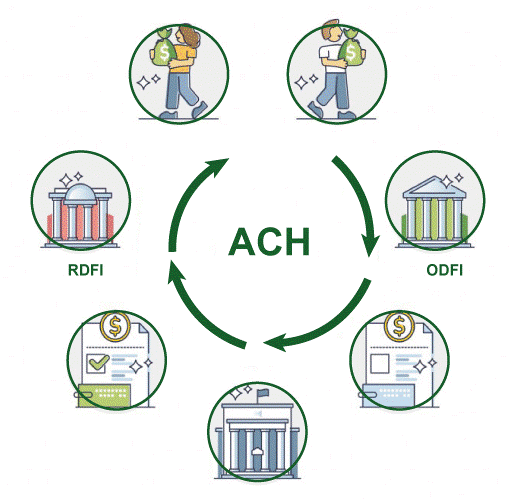

What Is the Automated Clearing House, and How Does It Work?Automated Clearing House (ACH) is a widely used electronic funds transfer system in the United States that facilitates the movement of funds between banks and financial institutions. It is an efficient and secure method for processing various types of transactions, including direct deposits, bill payments, and business-to-business payments. In India, Electronic Clearing Service (ECS) is a similar concept used for processing transfers like ACH.

ACH operates as a batch processing system, where transactions are grouped and processed in batches rather than individually. This method allows for efficient processing and settlement of large volumes of transactions, resulting in faster and more cost-effective fund transfers compared to traditional paper-based methods. The ACH network is managed by the National Automated Clearing House Association (NACHA), a nonprofit association that establishes the rules and standards for ACH transactions. NACHA ensures the smooth operation of the ACH system and governs the rights and obligations of participating financial institutions. ACH transactions can be categorized into two main types: credits and debits. Credit transactions are typically used for direct deposit of salaries, government benefits, tax refunds, and other types of payments where funds are being deposited into an account. Debit transactions, on the other hand, involve payments where funds are being withdrawn from an account, such as bill payments, online purchases, and recurring subscriptions. To initiate an ACH transaction, the sender must have the necessary authorization from the receiver, either through a signed agreement or online consent. The sender then submits a transaction file to their financial institution, which is responsible for routing the transaction through the ACH network. The transaction file contains relevant information such as the sender's and receiver's account details, the transaction amount, and any additional information required for processing. ACH transactions are usually settled in batches according to a predetermined settlement schedule. The settlement process involves the transfer of funds between the participating financial institutions to complete the transaction. Settlements can occur either on the same day or on a next-day basis, depending on the type of transaction and the ACH operating rules. ACH transactions are also known for their security and reliability. The ACH network utilizes robust security measures to protect sensitive financial information and ensure the integrity of transactions. Financial institutions are required to comply with strict security standards to participate in the ACH network, providing users with a high level of trust and confidence in the system. How does Automated Clearing House work?Let's dive into the step-by-step process of how an ACH transaction is initiated and processed:

ACH transactions can be settled on the same day or a next-day basis, depending on the type of transaction and the ACH operating rules. For example, same-day ACH allows for faster settlement of certain types of transactions, providing quicker access to funds.

Advantages of ACHCost-Effectiveness and EfficiencyOne of the most prominent advantages of ACH is its cost-effectiveness. Compared to traditional payment methods like checks or wire transfers, ACH transactions are significantly cheaper. Businesses can reduce costs associated with printing, postage, and handling physical checks. Moreover, ACH eliminates the need for manual processing and reduces administrative tasks, freeing up valuable time and resources for organizations. Convenience and AccessibilityACH offers unparalleled convenience and accessibility for both businesses and consumers. Through ACH, individuals can conveniently set up direct deposits for their paychecks, ensuring prompt and hassle-free transactions. Similarly, businesses can leverage ACH for automated bill payments, enabling customers to settle their invoices electronically. This accessibility eliminates the need for paper checks and provides a seamless payment experience for all parties involved. Reliability and PredictabilityACH transactions provide a high level of reliability and predictability. Unlike paper checks that can be lost, damaged, or delayed in the mail, ACH transfers occur electronically, ensuring a more secure and efficient transfer of funds. Additionally, ACH transactions are often processed within fixed timeframes, allowing businesses to plan and manage their cash flow with greater accuracy. Enhanced Cash Flow ManagementFor businesses, efficient cash flow management is crucial to sustain growth and success. ACH enables businesses to gain better control over their cash flow by automating payment and collection processes. With ACH, businesses can accurately predict when funds will be received, allowing them to plan and allocate resources accordingly. This enhanced visibility and control empower businesses to make informed decisions and optimize their financial operations. Environmentally FriendlyIn an era of increasing environmental consciousness, ACH provides a sustainable solution. By eliminating the need for paper checks and reducing physical mailings, ACH significantly reduces paper waste and carbon emissions associated with traditional payment methods. Embracing ACH contributes to a greener future and aligns with the principles of corporate social responsibility. Security and Fraud PreventionIn today's digital age, security, and fraud prevention are critical concerns for businesses and consumers alike. As electronic payments continue to dominate the financial landscape, it becomes imperative to understand the security measures in place to protect transactions. This section delves into the robust security protocols of the Automated Clearing House (ACH) system and how it ensures the integrity and confidentiality of ACH transactions.

