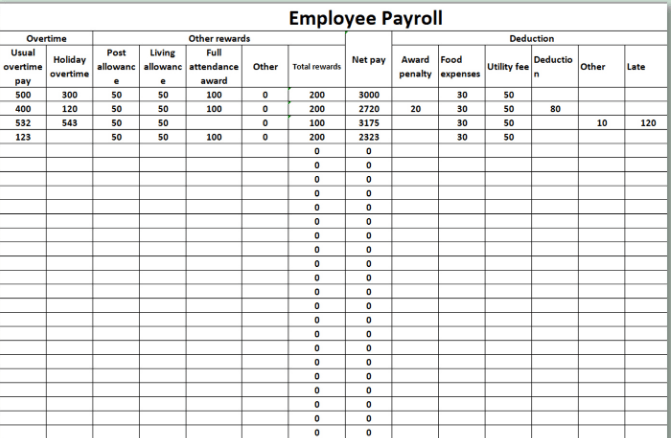

Salary Slip FormatThe salary slip is essential for the employees working in their company. Creating a salary slip format in Excel is an easy and time-saving process using the respective formulas. In this tutorial, the steps to create the salary format are discussed here. What is called Salary Slip?The Salary slip is also called a Pay Slip. It is created by the respective person of the company and is given to the employees once a month. The salary slip consists of details such as Name of the Company Name of the Employee Pay Slip Month Bank Account Number Identification Number Basic Salary Gross Salary Allowances Provident Fund Bonus Paid TDS Reimbursements etc The salary slip is provided to the user through mail or paper. It acts as evidence between the company and the Employee. Excel provides various templates useful for HR experts, administrative personnel, and HR executives by saving time. Why is a Salary Slip Required?Salary slip is essential for companies, as the employer gives the salary slip to the Employee every month. It contains all the necessary details to help the Company's HR transfer the money to the Employee. The details present in Salary Slip are as follows: 1. Detail of the CompanyThe essential detail of the company is present in the Salary Slip, such as Name, Address, Contact Number, and Pay Slip. 2. Detail of the EmployeeThe payslip contains the employee detail such as the Name of the Employee, Employee Id, Designation, Net pay of the Employee, designation, and Bank account details. 3. EarningsThe Employee's earnings are in the Salary Slip Format, such as Basic salary, allowance including Medical, home Rent, travel allowance, etc. Added to that, it consists of Performance Bonus and various other benefits. 4. DeductionsThe deduction details in the salary slips, such as PF called Provident Fund, TDS, Loan, EMI, HRA( Home Rent allowance), Salary Advance, Insurance for Health, Professional Taxes, etc., are in the salary slip format. Excel Salary FormatExcel provides some predefined Salary Format Slip Template. Based on the requirement, the user can choose the appropriate salary format. Some of the names of Salary Slip Format are: Wage Payment Salary Statistics Chart Salary Level Structure Table Salary Slip Calculator Pink Salary Schedule. Etc and many more salary slip formats are available One of the examples of Excel's Salary Slip format.

