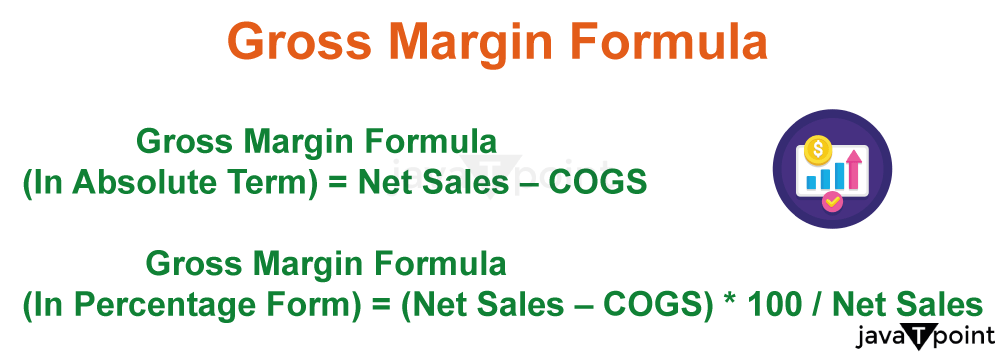

Gross Margin: Definition, Example, and Formula for How to CalculateGross margin is a crucial indicator of a company's profitability in finance and accounting. It is a key gauge of a company's capacity to bring in money and efficiently control expenses. The notion of gross margin, as well as its Importance and calculation, are all covered in this article. What is Gross Margin?A profitability metric that measures a company's gross profit against revenue generated for sales after deducting all expenses incurred in direct costs and services is known as gross margin. The percentage representation of a company's gross margin is used in calculating gross sales which yields information about gross profit. The higher the gross margin, the more effectively a corporation can use excess capital to cover other expenses or pay down debt. The revenue or sales amount is calculated as gross revenue or sales minus cost of goods sold (COGS), comprising overall returns, given allowances, and proposed discounts. Calculation of Gross MarginThe cost of goods sold (COGS) is subtracted from the total revenue, and the result is divided by the revenue and multiplied by 100 to determine the gross margin in a percentage form. As a proportion of revenue, the resulting number shows the gross margin. Thus, a simple formula used to get the gross margin in percentage form is: Gross Margin = [(Revenue from Net Sales - Cost of Goods Sold) / Revenue] * 100

Understanding COGS and Revenue

It's essential to ensure that all pertinent costs directly associated with creating or providing the goods or services are factored into the COGS calculation to determine the gross margin appropriately.

Importance of Gross MarginWhen evaluating a company's financial stability and profitability, the gross margin is of utmost significance. Some of the importance of gross margin are listed here:

Interpreting Gross MarginGross Margin PercentageGross margin, which is stated as a percentage, offers important clues about how profitable a business is. A higher gross margin means that more of each dollar of revenue is kept after the cost of goods sold (COGS) is subtracted. This suggests that the business has more effective control over its manufacturing expenses, pricing, and total profitability. A lower gross margin, on the other hand, indicates that a more significant proportion of income is spent on the direct costs of producing goods or services. Benchmarks and Industry StandardsIt is important to consider industry benchmarks and standards when interpreting gross margins. Various factors, including production complexity, input costs, and competitive dynamics, affect industry gross margin figures. It gives context for performance evaluation to compare a company's gross margin to industry averages or competitors of comparable size. When a company's gross margin continually exceeds the industry average, it can signify greater cost control or a competitive advantage. A lower gross margin, on the other hand, might indicate that it's time to look into cost-cutting measures or consider pricing options. Analyzing historical trends is another step in interpreting gross margin. Analyzing variations in gross margin can reveal whether profitability is rising, falling, or staying the same. If the gross margin is trending upward, the business may be successfully controlling costs or putting strategies in place to strengthen its position as a price leader. Conversely, a diminishing gross margin may signal increased manufacturing costs or competitive challenges that demand attention. Factors Affecting Gross MarginPricing DecisionsA company's pricing policy has a direct impact on its gross margin. Prices that are set too low may result in reduced gross margins since the money made may not be enough to cover the cost of the items sold. However, pricing that is too high may result in fewer sales, which may also have an effect on overall revenue. To maximize profitability, businesses must strike the right balance between pricing and gross margin. Cost of Goods Sold (COGS)An essential part of gross margin is the cost of goods sold. Any changes in the expenses connected with manufacturing or obtaining goods or services immediately affect the gross margin. Factors such as raw material pricing, labour costs, transportation charges, and manufacturing overhead costs influence COGS. Fluctuations in these costs can impact a company's profitability by either increasing or decreasing the gross margin. Economies of ScaleEconomies of scale can affect gross margin significantly. Businesses can gain from cost savings and lower per-unit production costs as production volume rises. Gross margins may increase as a result of this. The gross margin, on the other hand, may suffer if production volume declines or a business cannot realize economies of scale. Market Conditions and CompetitionMarket dynamics and competition may impact a sector's gross margin. Intense competition may force businesses to lower prices, reducing gross margins. Additionally, changes in market demand and consumer preferences might alter the sales volume and pricing power, ultimately influencing the gross margin. Product MixThe variety of goods and services may impact a company's gross margin it provides. Different products or services may have distinct cost structures, profit margins, and pricing dynamics. A corporation with a product mix that includes high-margin products can attain a greater overall gross margin. On the other hand, a product mix that includes low-margin products may lead to a reduced gross margin. Supply Chain EfficiencyA company's gross margin may be impacted by the effectiveness of its supply chain. Costs might rise, and the gross margin can decrease as a result of delays, interruptions, or inefficiencies in the production, distribution, or procurement processes. The gross margin can be raised by streamlining the supply chain, managing inventories optimally, and increasing operational effectiveness. A combination of internal and external factors affects gross margin. Businesses can discover areas for improvement, optimize pricing strategies, efficiently manage costs, and maintain a healthy gross margin by being aware of these variables, which will help them achieve profitability and long-term success. Strategies to Improve Gross MarginBusinesses should focus on increasing gross margin because it directly impacts profitability. Here are a few tactics companies can use to raise their gross margin:

Gross Margin vs. Net MarginGross margin and net margin are two essential measures to assess a company's profitability. While both offer perspectives on profitability, they concentrate on various aspects of financial performance. Gross margin is the portion of income left over after all direct expenses for manufacturing or providing products or services have been paid. It displays a company's capacity to make money from every unit sold and the profitability of its primary businesses. In contrast, net margin considers all costs, including interest, operational costs, taxes, and direct and indirect expenditures. Taking into account every expense related to a company's activities offers a complete picture of that business's profitability. While net margin evaluates the company's overall financial health, gross margin highlights the effectiveness of the company's pricing and production methods. While a greater net margin implies better profitability taking into account all expenditures, a higher gross margin suggests better profitability in terms of revenue left over after direct costs are subtracted. Gross Margin vs. Gross ProfitGross margin and gross profit are among the metrics companies can use to measure their profitability. A company's income statement, particularly, can be used to find these statistics on its financial accounts. These two figures are different, although they're frequently used as synonyms.

The profitability metric, known as gross margin, is expressed as a percentage, as was previously mentioned. Contrarily, gross profit is represented as a monetary amount. The cost of items sold can be deducted from a company's revenue to determine gross profit. It illuminates how much money a business makes after deducting manufacturing and sales expenses. What is a good Gross Margin?An excellent gross margin exceeds the industry standard or the company's previous results. When a higher percentage of revenue is kept as profit before accounting for other costs, a company successfully manages its manufacturing costs, pricing, and sales techniques. This further helps to improve operations and grow faster. The Bottom LineGross margin is vital for assessing a company's profitability and operational efficiency. Businesses can increase their gross margin by carefully controlling manufacturing costs, enhancing pricing policies, and concentrating on higher-margin goods or services. As a result, the financial performance and long-term viability of the business improve in today's competitive market.

Next TopicSpotting Breakouts as Easy as ACD

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share