Debt-Service Coverage Ratio (DSCR): How To Use and Calculate ItUnderstanding Debt Service Coverage Ratio (DSCR)In terms of personal, public, and corporate finance, the debt-service coverage ratio is very crucial. The debt-service coverage ratio (DSCR), a measure of a company's ability to generate enough cash flow to pay down current debt obligations, is mainly used in corporate finance. Investors can see from a company's DSCR whether it generates enough revenue to meet its obligations.

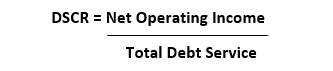

A common measure of a company's financial health, particularly for heavily leveraged and indebted companies, is the debt-service coverage ratio. The ratio contrasts a company's operational revenue with its debt commitments, including principal repayments and some capital leasing contracts. Different DSCR measures will be the focus of various lenders, stakeholders, and partners. Moreover, a company's background, sector, product pipeline, and previous connections with lenders are all such statistics that are indirectly observed through DSCR. While DSCR restrictions are frequently incorporated in loan agreements, external parties may be more sympathetic during seasonal operations when a company's income is changeable. Formula and Calculation for DSCRIt is the ratio of the entity's total debt service to net operating income. Revenue less (minus) certain operating expenses (COE), excluding taxes and interest payments, equals a company's net operating income. The formula for calculating DSCR is defined below:

Where: Net Operating Income = Revenue - COE COE = Certain Operating Expenses Total Debt Service = Current Debt Obligations Non-operating income is accounted for when calculating EBIT (earnings before interest and taxes) in certain estimations. When a lender, investor, or management determines the creditworthiness of numerous firms, compares different years or quarters, or uses DSCR to evaluate their own performance, it is critical to utilize consistent criteria. Lenders may compute DSCR in a variety of ways, and borrowers should be aware of this possibility. All interest, principal, sinking fund and lease payments that are due in the upcoming year are included in the total debt service. The term "outstanding debt" can also refer to commitments that are now due. On a balance sheet, this will show up as both short-term debt and the current portion of long-term debt. Income taxes make DSCR calculations more challenging since interest payments are tax deductible, but principal repayments are not. Therefore, the following formula is a more precise method to determine total debt service: TDS = (Interest × (1 - Tax Rate)) + Principal Where: TDS = Total Debt Service Excel Formula for DSCR CalculationYou can't just run an equation that splits net operating income by debt service to build a dynamic DSCR calculation in Excel. The labels of the next two cells, A2 and A3, should instead record "net operating income" and "debt service". Then, you would enter the corresponding numbers from the income statement in cells B2 and B3, which were next to those cells. By replacing the B2 and B3 cells with their real numerical values (e.g., B2 / B3), enter the DSCR formula in a new cell. This will calculate the values mathematically. It is ideal to utilize a dynamic formula that can be changed and computed automatically, even for a straightforward computation. Comparing a company to others in the sector is one of the main goals of calculating DSCR, and comparisons can be made more quickly if the statistics are readily available. What can the DSCR inform you?No matter the context-corporate finance, public finance, or personal finance-the debt-service coverage ratio shows the ability to pay debt given a certain amount of revenue. Net operating income is expressed as a multiple of all debt payments, including principal, interest, sinking funds, and lease payments, all of which are due within a year, according to the ratio. Considerations for LendersThe DSCR, as used in government finance, is the amount of export revenue a nation requires to cover its yearly principal and interest payments on its foreign debt. In the context of personal finance, bank loan officers utilize this ratio to determine income property loans. The macroeconomic environment may impact the minimal DSCR a lender may need. When the economy is expanding, credit is easier to obtain, and lenders could be more understanding of lower ratios. The economy's stability may also be impacted by a propensity to lend to borrowers who are less qualified. It might be argued that this was the situation before the financial crisis of 2008. With little examination, subprime borrowers could access credit, particularly mortgages. When these debtors started making mass defaults, the financial institutions that had provided them with financing failed. Analyzing DSCR ResultsBefore accepting a loan, a lender frequently assesses a borrower's DSCR. A DSCR below 1 shows negative cash flow, meaning that the borrower will need to incur more debt to pay off existing obligations. For instance, a DSCR of 0.95 means that net operating income can only cover 95% of yearly debt payments. This would mean that the borrower would have to utilize their own funds each month to maintain the project's financial viability. Lenders frequently disapprove of negative cash flow; however, some provide it if the borrower has significant resources in addition to income. If the debt-service coverage ratio is too close to 1, for example, 1.1, a slight decrease in cash flow might prohibit a corporation from being able to pay its obligations. Lenders may, in certain cases, demand that the borrower maintain a particular minimum DSCR during the loan's term. In some agreements, if a borrower's balance falls below that amount, they are said to be in default. An entity, be it an individual, corporation, or government, with a DSCR greater than 1 is considered to have sufficient income to pay its current debt obligations. DSCR vs. Interest Coverage RatioThe interest coverage ratio indicates the likelihood that a company's operating profits will be enough to cover all of the interest payable for a given period. This is determined annually and shown as a ratio. To calculate the interest coverage ratio, one may divide the EBIT for the specified period by the total of the interest payments due for the same duration. By subtracting overhead and operating expenses from sales, such as rent, the cost of goods, freight, wages, and utilities, the EBIT, also known as net operating income or operational profit, is calculated. This figure shows the amount of cash that is left or available for running the company's operations after all expenses have been subtracted. An organization's higher EBIT-to-interest ratio represents the potential strength of its financial position. This metric includes interest payments but excludes any possible principal payback requirements from lenders. A bit more detail is put into the debt service to income ratio. This metric assesses a company's ability to cover sinking fund payments along with the required minimum principal and interest payments for a certain time period. DSCR is calculated by dividing the total principal and interest payments required over a given time to generate net operating income by EBIT. The DSCR takes principal payments into account in addition to interest payments, making it a little more trustworthy indicator of a company's financial health. A company with a debt-service coverage ratio below 1.00, in either case, will not generate enough revenue to meet its minimum debt commitments. This is a risky concept for the management of a business or investment since even a brief period of below-average revenue might result in disaster. Benefits and Drawbacks of DSCRBenefits of DSCRDSCR, like other ratios, has various applications and benefits when measured consistently throughout time. A company can determine its monthly DSCR in order to analyze its average trend over time and predict future ratios. For instance, a declining DSCR may be a red flag for a company's financial viability. Instead, it could be extensively used while planning or creating a budget. Additionally, DSCR may be a significant indicator of judging a company's value across different industries. DSCR estimates may be used by management to compare its performance to that of its competitors, as well as to determine how well those competitors may be utilizing loans to support corporate development. The DSCR is a more precise analytical method for assessing a company's long-term financial health. Compared to the interest coverage ratio, DSCR is a more thorough and careful calculation. The DSCR is an effective annualized ratio that typically represents a change throughout the 12-month period. Although other financial measures frequently give a unified view of a company's health, DSCR is rather considered a more true depiction of a company's activities. Drawbacks of DSCRIt is possible to modify the DSCR calculation to take into account net operating income, EBIT, or EBITDA (depending on the lender's requirements). The company's income may be overestimated if operating income, EBIT, or EBITDA is employed since not all costs are considered. For instance, income is not included in taxes in any of the three scenarios. The DSCR's reliance on accounting advice is another drawback. DSCR is largely determined using accrual-based accounting principles, despite debt and loans fundamentally being dependent on required cash payments. As a result, there is some contradiction when comparing a set of financial statements prepared in accordance with GAAP (Generally Accepted Accounting Principles) with a loan arrangement that calls for predetermined cash payments.

