Account Analysis DefinitionWhat exactly is an Account Analysis?An account analysis refers to a process of examining the detailed line items in any financial transaction or statement for any specific account by a trained or skilled auditor/ accountant. It is simply a monthly summary that summarizes the financial services given to the company. The statement typically includes the firm's average daily balance as well as the bank charges that the company incurs.

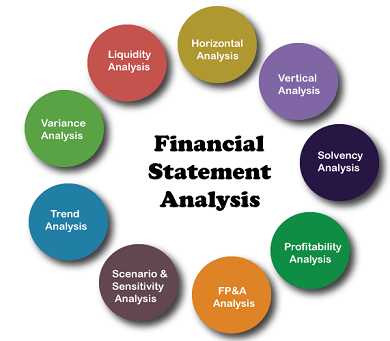

For example, consider an account analysis statement as a corporate invoice; an invoice describes the items or services acquired from that firm. Similarly, the bank gives an individual an account analysis statement, which details the actions or services individuals have received or used on their business checking account. In-Depth Understanding of Account AnalysisFinancial statement analysis examines a company's financial statements for decision-making and understanding an organization's overall health. Financial statements contain financial data, which must be analyzed to be relevant to investors, shareholders, management, and other interested parties. In cost accounting, this is a way for an accountant to examine and analyze a company's cost behavior. The procedure entails investigating cost drivers and categorizing them as either fixed or variable expenses. The cost accountant then calculates the projected variable cost per cost-driver unit or fixed price per period using the company's data. Account analysis in banking is a periodic statement that lists the financial services provided to a firm. The statement is typically delivered monthly and includes all relevant account data, such as the company's average daily balance and bank charges. How does one conduct an Account Analysis in the context of banking?To clarify the formula, each bank determines the Earnings Credit Rate, which is always displayed on an individual's account analysis statement. The Balance to Support Activity is made up of the account's average daily collected balance. Days in month/365 represents the number of days in a calendar month divided by 365 (the total number of days in a year). These combined will equal the earnings credit individuals will receive on their accounts to use toward bank services. The larger the average collected sum in their account, the more likely they will get little to no fee. To determine earnings credit, some banks use the formula below: Earnings Credit Rate X Balance to Support Activity X Days in a Month/365 = Earnings Credit Allowance Please note that the Earnings Credit Rate is determined by each bank and is stated in your Account Analysis Statement. The Average Daily Collected Balance in the account is used to calculate the Balance to Support Activities. What are the types of financial analysis?

Horizontal AnalysisIt compares the financial statements' line items to the previous (or base) year. It compares the data for one time to those for another. It is useful to compare the company's growth year over year or quarter over quarter as its activities expand. The company often operates in the industrial cycle. As a result, if the industry is deteriorating despite the firm's superior performance due to specific industry reasons, this analysis will show negative growth in the company. Vertical AnalysisThe vertical analysis evaluates the income or balance sheet line items by using any line item of the financial statement as a foundation and displaying the results in percentage form. The income statement, for example, presents all line items in percentage form using net sales as the foundation. Similarly, on the asset side, the balance sheet shows all line items as a proportion of total assets. The vertical analysis compares businesses of various sizes by presenting the financial statements in their final form. It only reflects data from a specific period, so it cannot be compared across periods. Trend AnalysisTrend analysis refers to a process of gathering data from several periods and projecting the data on a horizontal line to uncover actionable trends in the supplied data. Trend Analysis is used in finance for stock technical and accounting analysis. Liquidity AnalysisThis short-term analysis is concerned with normal costs. It examines the company's short-term capabilities for day-to-day payments to trade creditors, short-term borrowings, statutory obligations, salaries, etc. Its primary goal is to ensure that adequate liquidity is maintained during the time and that all liabilities are serviced without default. This analysis often uses the ratio analysis approach, which employs numerous ratios such as liquidity, current, quick, and so on. Solvency AnalysisLong-term analysis, also known as solvency analysis, is a kind of study that aims to immediately guarantee the firm's solvency and determine whether the company can pay all long-term responsibilities and obligations. It offers stakeholders confidence in the entity's financial health and existence. Solvency measures such as debt to equity ratio, equity ratio, debt ratio, and so on provide an accurate view of the firm's financial solvency and external debt load. Profitability AnalysisProfitability financial analysis enables us to comprehend how the organization earns income. The investment choice is one of the most important decisions that every businessperson must make to maximize the profit from the project's investment. To ensure the feasibility of choice, they must undertake a profitability study to determine the rate of return over a particular period. This analysis will assist the investor in acquiring confidence in the money's safety. Scenario & Sensitivity AnalysisDepending on the economic situation, various changes in tax structures, banking rates, charges, and so on continue to arise in business days. Each of these attributes has a major financial impact. As a result, the treasury department must undertake a sensitivity analysis for each element and assess its impact on the company's financials. Variance AnalysisAfter completing transactions, the company operates on estimations and budgets. Comparing the budget and assessments to the real ones is also critical. This variance analysis will identify gaps in the process and assist a business in making remedial efforts to avoid them. The standard costing approach may be used to analyze variance by comparing estimated, standard, and actual costs. FP&A AnalysisEvery corporation has a Financial Planning and Analysis (FP&A) department that analyzes the many data points inside the organization and builds the Management Information System (MIS) to report to senior management. The MIS is critical to the firm and may be published and unpublished. Furthermore, such analysis assists senior management in developing preventative policies to help avert catastrophic setbacks. Accounting and Banking Account AnalysisAccount analysis in accounting is highly sophisticated and requires a thorough grasp of the data and the respective firm. It is usually performed by an expert cost accountant, sometimes with the support of corporate management, who is intimately aware of the firm's expenditures. Account analysis in banking is analogous to the statements you receive for your bank accounts. However, if it's for a business account, it's on a much more in-depth and wider scale. How to conduct an Account Analysis in Excel?Account analysis may be performed effectively by itemizing the contents of an account on a single worksheet of electronic spreadsheet software like Excel. One must assign the month's start-to-end dates to any of the worksheet pages. Reconcile the worksheet detail to the account balance. When individuals complete the next account analysis for the same account, they may copy the worksheet contents to a new worksheet, name the page with the new month, and reconcile the account again. Using this method, one may keep a monthly record of the contents of an account for as long as one desire. This is valuable for studying past accounting problems and may be used to respond to auditor queries after the fiscal year ends. Horizontal Analysis Vs. Vertical AnalysisThe vertical analysis examines each line item in the statement as a percentage of a base number. Horizontal analysis, on the other hand, examines how the monetary balances (dollar amounts) in a company's financial statements have changed over time. Consequently, income statement line items may be stated as a percentage of gross sales, while balance sheet line items as a percentage of total assets or liabilities, and vertical analysis of cash flow statement exposes each cash inflow or outflow as a percentage of total cash inflows. Vertical analysis is also known as common-size financial statement analysis. The Bottom LineAccount Analysis is a separate account statement from the normal monthly account statements that detail the charges incurred by the firm as a result of banking services given to the business. The monthly account maintenance charge, the number of deposits, checks paid, remote deposit capture, ACH origination, wire transfers, and other services may be recorded. A thorough Account Analysis Statements provide an organized and simple way to analyze account balances, activity, and charges. This evaluation of financial statements provides a useful result that assists investors and other stakeholders in maintaining their connection with the firm. Experts and analysts utilize a variety of methods to assess financial data. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share