a need of hiring a designer. And a good and effective invoice template will help us to save time while creating the invoices and also helps in ensuring that our customers receive the best quality of service as soon as possible, if in case we are looking for a simple as well as an effective method for the purpose of making an invoices, then in that case, an invoice template can be efficiently used to create professional-looking bills and are easy to read and can be understood in an effective manner. Sample Format of an Invoice Template An invoice template is a document which includes all the relevant details regarding an invoice which need to be sent out and it will helps us in creation of the same invoice documents for all our clients. And the best part is that we can easily create a customized invoice format for every client, depending on their preferences. And by this, we can spend fewer hours formatting invoices for every client respectively. How can one make use of an Invoice Template in Excel?Now we will assume that we have already downloaded an invoice template, so our next step is to fill it out with all the necessary details effectively. And most of the templates will usually include similar sections for us to fill out, like:

And once we have filled out all the necessary information, we can save and print our invoice as well. But make sure to keep a copy for our records for future reference. What things need to be included in an Invoice Template?An invoice template is a document that we can use to bill our customers for various goods or services as well. And the invoice template which we have chosen must be simple and easy to read, and it must have enough space to include all the details related to each item efficiently. Furthermore, it should also be easily customized so that we can change all the information as per our requirements in the given scenario. And a suitable invoice template will ensure that our customer knows what they are paying for. Typically, an invoice will include all the following information respectively:

What are the Invoice payment collection methods available?In this modern era, the payments have come a very long way since the advent of the digital economy, and today there is a variety of the options which are made available to an individual for smooth running of their business:

But the fact is that an invoice can be paid through any of the above mentioned methods, and the real question that businesses need to ask is none other than: What are the advantages and disadvantages associated with collecting payment on invoices through these methods?

Acceptance of the credit cards as well as the debit card payments on our invoices primarily require us to set up an online payment link as well as making use of a payment processor or a merchant account to collect all the payment which are made via credits and debits cards. And for this to be achieved, we need to have a card reader machine to take card payments on our respective invoices over the phone as well. Besides all this our invoice must need to contain a link which will redirect to an online payment page allowing the customer to pay with their card. Advantages: Credit cards as well as the debit cards could be convenient payment methods and people are used for the purpose of paying online via cards, and the payment clears quickly. Disadvantages: The disadvantages of credit cards as well as the debit cards are that they have relatively high transaction fees and can suffer from a payment failure rate upto 10% - 15% as the cards get expire or be lost and can be canceled.

Digital wallets basically the includes the following ones:

As they offer consumers a highly convenient method to pay for their goods and services. So to accept the digital wallet payments, we are first required to sign up for the respective service as a business; after that we are required to set up all the payment by just making use of the particular interface provided as well as emailing a link with our invoice as well. Digital wallet providers like Google also offer various invoice services respectively. Advantages: Digital wallets can be much more convenient payment methods but are typically used for the online or it could be extensively used for the street purchases. Disadvantages: The disadvantages of the digital wallets are that the processing fees will add up, and hence making it quite expensive as compared to the other methods of collecting payments from clients.

We all knew that the acceptance of the cash as well as the cheques on invoices is relatively unusual now a days, an in comparison to the past days cheques would have made a significant portion of the invoice payments, but these days they have mainly been replaced by the digital payment methods as well. Advantages: Cash is considered to be an instant payment method, the businesses get to meet out the customers, and there is no upfront financial cost for the purpose of accepting the cash. And the cheques are slightly more convenient as compared with the carrying of the cash; and are not instant, but can be mailed out, so they do not require the customer to be physically present at the time of purchasing out the respective product as well as the services. Disadvantages: The disadvantages of this method are that both need to be an updated methods of settling out the invoices from their customer, and besides all this a high level of manual processing is required as both need to be banked as well as reconciled.

