AA+ vs. Aa1: What's the Difference?Credit rating firms provide scores to people, businesses, and governments based on their capacity to repay their obligations. These ratings are given to organizations (corporations and governments) that issue debt, such as bonds, by organizations like Standard & Poor's (S&P) Global Ratings and Moody's Investors Services using a letter-based grading system. The bond rating is the most important determinant of the bond issuer's creditworthiness and, consequently, the degree of risk to the investor that the issuer might default on the obligation.

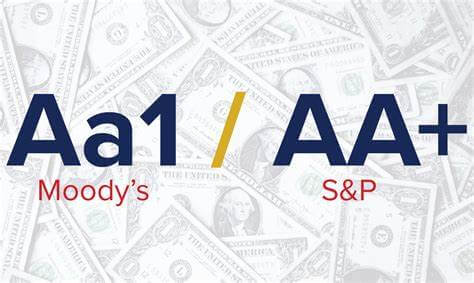

S&P and Moody's have issued ratings of AA+ and Aa1, respectively. Investment-grade items receive these marks because they are of a high calibre. They demonstrate that the issuer is financially stable and has sufficient income and cash to cover its liabilities. For investors or policyholders, there is little chance of default with certain ratings. AA+On a scale based on letters, S&P ratings are given to insurance firms and long-term credit issuers. The highest grade is an AA, while the first is a AAA. The next thing is an A rating. Anything in the A-class is regarded as excellent quality, indicating a good chance the debt issuer will be able to pay its debts. A company with an AA grade is considered to have a "very good capacity to satisfy its financial commitments", according to S&P Global Ratings. It marginally deviates from the top-rated businesses. These letter grades may also have a "+" or a "-" added by S&P to "indicate relative standing within the rating categories". This indicates that an AA+ mark is marginally superior to an AA grade. The fact that S&P utilizes a distinct scale for long-term and short-term debt is a crucial issue to keep in mind. The short-term bond rating scheme is rather straightforward. A-1, A-2, or A-3 ratings are assigned to short-term bonds considered investment grade. Short-term bonds with ratings of B or C are considered speculative or worse. According to information provided by the Environmental Protection Agency (EPA), S&P gave Ameritech Corporation's senior debt one of the highest ratings for corporate debt-AA+. S&P has assigned the U.S. an AA+ grade. This indicates that the United States has a solid reputation and can fulfil its promises. As a result, U.S. government debt issuances are regarded as high-grade and investment-worthy. Aa1S&P and Moody's both employ somewhat comparable systems. The highest-rated debt issuers fall under the A category, starting with Aaa. The next level after A-grade investments is Aa. Aa-grade investments are "judged to be of good quality and are subject to extremely minimal credit risk", according to Moody's. These letter-based ratings are assigned by Moody's with a numerical modifier. Adding a 1 moves it to the top of that range, 2 places it in the middle, and 3 places it at the bottom. An Aa1 rating is superior to an Aa2. After the Aaa rating, it is also the second-highest rating that Moody may provide to assets and businesses. A P-1 classification is given to investments with an Aa1 rating, indicating they have a "better capacity to fulfil short-term debt commitments". According to EPA data, Moody assigned an Aa1 rating to the senior debt issued by Emerson Electric. Austria is rated Aa1 by Moody, which indicates that the country's federal government is likely to pay back its obligations if it chooses to issue bonds. Particular ConsiderationsS&P and Moody assign ratings based on internal (of the debt issuance, the issuing corporation, or the government) and external (external) considerations. These include having strong financial standing, which may be assessed by looking at financial statements and related financial statistics. Interest rates, monetary and fiscal policies, and a company's connections to other significant entities, such as a parent company, are a few external factors. When evaluating a nation's capacity to pay off obligations, geopolitical considerations also come into play. Ratings below AA+ and Aa1The following categories apply to ratings that are below S&P's A grades:

The following categories apply to ratings that are below Moody's A rating:

How do Bond Ratings function?For businesses and governments looking to borrow money, bond ratings are comparable to a consumer's credit rating. The rate of return (RoR) that a corporation will provide on its bonds depends on the rating that it earns. The rate of return decreases while the degree of risk increases with each subsequent level below the A-level ratings. Bonds of high calibre also have lower interest rates. They are viewed as safe-haven assets and are frequently purchased by retirees looking for a consistent income stream and investors looking to diversify their portfolios between high-quality, low-risk bonds and riskier investments like equities.

High-yield bonds are a common name for low-quality bonds. They are more expensive because there is a higher chance that the issuer may stop making bond payments. Non-investment grade bonds are those that have a bond rating below the A grade level. They're frequently called "junk bonds". |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share