Accumulated Depreciation: Everything You Need To KnowUnderstanding Accumulated DepreciationDepreciation is the process of spreading out a tangible asset's cost over the course of its useful life. The total amount of depreciation applied to an asset since it was purchased and put into use to date is known as Accumulated Depreciation. A contra-asset account with a credit balance is deducted from the asset's cost to determine an asset's net book value and the accumulated depreciation.

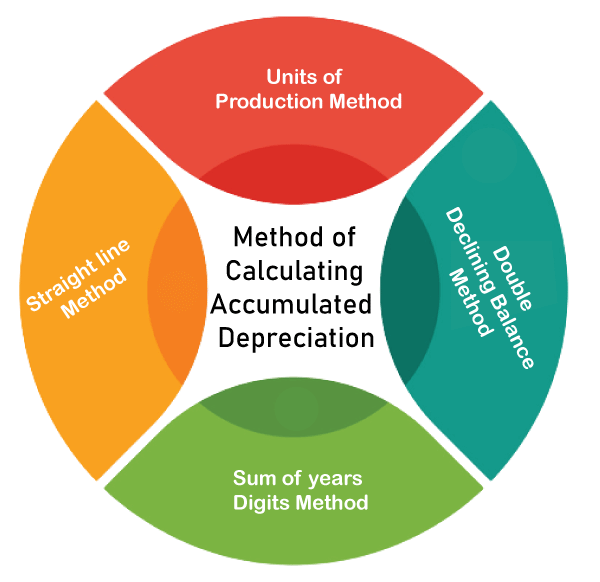

The matching principle, dictated by generally accepted accounting principles (GAAP), states that expenses must be attributed to the same accounting period as the appropriate revenue is realized. Each year an asset is used, a business will write off a percentage of its value through depreciation. This means that the cost of using up a capitalized asset is recorded every year it is put to use and generates income. Accumulated depreciation is the cumulative amount of depreciation that has been applied to an asset up to a specific point. Each period's depreciation expense adds to the starting cumulative depreciation amount. The carrying value of a purchase on the balance sheet is calculated by deducting its total depreciation from its original cost. The salvage value of an asset at the end of its useful life will be equal to its carrying value on the balance sheet. How does accumulated depreciation work?While documenting depreciation in the general ledger, a business credits accumulated depreciation and debits depreciation expense. Depreciation expense is added to the income statement when it is incurred. Accumulated depreciation is displayed on the balance sheet beneath the corresponding capitalized assets line. The accumulated depreciation balance is increased over time by the depreciation expense recorded in the current period. Purpose of Accumulated DepreciationAccumulated depreciation accurately and transparently depicts an asset's worth on a company's balance sheet. To do this, one needs to find the asset's net book value by deducting the asset's cost from the cumulative depreciation. Depreciation is used to spread out the expense of a tangible item throughout its useful life. This is crucial because most assets, including structures, tools, and vehicles, depreciate over time due to damage, obsolescence, or other circumstances. Instead of recognizing the entire cost of these assets in one year, depreciation enables a business to spread the expense throughout the assets' useful lives. As a result, costs and revenues are better matched, which supports accrual accounting's core principle. For financial reporting purposes, accumulated depreciation is also crucial. It gives stakeholders, including investors, a clearer view of the assets and values of a company. Additionally, it makes it possible to calculate metrics like return on assets-a critical performance indicator that gauges a company's profitability about its asset investment-more precisely. How to calculate Accumulated Depreciation?It symbolizes a loss in an asset's worth brought on by usage, aging, and wear and tear since the asset was put into use. Financial accounting requires the calculation of accumulated depreciation since it is used to estimate an asset's book value, which is the asset's initial cost less its accumulated depreciation. Here are the steps to calculate accumulated depreciation: Step 1: Determine the Original Cost of the Asset The asset's initial cost consists of its actual cost plus any further expenses to put it into use. This cost on the balance sheet represents the initial value of the asset. Step 2: Determine the Useful Life of the Asset The estimated time frame over which the asset is anticipated to be employed by the company before it becomes unusable or worn out is known as the asset's useful life. This is often decided by the manufacturer or based on the company's past performance. Step 3: Determine the Salvage Value of the Asset The item's estimated value at the end of its useful life is known as the salvage value. This is an estimate of the asset's worth following total depreciation. Step 4: Determine the Depreciation Method to be Used Depreciation can be calculated in various methods, including straight-line, declining balances, sums of years, and units of production. The most popular technique is the straight-line method, which allocates the same depreciation expense for each year of an asset's useful life. Step 5: Calculate the Annual Depreciation Expense One needs to divide the result of deducting the salvage value from the asset's initial purchase price by the asset's useful life to determine the annual depreciation costs. The formula can be written as: Annual Depreciation Expense = (Original Cost - Salvage Value) / Useful life Step 6: Calculate the Accumulated Depreciation To calculate the accumulated depreciation, multiply the annual depreciation expense by the years the asset has been in service. The formula can be written as: Accumulated Depreciation = Annual Depreciation Expense x Number of Years of Service Different Methods for Calculating Accumulated Depreciation

