Accounting Cycle Definition: Timing and How It WorksWhat exactly is the Accounting Cycle?It is basically the discovery, evaluation, and documentation of a company's accounting events. It is a standard eight-step process that starts with the occurrence of a transaction and ends with its inclusion in the financial statements.

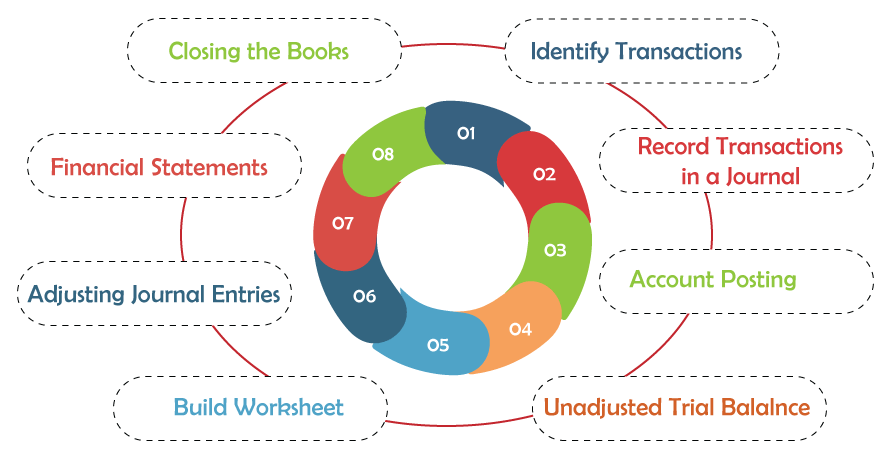

The eight-step accounting cycle covers journal entry recording, general ledger publication, trial balance calculation, amending entries, and financial statement preparation. In-depth Understanding of the Accounting CycleThe accounting cycle entails the preparation of various financial statements that firms use to examine their current market position after each fiscal year. These statements enable firms to evaluate their performance and make the following decisions: launching a recruiting campaign or investing in technological innovation and other resources. Accounting transactions start the process and end with the books of accounts being closed. A bookkeeper or accountant records all financial accounting processes for the fiscal year. Companies or firms repeat the method every fiscal year to monitor, analyze, and appreciate the economic position. The accounting period for this assessment could be monthly, quarterly, yearly, or any other time. In the United States, businesses must finish the statements and submit the final financial reports and documents to the Securities and Exchange Commission (SEC). Accounting is completed by companies based on multiple reporting dates. Furthermore, bookkeepers use accounting software to ensure the procedure is accurate. How the Accounting Cycle Works?The accounting cycle is a collection of procedures to keep financial statements accurate and consistent. Accounting cycle consistency and computerized accounting systems have aided in the elimination of arithmetic errors. Nowadays, most accounting software fully automates the accounting cycle, resulting in less human work and problems associated with manual processing. 8 Steps of the Accounting CycleThe accounting cycle aims to produce an accurate financial report for a corporation. The following are the eight steps of the accounting cycle.

1. Analyze TransactionsThe analysis of transactions is the first step in the accounting process. First, accountants gather, identify, and categorize receipts, invoices, and other financial data. Following that, the specialists read the acquired data, scrutinizing each transaction and noting the causes for those transactions. Lastly, they categorize it appropriately and assess its influence on various accounts based on their study. 2. Record in the JournalThe next step is to record the transactions in a journal. Whether one employs a single-entry or double-entry accounting system, one must apply a debit or credit to every transaction. The transactions are transferred to a cash accounting system as money is paid or received. All transactions during an accounting period must be recorded in a journal. 3. Create a Trial BalanceFollowing the transfer of all entries to the general ledger, the next step is constructing a trial balance to confirm that the total debits and total credits for the accounting period match. This step, however, may reveal some differences by displaying an unadjusted trial balance. 4. Make CorrectionsUnadjusted records result in accounting problems that must be corrected. As a result, the businesses create a worksheet to track the inaccuracies in the record. Once accountants uncover errors, they fix them in the spreadsheet to ensure debits match credits. 5. Adjust EntriesIt's now time to enter the updated trial balance entries. It is an important step since the discrepancy, if managed effectively, could lead to internal and external stakeholders making correct business decisions. Furthermore, by modifying entries, the accountant ensures that the trial balance provides the information searchers with crystal clear accounting details. 6. Prepare Financial StatementsThe firms compile the relevant financial statements after cross-checking the accounting details and correcting inaccuracies. Income statements, balance sheets, shareholder equity statements, and cash flow statements are the various types of statements. 7. Analyze StatementsAccountants study the respective statements after they have been created to identify trends indicated by the recorded accounting operations. Next, based on the analysis, they communicate their findings to managers and other stakeholders, who use the data to assess the performance of the businesses and make well-informed and productive decisions. 8. Close the BooksThe final step in the accounting cycle is to make closing entries. It signifies that firms have prepared all financial statements and thoroughly recorded, examined, and summarized all company transactions. But, once the books are closed, the bookkeepers and accountants must repeat the steps for the next accounting period. ExampleTo better understand how the process works, consider the following accounting cycle example: On March 15, 2022, A Company called JTP got $500 for its software goods and logged the transaction. The sum is credited to the Sales Revenue account and debited from the cash account. If the company's cash transactions for the day comprised a cash sale of $500 and a cash return of $200, the business's cash transaction would be a debit of $600. Additional transactions or activities of the corporation revealed $800 in Accounts Receivables and $100 in inventory, in addition to a $600 cash debit. As a result, the trial balance's credit balances of $1,200 do not balance with the debit balances of $1,500. As a result, the bookkeeper must locate the missing records to total both the credit and debit sides. So, accountants make financial statements and close the books for that accounting duration after correcting the entries. Benefits of Accounting CyclesWhile the holistic accounting cycle might seem like a long and complicated process, it's a worthwhile process worth implementing. The accounting cycle is the foundation for an organization's accounting process, and there are many benefits, including:

What are Some Accounting Cycle Best Practices?Some general best practices should be kept in mind throughout the accounting cycle. Consider the following to achieve the best results:

Accounting Cycle vs Budget CycleMost financial players need clarification on the accounting and budget cycles as both deal with recording transactions. However, these cycles differ concerning when and for what these transaction details will be recorded. An accounting process keeps a record of financial transactions for an accounting period so that accurate details can be provided to the internal and external stakeholders. On the other hand, the budget cycle includes recording and analyzing a company's budget-based transaction for a future project.

Next TopicAccounting Manual

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share