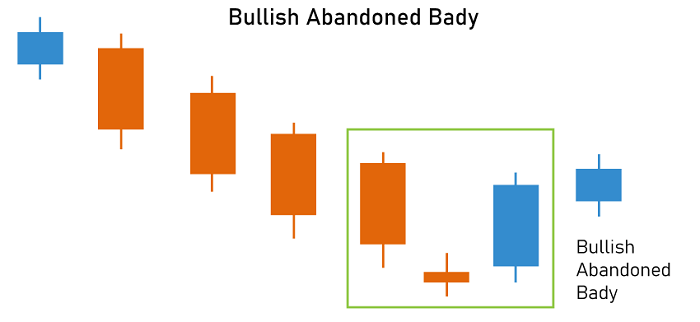

Bullish Abandoned BabyA bullish abandoned baby is a distinct type of candlestick pattern used for financial analysis. In the stock market, the word bullish is used to represent the state of the market. The pattern represents a reversal to an uptrend and is mainly utilized by traders to enter a buy position. The term bullish abandoned baby was first coined by the Japanese, which includes three candles: one doji and two candles with bodies. In simple terms, a bullish abandoned body is a pattern made of three candles. The first candle is usually red and is a long bearish candle stick. The second candle in the pattern can be of any colour, and the colour of the second candle is not important; it is a typical small doji candle stick. Doji candle means that the candle's opening and closing prices are the same. But, the second candle must be making a gap-down opening. The third candle of the pattern must be bullish. Here, the first candlestick of the pattern will be large, while the second candlestick should be small in size, and the third candlestick of the pattern will be a large green candlestick.

It is used to represent the market's bullish trend and is known as a bullish candlestick pattern. If the bullish abandoned baby pattern is seen, it means that it is the end of the bearish trend, and the market is about to see a bullish trend. It should be noted that a bullish abandoned baby pattern is made after a long bearish trend of the market to end the bearish trend and represent a start of a bullish trend. After confirming that a bullish abandoned baby pattern is observed in the charts, investors can invest and make profits. The volume also plays a very important role in the bullish abandoned baby pattern. The volume of the third candle of the pattern must be more than the volume of the first candle of the pattern. However, the volume of the second candle is not important. In simple terms, it can be said that the volume of the candles from the first candle to the third candle must be in ascending form to represent a bullish abandoned baby pattern. The Bullish Abandoned Baby Pattern in Intraday ChartA bullish abandoned baby candlestick pattern can also be seen in the intraday chart, and the formation of this pattern is frequently seen in the intraday chart. This pattern also works in a very efficient manner in the intraday chart. If you are into intraday trading, you must check it within 5-15 minutes of the chart, and you can make a decent profit from this. The Bullish Abandoned Baby Pattern in Daily ChartThe bullish abandoned baby candlestick pattern can also be seen in the daily chart, and it shows that the buyer could be in a strong position if trading is done. If you do position trading, then you must check for the bullish abandoned baby pattern in the chart, and you can make a good profit by using it. Working of the Bullish Abandoned Baby Candlestick PatternSuppose a bullish abandoned baby candlestick pattern was formed in yesterday's chart and the new candles of today's chart have made a gap up while opening; then it is the time when you can make buying in the market. But if today's new candles are not closing above the high of the first candle of the bullish candlestick pattern, then, in that case, the buyers should not make any purchase in the market. When the value of the new candlestick goes beyond the high of the first candle of the bullish abandoned baby pattern and closes above it, then it can be seen as a confirmation of the bullish trend of the market. Some Key Points to be Remember

Bullish Abandoned Baby Trading StrategiesNow, after clearly understanding what a bullish candlestick pattern is, it is time to see what trading strategies can be used by the buyers so that they can make a profit using the bullish abandoned baby. The trading strategies we will mention are not for live trading but only to serve as inspiration. It should always be kept in mind that which strategy you choose depends on the market situation and the timeframe in which the purchase is made. So, it is always recommended to do a deep analysis considering various factors before investing. Trading Strategy 1: Gap Condition and Bullish Abandoned BabyPart of what makes the bullish abandoned baby pattern different from other patterns is that it creates two large gaps. Now, to check whether we should make a trade or not, the measurement of the gap becomes very important as the size of the gap could be one of the factors for determining whether the buyer should make a purchase or not. It is only beneficial to trade when the gap size is bigger than the true average range of the gap. If we have a bullish abandoned baby pattern and the size of both gaps is bigger than the average range, then in such a case, we need to exit the trade after five consecutive bars. Trading Strategy 2: Bullish Abandoned Baby and Oversold ConditionsA bullish abandoned baby is seen after a long downfall of the market, and therefore it becomes important to how much the market had fallen. If we can determine how much the market has fallen, we can use it to determine when we should enter the market. This can be done so by using the RSI (Relative Strength Index) indicator. If the RSI indicator shows a low reading, then it represents that the market has been oversold and will turn around. That is how the RSI indicator will be used in this strategy. To confirm whether we should act on the bullish abandoned baby pattern or not, the 5-period RSI indicator should be below 30. Bullish Abandoned Baby vs Bearish Abandoned BabyNow that the concept and the use of bullish abandoned baby have already been covered, there is another candlestick pattern that the viewers must know: a bearish abandoned baby. A bearish abandoned baby is seen as a reversal sign, showing that the market may fall soon. A bearish abandoned baby is formed in a bullish trend and is totally the opposite of a bullish abandoned baby pattern. The bearish abandoned baby pattern also consists of three candlesticks and occurs in a downtrend and uptrend, in which the first candle will be a bullish candle, and the other will be a bearish candle. In this pattern, the first candle will be a bullish candle, the middle candle should gap up and not gap down, and the third candle will be a bearish candle. Morning Doji Star vs Bullish Abandoned BabyMorning Doji Star and Bullish Abandoned Baby are very similar, but the major difference between these two is that Morning Doji Star has only two candles, whereas Bullish Abandoned Baby consists of three candles. The Bottom LineA bullish abandoned baby is a pattern that does not occur frequently and is considered rare in the stock market. Like other candlesticks patterns, if the buyers identify the bullish abandoned baby pattern and make purchases accordingly, they may profit from it.

Next TopicCalifornia Assembly Bill 5 (AB5)

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share