Some form of manual bank payment, or transfer, is considered one of the most common ways for the purpose of settling out the B2B invoice efficiently. Advantages: The advantage realted with the manual bank payments is that they do not require any third-party involvement but instead of this it require the recipient's banking details as well as an access to an online banking app. Manual bank transfers are also cheap in nature in comparison to the other payment methods; in fact, they are typically accessible as well; and are fast in action - once initiated, funds will arrive on the same day or the next day at the latest respectively. Disadvantages: The disadvantage associated with manual bank transfers is a significant issue that applies to all of the above-discussed methods of accepting payments on our respective invoices. What are the various tips related to the Invoice Template?While creation of an invoice template, we are required to remember few things to ensure our customers easy understanding and pay their invoices on time. And here are a few tips for creating an invoice template respectively:

What are the Advantages of an Invoice Template?It is well known that invoicing is a very common task for all business owners, and it is essential for keeping track of the money owed and the expenses incurred. And the respective Invoices aid in this process by just providing a clear overview of our expenses and the revenues to the given date effectively. The following are the essential advantages of making use of an invoice template as well:

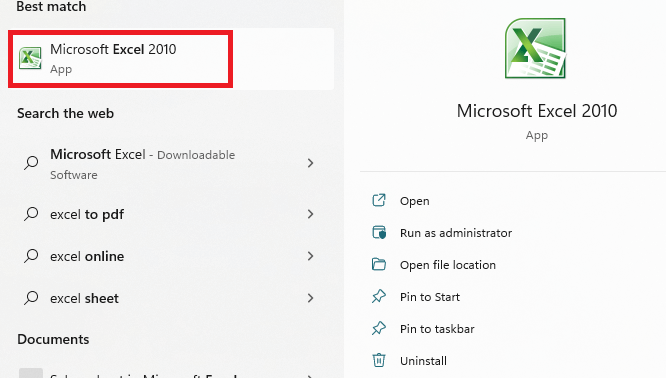

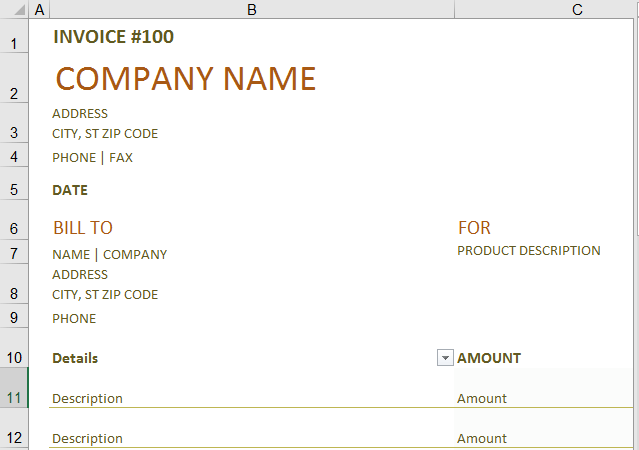

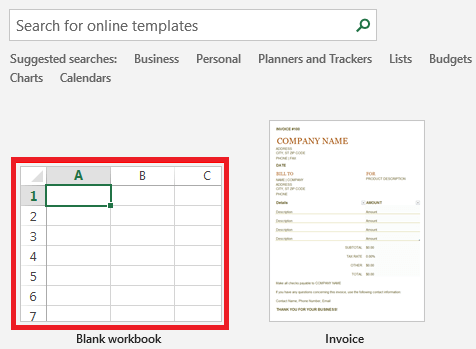

How can one easily create an Invoice in Microsoft Excel?It was well known that creating an Invoice in Microsoft Excel is very easy. And for this to be get achieved, first of all, we need to have a template as well as some of the various necessary fields which are usually a part of any regular invoice, like as Name of the company, Date of the order, Name of the Item, Items Quantity, as well as their Delivery Address. Every field we choose has a definite position in Microsoft Excel which we can put in any of the cells we want to with the required font size and type. It also includes a table in which we can efficiently enter the item name, quantity, and price it owes. And it isessential to keep at least 3 to 4 lines of space for the address, along with a section for the contact details respectively. Examples of Invoice Template in Microsoft Excel Now we will look at some examples related to the Invoice Template in Microsoft Excel and see how we caneasily create the Invoice Template in Microsoft Excel. # Example 1: How we can create an Invoice in Microsoft Excel by making use of a Predefined Template Step 1:First, we must open Microsoft Excel in our respective Windows system by simply typing "excel" in the search box. And a Microsoft Excel home page will get appears on our screen.

