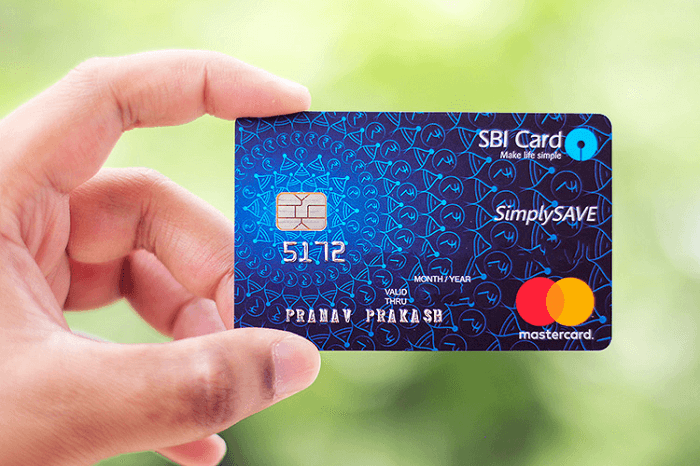

Top 10 Credit Cards In IndiaAt this point of time when inflation is eating away at your funds and prudent spending is the only way to prevent burning a deeper hole in your wallet, picking the correct credit card is crucial. Using a credit card could help you not only save more money but also spend more wisely on everything from travel expenses to everyday shopping. Some examples include cash back on online purchases, rewards points for gas purchases, and discounts on hotel and travel reservations. The Reserve Bank of India and PwC conducted a study that found that the Indian credit card market grew exponentially at a CAGR of 20% over the previous five years, with the highest monthly credit card spending ever being INR 1.13 lakh crore in May 2022. With an increasing number of new fintech players offering credit cards, the industry is poised to contribute to the further expansion of the credit card market in India. The demand for online shopping credit cards is growing as more consumers pick online retailers over traditional physical establishments. People purchase almost anything online, including equipment and groceries, and they surely anticipate a payment for their purchases. 1. SBI SimplySAVE Credit Card

In order to meet the needs of its young clients, who like dining out, shopping, and frequenting malls and movie theatres, SBI introduced the SimplySAVE credit card in March 2018. This card is best used for offline purchases. Savings on numerous purchases or transactions that we make on a daily basis are available with this credit card. The credit card provides additional helpful features, such as expedited reward points, spend-based rewards, and remission of the renewal fee, that enable users to save money when using the credit card. This card offers 10 times the reward points on purchases of more than 100 rupees for eating, movies, or grocery. The reward points can be redeemed for a credit card balance reduction or used to buy SBI-approved merchandise. Other Key Features-

2. HDFC Regalia Credit Card

Prior to the introduction of their second card, the HDFC Millennia Credit Card, Regalia, a premium point-based credit card, used to be HDFC's top premium card. Because Regalia is less expensive than other premium cards and provides almost all of the functionality of the bank's other cards, albeit in a somewhat minimal fashion, it is still important. This premium credit card is great for people who frequently fly, shop online, preferably on foreign websites due to the advantages of foreign currency markup, and love dining out. Through the Regalia Visa Credit Card Lounge programme, cardholders can access domestic airport lounges for free. 12 free trips to domestic airport lounges are provided by the programme each year. Other Key Features-

3. American Express SmartEarn™ Credit Card

In September 2019, American Express introduced SmartEarnTM with India's millennials in view. Thanks to the American Express Reward Points programme, it is one of the most effective cards offered in India. It works perfectly when used at renowned businesses or while purchasing online. Those who are self-employed and make a personal yearly income of INR 6 lakh or more or with a personal annual income of INR 4.5 lakh or more are eligible to apply. Minors cannot apply for this card. It's a basic credit card made for a wide range of customers. The fee and waiver requirements are very alluring. This card is a brilliant option if you want to fill your Amazon Pay or Paytm Wallet. Other Key Features