The Impact of Technology on ACHReal-Time Payments and Faster ProcessingReal-time payment facilitation is one of technology's most significant effects on ACH. In the past, ACH transactions required batch processing because the settlement could take several days. However, real-time payment systems involve batch processing and have emerged as a result of technological advances, making instant or near-instant money transfers possible. Faster processing times have transformed sectors like e-commerce, where prompt payment settlement is essential for client pleasure and company expansion. Integration with Emerging TechnologiesThe capabilities of ACH have been considerably increased by the integration of new technology. Due to its decentralized structure and immutability, blockchain technology has the potential to completely transform ACH by enhancing transaction transparency, security, and traceability. Blockchain-based smart contracts can automate ACH processes, remove the need for middlemen, and cut costs. Additionally, machine learning and artificial intelligence (AI) algorithms can improve fraud detection and prevention systems, protecting ACH transactions from changing threats. Mobile Applications and ACH PaymentsThe widespread use of mobile devices has changed how people handle their money. Consumers now have easy access and convenience to ACH transactions due to mobile applications. Users can start direct deposits, pay bills, transfer money, and view real-time financial activity with just a few touches on their smartphones. In addition to enhancing the user experience, the mobile-first strategy has made it possible for people who do not have access to traditional banking services to join the digital economy. Open Banking and API-driven ACH InnovationOpen banking initiatives, driven by technology, have fostered collaboration and innovation within the financial industry. Application Programming Interfaces (APIs) have become instrumental in connecting different financial systems and enabling seamless data exchange. In the context of ACH, APIs allow businesses and developers to integrate ACH functionality directly into their applications, simplifying payment processes and enabling more efficient cash management. This integration promotes interoperability, enabling businesses to leverage ACH services while customizing their user experiences. Enhanced Security and Risk ManagementTechnology has played a pivotal role in bolstering the security and risk management measures of ACH systems. Encryption techniques ensure the confidentiality of sensitive data during transmission, protecting against unauthorized access. Multi-factor authentication mechanisms provide an additional layer of security, safeguarding ACH transactions from identity theft and fraud. Furthermore, regulatory compliance requirements and industry standards, such as NACHA rules and the Bank Secrecy Act, have evolved to address the challenges posed by technological advancements, ensuring the integrity of ACH transactions. Challenges of the Automated Clearing HouseThe Automated Clearing House (ACH), which offers ease, cost savings, and efficiency, has unquestionably revolutionized the way financial transactions are carried out. To ensure ACH's future success, several issues must be resolved as it continues to develop. In this section, we examine the main difficulties faced by ACH and talk about the way forward. Scalability and System ModernizationAs the volume of ACH transactions continues to increase, scalability becomes a critical challenge. ACH systems must be capable of handling large transaction volumes efficiently without compromising speed or security. Upgrading infrastructure and adopting modern technologies are necessary to ensure seamless scalability. Compliance with Evolving Regulations and Data Privacy LawsRegulatory compliance is a perpetual challenge for ACH participants. As financial regulations and data privacy laws evolve, ACH systems must adapt to ensure compliance. Stricter anti-money laundering (AML) and know-your-customer (KYC) regulations require enhanced due diligence, placing additional burdens on ACH participants to verify transaction details and maintain proper documentation. Addressing Cybersecurity Risks and Emerging ThreatsAs technology advances, so do the methods employed by cybercriminals. ACH systems face the constant threat of cybersecurity breaches, including hacking, phishing, and malware attacks. Robust cybersecurity measures, including encryption, multi-factor authentication, and continuous monitoring, are necessary to safeguard ACH transactions and protect sensitive customer information. The Bottom LineThe Automated Clearing House (ACH), which offers a safe, quick, and affordable way to move money electronically, has revolutionized the way financial transactions are handled. Its widespread use has revolutionized the way people, companies and organizations manage payments, making it a vital component of the contemporary financial ecosystem. Using ACH, consumers can take advantage of the convenience of electronic payments, eliminating the need for paper checks and reducing the potential for fraud and errors. Businesses have been able to enhance their cash flow management and streamline their operations thanks to the ACH system, which has made it easy and quick to move money. Since ACH transactions provide services to people who may not have access to banking services through traditional banking channels, it has also played an important role in promoting financial inclusion. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share