Section 1256 ContractA Section 1256 contract is a category of transaction that the Internal Revenue Code (IRC) classifies as a dealership stocks futures market, controlled futures market, foreign currency agreement, non-equity choice, or dealer ownership alternative. A Section 1256 contract differs from other contracts because every agreement owned by the client at the conclusion of the taxable year is considered as it has been purchased for its market value, and profits or losses are regarded as short-term or long-term investment income.

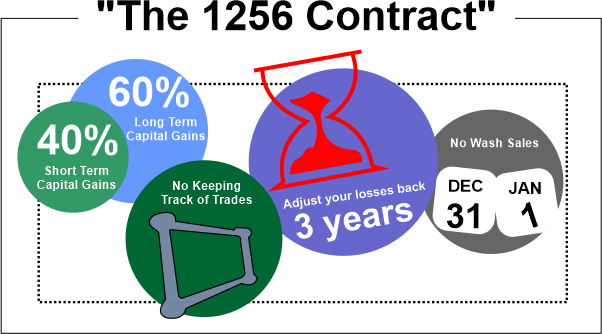

Every regulated futures price, foreign exchange contract, non-equity choice, debt alternative, commodity futures option, currency alternative, dealer equity alternative, and any dealership securities futures contract are all considered 1256 Contracts under Article 1256 of the U.S. Internal Revenue Code. Each 1256 contract is subject to mark-to-market reporting for U.S. federal tax purposes as of the end of each tax year, and such contracts are regarded as having been purchased for their actual market value on that financial year's final business day. Regarding if QQQ, DIA, and SPY futures should be regarded as section 1256 agreements, the Internal Revenue Service (IRS) is unsure. These are considered wealth on the one hand. Understanding Section 1256 ContractsHere is a helpful illustration involving the trading of options: Holding agreements that balance each other's loss risks is the straddling approach. A straddle is what is known as an investment when a trader buys both a call option and a put option for the same investment asset at the exact time. Tax-motivated straddling that would delay revenue and turn short-term investment income into long-term financial profits is prevented under Section 1256 agreements. The IRC's Subdivision A (Taxes On Income), Chapter 1 (Basic Taxation and Excise taxes), Subparagraph P (Capital Profits and Losses), and Part IV (Special Procedures for Assessing Financial Gains and Losses) all contain more extensive data regarding Section 1256 contracts. The IRC is put into effect by the Internal Revenue Service (IRS). Tax BenefitsIrrespective of the holding period, any loss or profit from a 1256 Agreement is regarded for tax reasons as a 40% short-term gain as well as a 60% long-term gain. The profit from any futures contract that does not meet the 12-month minimal holding period requirement for long-term taxes on capital gains will normally be paid at the greater short-term level because the majority of commodity futures are kept for shorter periods of time. Consequently, the classification of the 1256 Contract improves the commercial viability based on the appeal of these goods post-tax. In order to move to the following tax year instead of reimbursing the short-term taxes on capital gains on such roles, traders were diversifying their short-term futures and options (going lengthy and brief at the same moment). This successfully qualified these roles for long-term taxation and was the rationale for the execution of segment 1256. People with a net Section 1256 agreement loss may choose to take it back 3 years (rather than ahead to the next year), beginning with the oldest year, but only up to the amount of a net Section 1256 agreement profit in that year (the rolling back cannot result in a net annual deficit during the year). File Form 1045, Application for Tentative Refund, or an amended return to carry your loss back. Add updated Schedule D (Form 1040) and Form 6781 (Form 6781) for the relevant years. Mark-to-MarketSection 1256 contracts must be understood by traders who trade futures, futures options, and broad-based index options. If held through the conclusion of the tax year, these contracts, as previously specified, must be marked-to-market. Regardless of whether the contracts were sold for a gain or loss, revenue or loss here the actual market value of the agreements should be computed. Despite being unrealized, the mark-to-market gain or loss is required to be disclosed on the dealer's tax return. StraddleIf a taxpayer or linked party holding a position has a significantly reduced risk of loss as a result of having one or more positions, those positions are offsetting and may be a component of a straddle. Other holdings held by the taxpayer, however, won't be considered offsetting with regard to any position that is part of a recognized straddle if it is correctly documented. Form 6781Diversification transactions are managed differently than profit and loss reported by investors for Article 1256 contract assets on Form 6781. The holding duration of the underlying securities does not affect whether a gain or loss is of the longer or shorter period because these agreements are assumed to be sold annually; rather, all profits and losses on such agreements are instead divided into 60% long-term & 40% short-term categories. In other terms, regardless of whether the agreement was only kept for a year or less, Section 1256 agreements require an investor or trader to receive 60% of the gain using the more advantageous long-term tax rate. For instance, on May 5, 2017, a trader purchased a controlled futures contract. He still retains the agreement in his inventory as of the conclusion of the tax year, which is December 31, and it is worth $29,000. He declares a $4,000 mark-to-market gain on Form 6781, which is divided into 60% long-term & 40% short-term capital gains. Occupies and Article 1256 Agreements each have their own areas on Form 6781, so investors must specify the precise sort of investment they used. Section 1256 investment is required in Part I of the application and must specify the precise sort of investment made. Section 1256 investment profits and losses must be reported in Part I of the application using either the real cost the asset was purchased for or the mark-to-market value determined on December 31. The trader's straddle losses must be documented in Section A of the form's Part II, and winnings must be estimated in Section B. Part III is required only if a loss is realized on a stake, but it is supplied for any unrealized gains on holdings retained at the conclusion of the tax year. Who Is Eligible To Submit Form 6781: Profits and Losses from Section 1256 Agreements and Straddles?Mark-to-market regulations require individual income taxpayers to record profits and losses for agreements. Investors must specify the precise kind of investment they used because Form 6781 contains distinct areas for straddles and Section 1256 agreements. Products covered by Section 1256 may also include controlled futures and options, foreign exchange contracts, choices, dealer stock options, or futures markets on dealer assets. For taxation purposes, these assets are deemed to have been sold at year's end. To calculate profits and losses, their reasonable market value is calculated. Straddles & Section 1256 agreement transactions are reported by clients using Form 6781, but offsetting activities are not. For illustration, let's say a trader spent $25,000 on a controlled futures market on May 5, 2019. They still hold the option in their inventory, which is worth $29,000 at the conclusion of the tax year. The mark-to-market gain for this dealer is $4,000.00. On Form 6781, the dealer records this as a 60% long-term and 40% short-term capital appreciation. The dealer trades their major stake for $28,000 on January 30, 2020. The dealer will report a $1,000 loss on their 2020 taxable income (measured as $28,000 less $29,000; classified as a 60% long-term & 40% short-term incurring loss) because they had reported a $4,000 profit on their 2019 tax form. The dealer's straddle liabilities must be recorded in Section A of the form's Section 2, and its straddle gains must be recorded in Section B. Part III is required only if a deficit is realized on a stake, but it is supplied for any unrealized profits on holdings retained at the conclusion of the taxable year. Section 1256 ContractThese are a few rules for the Section 1256 Contract:

If each of the compensating roles that make up a crossing consists of section 1256 agreements to whom this clause provides (and the long position is not a component of a larger long position), then sections 1092, as well as 263 (g) do not pertain with regard to the straddle. Any gains or losses must be accounted for as subject to the tax year.

Next TopicThe 1003 Mortgage Application Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share