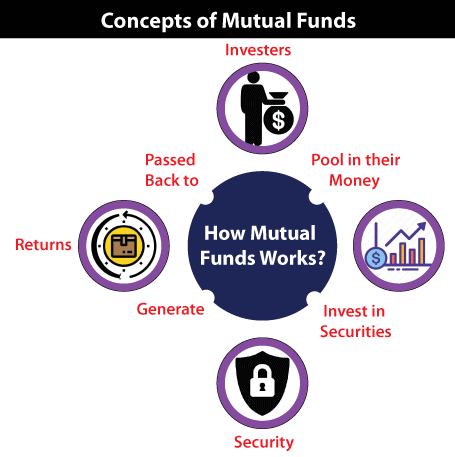

Top 10 Mutual FundsTop 10 mutual funds or highest performing mutual funds exceed their standard and competitor funds on a constant basis. To put it another way, Top 10 mutual funds with the best performance are the best in their area. They offer excellent value for money. Top mutual funds usually have a low expense ratio and a track record of producing good yields. The top mutual funds' metrics like alpha, beta, Sharpe ratio, and standard deviation support and validate the revenue earned and are within acceptable bounds. Mutual Funds are a sort of financial structure that pools money from a number of individuals to invest in financial assets and securities such as stocks, bonds, and other assets.

Financial managers oversee them, assisting you in allocating plans, funds and attempting to generate capital benefit for its investors. Mutual funds provide small investors with accessibility to professionally run equity, bond, and other security portfolios. They're also separated into a variety of categories, such as investment goals, types of returns and risks, and the stocks you invest in.

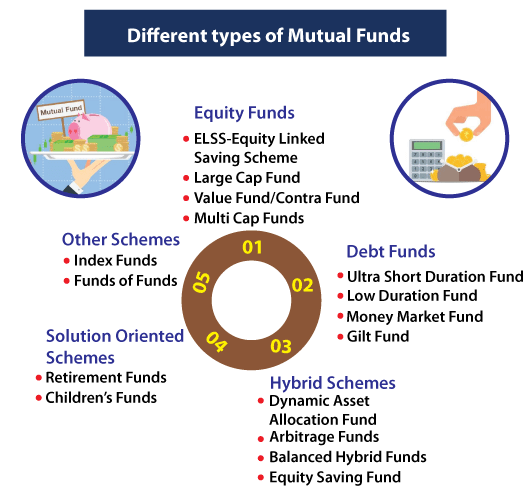

If you're wanting to start investing in mutual funds, keep reading to learn about the"Top 10 Mutual Funds." 1. SBI Small Cap FundThis is one of the top mutual funds in the country. It is an excellent scheme for extra income. SBI Small Cap Fund has the ability to serve its investors with long-term financial appreciation ability by encouraging investments in a well-diverse plan of small-cap investment companies. Small-cap investment include the major of the fund's holdings (almost 60 per cent). Other assets (including large and mid-cap businesses) and/or debt and money market funds can account for up to 35 per cent of the SBI Small Cap Fund's portfolio. The SBI Small Cap Fund is the best-performing small-cap mutual fund strategy. A 5-year investment in SBI Small Cap Fund yielded an 11% average annual return, while a ten-year SIP yielded almost 19% average annual return. SBI Small Cap Fund in 2020 had a spectacular year, with gains skyrocketing. In reality, the fund's gains have been close to 38% since last year, in accordance with the industry's strong pace. As a result, it is one of the best-performing equities mutual funds. SBI Small Cap Fund's long-term performance has also been impressive. In the last seven years, the fund has delivered solid returns of 27% on an annualised basis, while the 10-year gains have been 20.13 per cent on an annualised basis. Elgi, JK Cement, Blue Star, Sheela Foam, V-Guard Industries, Hawkins, City, Hatsun Agro, and other companies in the SBI Small Cap Fund's portfolio are among the best in the industry. 2. SBI Equity Hybrid FundSBI Equity Hybrid Fund is a combination of debt and equity to serves its investors with long capital growth with the liquidity of an open-ended strategy. The investors invest in a wide range of assets stocks and balances investors risk by keeping the remainder of their assets in fixed-income securities. The SBI Equities Hybrid Fund makes investments of at least 60-70 per cent of its assets in equity and equity-related securities. At any particular moment, the mutual fund will incline 20-35 per cent of its assets to debt and money market funds. This plan or scheme has an assured track record of paying dividends to shareholders on time. This fund is appropriate for individuals searching for a steady flow of revenue from their investment (especially retirees).

