Balance Sheet: Explanation, Components and ExamplesA firm's balance sheet, income statement and cash flow statement are important sources of information in determining the company's financial health and the value of shares. Investors do not need to be analytical experts to analyze financial statements; they can easily review these financial records to get an overview of a company's value. Whether they follow the advice of an investment professional or do it themselves, these financial records are essential for proper analysis. There are several independent stock research sources available today, both online and in print, that can perform the "number crunching" for you. However, you must have a fundamental grasp of how financial statements are used if you intend to become a professional or informed stock investor. We assist you in familiarizing yourself with the general layout of the balance sheet in this article.

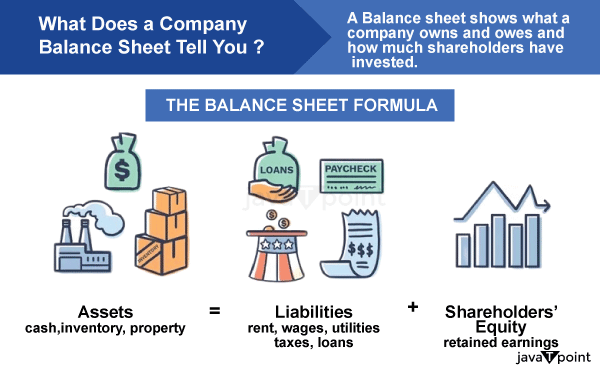

What is a Balance Sheet?A financial statement that lists a company's assets, liabilities, and shareholder equity at a certain point in time is referred to as a balance sheet. The foundation for calculating investor return rates and assessing the capital structure of a firm is provided by balance sheets. A Balance Sheet's CompositionAssets, liabilities, and Equity are all included on a company's balance sheet. The values of objectively measurable items that a firm possesses, owns, or will receive are referred to as assets. What a business owes to other parties, such as creditors, suppliers, tax authorities, and workers, is known as its liabilities. They are debts that have terms and deadlines that must be met in order to be satisfied. The Equity of a firm is made up of retained earnings and capital contributions from its shareholders, who are willing to take on ownership risk in exchange for the potential for a healthy return on their investment.

The basic balance sheet equation reflects the link between these items: assets, liabilities and equity. The relationship is defined as: Liabilities + Equity = Assets The importance of this equation must be understood. The rising sales, whether they happen quickly or gradually, typically dictate a larger asset base?higher levels of inventories, receivables, and fixed assets (plant, property, and equipment). For a company to remain financially balanced, as its assets increase, its liabilities and/or equity must also increase accordingly. It is possible to learn a lot about the financial health of a firm by looking at how assets are supported or funded by a comparable development in payables, debt obligations, and Equity. For the time being, it is necessary to remember that, based on the company's line of business and industry characteristics, having a reasonable balance between liabilities and Equity is a sign of a financially viable organization. Even though this may be an oversimplified interpretation of the fundamental accounting equation, investors should see a significantly bigger equity value instead of liabilities as a measure of positive investment quality because having a lot of debt might make a firm more likely to encounter financial issues. The Pattern of Balance SheetIn accordance with accepted accounting practices, the balance sheet is displayed in one of two ways: either horizontally (the account form) or vertically (the report form). The preferred report format for most businesses is vertical, which deviates from the standard justification given in investing literature that the balance sheet has "two sides" that balance each other. All balance sheets follow a presentation that groups the different account entries into five categories, whether the arrangement is up-down or side-by-side:

Current and non-current liabilities + Equity comprise the balance sheet's entire (Liabilities + Equity) side. Using these things, the following equation is matched to see the economic strength of any business: Assets = Liabilities + Equity Presenting Your AccountAccording to their liquidity (how quickly and readily they may be converted to cash), the accounts are listed in the asset areas in descending order. Liabilities are similarly classified in order of importance for payment. The words "current" and "non-current" are analogous to the terms "short-term" and "long-term," respectively, in financial reporting and can be used interchangeably. The range of operations carried out by publicly listed corporations is represented in the balance sheet account presentations. Utility balance sheets, bank balance sheets, insurance company balance sheets, brokerage and investment banking firm balance sheets, and other specialized business balance sheets all show their accounts in quite different ways from those often covered in investing literature Accounting terminology is also not uniformly used. As an illustration, the balance sheet itself is referred to by a number of various names, such as "statement of financial position" and "statement of condition". This phenomenon also affects balance sheet accounts. Fortunately, large dictionaries of financial jargon are readily available to investors so they can decipher a mysterious account entry. Balance Sheet's ElementsAssets The accounts in this section are organized in ascending order of liquidity. As can be seen, they can be directly converted into cash with ease. They are divided into two groups: current assets, which can be converted into cash in one year or less, and non-current or long-term assets, which can take longer than one year. The standard configuration of accounts within current assets is as follows: Cash and its equivalents, marketable securities, accounts receivables, inventory, and distinct prepaid costs or expenses.

