Form 1099-NEC: Nonemployee CompensationForm 1099-NEC is an income file that discloses remuneration paid to an individual who is not a worker by a company or organization. It's a relatively recent addition to the barrage of tax records that arrive in January, having been resurrected for the 2020 income year. Therefore, business owners reported similar fees using Form 1099-MISC. A 1099-NEC should be issued to any freelance writer or contract worker who is paid a minimum of $600 by a single client.

What Is Form 1099-NEC: Remuneration for Nonemployees?The IRS Form 1099-NEC is used by business owners to report money paid to contract employees, freelance writers, self-employed people, and self-employed individual citizens. The current iteration is a refresh of the 1982 version that bears the same title. Form 1099-NEC was reanimated in 2020 to confront the disruption caused by the January 31st and March 31st primary elections for only certain earnings and recompense trying to report on Form 1099-MISC. Many taxpayers were perplexed by the dual-filing time limit. Form 1099-NEC is one of the numerous 1099 tax filings available, including the 1099-MISC for income from other sources, the 1099-INT for investment earnings, and the 1099-DIV for return on capital and allocation income. Who Is Eligible to File Form 1099-NEC: Non-Employee Remuneration?Business owners must file a Form 1099-NEC for just any non-employee individual toward whom they paid $600 more than during the fiscal year. This would include money paid to contract workers for services rendered, payments made for fish bought from anybody involved in the industry of catching fish, and money paid to a lawyer. The form also needs to be finished for anyone who has had federal income taxes kept confidential under standby threatening to withhold rules, irrespective of the amount of reimbursement. Business owners must issue 1099-NECs to beneficiaries by January 31 of the very next year. Gross revenue, such as lawyer high settlement, should not be noted on the 1099-NEC. It is instead noted on box 10 of the 1099-MISC. On 1099-NEC, only lawyers' bills funded directly to the lawyer are reported. Who Doesn't Require a 1099-NEC?The necessity for business owners to report non-employee reimbursement has a few exceptions. These are some examples:

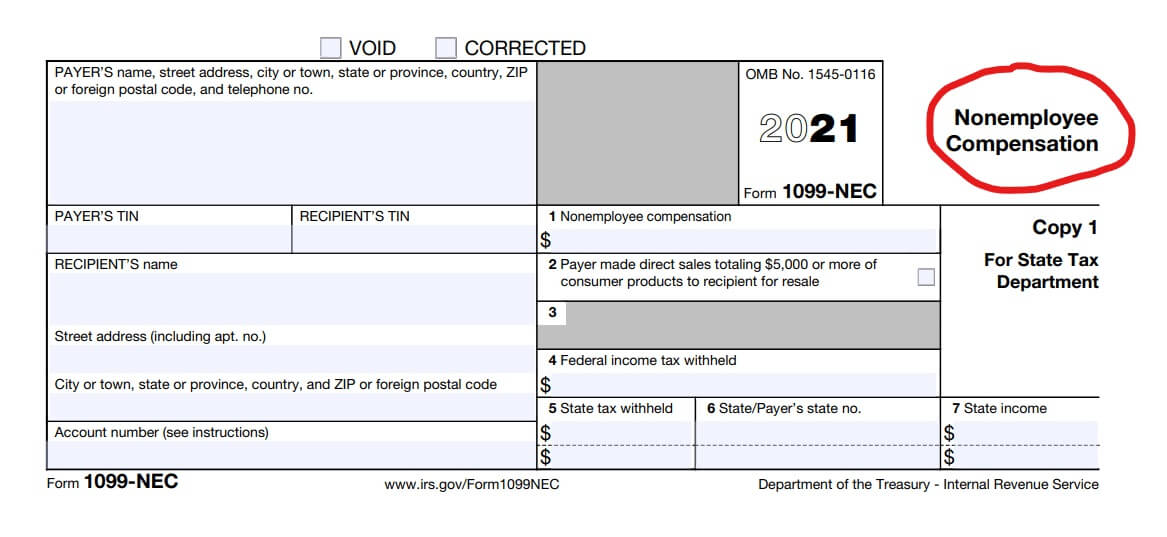

How to Register Form 1099-NEC: Remuneration for Non-EmployeesCash transactions to self-employed for services rendered, purchases of fish from an individual in the fishing industry or business, or payments made to a lawyer are disclosed in box 1 of Form 1099-NEC. Access an "X" in the check mark on box 2 if the taxational business started to sell consumer goods totaling $5,000 or greater to the beneficiary on a purchase, payment, reselling, or another basis. Box 3 should be left blank; it will be used in future tax decades. Box 4 reports federal income tax deferred during the year. Boxes 5-7 hold information for state taxes on income. Form 1099-NEC beneficiaries should use the data provided on the form to complete the segment constituted on their tax records. Disclose this data on Schedule C (for company income statement) or F for sole traders (for farming profit and loss). If the beneficiary is a collaborative effort, the data must be used to finalize Form 1065 as well as Schedule K-1 would be completed by the associates, who would then accomplish Schedule SE (Form 1040). If the revenue disclosed on Form 1099-NEC is not derived from self-employment but rather from a scattered action or recreation, notify it on Schedule 1 line 8, "Other Revenue" (1040). The 1099-NEC shapes must always be submitted to the IRS on a document or electronically by January 31. If you're going to file a paper yield, print it and mail it to the IRS somewhere at a registered address for your state. You can also file digitally through the IRS's Filing Information Returns (FIRE) mechanism. You cannot send paper forms if you're filing 250 or even more 1099-NEC forms; you should indeed file digitally. What Should I Do If I Receive Form 1099-NEC?If you obtain a Form 1099-NEC, it implies that one of your customers compensated you $600 or over in the previous tax year. Because employers must file Form 1099-NECs by January 31, you should receive the form in early February. While you must always account for any self-employed or advising revenue on your tax filing, a Form 1099-NEC has two purposes for the taxpayer:

Form 1099-NECs, such as the majority of other 1099s, are referred to as information-based returns. That implies all you must do when you get one is referring to it when filing your tax form. It will assist you in completing specific timelines (extra tax forms) that must be attached to your exchange, including such Schedule C, which pertains to business profits. You'll involve your installments in your estimations for personal or company revenue for the year, then you'll look to see if anyone has any deductions or reward points that decrease the amount of taxes you must pay on the funds raised. If you get trapped, tax software will most likely help you through the steps. What Information Is Contained In Form 1099-NEC?Form 1099-NEC is a relatively short form that comes in extra versions.

Why Does The IRS Bring Back 1099-NEC?The form for the last moment 1099-NEC was in use till 1982. Previous to the financial year 2020, firms generally submitted Form 1099-MISC to notify installments totaling $600 or greater to a nonemployee for only certain company payments. These payouts are generally non-employee remuneration and would have previously appeared in box 7 of a 1099-MISC. The IRS made the decision to reinstate Form 1099-NEC, with a solitary registration deadline including all payment transactions that utilize the form, to make it clearer the separation of the numerous filing due dates when going to report distinct types of transactions on Form 1099-MISC. What Exactly Is Non-employee Compensation?According to the IRS, you should indeed report payments made if they fulfill the four criteria listed below:

Furthermore, irrespective of the number of payments made to the active client for the year, business owners must file Form 1099-NEC if they have withdrawn any federal income tax there under fallback threatening to withhold rules. Remuneration for non-employees may include:

What Should You Do If You Do Not Obtain Form 1099-NEC?As a non-employee, if you received $600 more than from every payee throughout the year, you should indeed file Form 1099-NEC with both the IRS as a component of your federal return. If you earned non-employee revenue and didn't receive your form even by the end of January, touch the beneficiary to request it. The IRS has brought back Form 1099-NEC as the fresh method for reporting self-employment revenue, replacing Form 1099-MISC, which had previously been using it. This was done in order to make clear the different filing timelines for Form 1099-MISC vs Form 1099-NEC. Backup Withholding and the 1099-NEC FormNon-employees are not subject to withholding, but there is an exception to the backup nonpayment. The IRS usually requires backup taken away if a payer fails to enter the appropriate taxpayer Identification number on their W-9 form at the time of hire. Therefore in a particular instance, the IRS starts sending the public purse a fallback threatening to withhold court orders to hold back federal income taxes from either the account holder at a rate of 24%. This exempting order stays in place till the IRS removes it. When Is The 1099-NEC Form Due?The deadline for submitting Form 1099-NEC is January 31. By this date, businesses must submit a duplicate of the form to each of the beneficiaries and the IRS. You can order formal 1099 forms from the Official website and have them mailed to you. You have access to the IRS Filing Information Returns Electronically (FIRE) system if you document digitally. The 1099-NEC can be accessed for decisions or on paper. How Do I Submit A Revised Form 1099-NEC?To correct Form 1099-NEC for common errors, start over and check the "Corrected" box at the top of the form. If you submitted a paper form, send the corrected Copy A and Form 1096 to the appropriate IRS processing center. Some errors necessitate a different procedure that does not include checking the "Corrected" box. Specifics about how to true specific errors can be found in the Public Guidelines regarding Particular Information Rates of Return. Is It Still Necessary For Me To Request For Form 1099-MISC?Form 1099-MISC is no longer used to notify non-employee recompense because Form 1099-NEC has been reinstated. It does, however, play a role in corporate reporting even with. If you paid someone $10 in royalty payments or $600 more than in:

Overall, the money paid to a personal, collaboration, or property from a fictitious principal agreement.

The boxes have indeed been reorganized nowadays and non-employee remuneration is no longer listed on the 1099-MISC. Box seven, which previously included non-employee remuneration, is now utilized for direct sales of $5,000 or even more. The form will appear subtly different, but nothing has changed significantly. Please keep in mind that Form 1099-MISC has a bit more distinct due date than Form 1099-NEC. Business owners must send a 1099-MISC to all recipients by January 31, but they do not have to file the form with the IRS until February 28, or March 31 if able to file digitally. The IRS has brought back Form 1099-NEC as the fresh method for declaring self-employment revenue, replacing Form 1099-MISC, which had previously been using it. This was done in order to make clear the different filing timelines for Form 1099-MISC vs Form 1099-NEC. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share