Current Account Deficit: What It Is, Structural & Cyclical CausesWhat is a Current Account Deficit?A nation's current account deficit is a measure taken when the value of a country's imports exceeds the value of its exports of goods and services, serving as a barometer of its trade. Net revenue, including dividend income, and transfers, such as international assistance, are included in the current account despite making up a small fraction of the overall current account. The current account, which is included in a country's existing performance and displays its international transactions, functions similarly to the balance of payments (BOP).

Key Takeaways

Understanding a Current Account DeficitA country's current debt can be reduced by increasing its exports' value compared to its imports' cost. It may impose restrictions on imports, such as taxes or quotas, or concentrate on measures that promote exports, such as industrialization, import substitution, or actions that improve the global competitiveness of local businesses. By weakening the national currency to raise its value in foreign currencies, the country can also use monetary policy to reduce export costs. A current account deficit does not always mean that a country is living above its means, although it may suggest it is. If a government uses external debt to finance investments that give higher returns than its current account deficit, it can preserve financial stability. Suppose a country utilizes external debt to finance acquisitions with higher returns than the loan's interest rate. In that case, it is still possible to maintain monetary sustainability while having a current account deficit. However, a country risks bankruptcy if its current debt obligations cannot be settled with its anticipated future income. Deficits in Developed and Emerging EconomiesNegative net sales overseas reflect a current account deficit. While developed nations like the United States frequently have deficits, emerging economies frequently have current account surpluses. Developing and/or Impoverished nations frequently have current account deficits. Real World Example of Current Account DeficitsMarket dynamics mainly influence current account fluctuations. The deficit fluctuates even in nations that deliberately run deficits. For instance, the UK experienced a reduction in its current deficit following the 2016 Brexit referendum outcomes. Because it is a nation that relies on high levels of debt to pay for its excessive imports, the United Kingdom has historically had a deficit. Commodities make up a sizable amount of the nation's exports, and falling commodity prices have reduced revenues for domestic businesses. As a result of this decline, the UK's current account deficit grows since less income is coming back into the country. Although the Brexit decision on June 23, 2016, caused the British pound to lose value, this resulted in a reduction in the country's overall debt. This decline happened due to domestic commodities firms' increasing foreign dollar revenues, which increased the country's cash inflows. Causes of Current Account Deficit

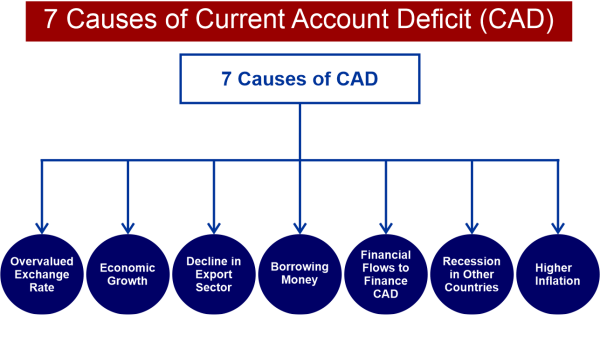

Although there are many factors that affect the current account deficits, it is mainly affected by the overvalued exchange rate, economic growth, decline in the export sector, borrowing money, financial flows utilized in financing CAD, recession in other nations, and higher inflation. Changes in these factors can lead to a significant increase or decrease in the current account deficit. Reducing Current Account DeficitsNumerous factors, including trade policy, currency rates, competence, forex reserves, inflation rate, and others, affect a country's current account balance. If shipments during a robust economic boom do not expand at the same rate as imports, the current account surplus will rise. In contrast, if imports decline and exports to stronger nations increase during a downturn, the current account deficit would reduce. The currency exchange rate significantly impacts the existing account and the trade balance. An overvalued currency makes imports more affordable and exports less viable, increasing the deficit in current accounts (or narrowing the surplus). On the other hand, a depreciated currency promotes exports while increasing the cost of imports, leading to an existing account deficit (or limiting the debt). Countries with enduring current account deficits usually come under enhanced investor scrutiny during uncertain times. During these times, speculators frequently attack the currencies of these nations. This leads to a vicious cycle where valuable foreign exchange reserves are emptied to maintain the native currency. The money is put under additional pressure due to the shrinking forex reserves and the widening trade imbalance. To safeguard their currencies, struggling nations frequently have to implement stringent regulations like raising interest rates and curbing capital outflow. Increasing exports (goods leaving a nation and entering other countries) or lowering imports are typically the two approaches to address a significant current account imbalance (goods exporting from an outside country into a nation). First, this is often done directly by import quotas, levies, restrictions (though they may also indirectly limit exports) or by encouraging exports (through subsidies, custom duty exemptions etc.). Indirectly raising the balance of payment will result from manipulating the currency rate to lower export prices for overseas consumers. Currency wars are considered the additional phenomena that have emerged in economies recovering from the crisis. Under this protectionist strategy, nations lower their currencies to maintain export competitiveness. Second, shifting government expenditure in favour of domestic vendors also works well. Increasing domestic savings (or reducing domestic borrowing), including lowering national government borrowing, are less obvious ways to minimize a current account deficit.

Not every current account surplus is a concern. According to the Pitchford thesis, a current account deficit primarily caused by the private sector is irrelevant. It is also known as the "consenting adults" approach on the existing account since it claims deficits are not a concern if they result from secret sector agents engaging in mutually beneficial commerce. A current account deficit results in the necessity to return foreign capital, which is made up of several separate transactions. Since each of these transactions is deemed financially sound when completed, according to Pitchford, their combined result (the current account surplus) is also good. In a floating currency, a current account deficit must be offset by a finance or capital account surplus. Calculating Current Account DeficitCalculating the current account deficit of any nation is a straightforward way. There are mainly three components involved in the calculation of CAD, such as the total Trade gap, Net current transfers and Net income abroad. When these components' measurements are available, one can simply add up all three to get the calculated current account deficit. The formula for calculating the current account deficit (CAD) can be defined as below: Current Account = Trade gap + Net current transfers + Net income abroad Where the trade gap is usually calculated by subtracting the imports from exports (i.e., Exports - Imports). The Bottom LineAccording to the authors of a 2012 report in the International Monetary Fund (IMF), a current account imbalance with higher assets and lower savings may signify that a nation's economy is highly productive and expanding. There may be issues with competitiveness if there are more imports than exports. Another factor that might contribute to low savings and excessive investment is "reckless fiscal policy or a spending spree". Despite all concerns and factors, the advantage of CAD is that it allows a higher level of domestic consumption as we are buying from abroad. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share