The following are examples of long-term assets: Securities, fixes assets, intellectual property and goodwill.

Liabilities Any money owed by a business to third parties is referred to as an obligation/Liability. Rent, utilities, salaries, interest on bonds given to creditors, as well as supplier invoices that the company is required to pay are all included in this. Current liabilities/obligations are those that are due within a year. As opposed to short-term liabilities, long-term liabilities are payable within one or more years. The following might be found in current liabilities accounts: Current portion of long-term debt, interest payable, wages payable, customers' prepayments, dividends payable, and account payables.

Long-Term Liabilities include interest payments, principal payments, pension funds, and some sort of deferred taxes.

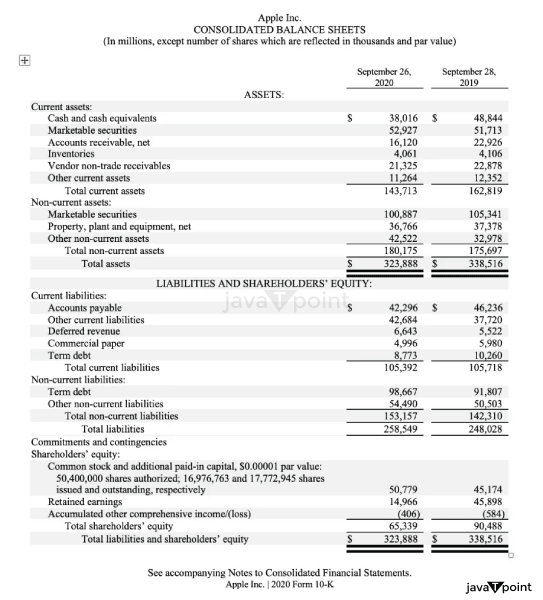

Off-balance-sheet liabilities are debts that are not shown on the balance sheet. Equity of Shareholder Equity held by shareholders or a company's owners refers to money that can be traced back to them and so it is known as shareholders' equity. It is frequently referred to as a corporation's "net assets" since it refers to the total assets after reducing its liabilities or the sum of the debt owed to parties other than shareholders. Net income that a corporation keeps rather than reinvests or uses to settle debt is known as retained profits. Dividend payments are made from the leftover sum to shareholders. The stock that a business has bought back is called treasury stock. You can reserve it to prevent an aggressive takeover by others or sell it later to raise money. Preferred stock, which is categorized separately from ordinary stock under this section, is a form of Equity that certain corporation issue. The market value of the shares has no influence on the par value of the preferred stock, which is given an arbitrary par value (as is common stock, in some situations). By multiplying the par value by the total number of shares issued, the common stock and preferred stock accounts are determined. Additional Paid-In Capital, sometimes referred to as Capital Surplus, is the sum that shareholders have contributed in excess of the common or preferred stock accounts, which is calculated using par value rather than market price. Equity held by shareholders and a company's market capitalization may not always correspond. Paid-in capital, on the other hand, is based on the price at which all of the Equity has been purchased, whereas the former type of capital (i.e., market capitalization) is decided by the stock's current price. Importance of Balance SheetRegardless of the size of a company or the sector in which it operates, a balance sheet provides a number of benefits. First and foremost, financial risk is determined by the balance sheet. This financial statement includes all of a company's assets as well as all of its liabilities. A business can rapidly determine if it has taken on too much debt, if the liquidity of its assets is inadequate, or if it has enough cash on hand to cover immediate expenses. Balance sheets can also be utilized to acquire funding. To obtain a business loan, a firm often has to give a lender a copy of its balance sheet. A company must frequently provide a balance sheet to investors when seeking private equity funding. In all scenarios, the objective of the third party is to assess the financial health, creditworthiness, and capability of the firm to repay short-term loans. All these factors can be gauged by analyzing the balance sheet. Managers can evaluate a company's liquidity, profitability, solvency, and cadence (turnover) using financial measurements listed on a balance sheet. Data from the balance sheet is required for several critical financial ratios. By examining historical trends or making comparisons to other organizations in a comparable industry, managers can better understand how to improve a company's financial health. Last but not least, balance sheets may attract and keep talent. Most workers like to know that their employment is secure and that the business they work for is doing well. Due to the requirement that public companies that trade publicly disclose their balance sheets, employees have the opportunity to assess the amount of cash the company has on hand, whether it is managing debt wisely, and whether they believe the company's financial health is consistent with what they expect from their employer. Issues with a Balance SheetDespite being a crucial piece of information for analysts and investors, there are certain problems with the balance sheet. Due to the static nature of the balance sheet, many financial ratios rely on data from the more dynamic income statement and statement of cash flows to give a more comprehensive picture