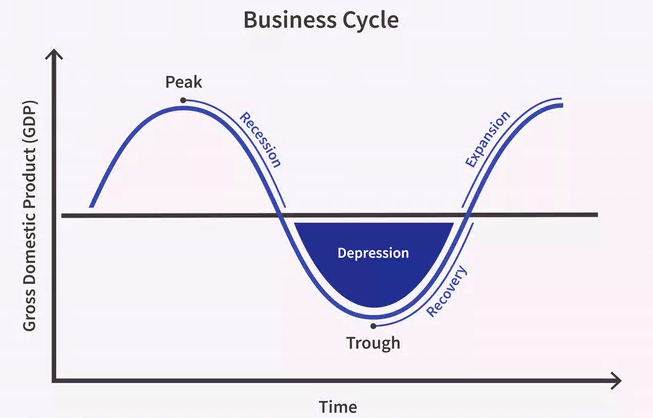

PeakWhat is a Peak?In a business cycle, a peak is the highest point that occurs between the close of an economic boom and the beginning of a downturn. The final month before numerous important economic indicators, such as employment and new housing starts, start to decline, is referred to be the cycle's peak. Real GDP spending is now at its highest position in the economy. The trough, which stands for the low point in a business cycle, is the opposite of the peak, which is the highest point in a business cycle.

Understanding the PeakOne of the four stages of the business cycle is the peak. Recovery/expansion, peak, contraction/recession, and trough are the four phases of the business cycle, which repeat itself without any particular order. Business cycles are dated by the point at which economic activity shifts and are quantified by the amount of time it takes for an economy to transition from one peak to another. The National Bureau of Economic Research (NBER), which sets the official dates of the peaks and troughs in U.S. business cycles, follows so because different economic indicators fluctuate at different times. For instance, the NBER declared on June 8, 2020, that the U.S. economy peaked in February 2020. The announcement of the peak marked the conclusion of the U.S. economy's 128-month boom, making it the longest in the country's history by eight months. How to measure a Peak?A peak often refers to the culmination of any cycle. The maximum point in a wave or an alternating signal is what the phrase "peak" refers to in physics. A peak, as used in economics and finance, represents the apex of a market cycle for goods or services. Real gross domestic product (GDP) is the primary metric used to assess business cycles, but real income, employment, and industrial production data are also taken into account. Economic expansions are determined by the rise in GDP from a cycle's low point to its high point, and contractions are determined by the fall in GDP from the high point to the low point.

The length of the economic cycle is determined by the distance between peaks and troughs. The typical U.S. business cycle has lasted six years from peak to peak since the end of World War II. When statistics dating back to 1860 are included, business cycles now run an average of 4 to 5 years, which is longer than in the past. The longest peak-to-peak cycle lasted over ten years, from 2009 to 2020, while the shortest lasted 18 months, from 1980 to 1981. In addition, three of the five peak-to-peak cycles that lasted more than 100 months did so after the 1980s. Reasons behind Business CyclesThe reasons for the economic cycle and whether it is necessary for it to happen at all are hotly contested topics. The importance of fiscal policy and the desire of policymakers for robust growth to maintain popular support are both undeniable. An economy produces positive growth in output and employment when it is in an expansion phase. In general, people will benefit from this as more employment equals more options. However, once the expansion achieves its peak growth and the economy develops, it might overheat. This is typically indicated by rising inflationary pressures. The cycle may restart from this point for a number of different reasons. The Federal Reserve frequently raises interest rates to stifle inflation by slowing consumer and investment expenditure. As a result, the economy may experience a time of decline as growth slows. Even though they result in job losses and require firms and households to undergo periods of adjustment, these recessions typically have manageable sizes. A more dramatic and uncontrollable correction that triggers a financial crisis can occur in more extreme circumstances, especially when the growth phase is brought on by too much credit. A particularly severe recession can be brought on by a significant increase in debt and speculative investment, as was the case during the recession of 2008-2009. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share