Liability DefinitionA liability is a financial debt that an individual or organization owes. In the end, liability is discharged by the transfer of economic advantages like money, goods, or services.

The balance sheet's right side is usually occupied by liabilities, which are made up of debts, including loans, accounts payable, mortgages, deferred income, bonds, warranties, and cumulative expenses. Liabilities and assets can be contrasted. Liabilities are things you owe money to or that you possess, whereas assets are things you own or have borrowed. Workings of LiabilitiesIn general, a liability is an obligation between two parties that hasn't been met or settled. However, it is more specifically defined by past commercial dealings, occasions, sales, trades of goods or services, or anything else that will provide income in the future. Due to the fact that they are expected to endure longer than a year, non-current liabilities are sometimes seen as long-term obligations (12 months or greater). Liabilities can be categorized as either current or non-current depending on their temporality. They can be obligations to deliver services in the future (such as a short- or long-term loan from a bank, an individual, or another entity) or obligations from a previous agreement that have not yet been fulfilled. Typically, the biggest liabilities-like accounts payable and bonds payable-are the most common. Most organizations will include these two line items on their balance sheet because they are a part of their current and long-term operations. Liabilities are a vital part of any organization because they help to pay for operations and large expansions. Additionally, they can enhance the efficiency of contracts between businesses. For instance, while delivering a case of wine to a restaurant, a wine distributor normally won't ask for payment. Instead, it sends the eatery an invoice to make payment easier and hasten drop-off. In this scenario, an obligation is an unpaid balance the restaurant owes to its wine supplier. On the other hand, the wine supplier views the money it owns as an asset. Additional Defined Terms of LiabilityLiability can refer to any amount of money or service owing to another party and generally relates to being accountable for anything. Tax responsibility, for instance, can apply to the federal income tax a homeowner owes or the property taxes he owes to the local government. A business that receives sales tax from a customer has a sales tax liability on its books before forwarding the money to the county, city, or state. In a civil action, one's prospective damages are another example of liability. Liabilities TypesBusinesses divide their responsibilities into current and long-term obligations. Obligations that must be paid over a longer time frame than current liabilities are referred to as long-term liabilities. A 15-year mortgage, for instance, a company takes out, is a good illustration of long-term debt. Short-term liabilities of the balance sheet are where mortgage payments due this year are recorded because they constitute the current element of long-term debt. Near-Term (Current) LiabilitiesIdeally, analysts seek to confirm that a company will have enough cash on hand to pay its present responsibilities in the upcoming year. Payroll costs and accounts payable, which comprise money owing to vendors, common utilities, and similar expenses, are a few instances of short-term liabilities. Other examples include:

Long-Term (Noncurrent) Liabilities

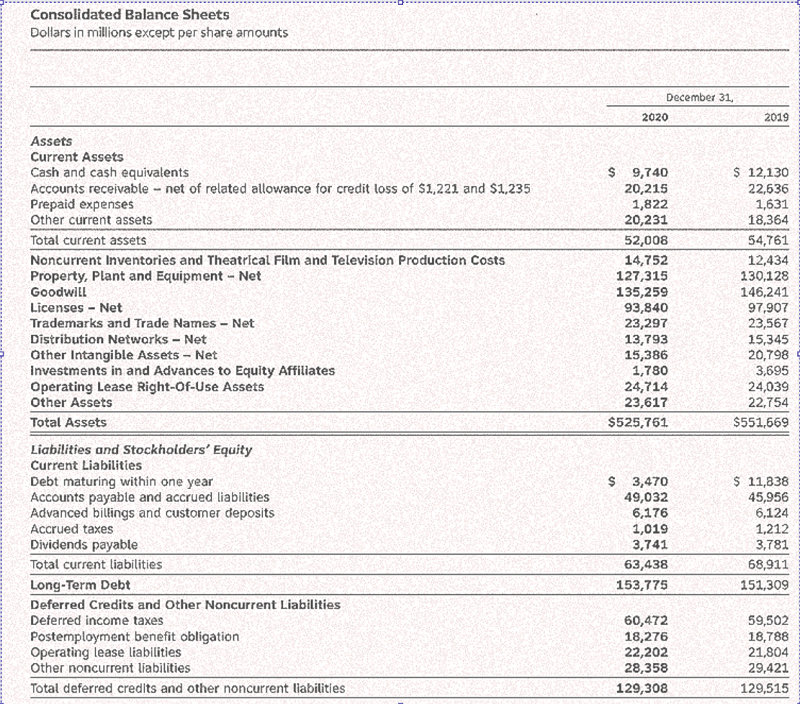

Given the name, it should be obvious that any debt that isn't due right away belongs in the category of non-current liabilities, which are expected to be paid off in a year or more. Using AT&T as an example once more, you can see that there are more products offered there than at a typical company, which might just feature one or two. The largest burden and first on the list are normally the bonds payable, often known as long-term debt. Companies of all sizes borrow money to fund a portion of their long-term operations from the parties that purchase their bonds. This line item is ever-changing as bonds are issued, mature, or are called back by the issuer. Analysts want evidence that long-term obligations may be settled with assets acquired from upcoming revenues or financing deals. Companies may have other long-term liabilities besides bonds and loans. Long-term liabilities can include commitments for rent, deferred taxes, salaries, and pensions. Other illustrations include:

Assets vs LiabilitiesThe things a corporation possesses or is due are referred to as its assets. These consist of both tangibles like buildings, machinery, and equipment as well as intangibles like unpaid bills, accrued interest, patents, or other forms of intellectual property. The difference left over after subtracting a company's liabilities and assets is its owner's or stockholders' equity. This connection can be stated as follows: Assets - Liabilities = Owner's Equity However, this accounting equation is typically expressed as follows: Liabilities + Equity = Assets Liabilities vs ExpensesAn expense is a business's operational cost incurred to produce income. Unlike assets and liabilities, expense payments are linked to revenue, and both are displayed on an organization's income statement. Essentially, net income is determined with the help of expenses. The net income is calculated as revenues minus expense costs. For instance, if a business has been losing money for the last three years and its expenses have exceeded its revenues, this may indicate insufficient financial stability. Liabilities and expenses should not be conflated. The first appears on a company's balance sheet, whereas the second is on its income statement. Example LiabilitiesLet's look at a historical example utilizing AT&T's (T) 2020 balance sheet to illustrate how to grasp a company's liabilities.

Suppose the balance sheet separates current and short-term liabilities from long-term and non-current liabilities. Under current liabilities, AT&T identifies the bank debts with a maturity of less than a year. For a business of this size, operating capital is commonly employed for ongoing expenses rather than long-term debt for financing more significant purchases. Liabilities are often carried at cost rather than market value and, as long as they are categorized, can be listed in the order of preference under generally accepted accounting principles (GAAP). The AT&T sample has a relatively high debt amount under current obligations. Smaller businesses will have higher current debt commitments due to additional line items like accounts receivable and various future responsibilities like wages. Since they cover daily operations, AP often has the greatest balances. Services, raw materials, office supplies, and any other classes of goods and services for which no promissory note is issued can be included in AP. AP is comparable to a pile of unpaid bills because most businesses do not pay for goods and services as they are purchased. How can I tell whether a specified action is a Liability?A liability is something that is owed to, borrowed from, or bound to another party. It can be real (like an outstanding bill) or fictitious (e.g., a possible lawsuit). It's not necessary for liability to be a bad thing. For instance, a company may take on debt (a liability) to grow and prosper. Or, someone could obtain a mortgage to purchase a home. How do Long-Term (Noncurrent) Liabilities differ from Current Liabilities?Companies usually separate their liabilities according to their time horizon when they become due. Current liabilities are represented as the due within a year and are frequently paid for through the current assets. Non-current liabilities are due for more than one year and mostly involve debt repayments and deferred payments. How do Assets and Equity relate to Liabilities?According to the accounting formula, assets equal liabilities plus equity. The equation can also be written as liabilities = assets - equity. A company's total liabilities will equal the difference between its total assets and shareholders' equity. An increase in obligations without a similar asset increase must cause a decline in the company's equity position. Understanding the Contingent LiabilityA contingent liability is a liability that may occur but only needs to be paid in the future because of unresolved issues, which makes it a possibility but not a certainty. Litigation and lawsuit threats, including unused gift cards, product warranties, and recalls, are the most frequent contingent liabilities. What kinds of liabilities can people or households have?Like corporations, a person's or a household's net worth is calculated by weighing their assets and liabilities. Liabilities for the majority of households will include money owed in taxes, bills that must be paid, rent or mortgage payments, money owed for loan interest and principal, and so forth. If you receive advance payment for providing a service or performing work, the job owing could also be considered a liability.

Next TopicLimited Company (LC)

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share