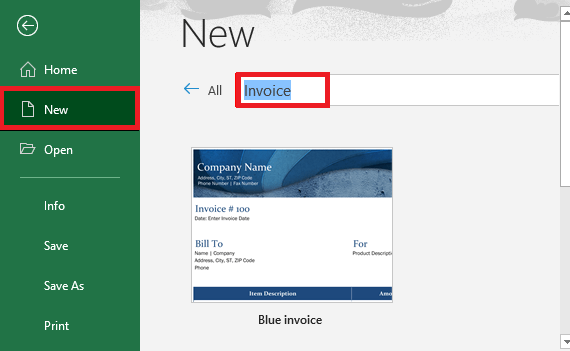

Step 2: Now, after that, in the search box, we will search for the inbuilt invoice templates by typing the "invoice" and pressing the Enter key from our keyboard. And we will see thousands of online invoice templates, primarily present in our Microsoft Excel, and we must make sure that we are connected to the internet to search those templates as well.

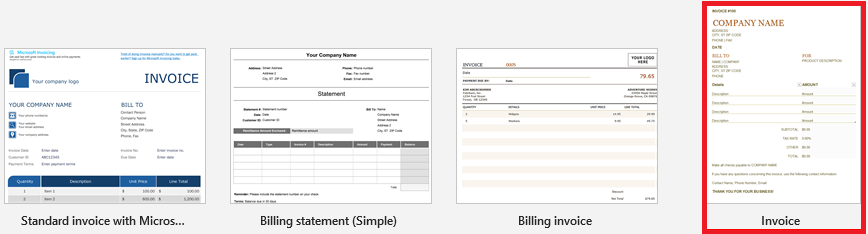

Step 3: In this step, we will be selecting and clicking on a template appropriately and fulfilling our needs as well.

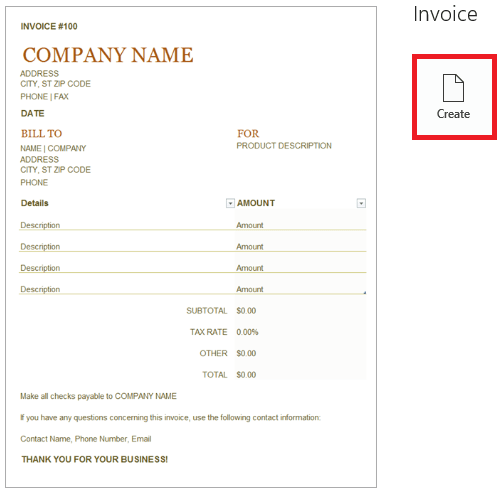

Step 4: Once we select any of thetemplates from the given list, then Microsoft Excel will allow us to download the same and use it in Excel for further purposes, clicking on the Create Button to also download to create the template in our Microsoft Excel effectively.

Step 5: Now, in this step, once we click on theCreate button, excel will download the template for us and opens it. After that, we will see a template in Excel.

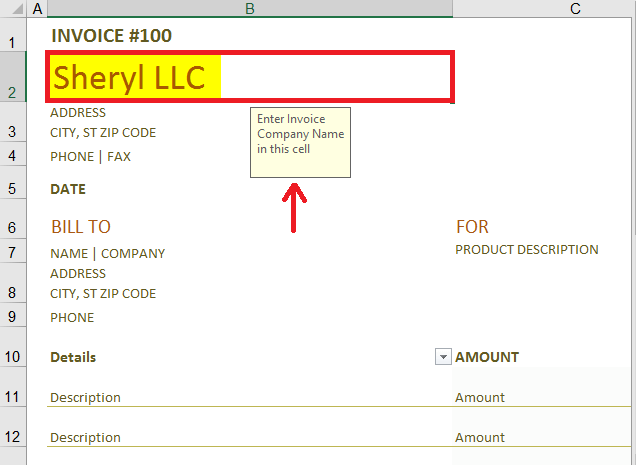

Step 6: In this step, we can easily edit as well as customizethis invoice template as per our requirements as well. Adding out the company name in this template, we can add the Amount which is effectively associated with the goods respectively.