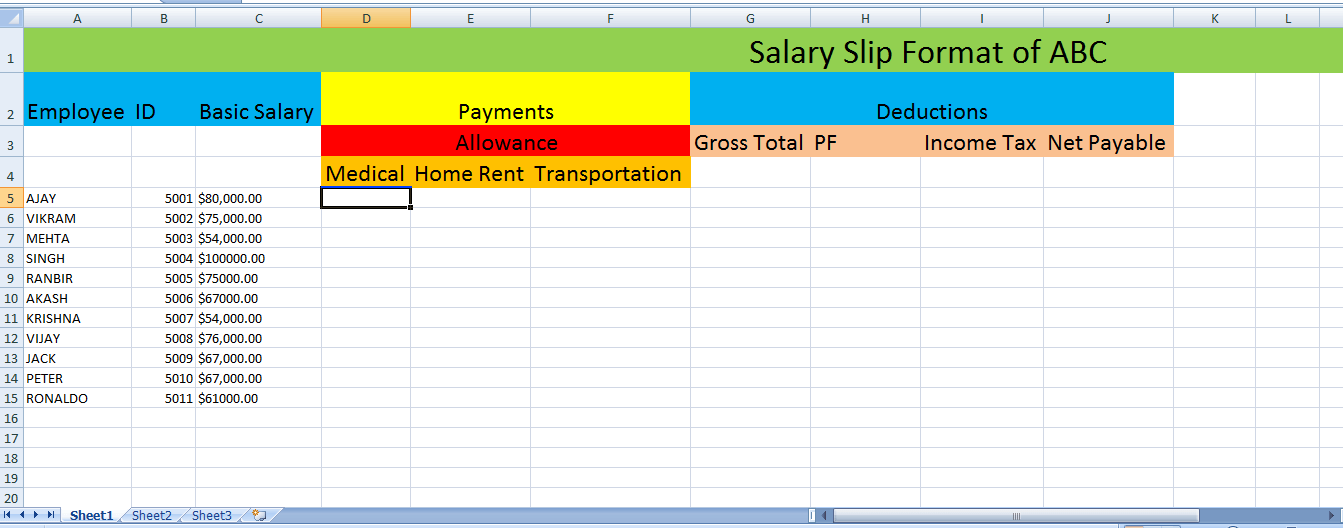

The links are provided to download the Excel Salary Slip Format, which is applicable based on the requirement. Steps to Create Salary Slip FormatThe quickest and easiest step to create Salary Slip Format is as follows: Example: Calculate the salary slip format for employees working in ABC Company. The details regarding the salary, such as,

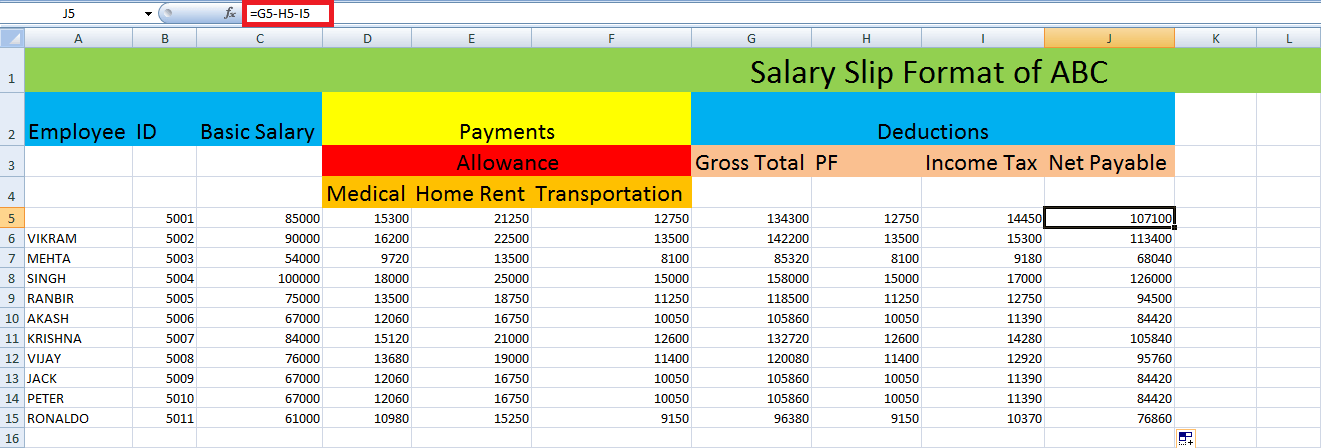

are present in the salary format. Step 1: Creating the Data Set for the DetailsThe dataset must be created in Excel Worksheet to create the salary bill format. Open a new worksheet and enter the details such as Employee Name, Identification Number, Salary of the Employee, Medical and Home Rent, etc.

