Most asked Top Banking Interview Questions and AnswersThe banking sector is considered one of the esteemed employers, where many people like fresher and experienced professionals prefer to work. Getting a job in the banking sector requires the right academic qualifications, aptitude, sincerity, responsibility and dedication, and experience if you apply for higher management positions. If you want to get a job in the banking sector, you have to face many banking interview questions in the final round. Here is a list of top banking interview questions: 1) What is the definition of a bank?A bank is a financial institution licensed by the Government to receive deposits and provide loans to their customers. Banks provide many other financial services such as wealth management, currency exchange, and safe deposit boxes or security boxes to keep your jewelry and other invaluable assets safe. 2) What are the different types of banks?There are several different kinds of banks, such as retail banks, commercial or corporate banks, agricultural banks, cooperative banks, investment banks, etc. In most countries, the central bank of natioGovernmentment regulates all kinds of banks. In the case of India, it is the Reserve Bank of India (RBI). 3) What do you understand by a commercial bank?A commercial bank is a type of bank that provides services such as accepting deposits, offering checking account services, making business loans, offering basic investment products, and offering basic financial products such as certificates of deposit (CDs) and savings accounts for individuals and small businesses. The commercial bank is the most common bank where most people do their banking. Commercial banks make money by providing and earning interest from loans such as mortgages, auto loans, business loans, personal loans, etc. They gain capital from the customers' deposits and then earn interest by providing loans to other needy customers or businesses. Commercial banks are owned by a group of individuals or by a member of the Federal Reserve System. 4) What are the main functions of a commercial bank?Following are some functions of a commercial bank:

5) What are the different kinds of commercial banks?Commercial banks are commonly categorized into three types:

6) What is investment banking?Investment banking is a specific division of banking used to manage portfolios of financial assets and capital for other companies, governments, and other entities. It also maintains portfolios of financial assets, commodity and currency, fixed income, corporate finance, corporate advisory services for mergers and acquisitions, debt and equity writing etc. 7) What do you understand by consumer bank?Consumer banks are newly introduced in the banking sector in some countries like the USA and Germany. These banks provide loans to their customers to buy a TV, Car, furniture, consumer electronics etc. and provide a simple option of easy payment through easy and small installments. 8) Why do you want to join the banking sector? / Why do you want to do a job in the banking sector?To answer this question, you have to explain your views on why you think the banking sector is most suitable for you. Here, you can say that the banking sector is one of the fastest-growing sectors and has influenced many people's lives. Avoid telling that you want to have a stable career or any other personal reason or view. 9) What are the different types of accounts in banks?Banks provide different types of bank accounts to serve different needs. You have to choose the best account type to put your money to meet your financial goals. Most of the Indian banks provide the following account types:

Saving Account: This is the most common type of bank account that consumers choose to keep their aside money safe for future uses. Banks provide some interest to this account type, and your money grows over time. This account type is best to keep your cash safe for emergencies. This account type is available for everyone. Even children and teenagers may open this account with a parent to learn the value of saving. In this account type, the number of withdrawals is limited, and you have to maintain the minimum amount of balance in the account to keep it active. Checking Account: Checking accounts are very similar to saving accounts, and you can use them as a saving account, but, unlike a saving account, you cannot earn interest on this account. These accounts are used for everyday spending. The biggest advantage of this account is that there is no limit for withdrawal. Money Market Account: This account gives the benefits of both saving and checking accounts. They facilitate you to withdraw the amount and yet earn a higher interest on it. These account types are best for the people who hold high balances in their account and want to earn higher interest rates. If you can hold a higher balance in your bank account, you can use these account types to keep your cash. To open these account types, you have to maintain a minimum balance. Certificate of Deposits (CD) Account: In these account types, you have to deposit your money for a fixed period of time, and the bank will provide great interest in it. Banks decide their interest rates, and it is more than any other account types, but you will have to commit to keeping your money in this account for the full term or the end of the "maturity date". If you withdraw your money before the maturity date, you will be imposed a withdrawal penalty. This type is best for saving for long term financial planning. For example, if you want to save money for your child's higher education, the CD would be a good place to keep and grow your money until you need it. Retirement Accounts: These account types are used to keep your aside money for spending in retirement. Most banks offer Individual Retirement Arrangements (IRAs) and other retirement accounts for small businesses. The most common bank accounts are classified into four different types.

10) What are the different ways to operate a bank account?A bank provides the following ways to operate your particular bank account:

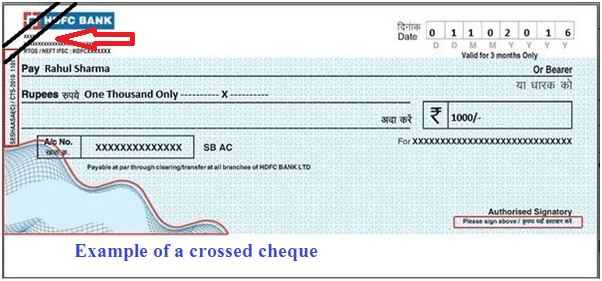

11) What do you understand by a Crossed Cheque?A crossed cheque is a cheque that has been marked specifying an instruction. The instruction specifies that the cheque is deposited directly to an account with a bank and not immediately cashed by the holder over the bank counter. It shows two cross-lines on the cheque's left side corner to indicate that it is a crossed cheque.