Step 7: We can also add them as per the service provided and also should have a look at the final Amount (total Amount). And in most of the Microsoft Excel invoice templates, we use formulas that keep our Final Total updated as well.

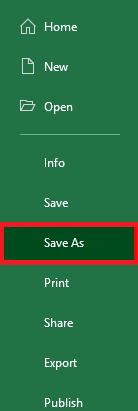

Step 8: Once we are done with the updation of the invoice, we are required to save this template, and we will be clicking on the File menu from the given Excel ribbons, which are present at the uppermost corner. And then, we will click on the Save As option. And will enter a name suitable for our invoice and click on the Save button, so in this way, we can easily save our invoice at any desired location of our choice in our system and send it when needed, and we can consider this step as an essential step it is because of the reason that if we fail to save the updated invoice then we will lose all the updated data from our invoice as well.

# Example 2: How one can create an Invoice in Microsoft Excel from Scratch Step 1: We must open an Excel file by just typing "excel" in the search box and double-clicking on it. Double-clicking on Blank Workbook will open a blank Excel workbook respectively.

Step 2: After that, we will be adding the following details under each cell :

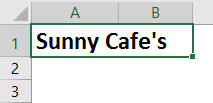

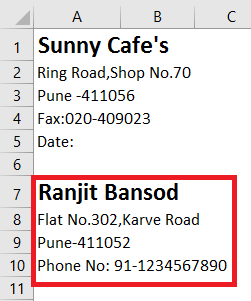

Step 3: Now, in the cell A1, we will be adding up the Name of the Company with the alignment on the left with font size 16, and make it bold as well as merging out cells A1 and B1.

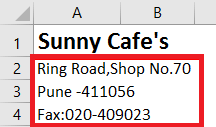

Step 4: After that we are required to add up the company address and their postal details on cell A2:A4.

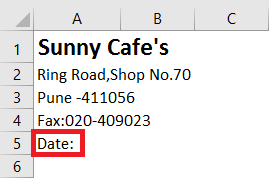

Step 5: In this step, we will add the date the invoice is issued to the particular customer under cell A5.

Step 6: And now, from cell A7:A10, we will be adding out the customer details, which include the following: Name, Address, as well as contact details.

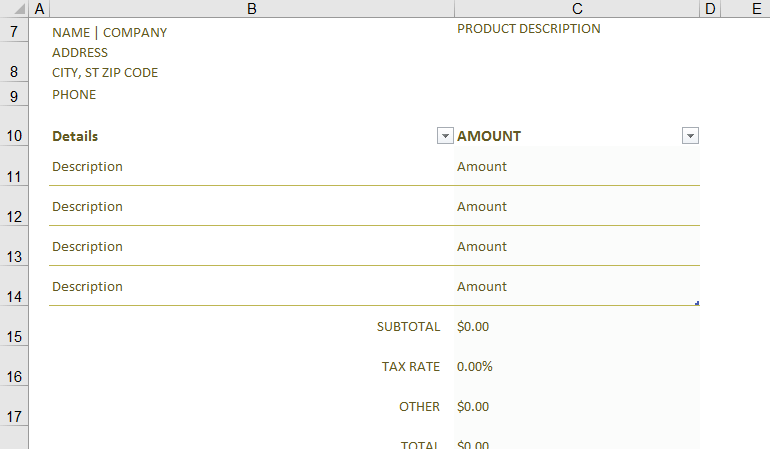

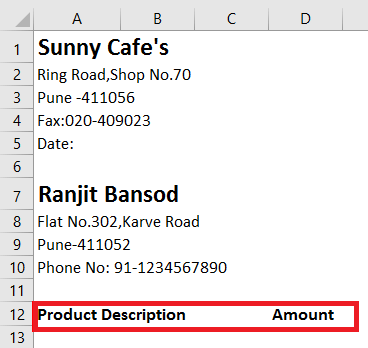

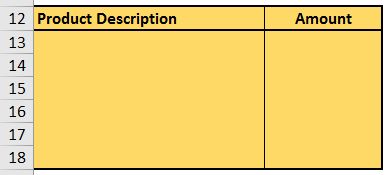

Step 7: Now from the cell A12: B18, we are required to add up the entire product description column as well as associated amount with each product category. In column A, the Product Description gets added, while in column B the Amount will be get added up.