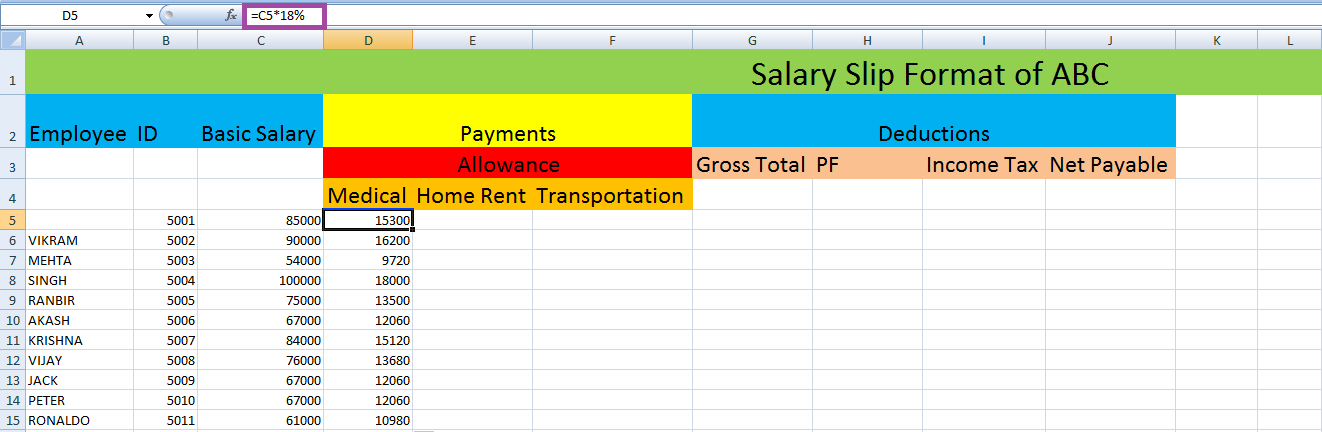

Step 2: Calculating the Gross TotalAfter entering the necessary details in Excel, the Gross total is calculated. The mathematical formula called the SUM function is used to calculate Gross Total. To calculate the Gross Total, the Medical Allowance is 18%, the House Rent allowance is 25%, and the transportation allowance is 15% of the Employee's Basic Salary. First, the Medical allowance is calculated. To calculate the Medical allowance, enter the formula in the cell =C5*18%. Press Enter, and the Medical allowance of the person is calculated. Drag the formula toward the individual cells to display the remaining cells' results.

Similarly, the House Rent is calculated by entering the formula in the respective cell. The formula entered is =C5*25%. Press Enter, and the House Rental allowance of the person is calculated. Drag the formula toward the individual cells to display the remaining cells' results.