12) What is the overdraft protection service?Overdraft protection is a service offered by banks to their customers. For example, if a customer has two accounts saving and credit account in the same bank, he has to submit a cheque to pay his bills. So, suppose one of his accounts does not have enough balance to process the cheque. In that case, the bank will transfer money automatically from one account to another account that does not have the cash to prevent cheque return or to clear shopping or electricity bills. 13) What are the things you should keep in mind while opening a bank account?Before opening a bank account, you should clear which type of bank account you want. Nowadays, banks provide several types of bank account according to their customers need. If you want to open a saving account, you have to check the deposit's interest rate and whether the interest rate remains consistent for the period. You should also check for different debit card options banks provide when you open a new bank account. If you want to open a checking account, see how many cheques they provide for free to use. Generally, banks charge their customers for using paper cheques or ordering new cheque books. You should check all the banks' online facilities and keep them in mind while opening a bank account. 14) Do banks charge for overdraft protection services?Yes. Every bank charges some amount for 'overdraft protection' services, but these charges will be applicable only when you start using this service. 15) What are the necessary documents required to open a bank account?According to the RBI advisory, banks have to follow the Know Your Customer (KYC) guidelines. So the bank asks for some personal information of the account holder. The main documents required to open a bank account are some photographs, proof of identity like Aadhar card or Pan Card etc., and address proof for residence verification. 16) What is the annual percentage rate (APR) in Banking?Annual percentage rate, generally known as APR, is a charge or interest that the bank imposes on their customers for using their services like loans, credit cards, mortgage loans etc. The interest for this service is calculated annually. 17) What do you understand by fixed APR and variable APR?Annual Percentage Rate (APR) is categorized into two types:

18) What is the prime rate used in APR?In some countries like the USA, the prime rate is the interest rate decided by banks for their preferred customers, having a good credit score. In the variable Annual Percentage Rate (APR), interest depends on the prime rates. For example, if the APR on your issued credit card is 8% plus the prime rate, and if the prime rate is 2%, then the current APR on that credit card would be 10%. 19) What do you understand by amortization and negative amortization?The term amortization specifies the loan repayment in installment to cover the principal amount with interest. When the loan repayment is less than the loan's accumulated interest, then negative amortization takes place. If the negative amortization occurs, it will increase the loan amount instead of decreasing it. It is also called 'deferred interest'. 20) What is the debt to income ratio?The debt to income ratio is your monthly debt payments divided by your gross monthly income. It is calculated by dividing a loan applicant's total monthly debt payment by his monthly gross income. 21) What do you understand by the term cost of debt?When a company borrows funds from a bank, the interest paid on that amount is called the cost of debt. 22) What is a balloon payment?The balloon payment is the final lump sum payment that is due. When the entire loan payment is not amortized within the loan's specified time, the remaining balance is due as the final repayment to the lender. A balloon payment can occur within an adjustable-rate or fixed-rate mortgage. 23) What is the difference between the cheque and demand draft?Cheque and demand draft are used to transfer an amount between two accounts of the same or different bank. But, there is a key difference between them. Cheques can only be issued by an individual who holds the account in a bank. On the other hand, a demand draft can be issued by the banks on request, and they charge you for the service. Also, the demand drafts cannot be canceled, while cheques can be canceled once issued. 24) What do you understand by debt-to-income ratio?The debt-to-income ratio is calculated by all your monthly debt payments divided by your gross monthly income. This is used to measure your ability to manage the monthly payments to repay the money you want to borrow. For example, if you pay 15000 a month for your mortgage and another 1000 a month for a bike loan and 4000 a month for the rest of your debts, your monthly debt payments would be 20000. (15000 + 1000 + 4000 = 20000.) If your gross monthly income is 40000, then your debt-to-income ratio is 50 percent. (20000 is 50% of 40000.) 25) What is the adjustment credit?In the USA, an adjustment credit is a short-term loan provided by the Federal Reserve Bank to a smaller commercial bank when it needs to maintain reserve requirements and support short term lending when they are short of cash. The commercial banks secure adjustment credits with promissory notes when interest rates are high, and the money supply is short. 26) What are the different types of banking software applications available in the Indian Banking Industry?Following are the main banking software applications used in the Indian banking industry:

27) What do you understand by a foreign draft?A foreign draft is a bank draft established at a foreign bank and used to pay a foreign currency transaction. It is an alternative to foreign currency. You can purchase a foreign draft from the commercial banks after paying a charge according to their bank's rules and norms. A foreign draft is preferred for sending money as this method of sending money is cheaper and safer. It is also very fast, and the receiver gets the fund quicker than a cheque or cash transfer. 28) What is loan grading in banking?Loan grading is the classification of the loan based on various risks and parameters like repayment risk, borrowers credit history etc. The system places a loan on one to six categories, based on the stability and risk associated with the loan. 29) What do you understand by the term Co-Maker?When a person takes a loan, he may have to take a guarantee with him. The person who signs a note to guarantee the loan's payment on behalf of the main loan applicant is called a co-maker or a signer. 30) How banks make a profit?There are several ways that a bank earns profit:

31) What do you understand by the line of credit?The line of credit is an agreement between the bank and the person or company who takes the loan. This agreement specifies that the bank has to provide a certain amount of loans on the borrower's demand. The borrower can withdraw the amount at any moment and pay the interest only on the amount withdraws. 32) What is the difference between a bank guarantee and a letter of credit?The bank guarantee and the letter of credit are very similar as both take the liability of payment. So, there is not much difference between them. However, the main difference between them is letters of credit to ensure that a transaction goes ahead. On the other hand, a bank guarantee reduces any loss incurred if the transaction doesn't complete or any other issue. So, the bank guarantee contains more risk for a bank than a letter of credit as it is protecting both parties, the purchaser and seller. 33) What do you understand by credit-netting?Credit netting is a system used to reduce credit checks on a financial transaction. This agreement is very common among large financial firms and other financial institutions. It contains all the future and current transaction into one agreement, removing the need for credit cheques on each transaction and making the transactions effectively combined, or "netted together." 34) What is a credit check?A credit check is also known as a credit search. It is done by the bank when they have to check your credit report to understand your financial behavior. It is done to ensure that an individual is capable enough to meet the financial obligation for its business or any other monetary transaction. When the banks do credit checks, they keep a few concerns like liabilities, assets, income etc. 35) What do you understand by inter-bank deposit?When you deposit an amount in one bank meant for another bank, this process is an inter-bank deposit. The bank for which you deposited the money is referred to as the correspondent bank. 36) What is the meaning of a cashier's cheque?A cashier's cheque is a cheque issued and guaranteed by a bank on behalf of the customer. The bank guarantees the payment, and the payment is made from the bank's funds. The cashier signs this cheque. These cheques are commonly required for real estate and brokerage transactions and issued when rapid settlement is necessary. 37) What is a home equity loan?A home equity loan is also known as an equity loan, home equity installment loan, or second mortgage. It is a type of consumer debt. Home equity loans allow the owners to borrow money against the value of equity in your home. The loan amount is based on the difference between the home's current market value and the homeowner's mortgage balance due. For example, if the value of your home is 100000 and you have paid 50,000. The balance owed on your mortgage is 50000. Now, your paid 50000 is equity, which is the difference between the home's actual value and what you owe to the bank. Now, you can get the loan based on your equity. Usually, the applicant will get 85% of the loan on its equity, considering your income and credit score. So, in this case, you will get 85% of 50000, which is 42500. 38) What are the different types of card-based payments?There are two types of card-based payments:

39) What is the full form of ACH?The full form of ACH is an Automated Clearing House. It is an electronic fund transfer between banks or financial institutions. 40) What is the convertibility clause?The convertibility clause is a provision for the borrower in which the bank can change the rate of interest from fixed to variable and vice versa for certain types of loans. 41) What is the full form of LIBOR?The full form of LIBOR is the London Inter-Bank Offered Rate. It is an average interest rate offered for the U.S dollar or Euro deposited between groups of London banks. It is an international interest rate set by world economic conditions and used as a base rate by banks to set interest rates. 42) What is the charge off in Banking?The charge off is a lender's declaration to a borrower not to pay the remaining amount when the borrower badly falls into debt. The unpaid amount is settled as a bad debt. 43) What do you understand by a Payday loan?A payday loan specifies a small amount and a short-term loan available at a high-interest rate. |

You may also like:

- Java Interview Questions

- SQL Interview Questions

- Python Interview Questions

- JavaScript Interview Questions

- Angular Interview Questions

- Selenium Interview Questions

- Spring Boot Interview Questions

- HR Interview Questions

- C Programming Interview Questions

- C++ Interview Questions

- Data Structure Interview Questions

- DBMS Interview Questions

- HTML Interview Questions

- IAS Interview Questions

- Manual Testing Interview Questions

- OOPs Interview Questions

- .Net Interview Questions

- C# Interview Questions

- ReactJS Interview Questions

- Networking Interview Questions

- PHP Interview Questions

- CSS Interview Questions

- Node.js Interview Questions

- Spring Interview Questions

- Hibernate Interview Questions

- AWS Interview Questions

- Accounting Interview Questions