Goods and Services Tax (GST): Definition, Types, and How It's CalculatedThe Goods and Services Tax, or GST, is an indirect tax that has mostly superseded other indirect taxes in India, like the excise duty, VAT, and services tax, which came into effect on July 1st, 2017. The Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax applied on all value additions. GST is imposed on the supply of goods and services, and it is a single domestic indirect tax law that applies to the whole nation.

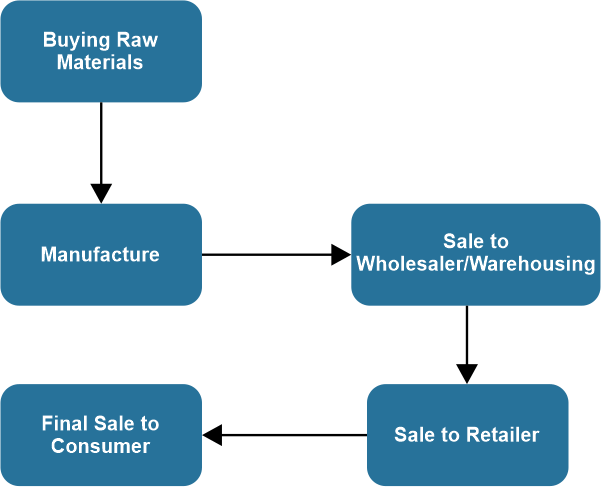

Let us now examine more about GST in detail: Concept behind GSTMulti-StageThroughout the whole supply chain, from the point of production to the point of end sale to customers, a product changes hands numerous times. Consider the key steps listed below:

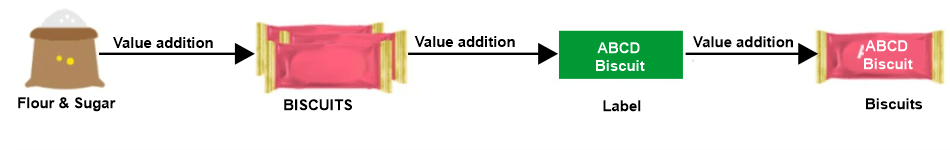

GST is charged on each of these levels, making it a multi-stage tax. Value AdditionSuppose a biscuit-making company purchases ingredients, including flour and sugar. By combining sugar and flour and baking the mixture into cookies, the value of the inputs rises. Following this, the maker sells the cookies to the warehousing agent, who packages and labels huge amounts of cookies in boxes. This gives the cookies additional value. It is then sold to the retailer by the warehousing agent.

The cookies are packaged in smaller quantities by the retailer, who also makes advertising investments to raise the cookies' value. GST is charged on these value additions as well, which are the monetary values added at every step to result in the ultimate sale to the end consumer. Destination-BasedConsider products that were produced in State A and sold to a customer in State B. Because the GST is charged at the point of consumption, the whole tax revenue will go to State B, not State A. Objectives of GSTTo Eliminate the Cascading EffectThe elimination of the cascade effect was one of the main aims of the GST. Formerly, taxpayers were unable to offset the tax credits from one tax against another due to disparate indirect tax legislation. For instance, excise charges paid during manufacturing could not be offset against VAT payable during the sale resulting in a tax-cascading effect. The GST tax is only levied on the net value added at each supply chain phase, and it has enabled the elimination of the tax cascade effect and the smooth flow of input tax credits across both products and services. To Attain the 'One Nation, One Tax' IdeaThe GST has taken the place of several indirect levies that were part of the former tax regime. The tax administration is facilitated since the central government establishes the tax rates and regulations. Additionally, tax compliance is improved because individuals are not burdened by numerous return forms and deadlines. Overall, it is a unified system for complying with indirect taxes, and the benefit of having a single tax is that each state applies the same rate to specific goods or services. To Include the Majority of India's Indirect TaxesPreviously, several indirect taxes were levied at different phases in the supply chain. States and the federal government each controlled different types of taxation, and there wasn't a single, centralised tax that applied to services and goods. Therefore, GST was implemented, where all the significant indirect taxes were united into a single tax under the GST. It has largely decreased the taxpayers' compliance burden and made it simpler for the government to administer taxes. To Curb Tax EvasionGST laws are significantly stricter than any former indirect tax legislation. Under GST, input tax credits can only be claimed on invoices uploaded by their suppliers, which reduces the potential of getting input tax credits on fraudulent invoices, and the goal is strengthened even further with the advent of e-invoicing. Also, because GST is a nationwide tax with a centralised surveillance system, finding defaulters is much faster as well as more efficient, and it has consequently reduced tax evasion and tax fraud. To Increase the Taxpayer BaseGST has helped in the expansion of India's tax base. Prior to this, the registration threshold for each tax law was varied and was based on turnover. Since the GST is a unified tax levied on goods and services, the number of tax-registered firms has grown. Also, stringent legislation governing input tax credits has helped bring certain unorganised sectors into the tax net. Take the construction sector, for instance. Online Procedures for Making Business EasierBefore, taxpayers encountered numerous difficulties while dealing with various tax agencies under each tax law, where, even though return filing was done online, most of the evaluation and refund processes were done offline. GST processes are now almost fully conducted online, where registration, return filing, refund requests, and the creation of e-way bills can all be made with the press of a button. It has significantly facilitated taxpayer compliance and the ease of conducting business. To Encourage Competitive Pricing and ConsumptionDue to the tax cascading effect of the former regime, commodity prices in India were higher than in the international market and also between states, resulting in procurement imbalances due to lower rates of VAT in some states. There was a rise in consumption and indirect tax revenues after GST was implemented. The uniformity of GST rates has enabled keeping prices competitive both within the country as well as internationally, and it also boosted consumption and generated larger income, attaining another significant goal. Advantages of GSTThe GST has largely eliminated the cascading effect on the sale of goods and services. The elimination of the cascade effect has had an effect on the cost of goods, where the cost of goods falls as a result of the removal of several taxes. Also, GST is largely driven by technology, and all functions, such as registration, return filing, refund application, and response to the notice, can be performed online on the GST portal, which speeds up the processes. Some other notable advantages of GST are as follows:

Different GST Tax Types

The type of GST tax is defined based on the kind of transaction. It is often defined as below: Inter-State TransactionIt involves a transaction between two states; as an illustration, a supplier from State A sends iron ore to a customer in State B, and the GST collected is split between the Central and State governments (State of consumption). Intra-State TransactionAn intra-state transaction is one that takes place within a state. For instance, a firm in a State might deliver 1 tonne of iron ore to a customer nearby, and the GST is subsequently diverted to the Central and State governments. Components of GSTThere are mainly three categories of GST depending on the type of transactions. SGSTIntra-state sales of goods and services are subject to SGST (short for State Goods and Service Tax), and the state government where the transaction takes place receives the money collected. A Union Territory Goods and Services Tax, or UGST, substitutes SGST in union territories. CGSTWithin-state sales of goods and services are subject to the CGST (short for Central Goods and Service Tax) tax levied by the central government, and it is charged in addition to SGST or UGST; the revenues are divided evenly between the central government and the states. IGSTAn IGST (short for Integrated Goods and Services Tax) is charged on products and services transacted across states, and it applies to imports and exports. The state and federal governments split the money collected through this tax. IllustrationAssume that a dealer in Gujarat transferred products worth Rs. 50,000 to a dealer in Punjab, and the tax rate is 18%, which includes only IGST. Dealer must impose an IGST fee of Rs. 9,000 in such a situation; the central government will receive these funds. The same dealer offers goods for Rs. 50,000 to a customer in Gujarat, and the products are subject to a 12% GST rate; SGST and CGST, both at 6%, are included in this rate. As this sale takes place in Gujarat, the dealer must collect Rs. 6,000 in Goods and Services Tax, of which Rs.3000 goes to the central government and Rs.3000 to the Gujarat state government. GST Tax RatesIndia has four GST rate slabs: 5%, 12%, 18%, and 28% GST; these rates apply to a variety of goods and services. Generally, luxury goods have high GST rates, while necessities have low GST rates.

Tax Laws before GSTThe state and the central governments levied numerous indirect taxes during the former indirect tax regime; the Value Added Tax (VAT) was the most common tax type that states collected, and there were various laws and regulations in each state. Earlier, the central imposed taxes on goods sold across state lines, and in the case of an interstate sale of goods, CST (Central State Tax) was applicable. Indirect taxes, like the entertainment tax, octroi, and local tax, were imposed jointly by the state and the central. As a result, the taxes collected by the state and the federal government frequently overlapped. For instance, the centre levied excise duty when items were produced and sold, and the state levied VAT on top of the excise duty. As a result, there was a tax-on-tax effect, commonly referred to as a cascading effect of taxes. Indirect taxes that existed prior to the GST are listed as follows:

CGST, SGST, and IGST have superseded all preceding taxes. What are the new Compliances under GST?The GST regime has also brought in several new systems in addition to the ability to file returns online. Some such new compliance includes E-Way Bill and E-Invoicing. E-Way BillSuppliers frequently issue E-way bills when they want to transfer their products to another state or union territory. These E-way bills are required for the commercial transfer of items worth more than $50,000 across state lines. There is an online E-way bill login site through which the document can be generated. They can also be generated via text message or with the official app, which is accessible on both the Play Store and the App Store. Following the generation of the E-way bill, each party-the "supplier", the "recipient", and the "transporter"-receives a special E-way bill number that effectively approves the transfer of goods from point A to point B. E-InvoicingLarge enterprises with annual aggregate revenue of more than 100 crores are required under the e-invoicing system to get a unique invoice reference number. The same rules will apply to any business-to-business invoice uploaded to the GSTN's portal. The site authenticates the invoice and approves it with a digital signature and a QR code. E-invoicing also enables invoice interoperability and decreases data entry errors. GST CalculationOne can use a specific formula to calculate the GST to be added or removed. Let us discuss each in detail: For GST AdditionTo include GST in the price of goods or services, one can use this formula: GST Amount = (Price x GST%)/100 Final price of product/service = Price of the product/service + GST Amount Let's use an illustration to understand it better. Let's say someone spent Rs. 1,000 on an item that is subject to an 18% GST rate. They are required to pay a total of Rs. 1180, i.e.: GST amount = (Rs.1000 x 18)/100 = Rs.180 Final Price = Rs.1000 + Rs.180 = Rs.1180 For GST RemovalThe following is the GST formula utilised to deduct GST from a product/service GST-inclusive price and determine the actual price: Original Price = Net price - ([100/(100 + GST%)]) To illustrate, consider the following GST computation example: Let's say someone purchased an item with a selling price of Rs.105 (GST included) that falls inside the 5% GST bracket. Original price = Rs.105 - ([(100/ (100 + 5)]) = Rs.100

Next TopicHow to Double Your Money

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share