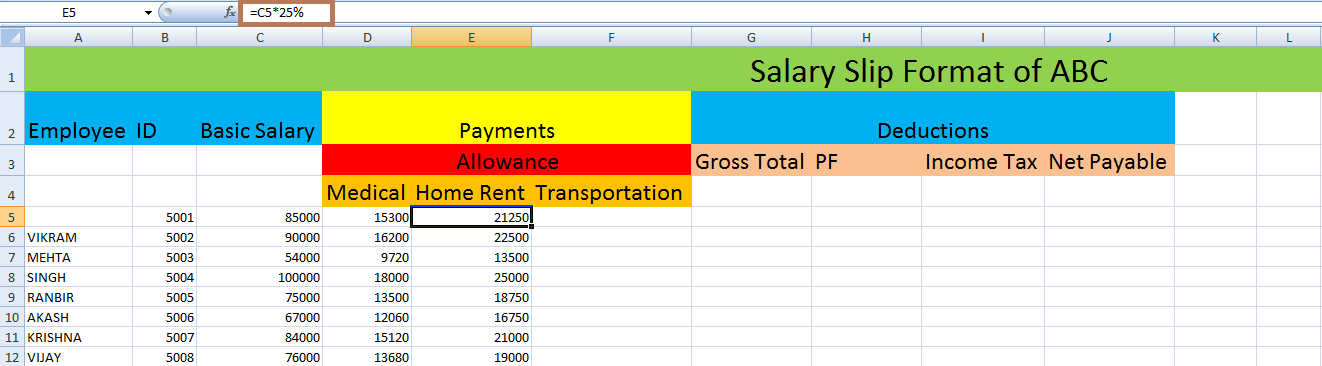

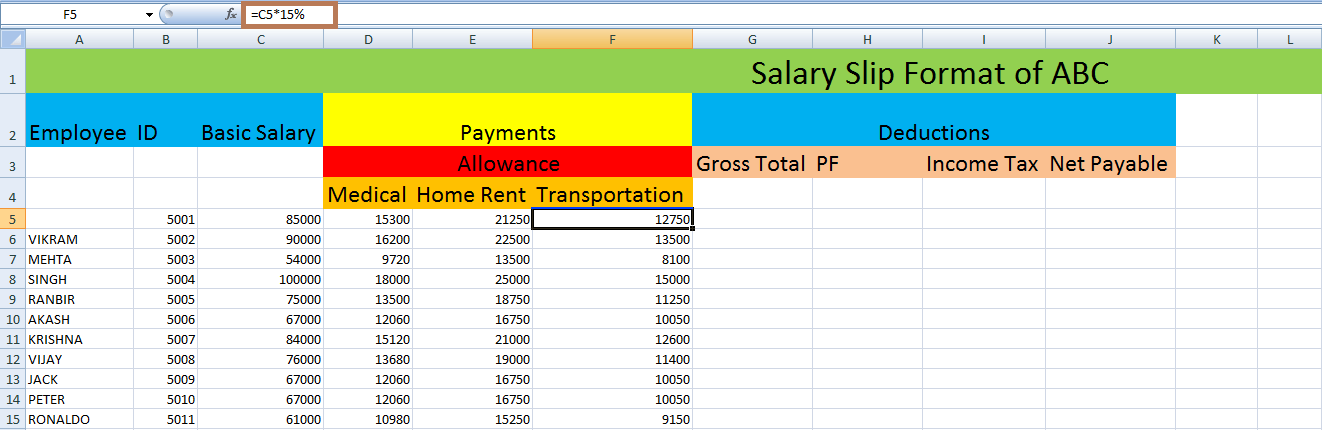

The transportation allowance is calculated by entering the formula in the respective cell. The formula entered is =C5*15%. Press Enter, and the Transportation allowance of the person is calculated. Drag the formula toward the individual cells to display the remaining cells' results.

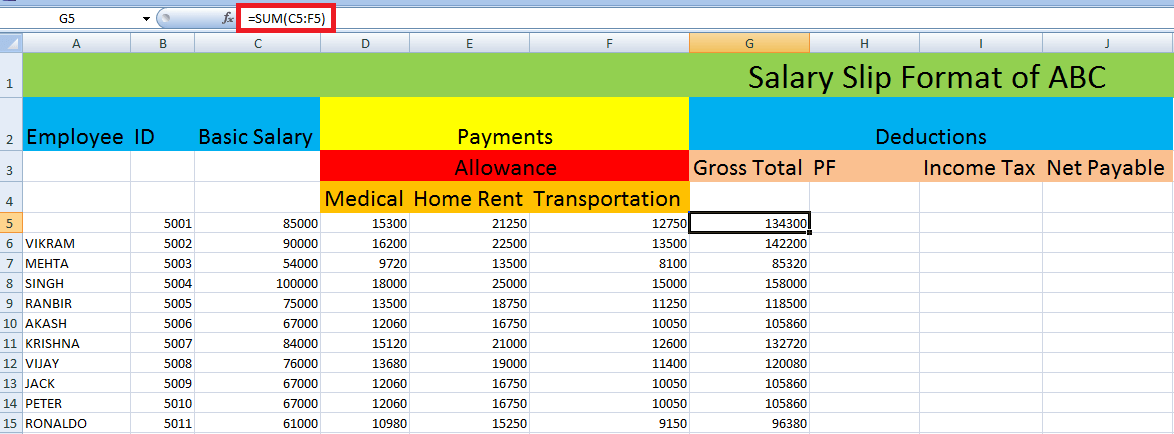

After calculating the necessary data, the Gross Total of the employees is calculated. The Gross total is calculated by adding the Medical allowance, House Rent Allowance, Transportation allowance, and Basic Salary. Select the data range from C5 to F5 and enter the formula in cell G5 as =SUM(C5:F5) Press Enter. The person's Gross Total will display in the selected cell using the SUM function. To fill the data for the remaining cells, drag the fill handle towards the remaining cells. The Gross Total for all the people will be calculated.