4. HDFC Millennia Credit Card

The HDFC Millennia Credit Card was reintroduced on October 1, 2021. New features added to the card make it simpler to use and give it a new look. The HDFC Millennium Credit Card is the best option for millennials who regularly buy online and want to maximize their returns on all their purchases. It stands out since the bank has partnered with some of the most recognizable companies to offer CashPoints worth 5% of every purchase. If you frequently purchase online, especially with the brands HDFC Bank has partnered with, you should think about acquiring this card. Additionally, the annual charge is pretty affordable and can be wiped altogether with only annual spending of Rs. 1 lakh, which is yet another bonus. Other Key Features

5. SBI card prime

The State Bank of India introduced their premium credit card, the SBI Card PRIME, in 2017. Compared to other premium credit cards, SBI PRIME might be easier for some people to obtain. As a result of SBI's partnership with VISA, Mastercard, and American Express, this card is available in three variations. The SBI Card PRIME Credit card is in direct competition with a few of the premium cards issued by other businesses. This card stands out since there are no income restrictions, which makes it more accessible. Its low foreign currency markup also makes this card stand out. Other Key Features

6. SimplyCLICK SBI Credit Card

In comparison to other credit cards in the same category, the SimplyCLICK Credit Card is a basic, affordable point-based credit card for online shopping. Users who are interested in saving money and earning reward points for online purchases are the best candidates for this card. The applicant must be between the ages of 18 and 60. The required income for a salaried individual is INR 20,000 per month, and the required income for a self-employed individual is INR 30,000 per month. The SimplyCLICK Advantage SBI Credit Card is the best option for those who enjoy shopping online. Numerous features and benefits given by this SBI credit card might be beneficial if you frequently shop online. Other Key Features

7. Flipkart Axis Bank Credit Card

The card was introduced on July 19, 2019, by Axis Bank and Flipkart. It offers limitless cash back on all types of purchases made both online and offline. The user of this card can recoup their card charge in the first year by using the many welcome advantages which are included with the card. Spending 200,000 is required to cancel the annual charge, and the following year's joining fee won't be required either. Other Key Features

8. SBI card ELITE

A premium credit card, the SBI Elite is issued by SBI. Due to SBI's cooperation with VISA, Mastercard, and American Express, this card is available in three different variations. Each of these three businesses offers slightly different facilities. Travelers can take advantage of amenities like Club Vistara membership and airport lounges, and even the reward point system is interesting. A more sophisticated version of the SBI Prime, this card offers the lowest foreign exchange markup and reward points for shopping on international websites. One of the top credit cards in India, SBI card ELITE is advantageous across all categories, including shopping, travel, movies, dining, and more. Even though there is a hefty annual subscription of Rs. 4,999, if used properly, the advantages readily outweigh the costs. This card also offers the option to link cards with your parents, spouse, partners, or siblings using an add-on card facility. Other Key Features

9. Axis bank ACE credit card

In conjunction with Google Pay and Visa, Axis Bank introduced the Axis Bank ACE credit card in October 2020. It is a cashback credit card designed to make using Google Pay to pay bills easier and earn cashback. The finest element of this card is that there is neither an upper nor a lower limit on the 5% cash back it offers on Google Pay bill payment transactions. Regarding the features offered, the annual cost of a credit card is relatively modest. The only card comparable to it is the Standard Chartered Super Value Card, which is slightly more expensive than this card and includes a double-sided cap, which gives the Axis bank ACE credit card an edge over this card. With ACE, you receive more than you paid for. Other Key Features

10. ICICI Platinum Chip Credit Card

A lifetime free credit card with no annual fee is the Platinum Chip Credit Card from ICICI. But rather than choosing it for the reward points, we did so because of the numerous deals and discounts it gives due to partnerships with various firms. It is distinctive since it provides a lengthy list of frequent deals from a variety of businesses. A valid fixed deposit with ICICI Bank was previously the only requirement for receiving this card. This card is available to everyone over the age of 23. Every transaction you complete with your ICICI Bank Platinum chip credit card will reward you with PAYBACK Points. These Payback Points can be used in an array of ways. These include gift cards for vacations, household goods, cinema tickets, appliances, mobile phones, and many other items. Other Key Features

Next TopicTop 10 of Series Of All Time

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share