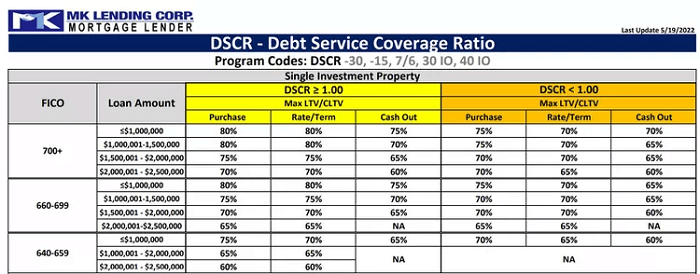

Example of DSCRLet's imagine a property developer trying to get a mortgage loan from a nearby bank. To ascertain the developer's capacity to borrow and repay the loan when the rental properties they construct produce money, the lender will need to compute the DSCR. Suppose the lender roughly calculates that the debt service will be $350,000 per year while the developer separately informs that the annual net operating income will be $2,150,000. Given the borrower's operational revenue and the calculated DSCR of 6.14x, the developer should be able to pay off the debts more than six times over. DSCR = $2,150,000 / $ 350,000 = 6.14 Sample (Instance) of Lender TermsLet's say MK Lending Corporation describes its loan specifications for brand-new mortgages in the example chart below:

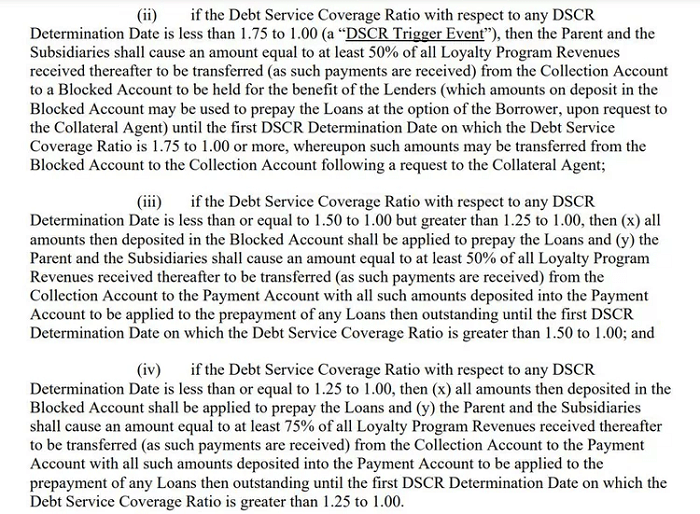

Investors with a DSCR of at least 1.0 are represented by the yellow-highlighted columns, while the orange-highlighted columns represent those with a DSCR of less than 1.0. The loan terms and LTV/CLTV terms for the yellow investors are better than those for the orange investors since they carry less risk. Sample (Instance) of Loan AgreementIn the example below, Sun Country, Inc. signed a contract with the Bank of New York Mellon and the U.S. Department of Treasury. The loan and guarantee arrangement included several financial conditions that Sun Country agreed to. As shown in the instances below, specific trigger events will occur if Sun Country's DSCR drops below a particular mark. Certain stopgaps will be used to safeguard the lenders when triggers happen. For instance, if Sun Country's DSCR falls below 1.00 for a specified period of time, the lenders will get 50% of a certain income.

The DSCR's ImportanceWhen businesses and banks negotiate loan agreements, the DSCR is a frequently utilized measure. For instance, a business applying for a line of credit could have to keep its DSCR over 1.25. If it doesn't, it could be found that the borrower has violated the terms of the loan. DSCRs typically help analysts and investors evaluate a company's financial health and can help banks manage their risks. How is the Debt Service Coverage Ratio (DSCR) calculated?Net operating income is divided by total debt service to determine the DSCR (which includes the principal and interest payments on a loan). A company's DSCR, for instance, would be around 1.67 if it had a net operating income of $100,000 and a total debt servicing cost of $60,000. What makes a strong DSCR?A "good" DSCR will vary depending on the sector, rivals, and business development stage. For instance, a smaller company that is just beginning to generate cash flow may have lower DSCR expectations than a more mature, more established company. However, a DSCR of 1.25 is typically seen as "strong", but ratios below 1.00 may indicate the firm's financial issues. The Bottom LineThe DSCR, a widely used financial ratio, evaluates a company's operating income in relation to its debt service costs. The ratio can be used to assess a company's capacity to use its income to meet its main and interest obligations. To reduce risk in loan conditions, lenders and other parties frequently adopt operational criteria using the DSCR.

Next TopicHow to Accept Credit Card Payments

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share