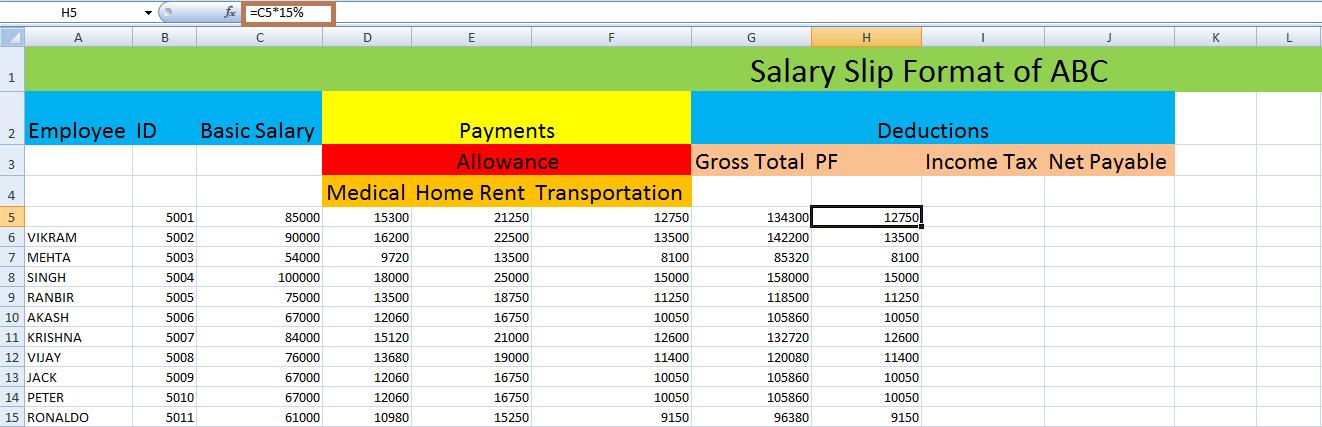

Calculating the Net Payable ValueThe Net Payable value is calculated in the Salary Slip Format. ABC company's Net Payable value is calculated using the Provident Fund and Income Tax, which is deducted from the Gross Total Salary, and the obtained result is called Net Payable Salary. In this data, the Provident Fund is 15%, and the Income Tax deduction is 17% of the Employee's Basic Salary. The steps to calculate the Provident fund Value is as follows: First, the Provident Fund value is calculated. The Provident fund mentioned here is 15% and 15% of the Basic Salary. Enter the formula in the respective cell as = C5*15% Press Enter. The result will be displayed in the cell. Drag the formula towards the cell to get the result for the remaining cells.

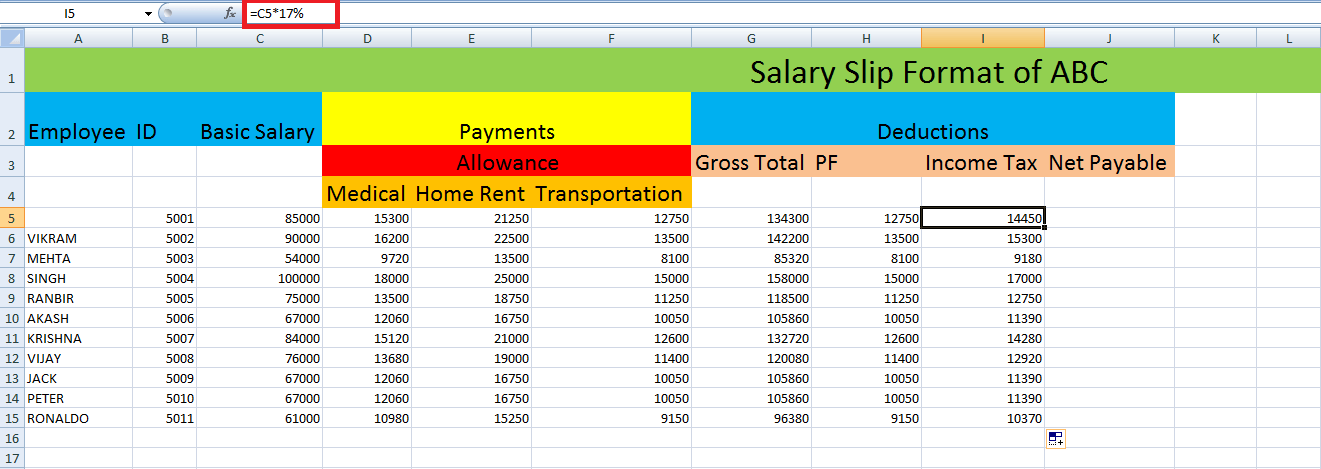

The Provident Fund is calculated for all employees. Similarly, the Income Tax value of each person in ABC company is calculated. In this data, the Income Tax deduction is 17% of the Employee's Basic Salary. The steps to calculate the Income Tax Deduction Value are as follows: The Income Tax Deduction mentioned here is 17% and 17% of the Basic Salary. Enter the formula in the respective cell as = C5*17% Press Enter. The result will be displayed in the cell. Drag the formula towards the cell to get the result for the remaining cells. The Income Tax Deduction is calculated for all employees.

Both the Provident fund and Income Tax Deduction are calculated. The Net Payable Salary is calculated by subtracting the Gross Total Salary, Provident Fund, and Income Tax. Hence the formula entered is =G5-H5-I5 in the respective cell. Press Enter. The result will be displayed in the cell. To get the result for the remaining cells, drag the formula toward the remaining cells. Hence the salary slip format is calculated in an Excel worksheet.

Notes:The #N/A ! error will arise if the specified formula or function in the formula doesn't find the referenced data. The #DIV/0! error occurs when the cell is blank or a value is divided by zero. SummaryFrom this tutorial, the step-by-step process of creating a Salary Slip Format is explained here. The user can choose the appropriate Salary Slip Template in Excel or create their salary slip based on the data, and by saving it, the user can use it whenever they need.

Next TopicHow to count colored cells in Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share