3. Axis Small Cap FundAxis Small Cap Fund is an open-ended equity mutual fund that invests in small companies. It primarily focuses on small-cap companies and, since its introduction, has outperformed the Nifty Smallcap 100 TRI (its benchmark index). This is a mutual fund scheme that makes investments in small firms. When stock prices come down, such funds tend to fall more than those that participate in bigger corporations. So, while you might expect larger long-term returns, you can also expect greater and extreme highs and lows along the journey. Axis Small Cap Fund invests in equities and equity-related products with the goal of creating long-term income (predominantly small-cap stocks). Yet, there is no certainty that this objective will be met. If you really need to retrieve your money in far less than seven years, don't invest in this mutual fund or any other small-cap mutual fund. 4. Mirae Asset Hybrid Equity FundAnother best performing mutual fund scheme is Mirae Asset Hybrid Equity Fund. This mutual fund is a direct growth and aggressive mutual fund plan that comes from Mirae Asset Mutual Fund. This mutual fund scheme has been around for 6 years, having been established on July 8, 2015. Mirae Asset Hybrid Equity Fund Direct-Growth has a total asset under management (AUM) of 5,609 crores as of 30 June 2021, making it an intermediate fund in its sector. The mutual fund has a 0.4 per cent cost ratio, which is lower than many of the other Aggressive Hybrid funds. The fund now has a 74.72 per cent equity allocation and a 19.12 per cent debt allocation. Mirae Asset Emerging Bluechip Fund is a big and moderate-cap open-ended equity plan that invests in both large and middle cap equities. A few of the fund investments include ICICI Bank, HDFC Bank, Infosys, Axis Bank, SBI, Reliance Industries, and Voltas. Mirae Asset Emerging Bluechip Fund is ideal for investors wanting long-term financial growth, according to the fund's specifications. It's also one of the top mutual fund schemes, which have performed well in almost all the criteria like high returns, low risk, strong portfolio cleanliness, and qualitative research. 5. DSP mid-capThe potential of the DSP Midcap Direct Plan-Growth plan is to provide a regular income stream along with most investments in its group. It has a mediocre capacity to control loss in a sinking market. The Financial, Chemicals, Consumer Durables, Automobile, and FMCG sectors account for the major of the fund's holdings. In comparison to another mutual fund scheme in the area, it has less allocation to the Financial and Chemicals sectors. Manappuram Finance Ltd., Balkrishna Industries Ltd., Max Financial Services Ltd., Atul Ltd., and Supreme Industries Ltd. are the mutual funds top five investments. DSP Midcap Fund is one of the mediocre mid-cap strategies that has regularly outperformed its competitors over five- and ten-years' time period Investing in excellent mid-caps with comparatively better balance sheets, cost control, and continuous and stable profit growth have all contributed to the plan's success.

6. Axis Mid CapAxis Midcap direct plan of growth is a middle cap or medium investment mutual fund scheme. This scheme has been there for more than 8 years now. The ability of the Axis Midcap Direct Plan-Growth plan to provide good returns is comparable to that of most products in mutual fund schemes. It has an average capacity to minimize the loss in a dropping market. The Financial, Technology, Chemicals, Consumer Durables, and Healthcare areas form part for the majority of the fund's holdings. When compared to other schemes in the sector, it has much less commitment to the Financial and Technology industries. NIIT Technologies Ltd., Cholamandalam Investment & Finance Co. Ltd., ICICI Bank Ltd., Voltas Ltd., and Crompton Greaves Consumer Electricals Ltd. are the fund's top five investments. It is a medium cap mutual fund scheme that delivers long-term growth, and this scheme outperforms average and is appropriate for investment goals with a time horizon of 10-15 years or longer (minimum 5 years).

7. Mirae Asset Large Cap FundThese investments are appropriate for long-term investments with a goal of wealth growth and financial appreciation, such as 10-15 years or longer (minimum 5 years). For assessment, the investment has a 13-year track record. The track record is outstanding. The fund allows investors to choose whether to receive dividends or reinvest them in comparison to other schemes. The one-year, three-year, and five-year returns by investing in Mirae Asset Large Cap Fund are significantly more. The Mirae Asset Large Cap Fund is an open-ended investment option that focuses on large-capital stocks. The mutual fund scheme has the ability to invest in a variety of areas and topics. It selects high-quality firms up to a certain point and keeps them for an extended length of time. 8. Axis Bluechip FundThis mutual fund scheme is open-ended and a large equity scheme that comes under the Axis Mutual Fund House. The said mutual fund scheme was launched in 2010. The Axis Bluechip Fund is a moderately risky investment. It has a positive long-term payback. You might choose this mutual fund scheme if you are an aggressive investor who is seeking long-term gains. You can simply invest in this plan through SIP or lumpsum via Axis Mutual Fund investment platforms. 9. Parag Parikh Long Term Equity FundThe Parag Parikh, Flexi Cap Fund, is a diversified equity fund managed by Parag Parikh. Its investing universe is unrestricted by self-imposed sector, market capitalization, region, or other constraints. Only 'real' long-term shareholders should participate in this programme. However, because the Parag Parikh Flexi Cap Fund is an open-ended strategy, its potential to grow during downturn markets will be determined by your investment behaviour. Since its inception 7 years ago, this mutual fund scheme (formerly known as the multi-cap scheme) has grown in popularity as a result of its outstanding performance. The fund is also fully involved in tech stocks. The fund invests in high-quality foreign stocks such as Alphabet Inc., Amazon Inc., Microsoft Inc., and Facebook Inc. 10. Kotak Standard Multicap FundKotak's multi-cap fund is an open-ended equity investment fund in large, mid, and small-cap firms. The plan's investment aim is to increase long-term capital growth via a portfolio of equities and equity-related assets, with an emphasis on certain select sectors. However, there is no guarantee that the program's goal will be achieved as it is subject to risks. One of the top holdings of this scheme includes ICICI Bank Ltd., Infosys Ltd., Ultratech Cement Ltd., HDFC Bank Ltd., Reliance Industries Ltd.

Next TopicTop 10 PC Games

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share