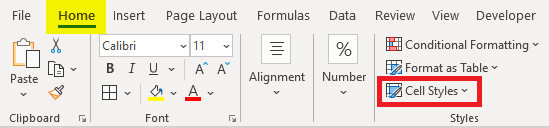

Step 8: It is good to format these details in a given table. And we are required to select a block of the cells from A12 to B18, and after that, we will click on the "Cell Styles" menu.

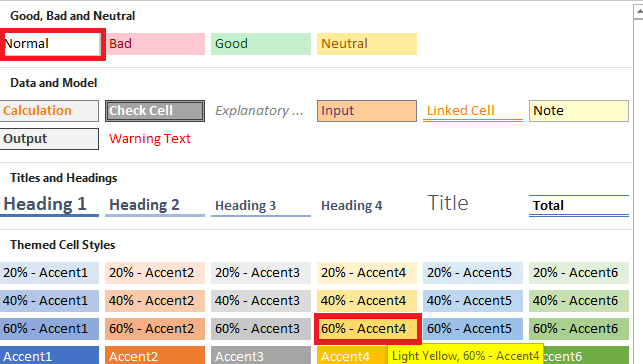

Furthermore, we can also change the style of this particular block of cells. And in this, we prefer "Light Yellow, 60% - Accent 4 Style".

Step 9:In this step, we will add a thick border to this range of cells with the help of the Border Menu, which are present just under the Home tab. And our invoice should look like the one below.

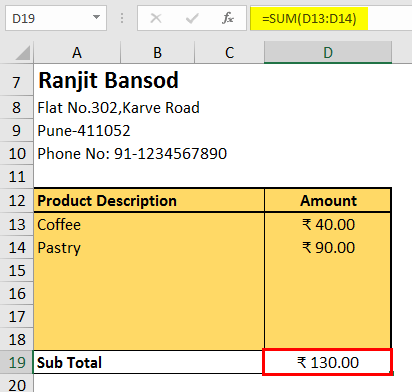

Step 10: In the respective cell A19, we will then add the Sub Total fields, which are associated with the subtotals being captured and calculated just under cell B19.

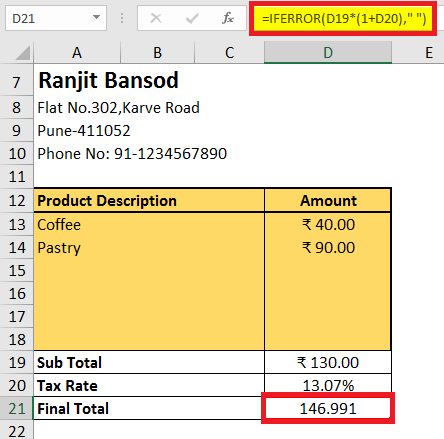

Step 11: In the similar manner we can easily add out the all the selected columns for the Tax Rate as well as for the Final Total on cells A20 and A21 as they will be reflecting the amounts in cells B20 and B21:

Note: And in this we are required to remember that the Final Total is formulated so that it will be get added to the Sub Total with the Tax Amount as well, which we will be getting after performing the calculation by using the Tax Rate on Sub Total amount.Step 12: And in this step, we will be adding a Thank You note in cell A22 respectively.

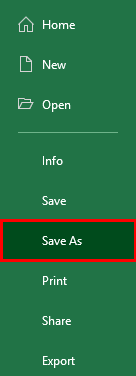

Step 13: At last, we will save this file.

Next TopicQuotation Format in Microsoft Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share