of a company's activities. Therefore, the balance sheet alone may not always adequately reflect the financial position of a company. Due to its constrained time frame, a balance sheet is restricted. Only the company's financial situation as of a given date is depicted in the financial statement. It may be challenging to determine whether a firm is functioning effectively by looking at a single balance sheet on its own. Consider a business that asserts to have $1,000,000 in cash on hand at the end of the month. Knowing how much cash a firm has on hand has minimal usefulness if there is no context, no comparison, no knowledge of its prior cash balance, and no awareness of operational requirements specific to the industry based on the current or present-day scenario. Using different accounting software and handling depreciation and inventories differently may affect the information shown on a balance sheet. To make the numbers more favourable, managers themselves may try to modify the information manually. To find out which systems are being utilized in their accounting and to keep an eye out for red flags, pay close attention to the footnotes of the balance sheet. Finally, there are a number of professional choices that might affect a balance sheet and have a significant influence on the report. For example, to represent potentially uncollectible accounts receivable, accounts receivable must be continually assessed and updated accordingly. A corporation must estimate and include its best estimate as part of the balance sheet because it does not know exactly what receivables it is likely to collect. There is always the possibility of defaults. An Illustration of a Balance SheetA comparative balance sheet for Apple, Inc. is shown in the image below:

The company's financial situation as of September 2020 and the previous year's financial situation are contrasted in this balance sheet. Each of the two categories in this asset section - current assets and non-current assets - is further subdivided into a variety of accounts. A quick examination of Apple's assets reveals that while their non-current assets rose, their cash on hand shrank. In this illustration, Apple's net worth of $323.8 billion as assets is shown separately near the top of the report. However, its assets in 2019 were around $338.5 billion. Liabilities and Equity for Apple are also reported in this balance sheet, with each item receiving its own section in the latter part of the document. Similar to the assets part, the liabilities section is divided into current liabilities and non-current obligations, with each category showing balances per account. The common stock valuation, retained profits, and cumulative other comprehensive income are all disclosed in the section on total shareholder equity. Apple's total assets are approximately equal to its total liabilities and total equity, indicating a balanced performance of the company. Who prepares the Balance Sheet?Various people could be in charge of creating the balance sheet, depending on the business. A corporate bookkeeper or the proprietor of a small, privately held firm may compile the balance sheet as well. Additionally, an external accountant may review them after they have been internally prepared for mid-sized private companies. On the other hand, publicly traded corporations are obligated to undergo external audits from public accountants. They must also make sure that their records are kept to a far higher level. Generally Accepted Accounting Principles (GAAP) must be followed in the preparation of these firms' balance sheets and other financial statements, which must also be submitted on a regular basis to the Securities and Exchange Commission (SEC). Therefore, these corporations often seek professional accountants to prepare their balance sheets following all approved measures and principles. The Bottom LineThe Balance Sheet emerges as a maestro in the symphony of the financial landscape, guiding the harmonious interaction between assets and liabilities. It accurately reflects the movement of resources, debts and equity to form a clear picture of the financial position of an organization. A view into the heart and soul of a company's financial story is provided by the balance sheet, which, like a masterful artist, weaves together the threads of fiscal life. As the last notes echo, it becomes clearly evident that the balance sheet is more than just a numerical tableau; it is a monument to the tenacity, foresight, and strategic skill that support the complex dance of financial well-being. Knowing that balance sheet and its components, one can understand the financial strength, stability and growth potential of enterprises.

Next Topic5 Companies Owned by Activision Blizzard

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share