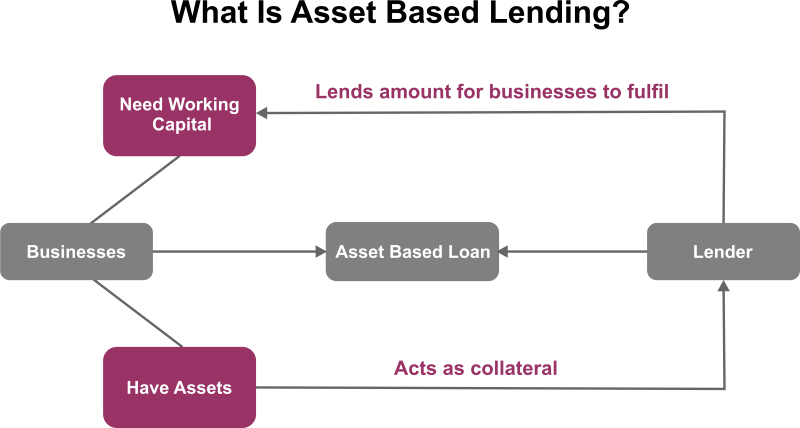

Asset-Based LendingThe Asset Based Lending is a form of lending money secured by an asset. The lender provides money to the borrower after taking any asset as collateral. This feature makes loans secure from getting default.

Generally, businesses opt for asset-based lending options for raising funds when the other channels for raising funds, like capital market, money market, and unsecured or mortgage-secured banks, are not available for lending. This happens when other fund-raising options have been exhausted by the company or when there is a need for immediate funds required for some special projects. This lending method has always been popular among businesses and retail borrowers. Nowadays, big financial companies provide multiple asset-based lending packages specially designed to serve various financing-related interests of the borrowers; some of them are JPMorgan Chase, Goldman Sachs, Morgan Stanley, etc. A Detailed Explanation of Asset-Based LendingIn ABL, the loan given to the borrower is secured by the collateral, which can be any valuable asset, and the lender keeps that asset till the final repayment of the loan. If the borrower fails to repay the loan, the lender can recover the amount lent to the borrower by selling the asset. Accounts receivables, inventory, movable and immovable property, plant and machinery, marketable securities, etc., can be used as collateral for securing the loan. The important things about the asset to be collateralized are: firstly, the current value of that asset must be more than the loan amount. Secondly, the asset must be liquid so the lender can recover his money in the case of default.

Calculation of loan amount under Asset-Based LendingThe amount of money lent to the borrower is always less than the asset's current value. It is because the value of the asset may depreciate in the future. This amount, to be provided to the borrower based on assets, is calculated by the concept of Loan-to-value-Ratio. The Loan-to-value-Ratio is a formula used to calculate the money that can be lent to a borrower based on his collateralized asset. The formula is given as follows: Loan-to-value ratio = Loan amount/Asset value With this formula, it is possible to calculate what amount the borrower can get with the stated asset. This ratio depends upon the liquidity of the asset. The highly liquid asset has a high loan-to-value ratio. Example of Loan-to-value RatioEvery type of asset has been assigned some loan-to-value ratio; based on that, we can identify the maximum loan amount the lender can give to the borrower. Suppose a lender has assigned the following Loan-to-asset ratio to certain assets:

And the current market value of the following assets is:

Now, suppose the borrower requires an amount of Rs. 1,00,000/-. What type of asset should he use as collateral for getting the loan (if only one asset is used at a time)? The maximum loan amount that can be granted to the borrower has been calculated below:

To borrow Rs. 1,00,000/-, the borrowers will have to choose the Plant & Machinery as collateral because, based on the Loan-to-value ratio formula, the borrower can get the said amount only after keeping Plant & Machinery as the collateral. Benefits of Asset-Based Lending

Next TopicBubble

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share