We will discuss the different methods for calculating accumulated depreciation. Straight-Line MethodThe straight-line method is the most straightforward and typical approach for computing accumulated depreciation. This technique depreciates an item by the same amount each year for its useful life. The straight-line method's formula for computing accumulated depreciation is: Accumulated Depreciation = (Cost of Asset - Salvage Value) ÷ Useful Life Units of Production MethodThe unit of production method bases its depreciation calculations on the asset's usage. This approach first calculates the difference between the asset cost and the salvage value and then divides the result by the calculation of the multiplication value of estimated total production and actual production. The unit of production method's formula for computing accumulated depreciation is: Accumulated Depreciation = (Cost of Asset - Salvage Value) ÷ Estimated Total Production × Actual Production Double Declining Balance MethodAn accelerated depreciation approach known as the double declining balance method assesses more depreciation in the early years of an asset's life and less in the later years. The asset is depreciated by a specified percentage of its book value each year using this approach, which doubles the straight-line depreciation rate. The formula for calculating the accumulated depreciation in the double-declining balance method is written as follows: Accumulated Depreciation = (Cost of Asset - Accumulated Depreciation) × Depreciation Rate The Sum of Years Digits MethodAnother accelerated depreciation approach is the sum of years digits method, which assesses greater depreciation in the initial years of an asset's life and lesser depreciation in later years. This method bases the depreciation rate on the total number of years that the purchase will be serviceable. The formula for accumulating depreciation using the method of the sum of the years' digits is: Accumulated Depreciation = (Cost of Asset - Salvage Value) × Depreciation Rate Suppose that the company ABC purchased a piece of equipment with a five-year useful life. The asset has a $15,000 depreciable base. The investment has a five-year useful life; the total number of years is 15 (5+4+3+2+1). The depreciation rate is then calculated as the inverse year number divided by 15 (e.g., Year 1 = 5, Year 2 = 4, Year 3 = 3, etc.). Depreciation will be recognized by the corporation as $5,000 ($15,000 * (5/15)) in Year 1 and as $4,000 ($15,000 * (4/15)) in Year 2. Accumulated Depreciation and Accelerated DepreciationIn accounting, the value of fixed assets over time is determined using both accelerated and accumulated depreciation. Despite the fact that both approaches deal with the depreciation of assets, they differ significantly. The total depreciation that has been applied to an asset throughout its useful life is referred to as accumulated depreciation. It is computed by deducting the asset's original cost from the asset's book value. An asset's book value is the actual cost less the total amount of depreciation. Accumulated depreciation is a contra-asset account that lowers the asset's value on the balance sheet. On the other hand, accelerated depreciation is a way of calculating depreciation that causes a bigger expense in the early years of an asset's life and a lesser cost in the later years. Rapid depreciation is a term used to describe how quickly assets depreciate in the first few years of their life. The decreasing balance approach and the sum-of-the-years'-digits method are the two most widely used techniques for accelerated depreciation. The decline in balance in an accelerated depreciation technique is one in which the annual depreciation expense is determined by multiplying the asset's book value by a fixed rate. According to this strategy, the cost associated with depreciating an asset is greater in the early years of its existence and reduces as the asset ages. Another accelerated depreciation method that causes a larger depreciation expense in the first few years of an asset's life is the sum-of-the-years'-digits approach. By dividing the asset's depreciable cost by a certain percentage, this method determines the depreciation charge. The denominator of the fraction is the sum of the digits of the asset's useful life, and the numerator is the number of years the asset has left in its useful life. In short, both accumulated and accelerated depreciation are important ideas in accounting for fixed assets. The amount of depreciation that has been added to an asset over its useful life is known as accumulated depreciation, and it lowers the asset's value on the balance sheet. Accelerated depreciation is a way of figuring out depreciation that results in a larger depreciation expense in the first few years of an asset's life to reflect the fact that assets depreciate more quickly in the first few years. The two most used accelerated depreciation procedures are the decreasing balance method and the sum-of-years'-digits approach. Example of Accumulated DepreciationConsider a scenario where a business spends $50,000 to purchase a delivery truck with a 5-year lifespan and a $10,000 salvage value. Since the company depreciates its assets using the straight-line technique, its annual depreciation expense is constant. With this knowledge, the annual depreciation cost would be ($50,000 - $10,000) / 5 = $8,000 for the property. As a result, the total depreciation after the first year would be $8,000. The truck's total depreciation would be $16,000 after the second year, and so on, until the end of its useful life. The truck's net book value at the end of the first year would be $42,000 ($50,000 - $8,000), and its cumulative depreciation would be $8,000 at that time. The accumulated depreciation would be $16,000 at the conclusion of the second year, and the net book value would be $34,000 ($50,000 - $16,000). The truck's net book value at the end of its useful life would be $10,000 ($50,000 - $40,000), and its total depreciation would be $40,000. The truck would have completely lost value by this time, and the accumulated depreciation would be equal to the original cost, less the anticipated salvage value. The Bottom LineThe total amount of depreciation or depletion charged to a fixed asset over the course of its useful life is represented by the accounting concept known as accumulated depreciation. It is important in figuring out an asset's net book value and is used to determine whether there was a gain or loss when the purchase was sold. A wide variety of fixed assets, including structures, machinery, intangibles, and natural resources, are subject to accumulated depreciation. Accurate financial reporting depends on properly accounting for accumulated depreciation because it impacts the company's income statement and balance sheet. It's critical for any business owner or accountant involved in asset management and accounting to comprehend how accumulated depreciation works.

Next TopicAccumulated Dividend

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share